Silver's 2025 rally has transcended early momentum gains as spot silver surged past $54/oz as of November 2025, breaking long-standing nominal records and fueling fresh bids. What once looked like a budding ascent is now a market in the midst of a squeeze.

Whether this rally sustains or gives way to a pullback depends on the delicate balance between ongoing investor flows, industrial demand strength, and supply constraints.

Where Silver Stands Today (Mid-November 2025)

1) Spot Price:

Silver recently traded around $54/oz on November 13, up ~75% year-over-year.

2) Momentum/YTD Gains:

Silver's exceptional performance has placed it among the top commodity performers of 2025, with year-to-date gains in the 60%+ range.

It is one of the best-performing commodities this year as markets priced lower real yields and safe-haven flows. ETF holdings and retail demand have been notable contributors.

3) ETF Flows:

During the initial six months of 2025, silver-backed ETPs saw approximately 95 million oz of net inflows, bringing worldwide holdings to around 1.13 billion oz, nearly 7% below their all-time high. [1]

ETF demand has also intensified in October, helping push prices upward.

What Are the Key Drivers Behind Silver's Rally in 2025?

Think of silver's price as a two-engine plane: one engine is investment demand (funds, ETFs, speculative flows), the other is industrial demand (solar panels, electronics, EVs). Both engines are currently firing, which explains the ascent.

1. Real Yields and Monetary Policy

Precious metals are sensitive to real interest rates (nominal rates minus inflation). When real yields fall, either because inflation rises or because central banks ease, owning non-yielding assets like silver becomes more attractive.

In 2025, markets will have gradually factored in Fed rate reductions, resulting in lower real yields and bolstering precious metals. That dynamic is a primary catalyst for silver's rally. [2]

2. ETF & Investment Flows

Silver ETFs have been a direct and fast channel for allocating capital into the metal.

When retail and institutional buyers flock to SLV-type products, they generate ongoing demand that is challenging to meet solely from spot sellers.

3. Industrial Demand: Solar, Electronics, EVs

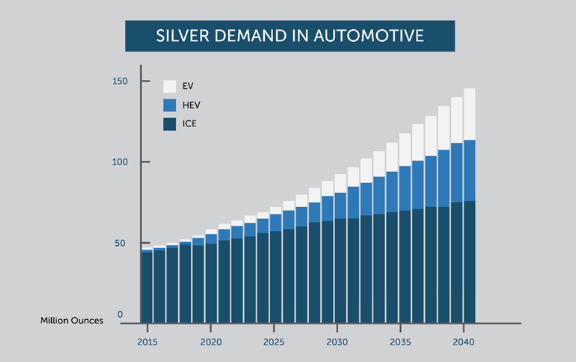

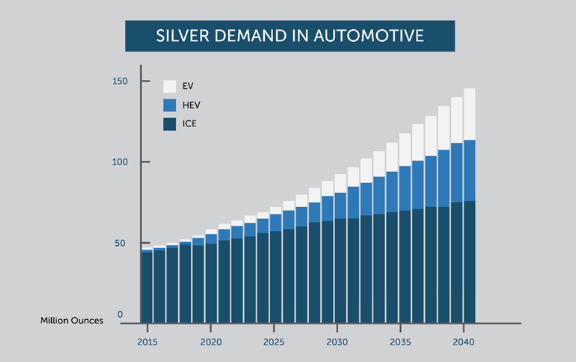

Silver's industrial side is not a small story: it's used extensively in photovoltaic (PV) panels, electronics contacts, and growing applications such as EVs and 5G hardware.

The World Silver Survey 2025 and industry reports highlight strong industrial demand in East Asia along with continuing replacement cycles.

This is essential since even slight percentage changes in demand can be significant, given that industrial usage totals hundreds of millions of ounces each year. That structural support helps underpin any investor-led price move.

4. Supply Dynamics and Deficits

Mine production rebounded from pandemic effects, yet global supply remains restricted in crucial areas, with primary silver mines being scarce.

Analysts estimate mined supply growth is modest and often needs to be supplemented by recycling and by-product flows, making the market sensitive to demand surges.

