Nvidia’s share price is moving higher as investors reassess the company’s ability to serve China demand for high-end data center GPUs within evolving export control rules. NVDA last traded around $189 per share, up about 3% from the prior close.

The immediate driver is renewed focus on whether Nvidia H200 shipments to China can proceed under a license-based framework. U.S. lawmakers have also referenced an “announced 25% fee” tied to H200 sales to China and have pressed the U.S. Department of Commerce for details on scope, timing, and legal authority. [1]

Important factors about Nvidia H200 Chip

H200 China Sales Depend On Licensing, Not Demand

U.S. export controls and licensing requirements have been a recurring operational constraint for Nvidia, and the company has repeatedly disclosed that shifting rules can directly affect what it can ship to China (including Hong Kong) and other restricted destinations. [2]

The 25% Fee Discussion Can Affect Economics And Order Behavior

A U.S. Senate letter has explicitly asked how the Administration intends to apply its announced 25% fee to H200 sales to China. Even without full published mechanics, the existence of a proposed fee matters because it can change effective pricing, deal structure, and buyer timing.

Guidance Language Shows How Sensitive Results Are To China Assumptions

In its Q2 fiscal 2026 results, Nvidia stated there were no H20 sales to China-based customers during the quarter and said it did not assume any H20 shipments to China in its outlook. That disclosure helps explain why investors can react quickly to any credible path for higher-tier products to reach China. [3]

Why H200 China Sales Can Lift NVDA Stock

Export controls have pushed investors to treat China-linked revenue as harder to forecast, so any improvement in the clarity of licensing outcomes tends to reduce the policy risk discount applied to forward expectations.

Nvidia’s SEC filings describe how export restrictions and licensing requirements have expanded and shifted over time, with direct implications for sales and distribution.

There is also a practical supply and product-cycle element. Nvidia is managing overlapping generations in data center GPUs, including the ramp of newer platforms, while still monetizing prior-generation capacity where permitted.

The ability to sell H200 into large markets under clear rules can support mix planning and reduce the chance of mismatch between demand, inventory, and allocation.

