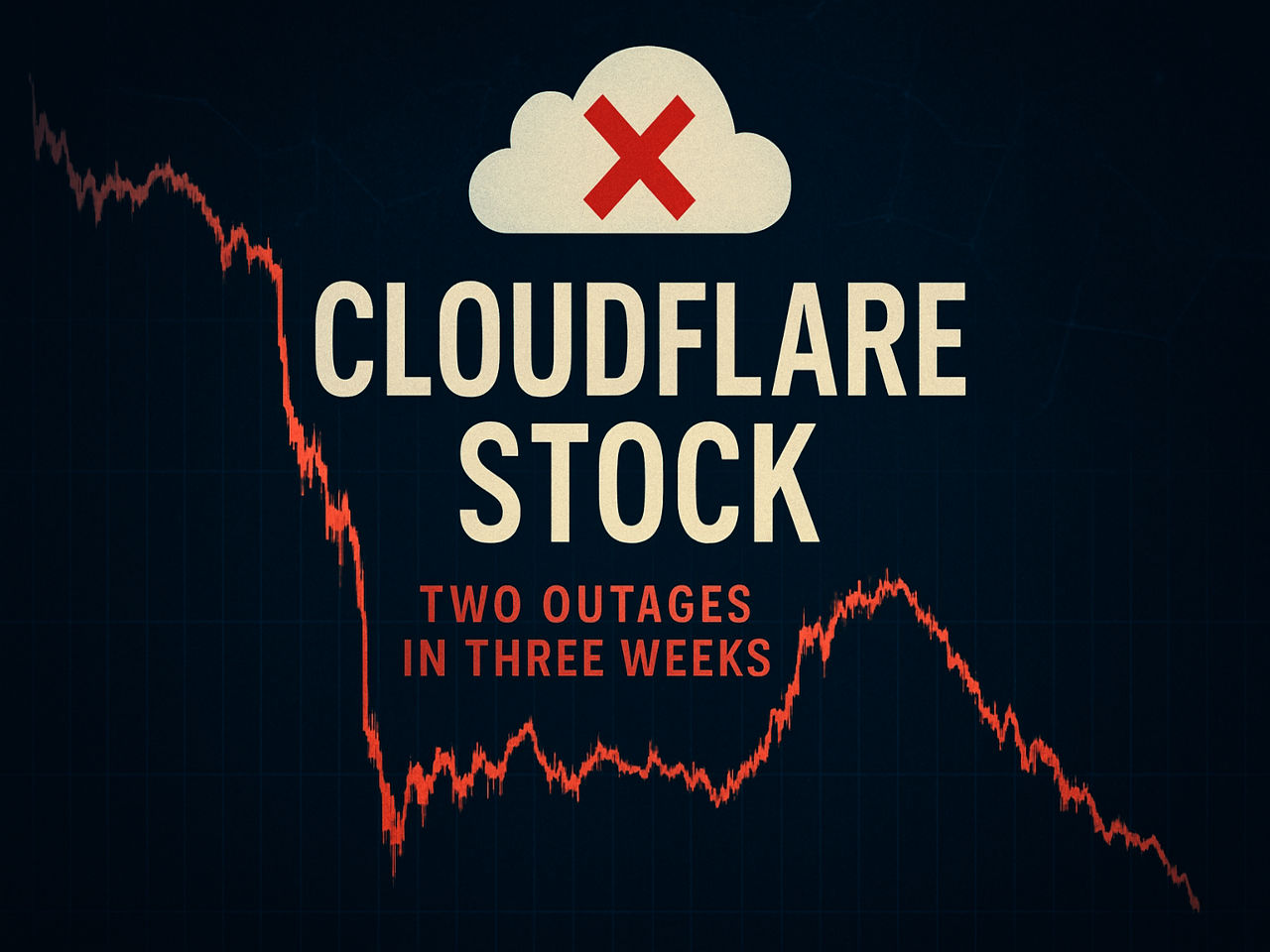

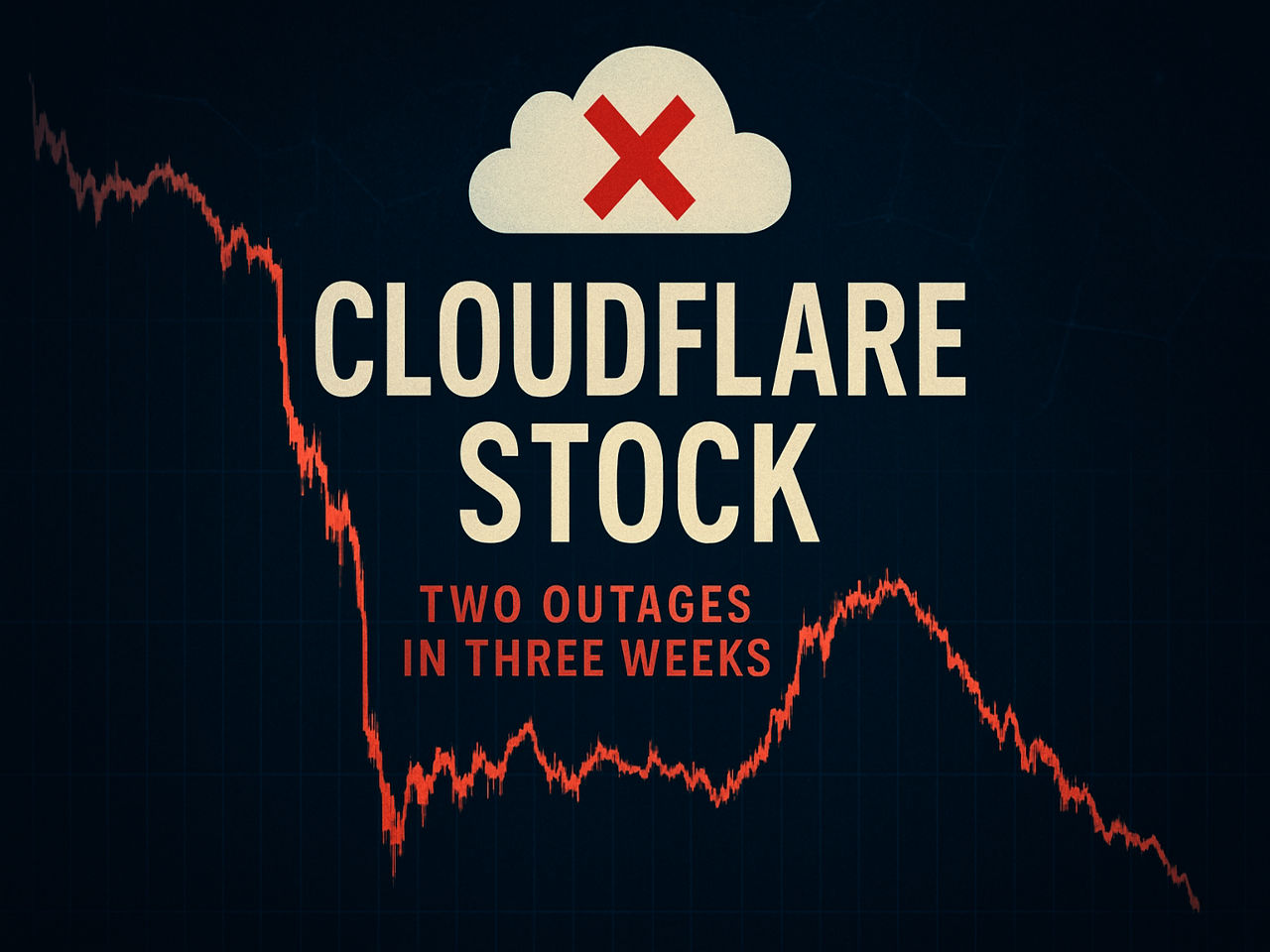

Cloudflare has gone from market favourite to volatility magnet in a matter of weeks. After hitting the high-$200s on strong third-quarter results, the stock is now trading well below its recent peak as traders price in a second large-scale outage in less than a month.

For traders, the story is no longer just about growth. It is about reliability, valuation, and whether this pullback is a healthy reset or the start of a deeper de-rating.

Cloudflare Stock Today: How Big Is the Slide?

At the U.S. close on 4 December, Cloudflare (NYSE: NET) finished around $204.15.

Pre-market quotes on 5 December show the stock slipping again toward $198.50, a drop of about 2.8% from the prior close as headlines about a fresh outage hit the tape.

A few key points:

NET is now slightly over 20% below its recent 12-month high near $260.

Despite the pullback, shares are still up roughly 80–120% over the past year, depending on the exact lookback used.

The slide accelerated after the 18 November outage and has picked up again with the 5 December incident.

In other words, this is not a collapse. It is a sharp reset from very stretched levels after two visible hits to confidence.

What Triggered Cloudflare Stock to Drop?

1) The November Outage Changed the Tone

On 18 November 2025, Cloudflare suffered its most serious outage since 2019. A bug in a Bot Management configuration file caused widespread HTTP 5xx errors across its network, disrupting access to major platforms, such as X, ChatGPT, Canva, and more.

Market reaction was quick:

Cloudflare shares fell about 4–5% in pre-market trading, pushing the stock down toward the low-$190s.

Reports estimated the stock lost around $1.8 billion in market value as it dropped from near $200 to about $193.

The slide came on top of a 13–14% decline over the prior week, even though NET was still up more than 100% over 12 months.

Technical coverage noted that the sell-off pushed NET below its 100-day moving average, a level many swing traders use as a medium-term support line.

For a stock priced for perfection, a visible outage that takes down key internet platforms is exactly the kind of event that prompts profit-taking and a shift in narrative from "flawless growth story" to "great business with real operational risk."

2) A Second Outage in December Keeps the Pressure On

On 5 December 2025, Cloudflare was hit again. Multiple outlets reported a new global disruption that briefly knocked out or slowed sites such as Investopedia, LinkedIn, Canva, Fortnite, Coinbase, and the outage tracker Downdetector itself.