5. Macro and Geopolitical Hedging

With renewed US–China trade tensions, inflationary pressures, and global uncertainty, safe-haven sub-threads are pulling capital toward metals. While gold often leads, silver tends to ride along, especially in "cheap hedge" mode.

Silver vs Gold Performance 2025

One question many investors ask is how silver is performing relative to gold. Gold has demonstrated robust growth in 2025, but silver has considerably outperformed it.

As of November 13, silver had increased approximately 75% year-over-year, while gold experienced smaller increases in numerous markets.

This outperformance stems from silver's dual role: it benefits from the same safe-haven flows that push gold higher, but also from booming industrial demand in sectors like solar energy and EVs.

Is Silver Undervalued Compared to Gold?

Additionally, the gold-to-silver ratio (i.e., the ounces of silver equating to 1 ounce of gold) decreased from over 80 in early 2024 to the mid-70s by fall 2025.

Historically, in robust silver bull markets, that ratio declines towards 60, indicating potential growth if industrial demand continues.

Will the Silver Rally Continue? Expert Insights and Predictions

Wall Street and commodity houses differ widely on silver. Some view the 2025 move as a short-lived momentum trade; others see structural upside. For instance:

1) Bullish Views:

Analysts at Bank of America, UBS, and TD Securities note that lower real yields, persistent ETF inflows, constrained mine output, and resilient industrial demand (notably photovoltaic and EV-related) continue to underpin silver's advance.

Bank of America, in its October 2025 commodity outlook, raised its 12-month target to $65/oz, calling silver "the tightest major metal market of 2025."

UBS similarly sees $70 potential if Fed easing accelerates and U.S.–China trade tensions sustain safe-haven flows.

ETF holdings have grown by over 90 million oz YTD, indicating continued institutional participation.

In short, the bullish camp believes the rally is not finished, with upside targets between $60 and $90+, depending on macroeconomic and policy shifts.

2) Neutral and Conservative Views:

On the other hand, Goldman Sachs and Citi have urged caution, citing silver's volatility and lack of central-bank support compared with gold.

These strategists argue that industrial demand growth could normalise by 2026, especially if solar and electronics demand stabilise.

They also note that high prices may stimulate recycling, easing deficits by late 2025.

Practical Consensus:

The majority of forecasters currently predict that silver will be traded within a range of $45 to $75 in the coming 6 to 12 months. The $60 level has replaced $50 as the new technical and psychological milestone, with upside risks skewed by real-yield compression and ETF momentum.

What Does Supply and Demand Indicate For a Long Silver Rally?

To understand whether the rally continues, you must look at the physical math: how many ounces are produced, recycled, consumed in industry, and bought by investors.

1. Key Supply Figures

Estimates for 2025 global mine output were in the ~835 million oz area, a slight increase relative to 2024 but not a surge.

Supply is geographically concentrated and reliant on a mix of primary silver mines and by-product output from base-metal (lead/zinc) mining.

2. Key Demand Figures

Industrial Demand: East Asia and PV demand are major drivers. The Silver Institute observed a rise in industrial demand for 2024 and 2025, especially within the electronics and renewable energy industries. Even small growth percentages here equate to millions of ounces.

Investment Demand: ETF inflows have turned investment demand into a swing factor; persistent ETF buying can create deficits even if mine supply is steady. The combined effect of investor buying plus industrial demand growth is what has tightened the market in 2025.

Recycle & Secondary Supply

Recycling offsets some industrial demand but is itself price-sensitive: higher silver prices encourage recycling, which can dampen rallies if sustained.

Yet recycling takes time to scale, so short-term rallies won't always be matched with an immediate recycled supply. That lag matters for price momentum.

Three Possible Scenarios for the Rest of 2025

| Scenario |

Price Range (2025+) |

Conditions Required |

| Base Case |

$45–$65 |

ETF inflows continue but moderate; Fed gradually eases; industrial demand steady |

| Bull Case |

$65–$90+ |

Sharp drop in real yields; ETF surges; industrial demand overtakes supply constraints |

| Bear Case |

$35–$50 |

Fed stays hawkish; real yields rebound; ETFs reverse; industrial demand stalls |

1. Base Case: $45 – $65 Range (50% Probability)

Silver is expected to maintain stability above the $50 level as ETF inflows persist, albeit at a reduced rate, and the Federal Reserve indicates one or two rate reductions going into early 2026.

