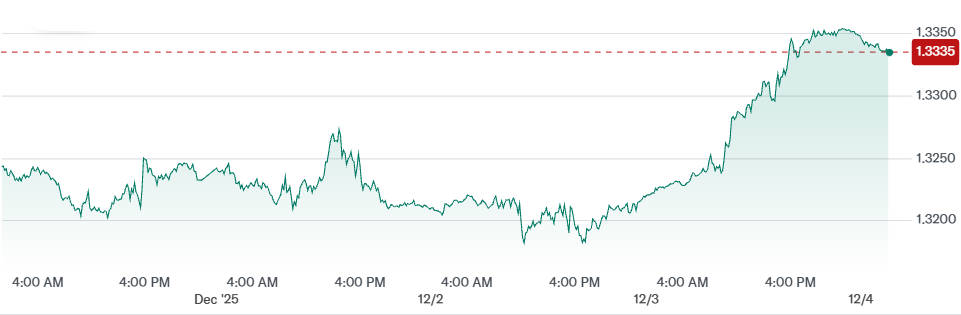

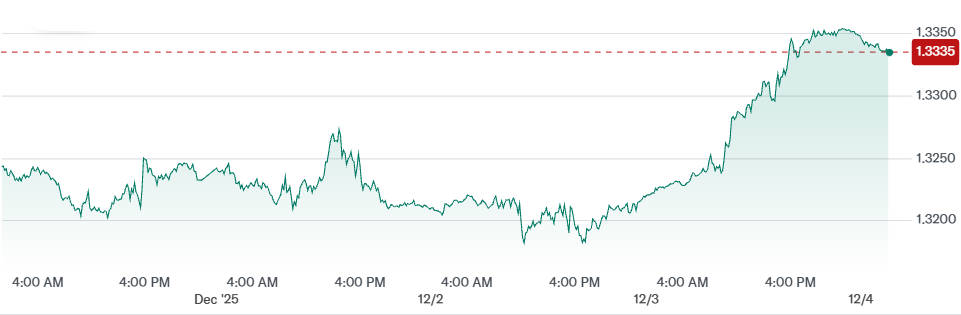

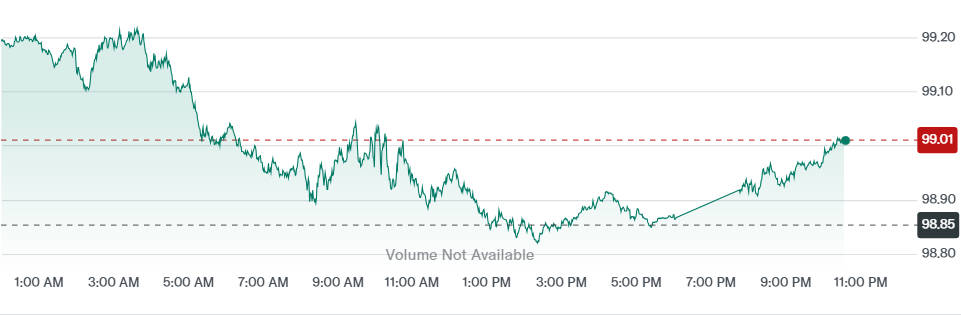

The British Pound has experienced a strong surge in recent trading sessions, with the GBP/USD exchange rate surging around 1% and reaching 1.333. This represents a one-month high for the currency pair, sparking considerable attention from traders, analysts, and investors alike.

In this article, we will explore the driving forces behind this rally, its implications for the UK economy, and the outlook for the Pound against the US Dollar in the near term.

What Triggered the Sharp Rise in GBP/USD?

Several factors have contributed to the Pound's recent surge against the US Dollar. The rise to 1.333 is a result of both fundamental economic data and market sentiment.

