A Historic Surge in the Global Gold ETF Boom

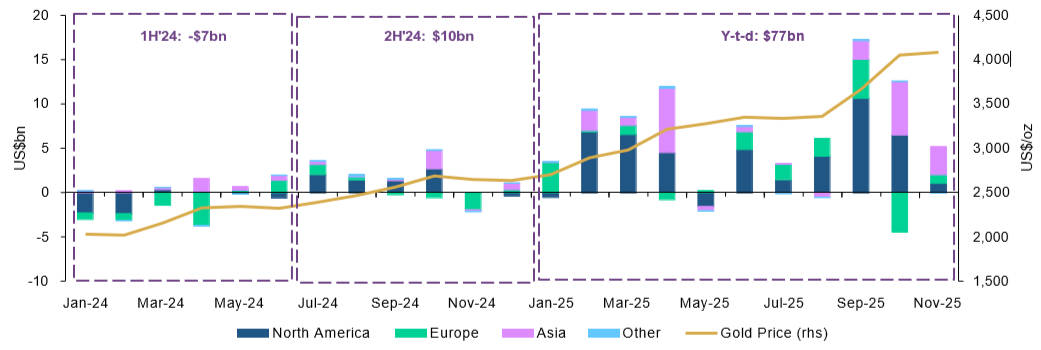

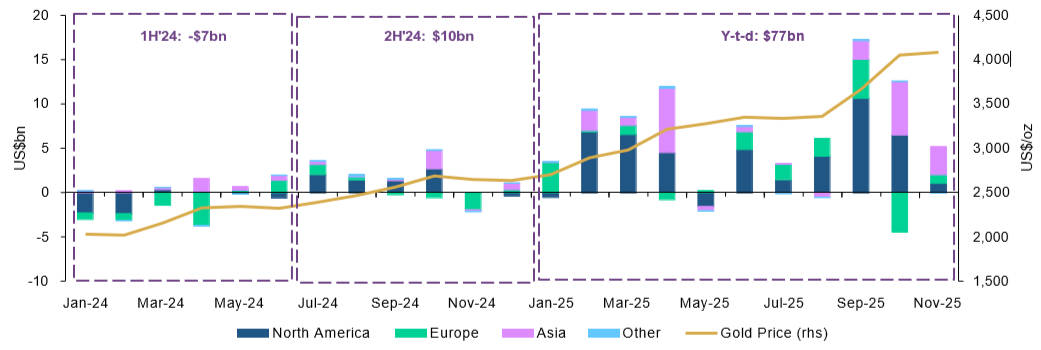

The financial markets are witnessing an unprecedented surge in physical gold ETFs, pushing global assets under management (AUM) and collective holdings to historic levels. Global funds have now recorded six consecutive months of net inflows, a powerful wave that culminated in a record month-end peak in November 2025. [1]

This exceptional performance is largely fueled by one dominant region: Asia. Investors are increasingly shifting capital into gold-backed funds, using them as reliable safe-haven assets amid persistent global economic uncertainty and geopolitical volatility. This Global Gold ETF Boom signals a fundamental shift in asset allocation, validating gold's role as a critical portfolio hedge.

2025 Gold ETF Boom: Recent Stats

| Period / Metric |

Key Data (2025) / Notes |

| H1 2025 inflows |

US$ 38 billion — largest semi-annual inflow since 2020. Gold holdings rose 397.1 metric tons. |

| Q3 2025 inflows |

US$ 26 billion — strongest quarterly inflow on record for gold ETFs. |

| End Q3 2025 AUM |

US$ 472 billion, up ~23% quarter-on-quarter. |

| November 2025 inflow |

US$ 5.2 billion — marking sixth consecutive month of net inflows. |

| November 2025 AUM / Holdings |

AUM hit US$ 530 billion; holdings rose to 3,932 tonnes — the highest month-end levels ever. |

Unpacking the Record: Gold ETF AUM and Holdings

The latest data from the World Gold Council confirms the remarkable scale of this market expansion. In November 2025. global physically backed Gold ETF AUM swelled to a staggering US$530 billion, marking yet another month-end peak. This inflow streak, alongside strong gold price performance, has also seen collective gold holdings rise to 3.932 tonnes—the highest month-end value ever recorded.

In November alone, global funds added US$5.2 billion in inflows. While North American and European funds contributed to the positive sentiment, it was the explosive appetite from Eastern markets that acted as the primary engine of this growth, underscoring Asia's growing influence in the global gold investment landscape.