Real yields are expected to fall modestly, keeping precious metals attractive. Industrial demand from solar, EVs, and electronics stays resilient, while mine supply and recycling only edge higher.

In this environment, silver fluctuates between $45 and $65, experiencing occasional surges due to shifts in risk sentiment or geopolitical incidents. This is the most probable "steady-trend" continuation case.

2. Bull Case: $65 - $90 + (30% Probability)

If the Fed accelerates easing and real yields plunge, institutional and ETF allocations could surge again.

Tight mine output, energy transition spending, and U.S.–China trade-war uncertainty would amplify safe-haven demand.

Once silver holds decisively above $60, momentum traders could drive prices toward the $70–$90 zone, especially if inflation expectations rise or industrial bottlenecks persist.

This scenario assumes a macro or policy shock, such as global stimulus or dollar weakness, triggering another wave of buying.

3. Bear Case: $35 - $50 (20% Probability)

Should the Fed re-embrace a hawkish stance or inflation cool faster than expected, real yields could rebound and the U.S. dollar strengthen.

ETF inflows may reverse as investors rotate back into equities or bonds, while higher prices encourage more recycling and by-product supply.

Industrial demand could soften if manufacturing activity in Asia slows.

In that case, silver could retrace toward $35–$50, consolidating before any new cyclical advance.

What Are the Risks or Red Flags that Could Reverse the Rally?

The Fed surprises hawkishly, real yields rise sharply

ETF inflows stall or reverse

Industrial demand growth disappoints

Significant expansion of mine output or a surge in recycling

Policy/regulatory interventions (e.g. silver classification, tariffs)

Saturation or weakening in solar/EV cycles

Goldman Sachs recently cautioned that silver is riskier than gold because it lacks central bank backing and is more volatile. [3]

Frequently Asked Questions

1. Will Silver Prices Rise if the U.S. Dollar Weakens in 2025?

Yes. A weaker dollar generally boosts silver as it is priced in dollars, resulting in lower costs for international purchasers.

2. How Have Fed Rate Cuts in 2025 Impacted Silver Prices?

The Fed's first rate cut in September 2025 has already supported silver, and further cuts could lift prices higher as lower yields make precious metals more attractive compared to bonds.

3. How Is Silver Performing Compared to Gold in 2025?

Silver has outpaced gold in year-to-date percentage gains, reflecting its dual role as a safe-haven asset and an industrial metal. While gold has risen roughly 18% YTD, silver has surged nearly 30% by Q3 2025.

4. Is Silver a Better Investment Than Stocks or Crypto in 2025?

Yes. Silver has been less volatile than crypto and offered more consistent gains than some stock sectors in 2025.

5. Can Silver Hit $55 in 2025?

While $55 is an ambitious target, it's not impossible. If the Fed cuts aggressively, the U.S. dollar weakens, and solar demand continues surging, silver could test the $50–$70 zone.

6. How High Can Silver Realistically Go?

Although extreme predictions of $100 are commonly seen on the internet, many analysts believe that $55–$70 represents the plausible upper limit in 2025 in optimistic scenarios, unless a significant financial crisis occurs.

Conclusion

In conclusion, silver's 2025 story has evolved from an emerging rally to a nominal breakout, no longer confined to the upper $40s. With prices exceeding $54 and increasing ETF interest, the metal now exists in a different pricing environment.

Should real yields keep falling, industrial demand persists, and ETF inflows stay robust, silver might reach $60 to $90 or higher. However, the downside is still significant: any unexpected hawkish move or abrupt change in flows could lead to severe corrections.

Regardless, silver is a metal that rewards patience and respect for volatility. If you treat it like a sprint, you'll likely get burned; if you treat it like a long-term allocation with tactical trades around events, it can be a valuable part of a diversified portfolio.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.mining.com/silver-etf-inflows-at-record-pace-in-2025-amid-surging-prices-report/

[2] https://www.reuters.com/world/china/gold-hits-record-high-us-china-trade-woes-escalate-silver-scales-all-time-peak-2025-10-13/

[3] https://markets.businessinsider.com/news/commodities/gold-price-today-silver-riskier-investment-central-banks-goldman-sachs-2025-10