What The Nvidia H200 Is, And Why It Matters In China

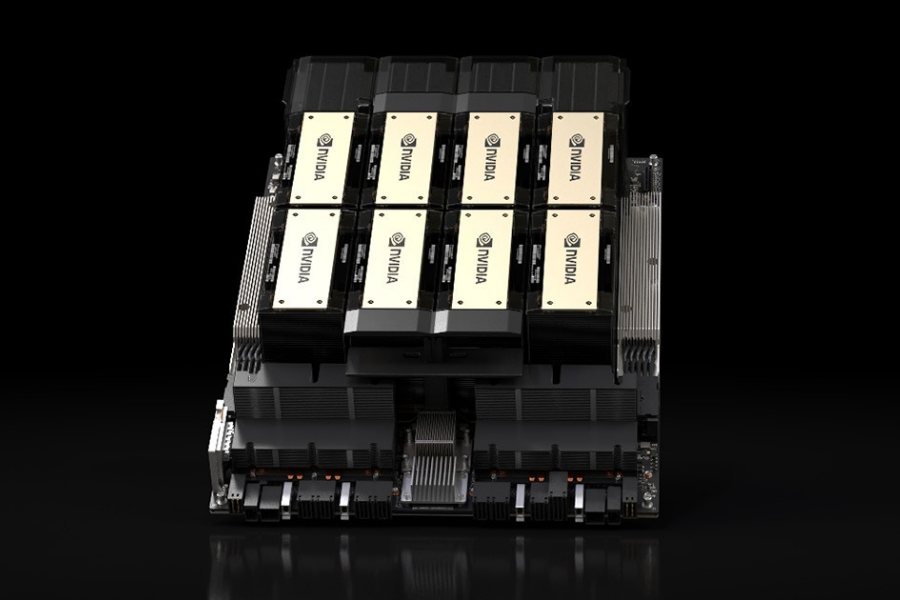

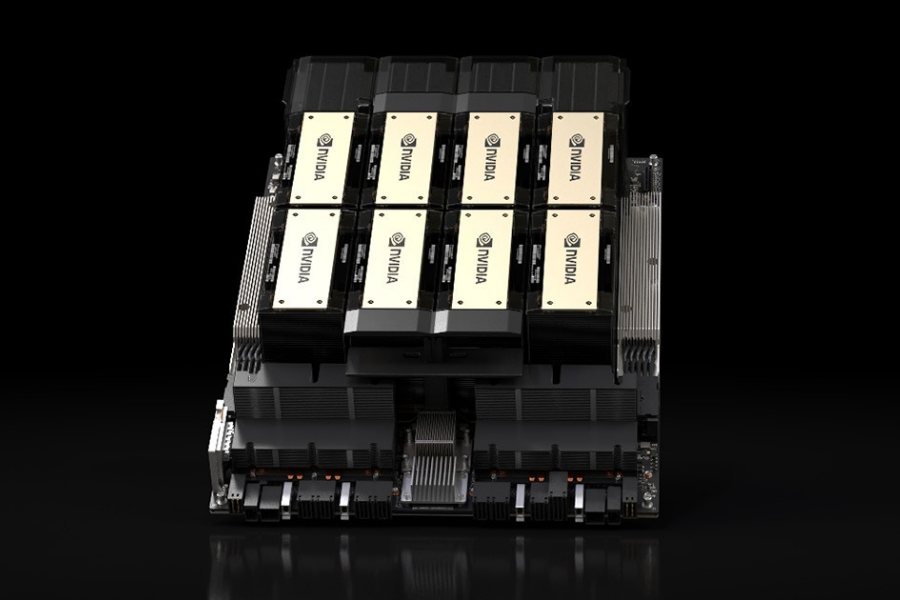

Nvidia positions the H200 as a Hopper-based data center GPU designed for large models and memory-heavy workloads. Nvidia’s published specs highlight 141 GB of HBM3e and 4.8 TB/s of memory bandwidth, a combination that can improve performance in training and inference where memory capacity and bandwidth become bottlenecks.

For cloud and internet platforms, that memory profile matters because it can reduce the number of GPUs required for certain deployments, improve throughput, and lower system complexity for large-model serving. The investment debate is less about whether there is demand, and more about whether licensing and compliance pathways allow supply to meet that demand.

H200 Versus H20 And Blackwell At A Glance

| GPU Line |

Positioning |

What Investors Should Note |

| H20 |

China-tailored data center GPU |

Nvidia has disclosed licensing constraints for exports of H20 to China and did not assume H20 shipments to China in its Q2 FY2026 outlook. |

| H200 |

Higher-tier Hopper |

Features 141 GB HBM3e memory and 4.8 TB/s bandwidth, targeting large-model training and memory-intensive AI workloads. [4] |

| Blackwell |

Newer generation |

Described as Nvidia’s latest data center platform, launched during fiscal 2025, with management emphasizing ongoing production ramp and customer adoption.

|

How Big Could China Be For Nvidia’s Financials

China remains visible in Nvidia’s geographic revenue disclosures. In Nvidia’s fiscal 2025 Form 10-K, China (including Hong Kong) accounted for $17.108B of revenue by customer billing location, versus $130.497B total revenue. Nvidia also notes billing location can differ from end customer and shipping location, a nuance that matters when interpreting “China exposure.” [5]

On the operating side, Nvidia’s recent scale is dominated by data centres. In Q2 fiscal 2026, Nvidia reported $46.743B in total revenue and $41.1B in data center revenue, and it reiterated that its outlook did not assume H20 shipments to China. This is why investors watch China policy and licensing as a potential swing factor around an already-large base business.

The Overlooked Angle: H200 China Sales As A Product-Cycle Release Valve

Many investors frame the story as “China demand returns,” but the more durable angle is how clarity on what can be shipped, and under what terms, can smooth generation transitions. Nvidia’s SEC filings describe how product transitions are difficult to execute and can affect demand prediction and supply mix.

If licensing rules create a workable channel for H200, it can help Nvidia monetize Hopper-era supply while it continues prioritizing newer platforms for customers that are already moving up the curve. That dynamic is often more important for margins and delivery confidence than the headline volume in any single quarter.

