The quick and upfront answer is yes. As of October 2025, gold remains one of the most sought-after safe-haven assets, reaching record highs above $4,000/oz amid global geopolitical uncertainty and expectations of Fed easing.

That said, gold is volatile as short-term pullbacks are possible if the U.S. dollar or real yields rebound or ETF flows reverse. Thus, use position sizing, risk controls and a clear role for gold in your portfolio before committing capital.

Gold Price Drivers in October 2025: What's Fueling the Surge?

Three drivers explain the October 2025 surge to record levels:

1. Massive ETF and Investor Flows

Physical gold ETFs saw historic inflows (record monthly and YTD flows), pulling demand off the spot market.

2. Falling Real Yields and Fed Easing Bets

Real (inflation-adjusted) U.S. yields have drifted lower as markets price Fed cuts, reducing the opportunity cost of holding non-yielding gold.

3. Geopolitical Risk and Market Uncertainty

Trade tensions and geopolitical incidents (notably U.S.–China friction and ongoing regional conflicts) are pushing investors into safe havens.

Those forces combined to lift gold through the psychological $4,000/oz mark in early October, a level that shifts the narrative from "recovering" to "new regime" for bullion. [1]

The Latest Gold Data Investors Must Know

Listed are the key, up-to-date data points that will influence gold's short-term trajectory:

1) Spot Price

Gold traded in early October 2025 in the $3,900–$4,100/oz range after briefly reaching an intraday peak of $4,078. That rally has been fast and wide, with swings of several percentage points on single sessions.

2) ETF Flows

Exchange-traded funds poured capital into physical gold instruments. For context, the World Gold Council reported record monthly inflows and roughly $64 billion YTD flows into gold ETFs by early October, with September alone posting one of the biggest months ever. That's real, persistent demand that tightens supply.

3) Real Yields & Fed Expectations

10-year nominal yields have been around the ~1.8% range recently, while real yields (TIPS-adjusted) have fallen. Markets are pricing multiple Fed cuts into late 2025, which reduces the opportunity cost of holding gold and supports higher bullion prices.

The FedWatch tool indicates strong market odds of easing at upcoming meetings.

4) Central Bank Gold Buying

Purchases by central banks continue to provide structural backing for gold. Several central banks have been adding reserves, and coordinated buying has become an important backstop to ETF demand in 2025.

Many analysts cite central bank accumulation as a lasting source of demand that differs from short-term speculative flows.

5) Analyst Forecasts

As of October, major banks increased their targets. For example, Bank of America and others elevated their medium-term gold projections (BofA raised 2026 targets to approximately $5,000/oz), indicating heightened structural demand and anticipated policy change. [2]

These do not represent guarantees but reflect institutional confidence.

