Key risks facing the Asian stock market

Overconcentration in AI and tech. Heavy reliance on a small cluster of names increases systemic risk for indices that have high sector concentration.

Sustained outflows. Continued foreign selling risks widening liquidity stress in smaller markets and could prompt forced sales from leveraged funds.

Macroeconomic slowdown. Weaker growth in major Asian economies would reduce corporate earnings growth and increase downside risk.

Policy mistakes. Misjudged central bank actions could trigger volatility and rapid repricing across asset classes.

Geopolitical and trade tail risks. Escalations in trade tensions or regional geopolitical events would add to investor uncertainty and encourage flight to safety.

Recent market trends across key Asian stock markets

| Market |

Recent move |

Principal driver |

| South Korea |

Sharp falls in tech heavyweights; largest regional outflows |

Concentration in semiconductor and AI linked firms; foreign selling. |

| Taiwan |

Significant pressure on chip manufacturers and large outflows |

Foundry and memory stock exposure; valuation reappraisal. |

| Japan |

Mixed performance with selective weakness in exporters and tech |

Q3 GDP contraction and attention on policy; cautious positioning. |

| India |

Net outflows but relative resilience in some domestic plays |

Rebalancing by global funds and local investor interest. |

| Southeast Asia |

Divergent results across markets |

Some countries saw modest inflows while others faced selling pressure. |

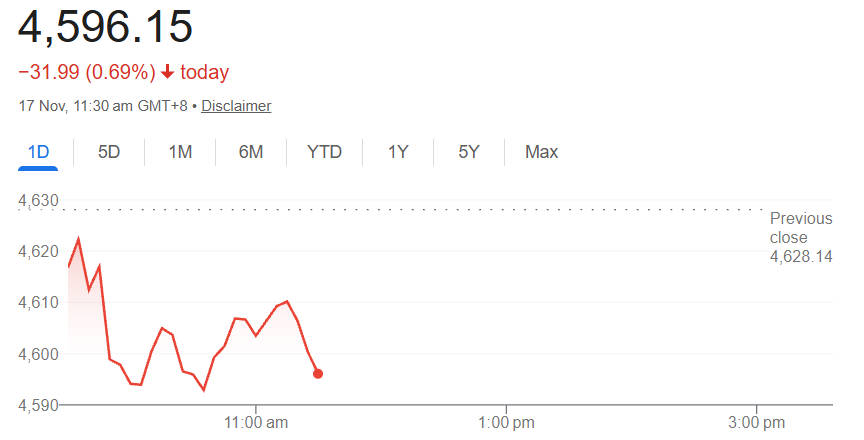

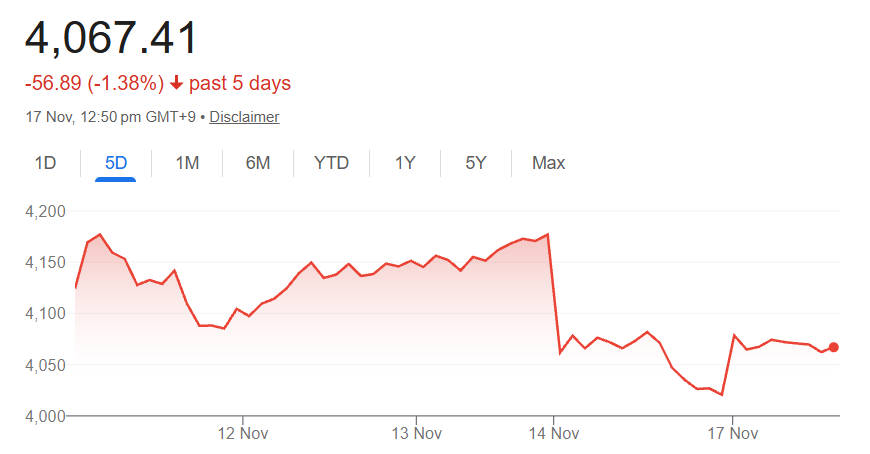

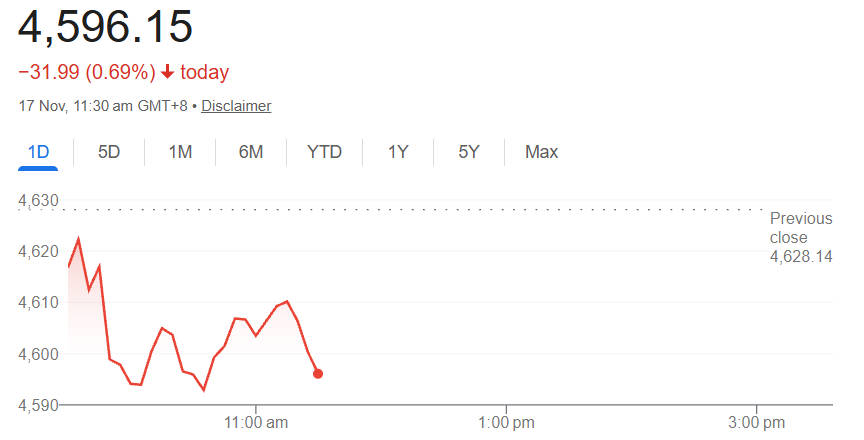

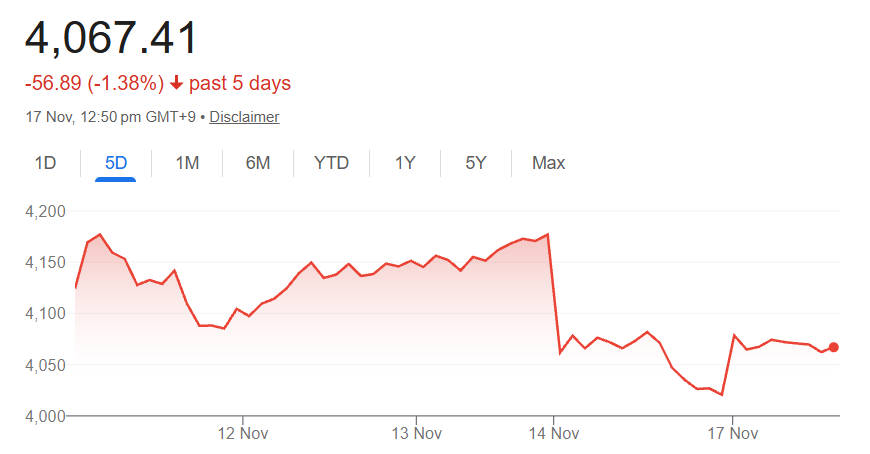

In summary, the Nikkei remains resilient but sensitive to external shocks. TOPIX shows broader market weakness. CSI 300 reflects caution in mainland equities, while the KOSPI faces the largest short-term pressure due to concentrated tech exposure.

A turning point for Asian stock markets

Foreign investors withdrew roughly US$10.18 billion from Asian equities in the first week of November, reversing modest inflows recorded in October. [1]

