When a major central bank cuts interest rates, forex markets almost always take notice, often with an immediate drop in the value of that currency.

In today’s environment of diverging global monetary policies, understanding how interest rate cuts move forex markets is vital for traders, investors, and policy watchers.

In this article, we explain the economic mechanisms behind rate-cutting and currency depreciation, examine empirical evidence including recent global examples, and lay out how traders can interpret and respond to such events.

How Interest Rate Cuts Affect Forex

Interest rate cuts affect forex markets by lowering the return investors earn from holding a currency, which typically reduces demand for that currency and causes it to weaken.

When a central bank cuts rates, yield differentials between countries shift, and traders often move capital toward currencies with higher interest rates.

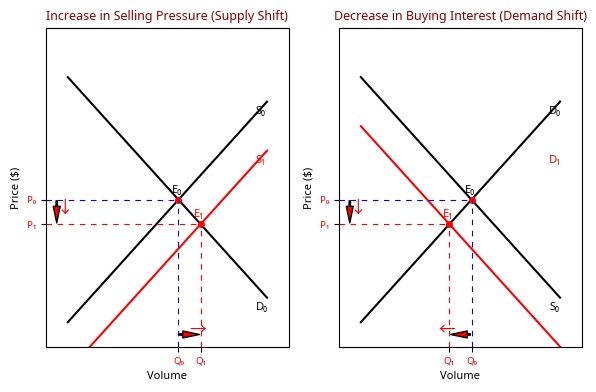

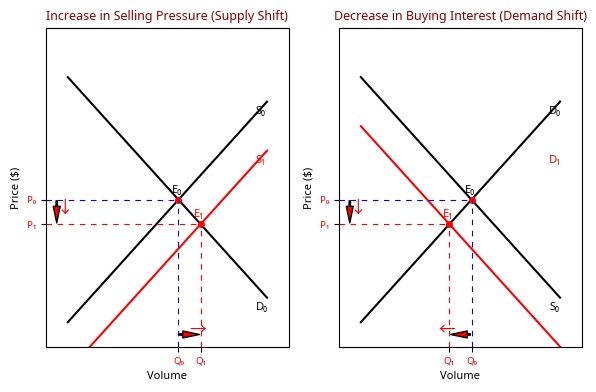

This can trigger immediate selling pressure, increased volatility, and sharp moves on major FX pairs.

Rate cuts also signal easier monetary conditions, which can expand money supply and further weigh on a currency’s value. However, the exact reaction depends on trader expectations, economic conditions, and whether the cut is viewed as positive or negative for future growth.

Why Interest Rate Cuts Typically Weaken a Currency

An interest rate cut is a monetary policy decision in which a central bank lowers its benchmark lending rate to make borrowing cheaper and stimulate economic activity.

1. Capital flows & yield attractiveness

A key link between interest rates and currency value: when a country’s rates fall, returns on deposits, bonds, and other interest-bearing assets denominated in that currency become less attractive.

A key link between interest rates and currency value: when a country’s rates fall, returns on deposits, bonds, and other interest-bearing assets denominated in that currency become less attractive.

In short, when a central bank reduces rates:

Bond yields decline

Foreign investors unwind positions

Demand for the domestic currency falls

The currency often depreciates in the short run

Lower yields tend to push foreign investors to shift capital toward higher-yielding currencies elsewhere, increasing demand for those foreign currencies and reducing demand for the domestic currency, thereby causing depreciation.

2. Money supply, liquidity and currency supply

Rate cuts often go hand in hand with monetary easing, central banks may expand liquidity via open-market operations, increasing money supply.

A larger money supply can reduce the value of the domestic currency relative to foreign ones.

When a country cuts rates while others remain steady or tighten:

Its interest-rate differential widens negatively

Traders shift toward higher-yielding currencies

Carry-trade flows amplify downside momentum

FX pairs involving the cutting currency typically move sharply

Guide: When domestic money becomes more abundant, the relative supply of that currency in forex markets increases, which, if not matched by demand, tends to depress its exchange rate.

3. Interest-rate differentials and carry-trade behavior

What often matters is not only one country’s rate but the difference in interest rates across countries (interest rate differential, IRD).

That said, when a central bank cuts rates while others keep them stable or raise them, the differential widens, making the currency less attractive.

Such rate divergences can trigger capital flows (or outflows) and carry-trade unwinds, contributing to rapid currency depreciation.

Interest-rate Differential And Volatility Dynamics

Changes in IRD don’t just shift “level” of exchange rates, they also affect volatility.