Media and monitoring sites highlighted:

A scheduled maintenance window coinciding with users seeing 500 Internal Server Errors on Cloudflare-protected sites.

Reports of users being unable to access major consumer apps, fintech platforms and local brokers, including those in India.

This is the second major outage in roughly three weeks, reinforcing worry about reliance on a single provider that touches about 20% of global web traffic.

Even if the December disruption was shorter than the November one, traders see a pattern. Reliability is now front and centre when they talk about Cloudflare, especially for brokers, payment firms and trading platforms that rely on its network to stay online.

What Traders See on the Cloudflare Chart

Listed is a simplified view of the main levels traders are watching:

| Indicator / Level |

Approx. value* |

Signal today |

What traders see |

| Last close (4 Dec) |

$204.15 |

- |

Bounced from post-outage lows |

| Pre-market (5 Dec) |

$198.50 |

Short-term negative |

Fresh selling after second outage |

| 21-day SMA |

$210.0 |

Price below

|

Short-term trend under pressure |

| 50-day SMA |

$215.95 |

Price below

|

Medium-term uptrend broken |

| 100-day SMA |

$210.91 |

Price below

|

Previous support now acting as cap |

| 200-day SMA |

$177.71 |

Price above

|

Long-term uptrend still intact |

| 14-day RSI |

~54 |

Neutral |

No clear overbought/oversold signal |

| MACD (12,26,9) |

Negative |

Bearish momentum |

Pullback phase not fully finished |

| 52-week high / low |

$260 / $89 |

- |

Still much closer to the high |

*Levels based on technical screens as of 5 December 2025.

Put simply:

The primary trend (above the 200-day) remains up.

The intermediate trend (21-, 50-, 100-day lines) is under pressure.

Momentum is cooling, not collapsing.

Short-term traders will pay close attention to the $190–195 band (recent outage lows) and the $175–180 zone around the 200-day moving average as potential support areas.

Cloudflare Stock Sentiment, Flows and Positioning

The outages arrived after a long bull run, and that context matters for positioning.

Before the November event, Cloudflare had recently printed record highs around $260 after its Q3 beat.

Outlets highlighted that NET was still up about 119% YoY, even as it dropped roughly 14% in the week around the outage.

Commentators describe Cloudflare as one of 2025's better tech performers, but now with heightened volatility and a more cautious tone from traders.

Retail participation has picked up, too, as Stocktwits data show message volume on the Cloudflare stream jumping around 2,000% in the 24 hours after the November outage, with retail sentiment flipping from bearish to "extremely bullish" as some traders moved to buy the dip.

On the flip side, other data reveal heavy insider selling throughout October and November, with multiple executives, including the CEO and CFO, cashing out shares above $190–$250. That does not mean insiders expect a crash, but it adds to the sense that management viewed the prior rally as a good time to take profits.

Adding to this is a broader market rotation, as concerns over AI-related valuations and high-multiple software stocks have pressured tech indices throughout November, amplifying the impact of any stock-specific shocks.

Key Takeaways for Traders

Price action: NET has dropped more than 20% from recent highs and is trading below key short- and medium-term moving averages, while still holding above its 200-day line.

Catalysts: Two large-scale outages in three weeks have made reliability the main near-term driver of sentiment, even though the core business remains strong.

Fundamentals: Revenue growth above 30%, improving profitability and a strong balance sheet remain intact, but the market is re-examining how much it is willing to pay for that profile.

Risk factors: High valuation, concentration risk in global infrastructure, and the possibility of further service incidents all sit on the risk side of the ledger.

For active traders, the upcoming few sessions around the $190–210 band will be crucial. For investors, the key question is simple: do the outages mark a bump in the road or the start of a more persistent "trust discount" in the valuation?

Frequently Asked Questions

1. Why Is Cloudflare Stock Dropping Today?

Cloudflare stock is under pressure as traders digest a second major outage on 5 December, only weeks after a large disruption on 18 November that took down services like X and ChatGPT.

2. Is Cloudflare Stock Overvalued After the Drop?

Even after the pullback, NET trades at over 30 times expected 2025 sales, and several valuation models from independent research firms still classify the stock as significantly over fair value.

3. What Levels Are Traders Watching Now?

Many short-term traders are watching $190–195 as near-term support, with the 200-day moving average around $178 as a deeper line in the sand.

Conclusion

In conclusion, Cloudflare's recent slide is less about its long-term story and more about how the market reacts when a high-priced growth stock shows a weak spot.

Two outages in a short span have shifted focus from pure revenue growth to a tougher mix of reliability, execution and valuation. Traders are now watching whether management can restore confidence as clearly as it delivered on earnings.

On the chart, NET remains in a long-term uptrend, but the break below key short- and medium-term averages shows that momentum has cooled. The $190–210 zone is now the main battleground.

A hold above support with calmer news flow could encourage "buy-the-dip" traders, while a clean break lower would signal that the de-rating phase is not finished.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.