USD/INR is trading close to ₹90 per $1, a level that reflects two forces moving in the same direction: relatively firm U.S. interest rates and a rupee managed for stability rather than allowed to swing freely.

When the U.S. rate complex rises, the dollar’s carry and safe-haven yield advantages strengthen, and USD/INR tends to drift higher unless India offsets them through growth, disinflation, capital inflows, or active liquidity and FX management.

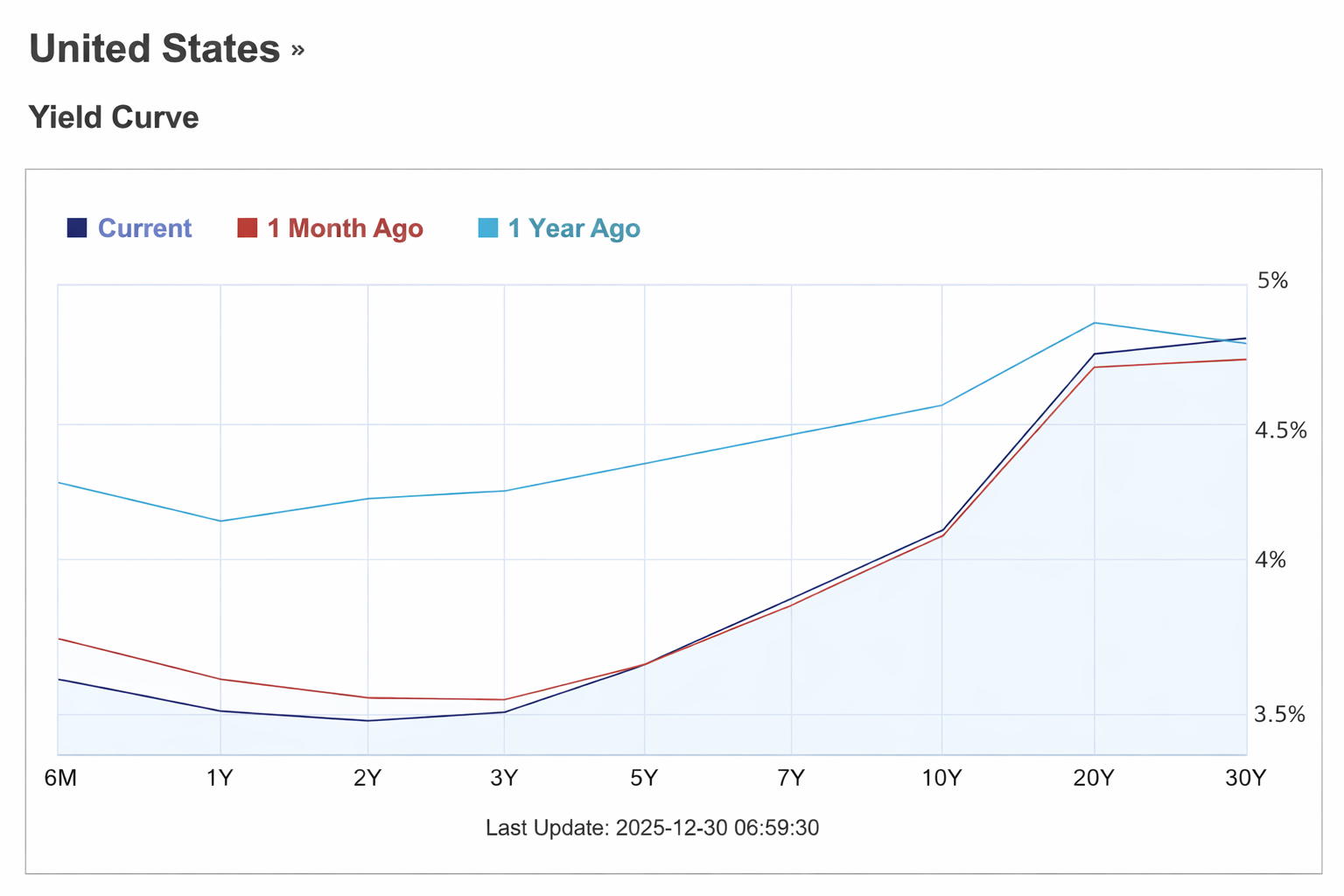

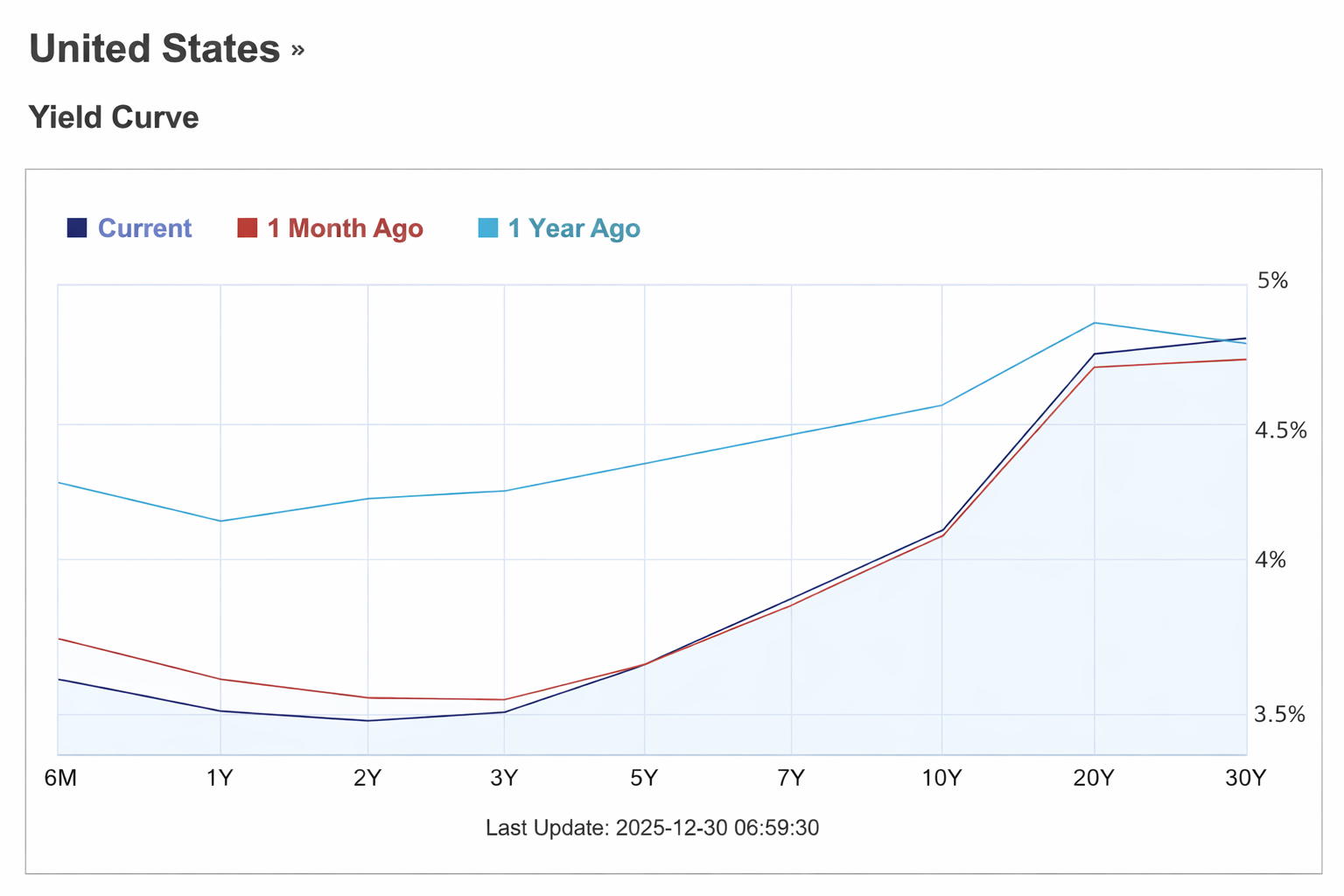

The latest official reference rate from the Reserve Bank of India for 29 Dec 2025 was ₹89.9756 per $1. U.S. rates are still elevated: the Federal Reserve’s H.15 release shows the 10-year Treasury at 4.14% and the 2-year at 3.46% (latest business day shown 26 Dec 2025), while the Fed’s target range is 3.5% to 3.75% after a 25 bps cut in December.