A study focusing on six major currency pairs found that narrowing or decreasing differentials often leads to increased exchange rate volatility, especially when low-interest-rate currencies are involved.

This is relevant for 2025, because many global central banks are no longer aligned. Some economies are cutting rates to support growth; others are keeping rates high or even raising them, creating divergence and elevated volatility across forex markets.

Recent Context (2025): Why This Matters Now

According to recent market commentary, 2025 stands out as a period of clear interest rate divergence globally: some central banks are easing, others are holding firm or tightening.

For example, In early 2025, the European Central Bank (ECB) cut rates,[1] while the Federal Reserve (Fed) in the U.S. held its policy rate steady. At the same time, Bank of Japan (BOJ) stood out as an outlier: it was among the few major central banks that were in, or moving toward, rate-hiking mode.

This created a three-way divergence:

| Central Bank |

2025 Policy Direction |

Likely FX Impact |

| ECB |

Cutting |

Euro depreciation pressure |

| Fed |

Holding |

USD strength relative to cutters |

| BOJ |

Tightening |

Yen support or appreciation |

Thus in 2025 you had in broad terms, Europe easing, the U.S. more cautious, and Japan tightening, creating a tripartite divergence across major currencies.

These divergences tend to feed volatility in forex markets, as capital flows chase yield and relative interest-rate attractiveness.

For forex traders this creates opportunities and risks: trading pairs where one currency comes from a cutting-rate economy and the other from a stable or tightening-rate economy is increasingly common.

Given the short-term nature of rate-cut effects, such trades tend to be most effective around central bank announcements and immediate aftermath, when volatility spikes.

Technical Analysis Perspective For Traders

If you are a forex trader looking to anticipate or respond to rate-cut decisions, technical analysis can augment the economic reasoning.

| Indicator |

What Typically Happens After a Rate Cut |

What It Means for Traders |

| Moving Averages (50–200 MA) |

- Price breaks below major MAs- Downward slope accelerates- Death cross may appear |

Signals a bearish trend; confirms continuation of currency depreciation |

| RSI (Relative Strength Index) |

- Quickly moves into oversold zone (<30)- Brief relief rallies possible- Deeper declines if bearish momentum stays strong |

Helps time entries/exits; identifies oversold conditions during high volatility |

| MACD |

- Momentum divergence appears- Bearish histogram expansion- Signal-line cross confirming downtrend |

Confirms momentum shift and supports bearish trade setups |

| Fibonacci Retracement |

- Price retraces after initial drop- Common levels: 38.2%, 50%, 61.8% |

Used to time short entries and identify likely reaction zones |

| Support & Resistance |

- Key support levels break- New multi-month lows form- Failed retests become bearish signals |

Helps validate whether depreciation continues and where breakouts may occur |

Frequently Asked Questions (FAQ)

1. Do all interest rate cuts weaken a currency?

No. Rate cuts often weaken a currency because they lower yields, but the reaction depends on what traders expected and how the overall economy looks.

2. How long do rate-cut effects last in forex markets?

The biggest moves usually happen right after the announcement and over the next few days. Longer-term trends depend on inflation, growth, and other fundamentals.

3. Can a currency strengthen after a rate cut?

Yes. If the cut boosts confidence in the economy or is smaller than traders expected, the currency can rise instead of fall.

Final Thoughts & Key Takeaways

Interest rate cuts generally make a currency less attractive to foreign investors because they reduce yields, triggering capital outflows and depreciation.

Lower rates often coincide with monetary easing and higher money supply, which can further pressure the currency.

The effect is typically most pronounced in the short term; empirical evidence shows long-term impacts tend to dissipate or be overridden by broader fundamentals.

In 2025, diverging global monetary policies have increased currency volatility, presenting both risks and opportunities for forex traders.

Traders can combine rate-cut analysis with technical tools (breakouts, moving averages, RSI, retracement) to time entries and manage risk.

However, rate cuts do not automatically lead to weaker currencies, context matters. Inflation, growth prospects, capital flows, and investor sentiment can all influence the ultimate outcome.

Understanding how rate cuts move forex markets remains a blend of macroeconomic insight and market psychology.

For traders and investors, the key is to monitor interest-rate differentials, central bank signals, and technical triggers, and stay alert to shifts in global capital flows.

Source

[1] https://www.ecb.europa.eu/press/press_conference/visual-mps/2025/html/mopo_statement_explained_june.en.html