The London stock market opened lower this morning following the latest data from the Office for National Statistics (ONS), which revealed a surprising 0.1% contraction in UK GDP for September, falling short of expectations for flat growth.

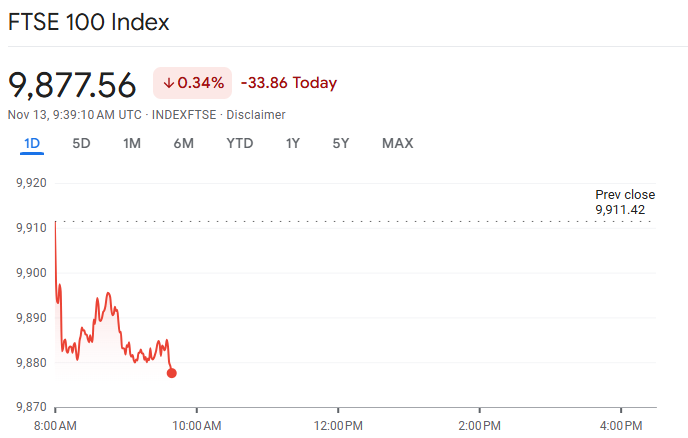

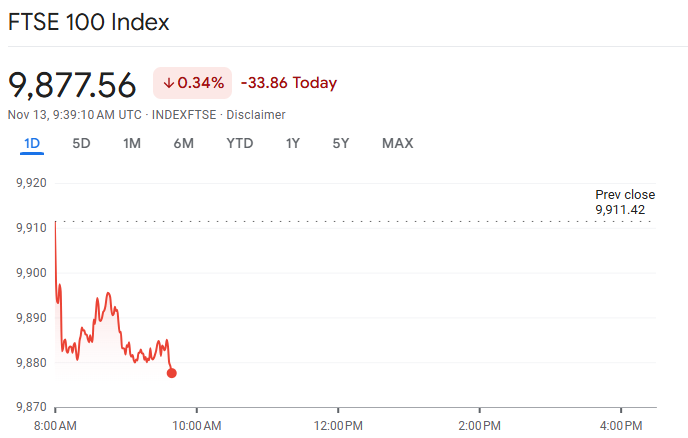

The FTSE 100, which closed last night at a fresh high, dropped roughly 33 points (0.34%) to around 9,877 early in trading, reflecting investor concern about slowing growth and its implications for monetary policy and corporate earnings.

FTSE 100 and Financial Markets' Reaction to the UK GDP Dropping

Immediate Market Reaction

The FTSE 100's dip today is modest but telling as markets are factoring in that slower growth may squeeze corporate earnings and reduce risk appetite.

According to Derren Nathan, head of equity research at Hargreaves Lansdown:

"The FTSE 100 is down at the open, looking weaker than early futures prices had anticipated. Investors are choosing to take a negative view of the double-edged sword that is GDP."

In other words, markets interpret the data both as a signal of economic weakness and as a catalyst for potential policy adjustments.

Monetary Policy Implications

With GDP shrinking and inflation still elevated in parts of the economy, the Bank of England (BoE) may feel more pressure to cut interest rates in December as markets currently price in over an 80% probability of a quarter-point cut.

A rate cut would normally boost equities, but in today's environment, the fact that a cut is being priced because of weak growth rather than recovery may dampen enthusiasm, especially for banks and financial-sensitive sectors.

Sector-Specific Impacts

Automotive and manufacturing firms are directly impacted, as the steep 28.6% decline in motor vehicle production significantly weighed on overall GDP.

While the services and construction sectors may be insulated, they still face challenges from weak demand and rising costs.

Exporters and international companies could benefit from a weaker pound if the economic slowdown continues, provided global demand remains stable.

Why Did the UK Economy Shrink

The Surprising Contraction

The ONS monthly estimate shows that real GDP fell by 0.1% in September 2025, following no growth in August (revised down from +0.1%).

That drop is significant because economists had forecast flat or minimal growth.

More broadly, for the quarter (July-Sept), GDP grew by just 0.1%, down from 0.3% in the April-June quarter.

What Pulled Growth Down

Production output fell sharply by 2.0% in September, largely driven by a 28.6% decline in motor vehicle manufacturing.

A significant portion of this drop was because of a major cyberattack on Jaguar Land Rover (JLR), which forced the company to halt production at its UK plants for several weeks.

Services output grew, but only by 0.2%. Construction also expanded by 0.2%.

Real GDP per head showed no growth for the quarter, underscoring weak productivity and population-adjusted output.

The Broader Context

This weak patch comes at a fragile moment for the UK economy: consumer price pressures, elevated interest rates, and fiscal uncertainty (with the upcoming Budget) all compound risks.

The unexpected slump adds fuel to concerns that the economy might be losing momentum.

What Investors Should Watch Next

1. November Budget & Fiscal Signals

Chancellor Rachel Reeves's Budget, set for later this month (November 26), will be scrutinised for how much it tightens or loosens policy.

With growth subdued, taxpayers may be cautious about tax increases or spending cuts, but markets are likely to respond sensitively to any signs of renewed economic momentum.

2. Revised Economic Data

The September data is an initial estimate as revisions are possible. Meanwhile, look for updates on employment, manufacturing output, and business investment, which could confirm or counter the weak signal from GDP.

3. BoE Guidance & Interest-Rate Outlook

Watch for tone from BoE Governor Andrew Bailey and other policymakers. If they shift toward a "cut sooner" narrative, fixed-income markets may rally, and bank stocks may come under pressure.

4. FTSE Sector Rotation and Forex Reaction

Given weakness in production, sectors such as industrials, autos and manufacturing may underperform.

Conversely, exporters (which benefit from a weaker pound) or defensive sectors may gain favour. Also monitor the pound sterling if it dips following the GDP print.

Conclusion

In conclusion, the 0.1% drop in the UK economy this September is more than just a monthly statistic; it's a signal that growth momentum is fragile and that markets may need to recalibrate expectations for earnings

policy and investor sentiment.

The FTSE 100's early dip serves as a reminder that, despite recent record highs, UK equities remain vulnerable to unexpected macroeconomic developments.

As a piece of advice, don't panic, but recognise this as a warning flag. Use this window to review exposures, stay diversified, and be selective. The story now shifts from "If growth returns" to "When growth returns." A thoughtful strategy and measured positioning will serve you better than chasing recovery too early.

Frequently Asked Questions

Q1: How Large Was the Monthly Drop in GDP?

The UK economy contracted by 0.1% in September 2025, following no growth in August.

Q2: Does This Mean the UK Is in Recession?

Not yet. While growth is very weak (0.1% in Q3), a single quarter of low growth doesn't constitute full recession status. But risk is elevated.

Q3: How Did the FTSE 100 React?

The FTSE 100 opened lower, down around 0.34% (-33 points) at ~9,877, as markets digested the weaker GDP data.

Q4: What Does This Mean for the Bank of England?

It strengthens the case for a rate cut in December, as growth is weaker than expected and inflation remains sticky in parts.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.