India has cut its policy repo rate to 5.25% and signaled durable liquidity injections via OMOs and a USD/INR swap, which directly affects money-market conditions and forward pricing.

Yields Drive The USD To INR Forecast

Why U.S. Yields Move USD/INR Faster Than Most India Data

U.S. yields matter because they reprice the global “risk-free” curve that underpins nearly every cross-border decision: holding dollars, buying Treasuries, hedging FX exposure, and valuing emerging-market risk. When U.S. yields rise, global investors can earn more in dollars without taking equity or credit risk, which tends to lift the dollar broadly and pressure EM FX, including the rupee.

The latest H.15 data show a positive slope between the 2-year (3.46%) and 10-year (4.14%). That matters for USD/INR because a steeper long end usually signals either stronger growth expectations, higher term premium, or both, which supports the dollar even if short rates are stable.

The Real Yield Channel Is The Overlooked Driver

Nominal yields can fall if inflation falls, but the dollar often responds more to real yields (inflation-adjusted yields). The same H.15 release shows the 10-year inflation-indexed Treasury Inflation Protected Security (TIPS) yield at 1.91%. Real yields at that level raise the opportunity cost of holding non-yielding or lower-yielding assets and often tighten global financial conditions by strengthening the dollar and weakening risk appetite. [1]

This real-yield link is especially important for India because the rupee’s day-to-day moves are typically smaller than peers due to managed volatility. That means pressure can accumulate and show up through gradual depreciation, higher forward points, or tighter domestic liquidity rather than sharp spot moves.

Rate Differentials Support INR, Hedging Costs Decide The Outcome

On paper, India’s policy rate at 5.25% remains above the Fed’s 3.5% to 3.75% range, which should support INR via carry. In practice, foreign investors focus on hedged returns. If the cost of hedging USD/INR (via forwards or swaps) rises, the apparent carry can disappear.

That is why RBI liquidity operations and USD/INR swaps matter: they can influence money-market rates, swap points, and the ease of rolling hedges.

Most Recent Levels That Matter

The USD To INR Forecast is most sensitive to a small set of observable “anchors” that traders price every day.

| Anchor |

Latest Reading (Official / Widely Used) |

Why It Matters For USD/INR |

| RBI USD/INR Reference Rate |

₹89.9756 per $1 (29 Dec 2025) |

Best daily benchmark for spot context in India |

| U.S. 10-Year Treasury |

4.14% (26 Dec 2025) |

Global discount rate and dollar support |

| U.S. 2-Year Treasury |

3.46% (26 Dec 2025) |

Short-end policy expectations |

| U.S. 10-Year Real Yield (TIPS) |

1.91% (26 Dec 2025) |

Tightness of real financial conditions |

| Fed Funds Target Range |

3.5%–3.75% (Dec decision) |

Sets the U.S. policy anchor |

| RBI Policy Repo Rate |

5.25% (Dec MPC) |

Sets INR money-market anchor |

Fundamental Drivers Behind The USD To INR Forecast

U.S. Side: Growth, Inflation, And The “Higher Real Yield” Bias

U.S. inflation is not collapsing. The Bureau of Labor Statistics reported that the CPI rose 2.7% year over year in November 2025, and the core CPI (excluding food and energy) rose 2.6%. [2] That combination can keep real yields firm even if nominal rates are not rising sharply, which is typically constructive for the dollar.

The Fed’s December statement cut rates by 25 bps but also emphasized ongoing assessment of the outlook and noted it would maintain ample reserves, including purchases of shorter-term Treasuries as needed. That mix can be interpreted as “easing at the margin, but not rushing,” which often keeps U.S. yields supported versus peers.

