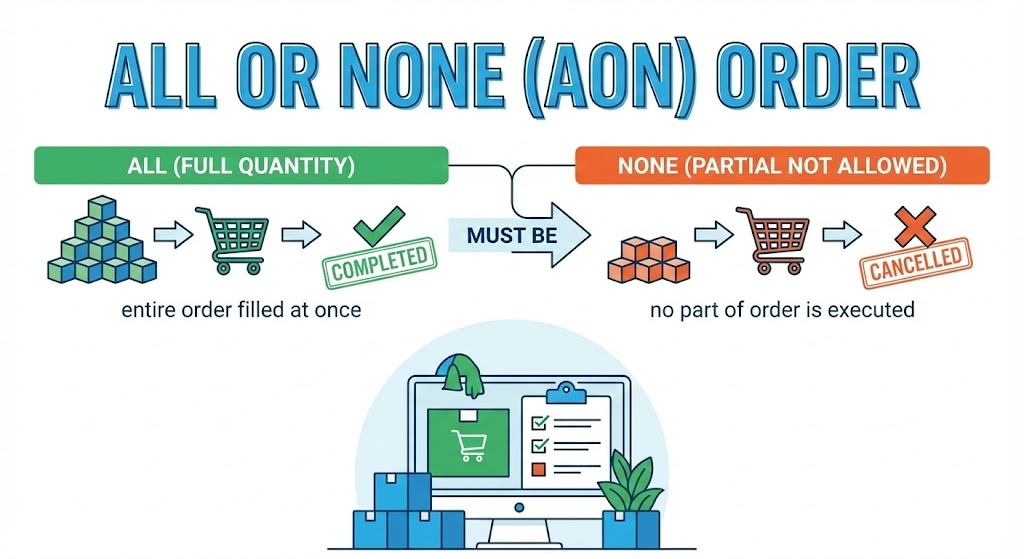

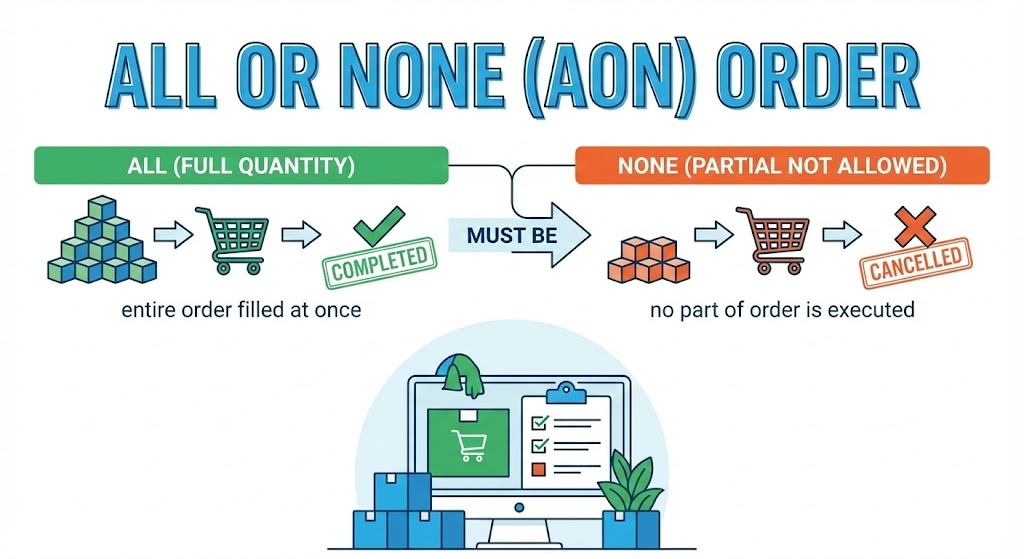

An all-or-none (AON) order is a trade instruction that requires the full order size to be executed at once, or not executed at all. If the market cannot provide the entire quantity at the specified price, the order remains unfilled.

This type of order is used by traders who want certainty in position size. Instead of accepting partial fills that can change risk and cost, an all-or-none order ensures that a trade only happens when the full conditions are met.

This makes it especially useful in markets where liquidity varies or where precise execution matters.

Definition

An all-or-none (AON) order requires the entire order to be filled at the specified price, otherwise no trade is executed.

If sufficient liquidity is unavailable, the order remains open until the full quantity can be matched or the trader cancels it. As a result, AON orders often face longer execution times and a higher likelihood of non-execution in fast-moving or thinly traded markets.

When Do Traders Use All-Or-None Orders

Traders use all or none (AON) orders when getting the full order size is more important than getting filled quickly. These orders are chosen to maintain control over position size, cost, and risk, especially in situations where partial fills could create problems.

AON orders are commonly used when a strategy requires a precise number of shares or contracts. For example, portfolio rebalancing or rule-based strategies often depend on exact sizing, and partial execution could distort results.