This selling was concentrated in markets with heavy technology exposure, reflecting a rapid reappraisal of stretched valuations and of how much near term earnings can deliver on lofty expectations.

The scale of flows highlights how sentiment can quickly amplify moves in concentrated rallies.

Capital flight pressures on the Asian stock market

Selling was not uniform across the region. South Korea and Taiwan experienced the largest single market outflows, at approximately US$5.05 billion and US$3.86 billion respectively. India also recorded notable outflows, while Indonesia and the Philippines received modest inflows in the same period.

The concentration of selling in South Korea and China is linked to those markets having the greatest exposure to semiconductor and AI supply chains.

The withdrawal of foreign capital has two practical effects. The first is on price discovery, as reduced demand at the margins can widen bid offer spreads and amplify volatility. The second is on sentiment, because sustained outflows feed narratives that can prompt further selling by domestic and international investors.

Valuation concerns in the Asian stock market's tech segment

The MSCI Asia ex Japan information technology index fell by about 4.23 per cent during the loss of momentum, following very large gains earlier in the year. That fall occurred after the same index had rallied strongly over the prior six months, which underlined the re-rating risk for the sector.

Forward price to earnings ratios for broader regional indices were elevated heading into November. The MSCI Asia Pacific ex Japan 12 month forward PE rose to roughly 15.81 times by the end of October, a level not seen since mid 2021. Elevated multiples make markets more sensitive to earnings disappointments and to changes in discount rate expectations. [2]

Prominent analysts and financial publications have warned that parts of the technology rally looked stretched, with some commentators using the term bubble to describe overly concentrated investor positioning.

