Why Instant Withdrawals Matter in Forex Trading

Instant withdrawals matter in forex trading because they give traders fast access to their funds, reduce risk, and enhance trading flexibility.

Traders who can withdraw instantly reduce risk, protect profits, and respond immediately to market volatility. A delay of even a few hours can result in missed trading opportunities, particularly during high-impact news events or sudden market swings.

This article will break down how instant withdrawal systems work, what defines a reliable broker, and how traders can maximise speed and security.

What Defines an Instant Withdrawal Forex Broker

An instant withdrawal forex broker is defined by its ability to approve and release withdrawal requests rapidly. While internal approval can happen within minutes, actual fund arrival depends on the chosen payment network.

Why Instant Withdrawals Are Important

Reduce exposure to overnight or gap risks.

Enable rapid capital redeployment for new trades.

Build trust and transparency with traders.

Many traders assume "instant" means money appears in their bank immediately. In reality, even the fastest brokers rely on external payment networks that may take minutes or hours.

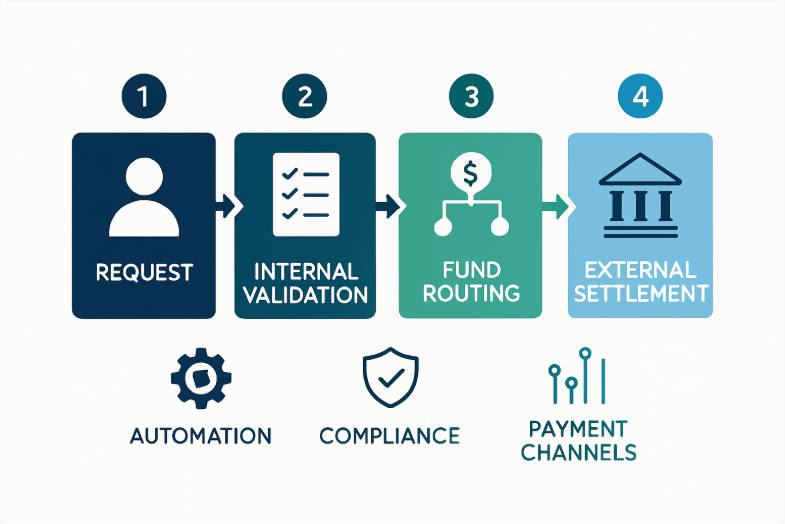

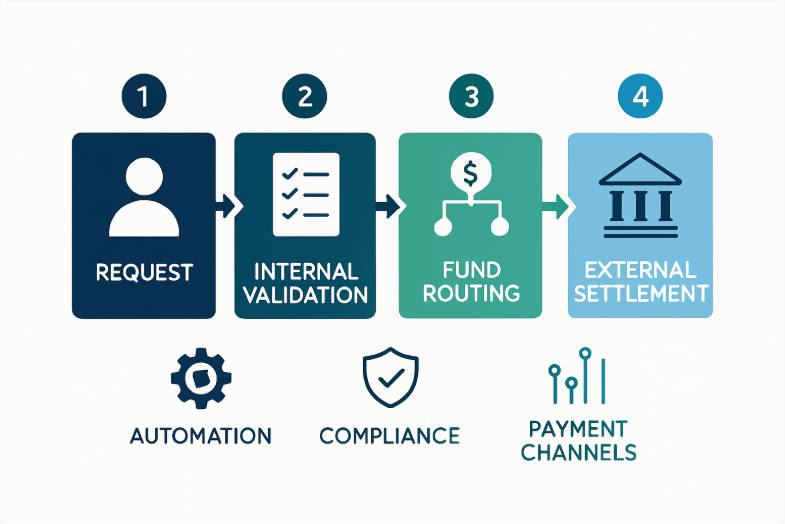

How Instant Withdrawal Systems Operate

The withdrawal process typically involves several stages:

| Step |

Description |

| Request submission |

Trader initiates a withdrawal via the broker platform. |

| Internal validation |

Automated checks verify identity, account balance, and compliance status. |

| Fund routing |

Broker sends funds through the chosen payment channel. |

| External settlement |

Payment network or bank completes the transfer; timing varies by method and region. |

Understanding these stages helps clarify why withdrawal speed can vary and highlights the critical points where efficiency, security, and external factors intersect.

Even with automated systems, each step plays a role in ensuring funds reach the trader safely and promptly, balancing rapid access with necessary compliance checks.

Automated internal approvals: Reduce human error and speed up processing.

Payment network dependency: External networks like banks or e-wallets can influence speed.

Fraud and compliance controls: Protect both the broker and trader, sometimes causing minor delays.

Features of a Reliable Instant Withdrawal Forex Broker

Traders should evaluate brokers on regulatory, operational, and technological criteria:

Regulation:

Licenses from recognised authorities ensure adherence to financial standards.