Risks That Can Reverse The Stock Move

Washington Can Still Tighten The Screws

Export controls are not static. BIS has updated advanced computing and semiconductor-related controls in recent years, and licensing decisions can change with policy objectives, enforcement posture, and definitions of controlled thresholds.

China Exposure Is Still A Reporting And Logistics Complication

Nvidia’s own filings stress that geographic revenue is based on billing location and may not reflect shipping location or end customer. That can create uncertainty for investors trying to translate policy headlines into precise revenue impacts.

Fee Mechanics Could Cap The Upside Even If Licenses Are Granted

A proposed fee at the scale referenced by lawmakers can change buyer economics, which can affect demand timing, system-level pricing, and the margin mix Nvidia ultimately reports. The open questions raised in the Senate letter highlight that key details still matter. [6]

What To Watch Next If You Follow NVDA Stock

The next moves are likely to come from licensing clarity, compliance requirements, and what Nvidia says about China assumptions in guidance and mix.

Focus on these concrete checkpoints:

License guidance and process updates from BIS and the Commerce Department.

Nvidia earnings language on China assumptions, inventory effects, and product mix, similar to the H20 disclosures in Q2 FY2026.

Any formal explanation of the proposed fee and its legal basis, which lawmakers have requested from Commerce.

Data center revenue and gross margin direction, since data center remains the earnings engine.

Frequently Asked Questions (FAQ)

1. Is Nvidia Allowed To Sell H200 Chips To China Now?

Nvidia has stated in SEC filings that exports to China are subject to shifting U.S. export controls and licensing requirements. Any H200 sales into China depend on licensing outcomes and compliance conditions under the Export Administration Regulations.

2. Why Does A China Sales Headline Move NVDA Stock So Quickly?

China is material in Nvidia’s geographic revenue disclosure, and licensing outcomes can change near-term shipment assumptions. When guidance explicitly excludes certain China shipments, the market tends to treat policy and licensing clarity as a meaningful swing factor.

3. How Much Revenue Does Nvidia Generate From China?

In Nvidia’s fiscal 2025 Form 10-K, China (including Hong Kong) accounted for $17.108B of revenue by customer billing location out of $130.497B total. Nvidia notes billing location may differ from end customer and shipping location.

4. Is the Nvidia H200 The Same As The China-Focused H20?

They are different products. Nvidia’s disclosures show H20 was designed primarily for the China market and became subject to a license requirement for export to China. H200 is positioned as a higher-tier Hopper GPU with 141 GB HBM3e and 4.8 TB/s bandwidth.

5. Could A 25% Fee Hurt Nvidia’s Margins?

A U.S. Senate letter references an announced 25% fee and asks Commerce how it would be applied. If implemented, a fee of that scale can affect effective pricing and deal structure, which can influence reported margins and product mix.

6. What Is The Most Important Near-Term Risk?

The near-term risk is that investors price in smoother access to China before licensing and compliance details are fully clear. Nvidia’s filings emphasize export controls can shift, and BIS licensing decisions are central to what can actually ship.

Conclusion

NVDA’s move higher reflects a market trying to price two realities at once: China remains a meaningful revenue geography by billing location, and the rules governing what Nvidia can ship into China can change forecasts quickly.

The durable impact depends less on headlines and more on formal licensing pathways, compliance conditions, and the economics of any fee structure. Investors should anchor on Nvidia’s own guidance language, SEC risk disclosures, and official U.S. export control processes when judging how much of a China-related uplift can become reported revenue.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.banking.senate.gov/imo/media/doc/letter_to_lutnick_on_h200_sales.pdf

[2] https://s201.q4cdn.com/141608511/files/doc_financials/2025/q4/177440d5-3b32-4185-8cc8-95500a9dc783.pdf

[3] https://nvidianews.nvidia.com/news/nvidia-announces-financial-results-for-second-quarter-fiscal-2026

[4] https://www.nvidia.com/en-us/data-center/h200/

[5] https://s201.q4cdn.com/141608511/files/doc_financials/2025/q4/177440d5-3b32-4185-8cc8-95500a9dc783.pdf

[6] https://www.banking.senate.gov/imo/media/doc/letter_to_lutnick_on_h200_sales.pdf