The global financial markets are still digesting the Federal Reserve's final monetary policy decision of 2025. While a 25 basis point rate cut—reducing the target federal funds rate to a range of 3.50-3.75%—was widely anticipated, the market reaction has been swift and decisive: a sharp decline in the value of the greenback.

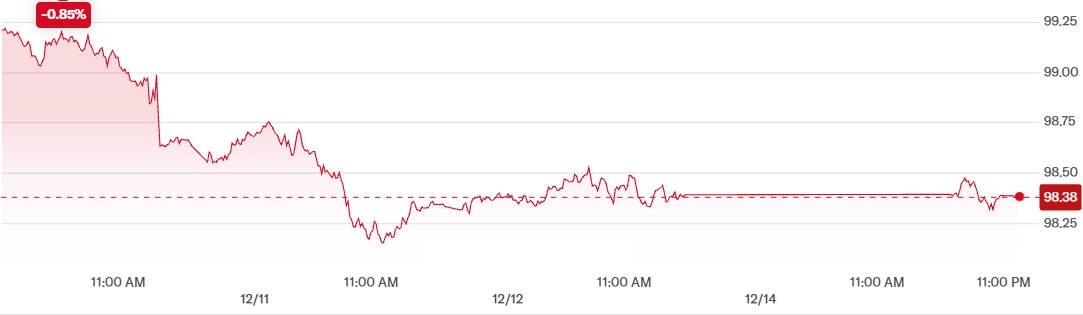

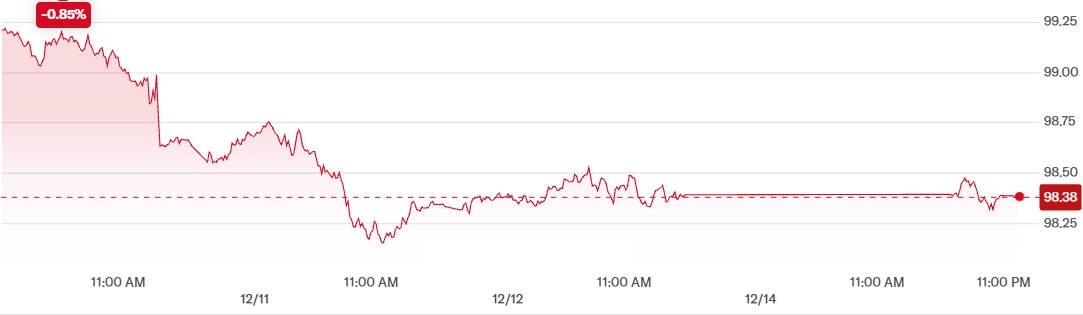

The US Dollar Index (DXY), which measures the dollar's value against a basket of six major currencies, is currently trading near its recent lows and is on track for its third consecutive weekly decline, firmly falling below the key 98.40 support level.

This performance confirms the classic economic principle that lower interest rates reduce the appeal of dollar-denominated assets to foreign investors. In this long-form analysis, we examine the core drivers behind the dollar's drop and assess the market's increasingly dovish outlook for the US economy heading into 2026.

Immediate Market Reaction and Dollar Index Performance

The Federal Reserve's announcement, accompanied by the latest Summary of Economic Projections (SEP), immediately sent tremors through the Foreign Exchange (FX) markets, reversing recent gains and pushing the dollar into a sustained downtrend.

1. DXY Performance and Key Levels

As of the latest close, the DXY is hovering around 98.36. registering a notable decline for the week and a more significant slide over the month of December. This is a critical development, as the index is testing levels not seen since the summer. Should the dollar fail to defend this support, analysts anticipate a potential drop towards 97.50. driven purely by technical selling pressure combined with bearish fundamentals.

2. Major Currency Pair Movement (vs. USD)

The dollar's weakness is most evident when viewing key cross-rates:

1) EUR/USD:

The Euro has been a major beneficiary, with the pair trading higher at approximately $1.1741. This strength is partly attributed to the fact that the European Central Bank (ECB) has signalled a far slower pace of rate cuts than the Fed, making Eurozone assets comparatively more attractive.

2) GBP/USD:

Sterling has also gained ground, consolidating above $1.33 and achieving a multi-week high. The Bank of England's (BoE) cautious approach to easing policy is providing tailwinds for the Pound.

3) USD/JPY:

The pair is under pressure, trading near 155.50. The Bank of Japan (BoJ) is widely expected to be the next major central bank to actually raise rates, creating a significant policy divergence that dramatically undermines the dollar's carry-trade appeal.

Core Drivers Behind US Dollar Weakness and Interest Rate Differential

The current market dynamic is not just a knee-jerk reaction to the rate cut itself, but a more profound response to the Fed's signals regarding the entire 2026 economic outlook.

1. The Dovish Fed Policy Outlook

The most important factor driving dollar selling is the market's interpretation of the Federal Open Market Committee (FOMC) statement and Chair Jerome Powell's press conference. While the cut was priced in, the associated forward guidance was viewed as significantly more dovish (less restrictive) than expected.

Crucially, the Fed's own "dot plot" of projections still suggests only one further rate cut in 2026. However, the market has essentially dismissed this guidance, choosing instead to price in the probability of two full 25 basis point cuts next year. This gap between the Fed's official projection and market pricing is the engine of dollar weakness: investors are selling the dollar based on the conviction that rates will be lower for longer than the Fed is currently willing to admit.

