Yield plays a central role in today’s market analysis because traders increasingly rely on it to compare risk, reward and real income potential across assets.

For traders, understanding yield is crucial when comparing assets in changing interest-rate environments, especially when central banks adjust policy rates or when credit spreads widen during risk-sensitive periods.

Definition

Yield refers to the income generated by an investment over a specific period, usually expressed as an annual percentage of the asset’s cost or market value.

In trading, yield helps investors evaluate whether an asset compensates them adequately for the risks taken. It is widely used across bonds, dividend-paying stocks, real estate securities, money markets, and complex yield-generating strategies in modern financial markets.

Yield is not the same as price appreciation. Instead, it focuses strictly on cash returns, such as coupon payments, dividends or periodic distributions.

How Is Yield Calculated?

Although the formula varies depending on the asset, the central idea stays consistent:

Example Of Basic Yield Calculation

Imagine you buy a small bond for 100.

Over the year, it pays you 5 in interest income.

Using the formula:

Plug in the numbers:

So this investment gives you a 5 percent yield, meaning you earn 5 percent of what you invested each year from income alone.

Common Yield Calculations

Bond yield: Coupon payment divided by the bond’s current market price.

Dividend yield: Annual dividends per share divided by the stock’s current market price.

Money market yield: Interest earned over a short maturity, annualised for comparison.

Yield to maturity (YTM): A more advanced bond measure combining coupon income with potential capital gains or losses held to maturity.

These metrics allow traders to compare fixed-income securities, income-focused equities and alternative products across the broader yield curve.

Why Yield Matters for Traders

Yield functions as a pricing benchmark, a risk gauge and a profit measurement tool.

Key reasons yield is essential:

Interest-rate sensitivity: Yields increase when prices fall. A rising-yield environment often signals expectations of higher interest rates.

Risk assessment: Higher yields may suggest greater credit risk, market volatility or liquidity concerns.

Relative value comparison: Traders use yield to compare two assets with similar maturity or risk characteristics.

Inflation impact: Real yield (nominal yield minus inflation) helps traders measure actual purchasing-power returns.

Benchmarking performance: Portfolio managers evaluate income strategies relative to market averages such as sovereign bond yields.

These relationships become especially important during periods of monetary policy shifts or macroeconomic uncertainty, when yield curves steepen or invert, affecting equity and credit markets.

Types of Yield Used in Trading

1. Current Yield

Current yield focuses only on the income component, not total return. It tells traders how much income they earn relative to the bond’s market price.

2. Yield to Maturity (YTM)

A comprehensive measure reflecting the total return a bondholder receives if held until maturity. It includes coupons, price changes and reinvestment assumptions.

3. Yield to Call (YTC)

Used for callable bonds where the issuer may repay early. Traders use YTC when market rates decline and issuers may call the bond to refinance at lower cost.

4. Dividend Yield

Applied to equities. It helps traders assess whether a stock offers competitive income compared to bonds or cash instruments.

5. Real Yield

Adjusted for inflation to reflect true purchasing-power gains. Real yield plays a large role in currency trading, inflation-linked bonds and macro strategies.

Yield and Market Conditions

Yield moves in response to economic expectations. When traders anticipate higher policy rates, yields normally rise on fixed-income assets. Conversely, falling yields often reflect expectations of slower growth, increased risk aversion or a shift toward defensive assets.

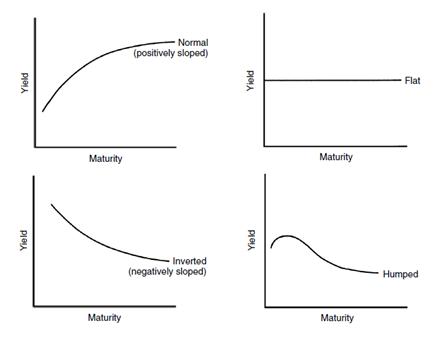

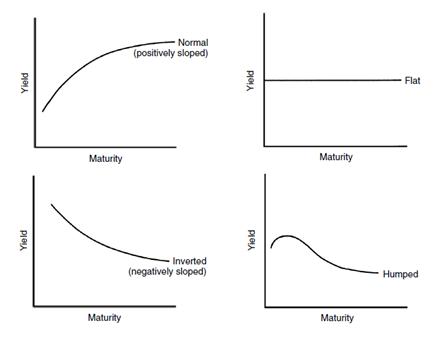

Common Yield curve behaviour:

Normal yield curve: Longer maturities offer higher yields due to inflation and risk considerations.

Flat curve: Signals uncertainty in economic direction.

Inverted curve: Often interpreted as a warning signal of economic slowdown, influencing risk-asset positioning.

Hump-shaped curve: Medium-term maturities show the highest yields, creating a peak that reflects temporary economic or inflation pressures.

Such shapes guide traders in forming strategies related to duration, curve steepeners, curve flatteners and cross-market arbitrage.

Advantages and Limitations of Yield

| Advantages of Yield |

Limitations of Yield |

| Simplifies comparison across assets |

Ignores price appreciation unless using advanced measures like YTM |

| Communicates income potential clearly |

Can be misleading if the underlying asset faces credit or liquidity stress |

| Helps assess risk-reward trade-offs |

Highly sensitive to market price movements |

| Supports macro and valuation analysis |

May not reflect total return for volatile assets |

Related Terms

Coupon Rate: The fixed annual interest payment of a bond based on its face value.

Dividend Payout Ratio: Measures how much of a company’s earnings are distributed as dividends.

Yield Curve: A graphical representation of bond yields across different maturities.

Real Interest Rate: Nominal interest rate adjusted for inflation to show true return.

Frequently Asked Questions (FAQ)

1. Is yield the same as return?

No. Yield measures income only, while return includes both income and price changes.

2. Why do yields move opposite to prices?

Because yields calculate income relative to current price. When price drops, income represents a larger percentage, pushing yield higher.

3. Which yield is most important for bond traders?

Yield to maturity, because it captures total expected return if the bond is held until maturity.

Summary

Yield is an important concept in trading because it quantifies the income efficiency of assets.

Whether evaluating bonds, dividend stocks or multi-asset strategies, traders use yield to compare alternatives, gauge risk, interpret macroeconomic conditions and build structured approaches to market analysis.

Understanding how yield is calculated, how it behaves in different environments and how it supports decision-making ensures more informed trading strategies, especially during shifting interest-rate cycles and evolving global market trends.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.