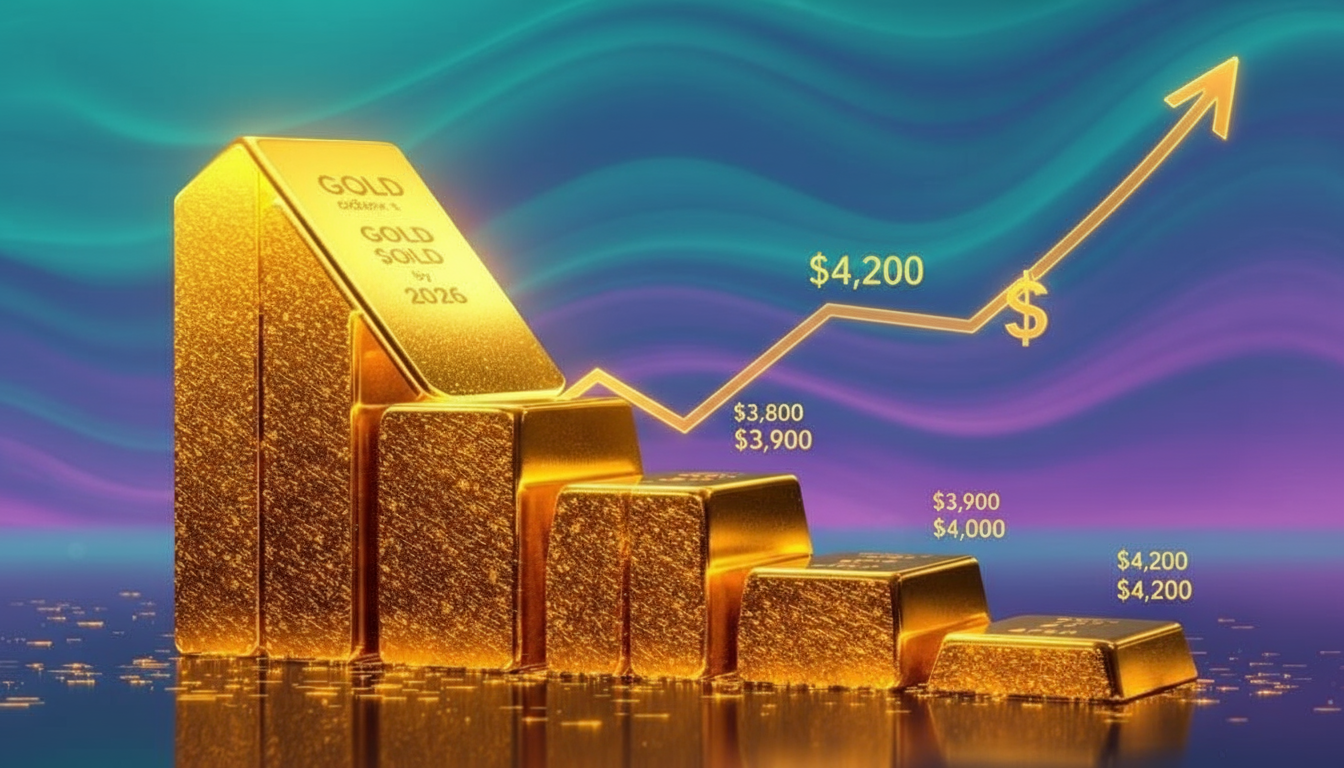

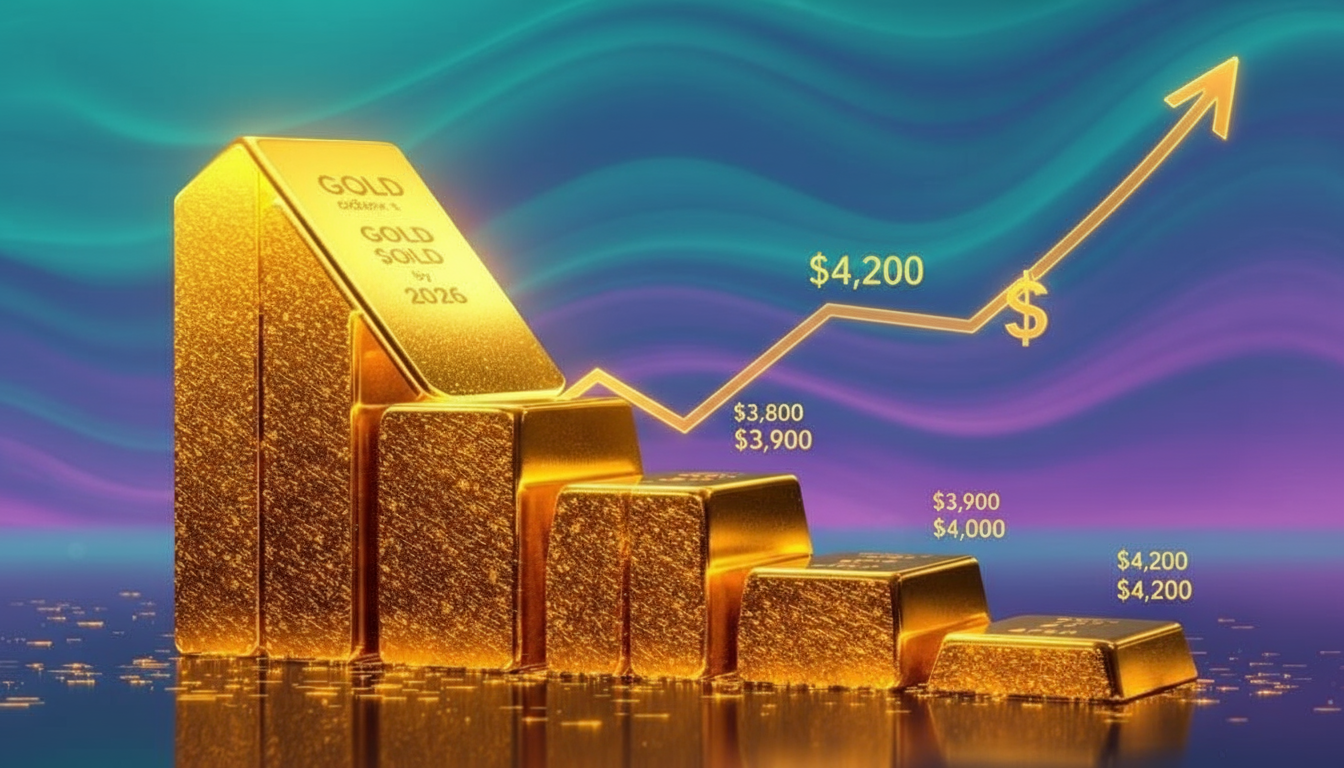

Gold Price Forecast 2025: Three Realistic Scenarios From Here

| Scenario |

Probability |

Key Drivers / Assumptions |

Gold Price Outlook |

| Bull Case |

30% |

Strong ETF inflows, continued central bank buying, falling real yields, and a weaker U.S. dollar. |

Gold consolidates above $4,000, potentially surging to $4,500–$5,000/oz by mid-2026. |

| Base Case |

50% |

Moderate ETF inflows, cautious Fed rate cuts, and ongoing but contained geopolitical tensions. |

Gold trades between $3,600–$4,200, showing rising lows and buying interest on dips. |

| Bear Case |

20% |

Strong U.S. data or diplomatic easing boosts dollar and real yields; ETF flows weaken, prompting profit-taking. |

Correction likely toward $3,000–$3,300/oz, with sharp sell-offs possible due to momentum-driven positions. |

To determine if a purchase is warranted, you need to examine the potential options ahead. Below are mapped scenarios with probabilities (subjective) and implications.

Bull Case (30% Probability):

ETF inflows remain strong, central bank buying continues, real yields fall further, and the dollar weakens.

Gold consolidates above $4,000 and surges toward $4,500–$5,000/oz by mid-2026. BofA's $5,000 target is an example of a bullish institutional view under these assumptions.

Base Case (50% Probability):

ETF inflows remain positive but moderate; Fed signals cuts but not aggressively; geopolitical flare-ups persist but do not escalate dramatically.

Gold fluctuates between $3,600 and $4,200 with rising lows and occasional volatility, attracting investors to buy during dips.

Bear Case (20% Probability):

A surprise strong U.S. data print or a quick diplomatic de-escalation lifts the dollar and real yields, ETF flows stall, and profit-taking triggers a correction back to $3,000–$3,300/oz. [3]

Fast sell-offs are possible because part of the recent rally is momentum-driven and tied to ETF positioning.