1. Strong UK Business Activity Data

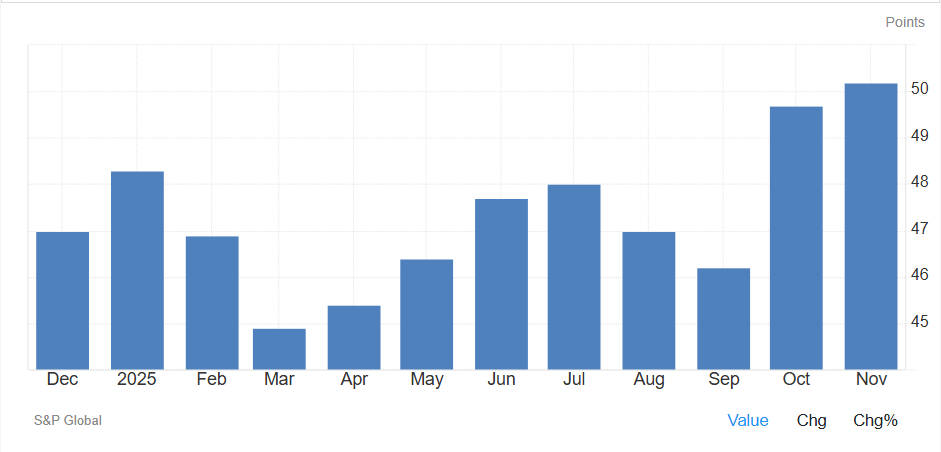

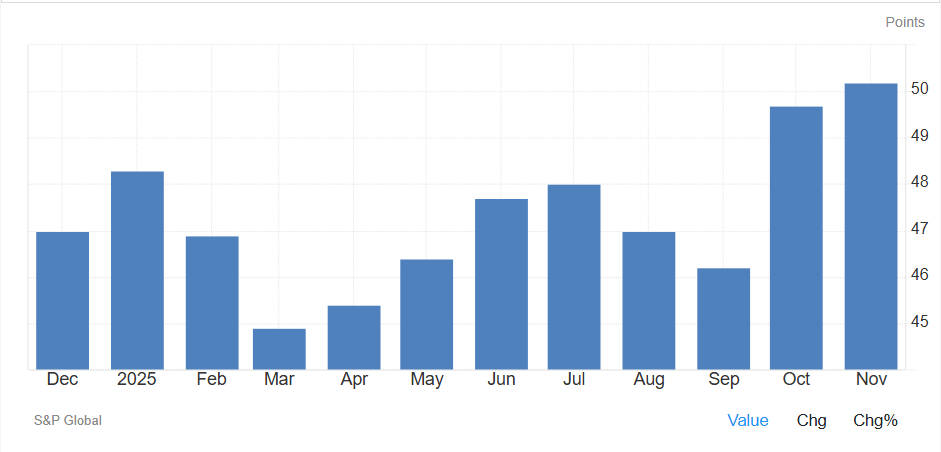

Recent economic data from the UK has shown positive signs of recovery, particularly in the services sector. The UK Services PMI for November 2025 registered at 51.3. indicating marginal growth in business activity, although it was a slight slowdown compared to the previous month.

More notably, the UK Manufacturing PMI rose to 50.2. its highest level in 14 months, signalling a return to expansion for the first time since September 2024. [1]

This uptick in manufacturing, coupled with the service sector's performance, suggests a broader recovery in the UK economy.

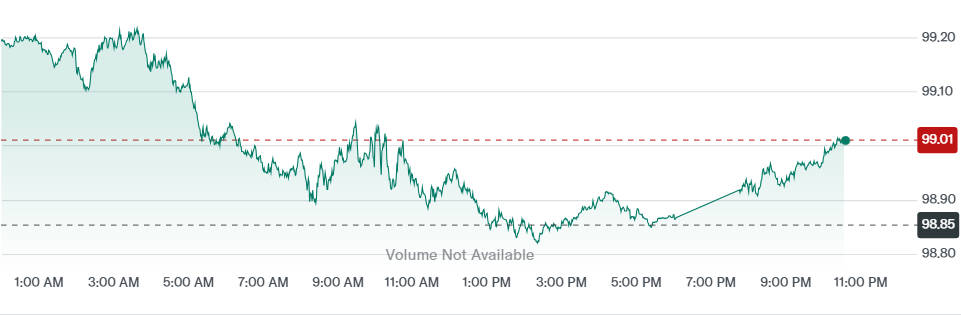

2. Weaker US Dollar

The US Dollar has been under pressure due to market expectations of a more dovish Federal Reserve stance. Following a series of interest rate hikes, the Fed's most recent statements have hinted at a potential slowdown in tightening measures.

As a result, investors have been moving away from the US Dollar, creating favourable conditions for other currencies, including the Pound.

3. Market Sentiment and Unwinding of Negative Bets on Sterling

The Pound had been under selling pressure for months, with many investors holding negative positions due to concerns about the UK's economic outlook.

However, the latest positive data has prompted a reassessment of these bearish positions. As a result, there has been a wave of short-covering, where investors who were betting against the Pound have had to buy it back, further driving up its value.

These factors combined have led to the GBP/USD rally, with the Pound now trading at levels not seen in the last month.

How Technicals and Charts Support the GBP/USD Surge

The rally in GBP/USD is also supported by technical factors, which can be observed through chart patterns and key support and resistance levels.

1. Key Resistance and Support Levels

When analysing the charts, it is clear that the Pound has broken through significant resistance levels, signalling further potential upside.

The key resistance level at 1.3200 was surpassed, followed by a strong push towards 1.3300.