At the same time, other analysts emphasise that medium term earnings trends for technology firms remain strong, particularly where secular demand for AI compute and data centre capacity is durable. This divergence of views explains why volatility has increased.

Macro and policy risks weighing on Asian equity flows

Slower than expected macro growth increases downside risk for risk assets. Japan's economy contracted in the third quarter of 2025. with GDP falling by 0.4 per cent quarter on quarter. [3]

The weaker reading served to tighten investor focus on growth risks in Northeast Asia and on the extent to which policy support will be needed to stabilise demand. Currency and rate expectations reacted to the data, and that in turn influenced portfolio allocations.

US trade policy and ongoing tariff uncertainty continue to complicate the picture for export dependent economies. Meanwhile, central bank communication in the United States and across Asia is likely to remain an important driver of capital flows, because shifts in interest rate expectations alter equity discount rates and cross border yield differentials.

Key Near Term Catalysts Shaping Asian Stock Market Direction

| Catalyst |

Why it matters |

| Tech earnings season |

Results will test whether revenue and profit growth justify current valuations. |

| Fund flow data |

Continued outflows would sustain downward pressure on prices and increase volatility. |

| Macro releases in Japan and China |

Growth surprises alter risk appetite and can change policy expectations. |

| Central bank communication |

Rate guidance from the Fed and regional central banks affects discount rates and currency flows. |

| Geopolitical and trade developments |

Any positive progress on trade talks could restore confidence; setbacks could deepen selling. |

Implications for investors in the Asian stock market

Investors face different choices depending on their time horizon and risk tolerance. The following are widely considered prudent approaches in the current environment.

For long term investors: Maintain exposure to quality names but consider taking profits on overly concentrated positions. Rebalance toward sectors and markets with more attractive valuations and clearer earnings visibility.

For tactical or active managers: Use earnings and macro data releases as tradeable events. Hedging via options or reducing gross exposure may be appropriate until flows stabilise.

For foreign investors: Monitor currency and local liquidity conditions carefully. Sudden outflows can widen bid offer spreads and increase transaction costs.

No single approach is correct for all investors. The right response depends on individual objectives and the ability to tolerate short term volatility.

Conclusion

Asian stock markets have reached an inflection point. The recent rotation away from AI related exuberance and the scale of foreign outflows have exposed vulnerabilities in markets with concentrated tech exposures.

Whether the current weakness proves to be a shallow correction, a prolonged consolidation, or the onset of a deeper correction depends on upcoming corporate earnings, macro releases, and whether foreign flows reverse. Investors should monitor fund flows, the technology earnings calendar, and key macro data to assess the likely path ahead.

Frequently asked questions

1. What caused the recent fall in Asian stock markets?

The primary drivers were profit taking and large foreign outflows of about US$10.18 billion, concentrated in South Korea and Taiwan. Elevated AI and tech valuations prompted investors to reduce exposure to high multiple names.

2. Are the valuation concerns justified or is this a normal correction?

Valuation concerns are justified where forward price earnings ratios are elevated. Some analysts see a routine correction while others warn that concentrated positions in AI could lead to larger re-ratings if earnings miss expectations.

3. Which Asian markets are most vulnerable to further downside?

Markets with a high concentration of semiconductor and AI related firms, notably South Korea and Taiwan, are most vulnerable due to both valuation risk and the largest recent outflows.

4. What should long term investors do now?

Long term investors should consider rebalancing to reduce concentration risk, retain exposure to high quality companies, and use periods of volatility to invest selectively in attractively valued sectors. Discipline matters more than timing.

5. Which events will determine whether markets recover or fall further?

Key events include technology sector earnings, fund flow trends, macro prints in Japan and China, and central bank communication. Positive surprises on these fronts could stabilise markets, while disappointments could deepen the sell off.

Sources:

[1]https://www.reuters.com/world/asia-pacific/asian-equities-witness-over-10-billion-foreign-outflows-november-ai-rally-stalls-2025-11-12/

[2]https://www.investing.com/economic-calendar/gdp-119

[3]https://www.reuters.com/world/asia-pacific/japan-q3-gdp-contracts-annualised-18-july-september-2025-11-16/

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.