Asia Powers the Structural Gold ETF Boom

Asia has emphatically taken the helm of the global gold investment market, driving over 60% of the November inflows. The region attracted US$3.2 billion, extending its streak of positive flows to three consecutive months. Several converging regional and global factors are compelling Asian investors to pour capital into Gold ETFs:

1. Chinese Investor Momentum:

China dominated the region's inflows, contributing $2.2 billion. Local investors, facing persistent equity market weakness and looking to hedge against domestic economic slowdowns, have increasingly turned to gold funds.

2. Geopolitical and Economic Uncertainty:

Geopolitical tensions and local currency depreciation against the US dollar have heightened demand for gold as a store of value. Furthermore, regulatory changes, such as newly announced VAT reform in China, are believed to have encouraged some investment jewelry buyers to switch to the more efficient gold ETF vehicle.

3. India's Consistent Buying:

Indian gold ETFs have consistently seen inflows, marking their sixth straight month of buying. This sustained interest is supported by favorable local currency dynamics and general bullish sentiment surrounding the yellow metal.

The Institutional Anchor: Central Bank Gold ETF Demand

A broader, structural factor supporting the entire gold price and, consequently, the Gold ETF AUM is the unprecedented level of official-sector buying. Central banks, especially from emerging economies, are accumulating gold at near-record pace—buying over 1.000 tonnes annually since 2022. This systematic accumulation is driven by:

1. De-Dollarization Strategy:

Following geopolitical events and asset freezes, many nations are actively reducing their reliance on the US Dollar as a primary reserve asset, seeking the neutrality and safety of gold.

2. Structural Demand Floor:

Unlike price-sensitive investors, central banks buy gold regardless of short-term volatility. This institutional commitment creates a structural demand floor that significantly tightens the physical gold supply, reinforcing the long-term upward trajectory for the metal and encouraging broader Gold ETF participation.

Macroeconomic Pressures Fueling the Global Gold ETF Boom

The rally is a direct response to deepening concerns about the global financial architecture and traditional portfolio hedges.

1. Eroding Fiat Confidence:

With global government debt soaring past $38 trillion, the reliability of sovereign bonds as a safe haven is being questioned. This erosion of confidence in fiat currencies is pushing both institutional and retail investors toward gold, which has no counterparty risk.

2. Lower Real Yields & Dollar Weakness:

Expectations for an aggressive US Federal Reserve rate-cutting cycle in the coming quarters will lower real interest rates. Since gold is a non-yielding asset, its opportunity cost decreases as rates fall, making it significantly more attractive relative to dollar-denominated assets.

3. The 60/40 Portfolio Breakdown:

Gold's uncorrelated nature is more valuable than ever. When the traditional inverse relationship between stocks and bonds breaks down (meaning they fall at the same time), gold acts as one of the few assets that can provide true diversification and portfolio stability.

Frequently Asked Questions

Q1: What are Gold ETFs, and why are they booming?

Gold Exchange-Traded Funds (ETFs) are investment funds that hold physical gold bullion. They are booming because they offer investors a liquid, low-cost way to gain exposure to gold prices, acting as a crucial safe-haven hedge against inflation and market volatility.

Q2: Which region is currently leading the global inflows into gold ETFs?

Asia is currently leading the inflows, particularly driven by China, Japan, and India. Asian investors are utilizing gold ETFs to navigate regional equity market weakness, capitalize on strong local gold prices, and hedge against persistent economic and geopolitical uncertainty.

Q3: How do gold prices affect the AUM of Gold ETFs?

The gold price directly impacts the AUM (Assets Under Management). A rising gold price increases the dollar value of the physical gold held by the funds. When coupled with high investor inflows, this compounding effect is what drives AUM to record high levels.

Q4: Why is gold considered a safe-haven asset in volatile markets?

Gold is considered a safe-haven asset because its price tends to hold its value or rise during periods of economic or political turmoil, unlike stocks or bonds. Investors use its stability to protect their purchasing power against currency depreciation and market shock.

Conclusion

The momentum witnessed in November 2025 is not merely a cyclical spike but a structural change in how investors, particularly in Asia, view portfolio resilience. The confluence of geopolitical risk, economic uncertainty, and the resulting massive inflows solidifies gold ETFs as a primary investment vehicle. This sustained Global Gold ETF Boom confirms that the yellow metal remains indispensable in an increasingly complex financial world.

Sources:

[1] https://www.gold.org/goldhub/data/gold-reserves-by-country

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.