These scenarios highlight why timing and risk management matter: the bull case is plausible, but short-term corrections are not uncommon.

How Geopolitical Risks Are Moving Gold in 2025?

As you may already know, gold's traditional role is as a safe-haven and real-asset hedge. Thus, geopolitical shocks do two things that matter for bullion:

As you may already know, gold's traditional role is as a safe-haven and real-asset hedge. Thus, geopolitical shocks do two things that matter for bullion:

1. Raise Risk Premia and Uncertainty

These encourage portfolio-insurance flows (ETFs, futures, physical). Investors fleeing risk assets or seeking liquidity prefer real assets that are not tied to any single currency or counterparty.

Recent U.S.–China trade escalations and regional conflicts prompted precisely that kind of flight.

2. Affect Policy Expectations

Geopolitical trouble often pressures central banks and governments to enact accommodative policies or fiscal supports that can be inflationary or weaken the domestic currency, ultimately benefiting gold (which typically increases when real yields decline).

The expectation of Fed easing is one reason why gold has performed better in the markets.

Put simply, geopolitical risk is not a one-day story; it changes the probability distribution of macro outcomes (growth slower, policy looser), and gold prices incorporate those probabilities.

How to Invest in Gold: Hedge, Diversify, or Trade?

Gold can serve three different roles, and the one you choose affects whether you buy now.

1) Insurance:

If your main focus is on safeguarding your portfolio from tail risk (geopolitical tensions and intense market strain), retaining gold as a hedge is reasonable at this time.

That argues for owning physical bullion or well-established ETFs (GLD, IAU) sized as a percentage of your portfolio (commonly 2–10% depending on risk tolerance).

