In the week ending 28 September 2025, global markets were mixed as investors weighed steady U.S. inflation, firm long‑end yields, a resilient dollar, and tariff implementation due from 1 October.

Core PCE inflation printed 2.9% year on year for August, in line with expectations, keeping the Fed's preferred gauge above target and shifting focus to this week's jobs data and PMIs. [1]

Weekly Snapshot

Equities: The S&P 500 slipped roughly 0.3% on the week, with a late rebound after the PCE release trimming losses but leaving a modest negative “S&P 500 Weekly Move” into the close.

Rates: The 10‑year Treasury yield held near 4.18%–4.20% and the curve changed little, reflecting “Treasury Yields Steady” through Friday.

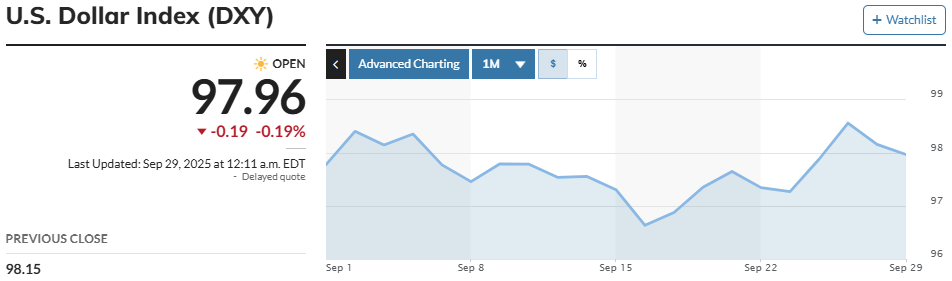

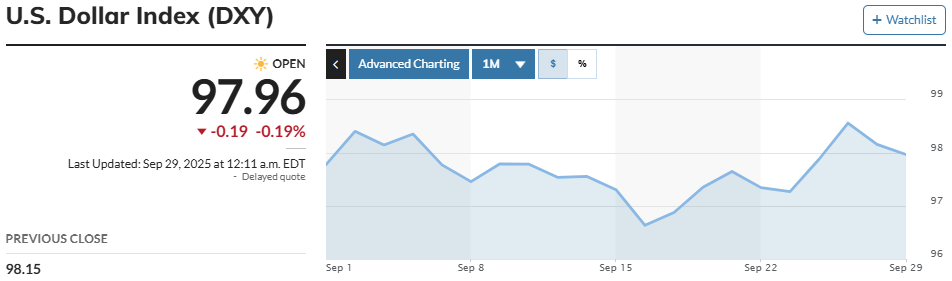

FX: The Dollar Index steadied above 98.30 and hovered near 98.5, keeping “Dollar Index Near 98” as a live theme for cross‑asset risk appetite. Commodities: Brent traded around 69–70 dollars per barrel, while gold stayed firm after the PCE print, supported by a “Gold Post‑PCE Bid”.

Key Weekly Moves

These figures summarise last week's cross‑asset direction at a glance for quick reference before deeper analysis.

| Asset |

Level/Range |

WoW Change |

Note |

| S&P 500 |

6643.70 close |

−0.31% |

Late bounce trimmed losses |

| U.S. 10-Year Yield |

~4.18%–4.20% |

Little changed |

Long-end stable post-PCE |

| Dollar Index (DXY) |

~98.30–98.50 |

Firmer bias |

Rates backdrop supported USD |

| Brent Crude |

~$69–$70/bbl |

Range-bound |

Quarter-end consolidation |

| Gold |

~$3,730–$3,775/oz |

Firmer |

Safe-haven interest post-PCE |

Inflation & Spending

Core PCE rose 2.9% YoY and 0.2% MoM in August, keeping disinflation on a plateau around 3% and placing “Core PCE 2.9% YoY (Aug)” at the centre of last week's debate.

Headline PCE printed 2.7% YoY, maintaining the “PCE vs CPI Inflation” gap as energy and goods diverged from services.

Personal income and outlays signalled solid spending alongside rising incomes, while U.S. consumer sentiment weakened further in September, adding a cautious note to the demand outlook. [2]

Fed & Tariff Watch

Markets tracked Fed Speeches This Week, including the Powell Remarks Preview and Miran On Policy Outlook, with in‑line PCE encouraging a steady tone into labour and PMI updates.

Under Trump Tariff News Update, the administration confirmed a 100% tariff on branded or patented drug imports from 1 October, unless a manufacturer is already building a U.S. plant, alongside 25% on heavy trucks, 30% on upholstered furniture, and 50% on cabinets/vanities from the same date.

Asia markets showed a cautious stance around tariff headlines and a firm dollar, fitting the “Asia Markets React To Tariffs” frame into Friday's session.

FX & Rates Setup

With the Dollar Index near 98 and long yields steady, rate‑sensitive crosses retained a mild U.S. dollar bias heading into the new week.

The “EUR/USD Week Ahead” hinges on whether an in‑line U.S. data run and subdued Eurozone PMIs cap euro rallies, while the “USD/JPY Rate Path” remains most sensitive to front‑end repricing and any fresh curve steepening.

Overall, conviction in FX awaits clarity from the jobs report and global PMIs to refine growth and policy differentials.

Data & Events Calendar

The highest‑impact releases and events below frame the near‑term path for rates, FX, and risk assets into early October.

Jobs Report This Friday: Nonfarm payrolls are due on Friday, 3 October; see “NFP Calendar Oct 3” for timing and consensus as labour momentum guides the rate path.

PMIs In Focus: Final manufacturing and services readings across major economies will steer growth narratives and FX rate spreads.

Fed Speeches This Week: Chair Powell and Governor Miran are expected to outline policy thinking after the PCE report, with balance‑sheet and rate‑path signals in focus.

ISM and jobless claims: Leading indicators for demand and hiring will refine the short‑term policy and earnings read‑across.

Selected earnings: Late‑cycle updates from energy, semis, and consumer discretionary should colour margin resilience heading into the holiday quarter.

What Could Move Markets

These catalysts are most likely to shift cross‑asset tone and volatility over the coming week as investors calibrate growth, inflation, and policy risks around the quarter‑end.

100% Drug Tariffs Oct 1: Implementation may influence healthcare pricing and supply chains; exemptions and pass‑through will be decisive.

25% Tariff Heavy Trucks: Potential price and logistics effects for industrials and transports warrant close monitoring.

Dollar Index Near 98: A firm dollar tightens financial conditions at the margin, tempering commodity and EM FX rallies.

Treasury Yields Steady: Long‑end stability supports valuations but limits a broad risk melt‑up absent softer growth data.

Consumer Sentiment Weakens: Another slip could cap spending resilience even if labour remains firm. [3]

Conclusion

With “Core PCE 2.9% YoY (Aug)” in line and yields steady, near‑term risk appetite turns on whether Friday's labour data shift rate‑cut probabilities and if PMIs support a gentle growth glide‑path rather than a sharper slowdown.

The tariff roll‑out introduces idiosyncratic risks for healthcare and heavy industry, yet a broader market impact likely requires visible pass‑through into Q4 inflation prints or guidance during early earnings updates.

For now, base‑case assumptions remain “Treasury Yields Steady,” “Dollar Index Near 98,” and a data‑dependent Fed narrative into year‑end.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.cnbc.com/2025/09/26/pce-inflation-august-2025.html

[2] https://www.morningstar.com/economy/august-pce-report-pce-inflation-index-up-27-line-with-expectations

[3] https://www.businesstoday.com.my/2025/09/29/consumer-sentiment-in-us-weakens-further-in-sept/