They are also used in markets where liquidity is uneven. In such cases, traders may prefer to wait for full matching rather than accept smaller fills at different times or prices.

However, traders usually avoid AON orders during fast-moving or highly volatile markets. In these conditions, prices can change quickly, reducing the chance that the full order will ever be matched.

How All Or None Orders Affect Your Trades

All-or-none orders primarily affect execution quality and position size precision.

They ensure full position sizing as planned, but at the cost of slower execution and a higher chance of missing the trade.

Good situation

Full position size is essential to the strategy.

Market liquidity is stable.

Price precision matters more than speed.

Bad situation

Liquidity is low or fragmented.

The market is moving quickly.

Immediate execution is required.

Quick Example

A trader wants to buy 1,000 shares of a stock at $20 and places an all-or-none order at that price.

In the market, sellers are offering:

600 shares at $20

300 shares at $20

Although 900 shares are available, the order does not execute because the full 1,000-share quantity cannot be filled at a single price.

Soon after, another seller enters the market with 400 shares at $20. At that point, sufficient volume is available, the full 1,000 shares are matched, and the AON order executes in full. If that seller never appears, the order remains unfilled until it is cancelled.

Benefits And Disadvantages Of All Or None Orders

| Aspect |

All or None (AON) Orders |

| Advantages |

Precise position sizing: Ensures the full order size is executed exactly as planned, with no partial fills. Cleaner risk management: Helps traders keep risk calculations accurate by avoiding uneven exposure. Better cost control: Prevents multiple partial fills that could increase transaction costs or complicate accounting. |

| Limitations |

Missed trades: If full liquidity is not available, the order may never be filled. Slower execution: AON orders often wait longer than standard orders to be matched. Less effective in fast markets: Rapid price changes reduce the chance of full execution at the desired price. |

Using Technical And Fundamental Analysis With All Or None (AON) Orders

Technical analysis and AON orders

Some traders use chart patterns and price levels to time entries and exits. When price breaks above or below a well-defined range, it may signal the start of a new trend. In these cases, an AON order can be useful because the trader wants the entire position filled at the breakout level, not partially.

This helps ensure the strategy is executed exactly as planned if the breakout is confirmed.

Fundamental analysis and AON orders

Other traders focus on company fundamentals such as earnings, valuation ratios, and financial strength. When analysis suggests a stock is undervalued or overvalued, they may want to buy or sell a specific number of shares in one complete transaction.

An AON order supports this approach by ensuring the full position is entered or exited only if the desired price and size are available.

In both cases, AON orders are used to align execution with analysis, whether the signal comes from price behaviour or company fundamentals.

Common Mistakes Traders Make

Using AON orders in low-liquidity markets: Limited available volume significantly lowers the likelihood of full execution.

Expecting instant fills: AON orders prioritise complete execution over speed, so immediate fills should not be expected.

Using AON orders during volatile periods: Rapid and fragmented price movements reduce the likelihood that the full order size can be matched at a single price.

Forgetting active AON orders: Orders may remain pending as market conditions evolve, leading to execution at an unintended time or no execution at all.

Related Terms

Active order: A buy or sell instruction that has been placed in the market and is still waiting to be filled or cancelled.

Market order: An order executed immediately at the best available current price.

Order book: A live list of buy and sell orders in the market, showing available prices and quantities.

Order block: A price area where large buy or sell orders have previously entered the market, often watched for future reactions.

Fill or kill (FOK) order: An order that must be executed immediately in full or cancelled if it cannot be filled at once.

Frequently Asked Questions (FAQ)

1. What does an all-or-none order mean?

An all-or-none order executes only if the full quantity is available at the specified price, preventing partial fills that could alter position size or risk.

2. Is an all-or-none order the same as a fill-or-kill order?

No, they are different. An all-or-none order can remain active in the market until enough liquidity becomes available to fill it completely. A fill or kill order, on the other hand, must be executed immediately in full or cancelled right away.

3. Do all or none orders guarantee execution?

No, an all-or-none order enforces execution terms, not execution itself. If sufficient volume is never available at the specified price, the order remains unfilled. Traders accept this limitation in exchange for strict control over position size.

4. When should traders use an all-or-none order?

Traders use all-or-none orders when exact position sizing matters, such as for portfolio balance, cost control, or avoiding partial exposure. They are most effective in markets with sufficient liquidity.

5. Are all-or-none orders suitable for beginners?

They can help, but beginners should be cautious. AON orders prevent partial fills but increase the risk of missed trades, so open orders should be monitored closely.

Summary

An all-or-none (AON) order ensures a trade is executed only if the full order size is available at the chosen price. The key trade-off is control versus speed: it protects position size and execution precision, but increases the risk of delays or missed trades when liquidity is limited.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.