2) Diversifier:

Historically, in multi-asset portfolios, gold has demonstrated low correlation with stocks during times of stress, helping to reduce volatility.

For strategic diversification, gradually incorporate gold rather than adding it all at once.

3) Speculative Trade:

If you're trying to capture momentum, you can trade gold with short time horizons. However, be aware of higher volatility and the potential for fast drawdowns if flows reverse. Use tight risk controls.

For most long-term investors, the correct posture is insurance or diversification rather than outright speculation.

Where to Buy Gold Now?

1. Physical Gold:

Best for ultimate sovereignty and no counterparty exposure.

Downsides include storage, insurance expenses, and reduced liquidity for small transactions.

2. ETFs (GLD, IAU):

Gold ETFs are highly liquid and cost-efficient, suitable for most investors seeking quick and secure access.

They monitor the market and are simple to trade. ETFs were the primary contributors to the recent increase in inflows.

EBC Financial Group offers Gold CFDs and Gold ETF CFDs, allowing traders to access the gold market with greater flexibility and precision.

3. Gold Miners (Equity Exposure)

Miners offer leverage to bullion (miners' margins expand more when gold rises).

They can significantly excel in bull markets but introduce operational, management, and equity market risks.

4. Futures / Options

Gold Investment Playbook: Strategies and Risk Rules

Listed below are sensible, practical approaches that suit different investor objectives:

1) Core Insurance Allocation (Conservative):

Allocate 2–5% of portfolio value to gold via physical bullion, allocated ETFs (GLD/IAU), or sovereign gold bonds (if available in your market). Rebalance annually.

2) Tactical Buy-On-Dips (Opportunistic):

Utilise a staggered purchasing method, such as DCA into gold at weekly or monthly intervals over a span of 3 months to average entry close to the market and minimise timing risk.

3) Event-Driven Play (Traders):

If you're short-term trading around geopolitical events, you prefer liquid ETFs or futures with strict stop losses. Consider defined-risk option strategies (buying puts for downside protection or call spreads for leveraged upside with limited cost).

4) Combination Approach:

Hold a core allocation as insurance and a smaller tactical sleeve (1–2% of portfolio) for opportunistic upside.

Risk Management Checklist Before You Buy

Set your reason.

Decide on the allocation size and stick to it.

Select your option and account for costs.

Use position sizing and stop rules for trading sleeves.

Monitor ETF flows, real yields and DXY daily/weekly.

Rebalance when gold overshoots or your portfolio drifts.

Maintain liquidity and steer clear of tying up capital in difficult-to-sell assets unless you plan to hold them for the long run.

In rapid rallies, managing risk is crucial as momentum can shift abruptly.

Frequently Asked Questions

Q1: Has Gold Already Run Too Far?

It's extended, but record ETF inflows and weaker real yields mean new higher ranges are possible.

Q2: Will Fed Rate Cuts Make Gold Skyrocket?

Federal Reserve cuts reduce real yields and may benefit gold. However, markets often price in cuts ahead of time.

Q3: How Do Central Bank Purchases Affect Price?

It reduces marketable supply and signals long-term reserve diversification, which supports price even if short-term flows falter.

Q4: Is Gold Still a Safe Haven in 2025?

Yes. Despite volatility, gold remains the preferred hedge during geopolitical stress and central bank policy shifts.

Q5: What's the 2026 Gold Price Outlook?

BofA and UBS expect potential highs near $5,000/oz if Fed cuts materialise and geopolitical risks persist.

Conclusion

If your goal is portfolio insurance against geopolitics and policy uncertainty, yes, now's a reasonable time to add or maintain a modest gold allocation (2–10% depending on your risk profile).

Data, including record ETF inflows, central bank purchases, and declining real yields, support the case for holding some gold.

If you're a short-term momentum trader, buy only with stop discipline and plan for volatile retracements. If you're thinking of a speculative squeeze for quick gains, be honest with yourself about the high drawdown risk if flows reverse.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.reuters.com/world/china/gold-hits-record-high-us-china-trade-woes-escalate-silver-scales-all-time-peak-2025-10-13/

[2] https://www.reuters.com/business/bofa-lifts-2026-gold-forecast-5000oz-sees-silver-65-2025-10-13/

[3] https://www.reuters.com/world/china/global-markets-flows-graphic-2025-10-10/