If GBP/USD can maintain this momentum, the next major resistance level lies at 1.3350. a key psychological barrier.

| Level |

Type |

Significance |

| 1.3200 |

Support |

Previously tested level, now a key support |

| 1.3300 |

Resistance |

Psychological level and short-term target |

| 1.3350 |

Resistance |

Major resistance level for next push |

| 1.3400 |

Target |

Long-term resistance if bullish trend continues |

2. Breakout Above Moving Averages

GBP/USD recently broke above its 21-day and 20-day moving averages, which are often used as key indicators for bullish momentum. A sustained move above these levels signals that the current uptrend could continue, especially if the price remains above 1.3200.

UK vs US: Why Sterling Strengthens Now

The divergence in economic conditions between the UK and the US has played a crucial role in the Pound's strength.

1. Improved UK Economic Sentiment

Recent data, including the PMI report and industrial output figures, have shown positive trends in the UK economy. Although the UK's economic growth remains slower than that of the US, the recent data indicates that the economy is performing better than expected.

The strength in the services sector, which is a major driver of the UK economy, has provided confidence to investors, making them more optimistic about the Pound's future prospects.

2. The US Dollar Weakness

On the other hand, the US Dollar has weakened due to dovish signals from the Federal Reserve. After months of aggressive interest rate hikes, the market now expects the Fed to slow down or even pause its tightening cycle.

This shift in policy expectations has led to a decrease in demand for the US Dollar, especially as global risk sentiment improves. The Dollar's weakness has benefitted currencies like the Pound, which have seen less aggressive monetary tightening.

What Analysts and Forecasts Say About the GBP/USD Near-Term Outlook

Several analysts and market experts have weighed in on the potential for further GBP/USD gains in the near term. Some are optimistic that the Pound could test levels as high as 1.35 if the bullish momentum continues and UK economic data remains supportive.

However, others caution that any sign of economic slowdown in the UK, or a stronger-than-expected US recovery, could limit the Pound's gains.

Analyst Forecasts

| Analyst Firm |

GBP/USD Forecast |

Reasoning |

| UBS |

1.3400 |

Continued UK economic recovery and USD weakness |

| Deutsche Bank |

1.3200 |

Caution over potential rate cuts in the UK |

| Citi |

1.3350 |

Mixed UK data and Fed policy uncertainty |

What the Surge Means for Businesses, Travellers, and Investors

The sharp rise in GBP/USD has several implications for different sectors and individuals.

1. For UK Exporters and Importers

A stronger Pound makes UK exports more expensive for foreign buyers, potentially reducing demand for British goods and services. Conversely, importers will benefit from cheaper imports, as the stronger Pound makes foreign goods less costly in the UK.

2. For Travellers and Remittances

The stronger Pound makes it cheaper for British tourists to travel abroad, especially to countries with a weaker currency. Remittances sent from the UK to other countries, particularly the US, will also be more valuable for the recipients.

3. For Investors and FX Traders

For investors and traders, the recent rise in GBP/USD presents opportunities for short-term gains. However, with potential volatility in the coming weeks due to both UK and US economic releases, it is crucial to monitor the market closely and manage risk effectively.

Things to Watch in GBP/USD Coming Weeks

As the GBP/USD pair continues to show strength, several factors could influence its future trajectory:

1. UK Economic Data

The UK's upcoming PMI, inflation, and labour market reports will be crucial in determining whether the Pound can sustain its gains. Strong economic performance will support further strength in GBP/USD.

2. US Economic Data

The US is scheduled to release key economic data, including job reports and inflation figures. Any surprises in these reports could lead to shifts in the Fed's stance, which would impact the US Dollar and, consequently, GBP/USD.

3. Geopolitical and Global Market Sentiment

Any shifts in global risk sentiment, particularly surrounding major geopolitical events or central bank policy changes, will likely affect GBP/USD as well.

Frequently Asked Questions

Q1: Is the GBP/USD rally sustainable?

The sustainability of the GBP/USD rally depends on continued positive UK economic data and a weaker US Dollar. If either of these factors changes, the rally could lose momentum.

Q2: Could GBP/USD reach 1.35 soon?

Some analysts believe GBP/USD could reach 1.35 if the current economic conditions persist. However, any surprise economic data from the UK or US may impact this forecast.

Q3: What risks could derail the uptrend?

Risks to the uptrend include weaker-than-expected UK data, unexpected policy shifts from the Bank of England, or a stronger-than-anticipated US economic rebound.

Conclusion

The recent rise of GBP/USD to 1.333 highlights a significant shift in market sentiment, driven by positive UK data and a weaker US Dollar. While there are optimistic forecasts for further gains, investors should remain cautious and monitor upcoming economic releases closely.

The balance between UK economic performance and US monetary policy will remain central to the direction of GBP/USD in the coming weeks.

Sources:

[1] https://www.pmi.spglobal.com/public/release/pressreleases

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.