Capital markets form the backbone of modern finance. They channel savings into investments, help companies raise funds, and allow investors to buy, sell or trade securities. Understanding the different types of capital market is essential for both businesses seeking capital and individuals exploring investment opportunities.

Below, this article explores the main categories of capital market, how they function, and why they matter for global finance and long‑term investors alike.

Types of Capital Market and Their Core Structure

At its core, a capital market is a system that connects those who need capital (companies, governments) with those who supply capital (investors, institutions). Efficient capital markets enable lower‑cost funding, wide investor access, and improved liquidity.

Capital markets can broadly be divided into two categories: the primary market, where new securities are issued, and the secondary market, where existing securities are traded among investors. On top of that, capital markets often are segmented by instrument type such as equity markets (stocks) and debt markets (bonds).

Primary Market Explained

The primary market is where new securities first come into existence. When a company decides to raise capital publicly, it issues new shares or bonds through mechanisms such as an initial public offering (IPO) or a bond issuance. Through this process, funds flow directly from investors to the issuer. This inflow enables businesses to expand operations, invest in new projects, repay debt, or engage in acquisitions.

Primary market offerings provide an opportunity for issuers to obtain long‑term funding under regulated conditions. Transparency and regulatory oversight make this market crucial for corporate expansion and responsible growth.

Secondary Market Explained

Once securities have been issued, they typically enter the secondary market. This is where trading occurs between investors, rather than between investors and issuers. Stock exchanges and bond trading platforms are typical venues for these trades. Secondary markets provide liquidity: investors can buy and sell securities without affecting the issuer's capital structure.

Through price discovery, supply and demand dynamics, the secondary market also helps determine fair market value for securities over time. This flexibility and liquidity make secondary markets essential for modern investing.

Equity Market Essentials

The equity market deals with shares of companies. When investors buy equities, they acquire ownership stakes in firms. These markets play a crucial role in enabling businesses to grow while giving investors potential for capital appreciation and dividends. Equity markets tend to be more volatile than debt markets but promise higher long‑term returns, in line with the higher risk involved.

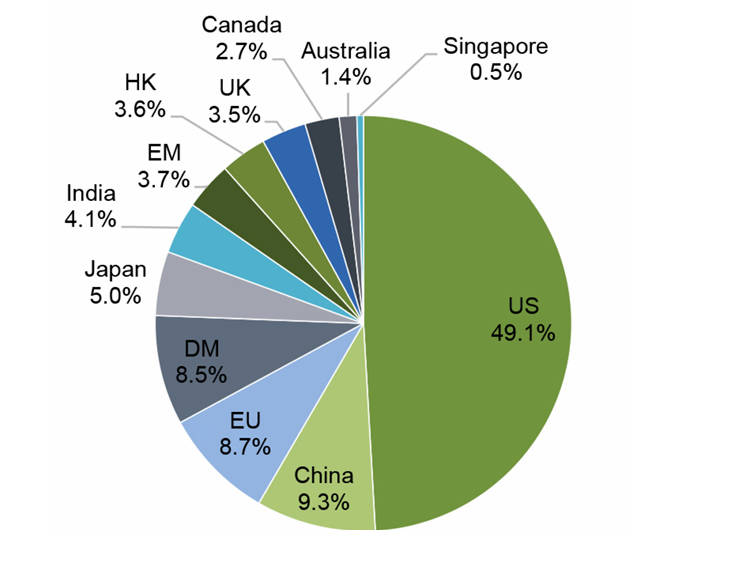

In 2024 global equity market capitalisation reached about US$126.7 trillion and rose by 8.7% year-on-year.

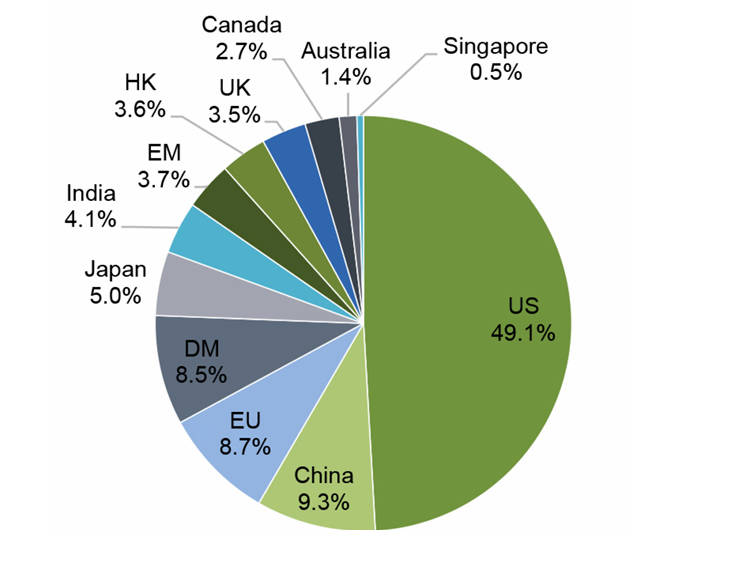

As of FY24 data, companies listed on U.S. exchanges alone accounted for nearly half of global equity value, with the United States maintaining a dominant position globally.