Segregated accounts:

Protects client funds from operational or liquidity risks.

Payment methods:

Multiple options (e-wallets, instant bank transfers, cards) increase flexibility.

Transparent fees and limits:

Clear costs and minimum withdrawals prevent surprises.

Technology and liquidity:

Robust systems and stable liquidity ensure smooth processing, especially during market volatility.

EBC as a Reference Example

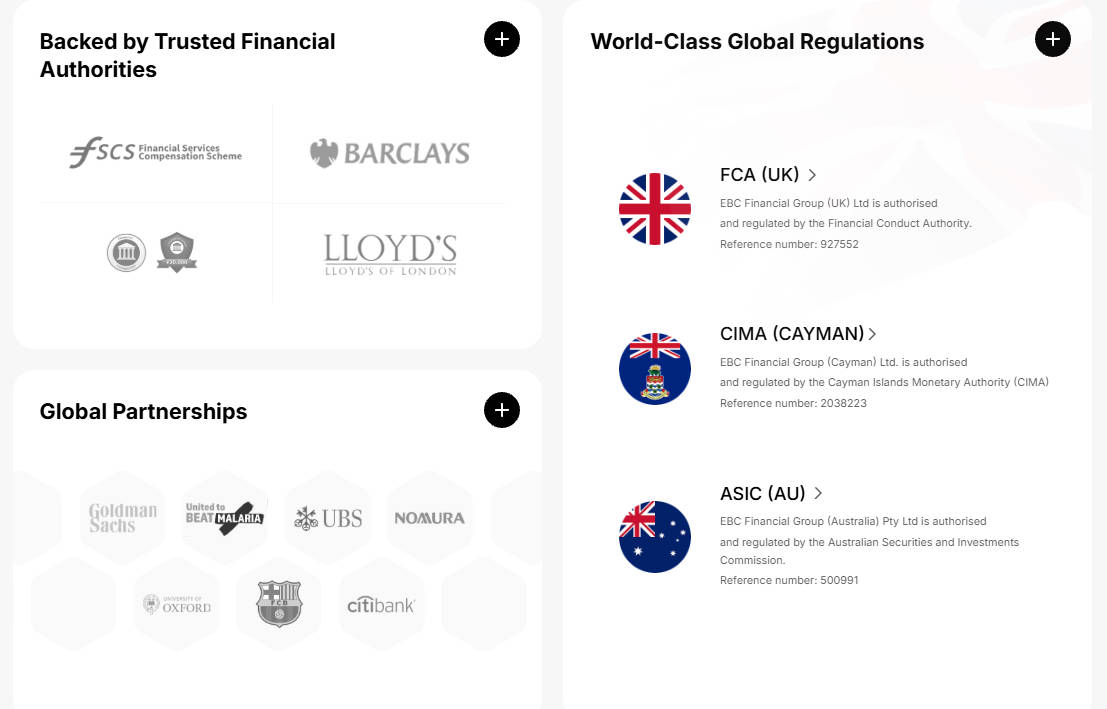

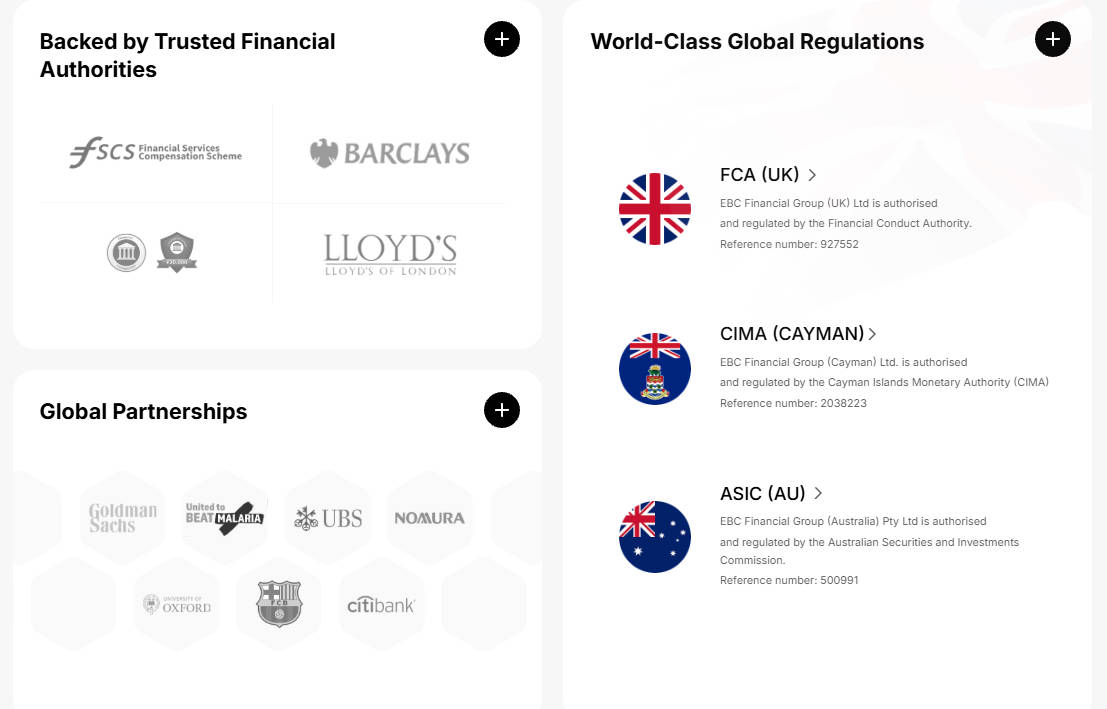

EBC is a useful case study for understanding how a broker can combine speed, compliance, and security:

-

Regulatory oversight:

EBC is regulated by FCA (UK), ASIC (Australia), and CIMA (Cayman Islands), ensuring adherence to high operational standards.

Segregated client accounts:

Reduces risk of operational insolvency affecting withdrawals.

Payment infrastructure:

Supports e-wallets, instant bank transfers, and card withdrawals, providing flexible and fast options.

Transparency:

Account types, fees, and withdrawal terms are fully documented.

Operational reliability:

High execution speed and deep liquidity prevent bottlenecks, even during high trading volumes.

By examining EBC, traders can see how a broker can structure systems for efficient, safe withdrawals while meeting regulatory and operational requirements.

Payment Methods and Their Impact on Speed

The choice of payment method directly influences how quickly funds reach a trader's account. Understanding these differences is critical for traders relying on rapid access to capital. Selecting the most appropriate method based on regional availability and speed expectations ensures that the withdrawal process aligns with trading needs.

Payment Methods and Processing Times

| Method |

Typical Speed |

Pros |

Cons |

| E-wallets |

5–30 minutes |

Fast, widely supported |

May have deposit/withdrawal limits |

| Instant bank transfers |

Minutes to a few hours |

Direct to bank, widely accepted |

Regional variations may slow settlement |

| Card withdrawals |

Hours to 2 business days |

Uses original funding source |

Slower, limited by card issuer rules |

Factors Affecting Withdrawal Speed

Even with a high-quality broker like EBC, several factors can influence timing:

Verification status: Incomplete KYC can delay approval.

Regional banking regulations: Some countries' systems are slower.

Payment method: E-wallets are generally fastest; banks and cards slower.

Market volume: High traffic can temporarily affect processing times.

Understanding these factors helps traders set realistic expectations and plan withdrawals strategically.