2. Softening US Labor Market & Economic Data

Recent economic indicators have provided the necessary ammunition for the Fed to adopt a more relaxed posture, thus reducing the dollar's appeal.

Jobless Claims: Weekly jobless claims for the week ending December 6th, 2025. climbed sharply to 236.000. significantly surpassing the market consensus. This figure indicates a cooling in the historically tight US labour market. A weaker labour market suggests less inflationary pressure, justifying further rate cuts.

Manufacturing Slowdown: Surveys and purchasing managers' indices (PMIs) show continued contraction in the manufacturing sector.

This consistent stream of slowing data is interpreted by the FX market as a green light for the Fed to prioritise support for economic growth over aggressive inflation fighting, a strategy that inevitably weakens the currency.

3. Narrowing Interest Rate Differentials

The concept of the interest rate differential is fundamental to currency valuation. When the Fed cuts rates, it narrows the gap between US interest rates and those in the Eurozone, Japan, and the UK. As the yield on US Treasury bills falls, the incentive for global capital to flow into dollar-denominated assets diminishes significantly. Fund managers seeking the best risk-adjusted return will reallocate capital to jurisdictions where rates are either stable or rising.

Impact on Other Asset Classes and Safe-Haven Status

The dollar's performance is rarely isolated; it acts as the keystone currency, influencing nearly every other major asset class.

1. Equities and Bonds

The rate cut is generally viewed as a positive stimulus for risk assets. US equity indices, such as the S&P 500 and the Nasdaq, have largely rallied on the news, as lower borrowing costs improve corporate profit margins.

Conversely, the US bond market has experienced a rally, with the prices of US Treasuries rising. This translates into a decline in yields. The 10-year Treasury yield has dipped, reflecting increased demand for bonds as investors lock in yields before anticipated future cuts.

2. Precious Metals (Gold/Silver)

A weaker dollar and lower real interest rates create a powerful bullish environment for non-yielding assets, particularly Gold and Silver. Gold prices have surged, with the spot price recently climbing past $2.150 per ounce.

Gold serves as a classic hedge against inflation and currency debasement; when the dollar falls, gold's value relative to other goods typically rises.

US Economic Forecast and Dollar Outlook for 2026

Looking ahead, the consensus among FX strategists is that dollar weakness is likely to persist into the first half of 2026. barring a significant and unexpected economic shock.

1. Analyst Expectations

Major banks are adjusting their forecasts, predicting that the DXY will struggle to regain the 99-level until at least the middle of next year. The key risk remains a global growth slowdown: if the economies of Europe or China deteriorate more rapidly than the US, the dollar could briefly regain its traditional status as a 'safe-haven' currency, forcing a temporary reversal of the trend.

2. Key Data to Watch

The dollar's path remains definitively data-dependent. Traders will be monitoring the following releases with forensic detail: Consumer Price Index (CPI) figures, Monthly Non-Farm Payrolls (NFP), and future FOMC dissents.

3. The Global Context

Finally, the dollar's fate is always relative. The policy decisions of other central banks are critical. If the Bank of Japan (BoJ) raises rates, the Yen will strengthen considerably against the dollar. Similarly, if the European Central Bank (ECB) surprises the market with unexpectedly hawkish comments, the Euro will continue its upward trajectory, further suppressing the DXY.

Frequently Asked Questions

1. Why is the dollar weakening after the Fed cut rates?

The dollar is weakening because lower interest rates decrease the returns on US bonds and savings, making them less attractive to international investors. This reduced demand causes capital to flow out of the US and into currencies with higher or more stable yields.

2. What is the significance of the DXY drop?

The DXY (Dollar Index) measures the dollar's strength against a basket of major currencies. Its drop signifies broad-based dollar weakness, indicating that it is losing value simultaneously against currencies like the Euro, Yen, and Sterling, reflecting a global shift in confidence.

3. How does the interest rate differential impact the dollar?

The interest rate differential is the gap between US rates and those abroad. When the US cuts rates, this gap narrows, reducing the yield advantage the dollar offers. This encourages traders to sell dollars and invest in currencies where the differential is more favourable.

4. Is the US dollar losing its 'safe-haven' status?

Not entirely, but its current weakness suggests investors are prioritising returns over safety. The dollar will likely regain its safe-haven appeal only if a major global crisis occurs, which would override the current focus on monetary policy differences for now.

5. What US economic forecast data should traders watch now?

Traders must watch upcoming US economic forecast data, especially the Non-Farm Payrolls and inflation (CPI) reports. Stronger-than-expected data could reverse the dollar's decline by suggesting the Fed may pause or slow its rate-cutting path in 2026.

Conclusion

The Federal Reserve's December 2025 rate cut has confirmed the market's bearish view on the US dollar. Driven by a perceived dovish pivot in Fed policy, softening US economic data, and the resulting erosion of the interest rate differential, the US Dollar Index (DXY) is firmly on the defensive.

While volatility is inevitable, the macroeconomic environment strongly suggests that the dollar's period of dominance is waning. The currency's immediate future is tethered to upcoming economic data releases and the final, decisive policy shifts of the Fed and its global counterparts.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.