This dominance underlines how central equity markets, particularly in the U.S., remain to global capital allocation and investment strategies.

Debt Market Fundamentals

The debt market, often referred to as the fixed‑income market, involves securities such as government bonds, corporate bonds, municipal bonds, and asset‑backed or mortgage‑backed securities. These instruments promise periodic interest payments and eventual repayment of principal.

In 2024. global fixed income securities outstanding reached approximately US$145.1 trillion.

Debt markets worldwide provide a more stable alternative to equities, with lower volatility and more predictable returns. They are crucial for issuers needing stable long‑term financing without diluting ownership, and for investors seeking income and capital preservation.

Debt‑based financing often plays a dominant role in corporate funding, especially in regions where debt capital markets are well developed. For instance, in the United States non‑financial corporations obtain most of their financing through capital markets rather than traditional bank lending.

Key Functions and Benefits of Capital Markets

Capital markets provide a range of benefits by facilitating equity and debt instruments as well as primary and secondary trading:

Provide efficient channels for companies to raise capital for expansion, innovation, or restructuring.

Offer investors access to diverse assets with varying risk‑return profiles, from stable bonds to growth‑oriented equities.

Supply liquidity, allowing participants to enter or exit positions with minimal friction.

Facilitate price discovery, exposing true market value based on demand, risk, and macroeconomic factors.

Support global economic growth by directing savings toward productive investment rather than idle funds.

Market Types at a Glance

| Market Type |

Primary Purpose |

Main Participants |

Typical Risk / Return |

Liquidity |

| Primary Market |

Issuance of new securities |

Issuers, underwriters, investors |

Moderate (issuance risk) |

Low (until listing/trade) |

| Secondary Market |

Trading existing securities |

Investors, institutions |

Varies (market risk) |

High |

| Equity Market |

Ownership in companies |

Shareholders, traders |

High volatility, high potential return |

High (on exchanges) |

| Debt / Fixed Income Market |

Lending via bonds / notes |

Bondholders, institutional investors, governments |

Lower volatility, fixed income |

Moderate–High (though many bonds trade OTC) |

Real‑World Scale and Market Examples

Global capital markets are nothing short of monumental in scale. By 2024. the total value of outstanding fixed income securities worldwide reached an astonishing US$145.1 trillion. At the same time, global equity markets collectively held a market capitalisation of approximately US$126.7 trillion. These figures highlight not only the sheer size of capital markets but also their central role in the modern economy.

The United States continues to dominate the landscape. Nearly half of the world's listed equity value resides in U.S. markets, while American fixed income securities account for roughly 40 per cent of global issuance. This concentration underscores the country's pivotal influence on global finance.

Leading exchanges in New York, London, Hong Kong and Tokyo bring this scale to life. They host thousands of listed companies, facilitate daily trading volumes worth trillions of dollars, and provide the liquidity that investors and issuers rely upon. The depth and reach of these markets make them indispensable engines for capital allocation, risk management and wealth creation across the globe.

Frequently Asked Questions

1. What are the main types of capital market?

The main types of capital market include the primary market, where new securities are issued, and the secondary market, where existing securities are traded. Together, they support fundraising, liquidity, pricing, and long-term investor access.

2. Why are capital market types important for investors?

Understanding capital market types helps investors make informed decisions about equity, debt, and long-term opportunities. Knowing how each market works improves diversification, risk control, and timing for entry or exit strategies.

3. How do equity and debt markets differ?

Equity markets involve ownership trading with higher growth potential but more volatility. Debt markets provide fixed-income securities with lower risk and stable returns. Both support different investment goals depending on risk tolerance and time horizon.

4. What role does the primary market play in finance?

The primary market enables companies and governments to raise new capital through fresh securities. It delivers transparency, regulation, and structured fundraising, supporting economic expansion and long-term development.

5. What makes the secondary market essential?

The secondary market provides liquidity, price discovery, and easy entry or exit for investors. It allows securities to be traded freely, making the overall financial system more efficient and accessible.

Conclusion

Capital markets provide the frameworks through which capital flows efficiently across economies, enabling growth, innovation, and access to investment opportunities. Whether you are an investor seeking long‑term growth, a company looking to raise funding, or a student of finance learning about global markets, a clear grasp of how different capital market types function is indispensable.

Capital markets are more than simply venues for trading. They are vital engines of economic development and wealth creation. By understanding their structure and roles today, you can better assess your own investments, opportunities, and risks in a complex global financial system.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.