Best Practices for Maximising Withdrawal Speed

Complete verification early: Ensure all KYC documents are submitted in advance.

Choose the fastest payment method available: E-wallets or real-time banking options are preferred.

Submit requests during off-peak hours: Avoid delays caused by high traffic.

Maintain accurate account details: Mistakes can lead to unnecessary processing delays.

Keep a consistent transaction history: Reduces additional compliance checks.

EBC vs Industry Expectations

| Criteria |

Typical Industry Standard |

EBC Offering |

| Regulation |

Licensed by at least one recognised authority |

FCA (UK), ASIC (AU), CIMA (Cayman) |

| Client Fund Segregation |

Recommended practice |

Fully segregated accounts |

| Payment Methods |

Fast rails preferred |

E-wallets, instant bank, card options |

| Fee Transparency |

Clear terms |

Account types and withdrawal terms fully documented |

| Technology & Liquidity |

High uptime and reliable liquidity |

Fast execution and stable liquidity pool |

| Reputation |

Positive track record |

Recognised by global awards and long-standing operations |

Frequently Asked Questions

Q1: What defines an instant withdrawal in forex trading?

It is a withdrawal that the broker approves and releases rapidly using automated systems, though final arrival depends on payment channels and regional banking networks.

Q2: Why is EBC a useful example?

EBC combines multi-jurisdiction regulation, segregated accounts, transparent fees, and stable infrastructure, showing how brokers can balance speed and security in withdrawals.

Q3: Can withdrawals still be delayed?

Yes. Verification issues, banking network delays, and regional regulations can extend processing times even with a reliable broker.

Q4: Which payment methods are fastest?

E-wallets and real-time payment networks are usually fastest. Bank transfers and card withdrawals can be slower and region-dependent.

Q5: How can traders maximise speed?

Complete verification, select the fastest payment method, ensure accurate account details, and submit requests during off-peak times.

Conclusion

Instant withdrawals are increasingly important for modern forex traders. EBC provides a clear example of how brokers can structure systems to balance speed, security, and compliance. While no broker can fully control network delays, understanding internal processes, payment methods, and regulatory safeguards allows traders to make informed choices and optimise withdrawal speed.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.