A separate structural support is the U.S. external balance. The U.S. current account deficit in Q2 2025 was -$251.3 bn, still large in level terms even after narrowing. Persistent deficits are not automatically bearish for the dollar, but they make USD strength more dependent on capital inflows, which tend to increase when U.S. yields are attractive.

India Side: Disinflation, Stronger Growth, And A Managed FX Regime

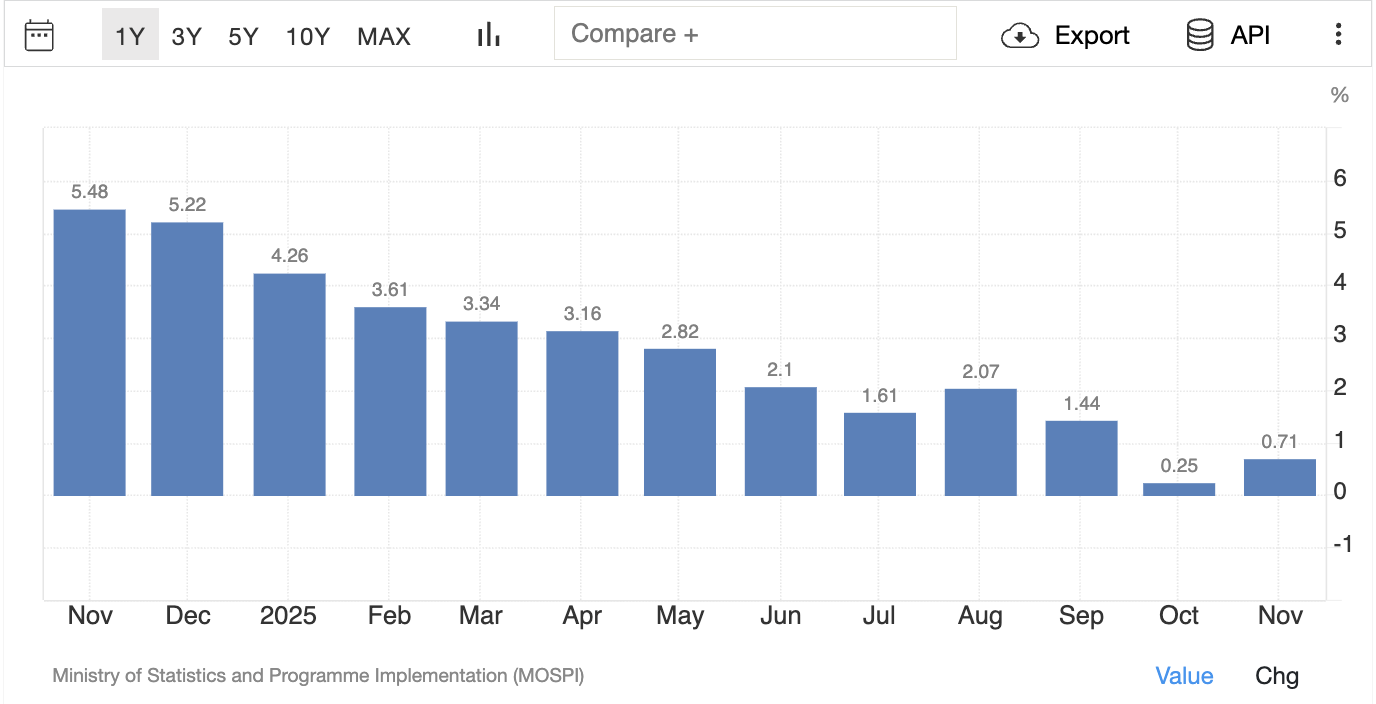

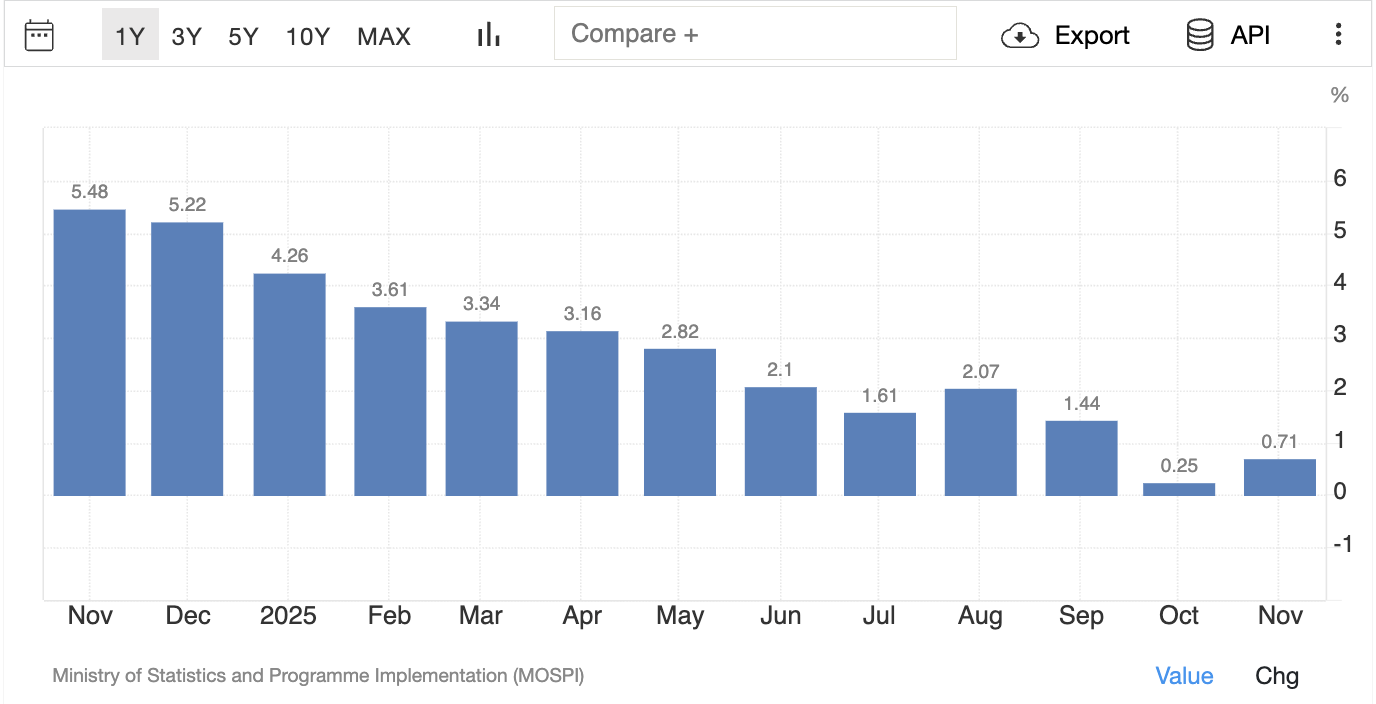

India is in an unusual macro mix: very low headline inflation readings alongside strong growth. The Ministry of Statistics and Programme Implementation reported headline inflation at 0.10% (provisional) in Nov 2025 and -0.25% in Oct 2025 for rural inflation, showing how sharply food-driven inflation eased.

The RBI’s December statement explicitly links the benign inflation outlook to policy space, projecting CPI inflation for 2025-26 at 2.0% and describing underlying pressures as even lower after adjusting for precious metals.

At the same time, growth is not weak. The RBI statement cites real GDP growth of 8.2% in Q2:2025-26, supported by domestic demand. Strong growth typically supports INR through investment inflows and confidence, but it can also widen imports and the trade deficit, which is why yields and oil remain critical swing factors.

The most important INR stabilizer is external resilience and policy capacity. The RBI reported foreign exchange reserves at $686.2 bn as of 28 Nov 2025, providing import cover of more than 11 months. Reserves at that scale allow the RBI to smooth volatility, which changes the nature of the USD/INR forecast: instead of frequent spikes, the base case often becomes a controlled grind with occasional step moves when global yields jump.

Technical Analysis For USD/INR

USD/INR is in a late-stage uptrend, but it is also trading near a psychologically important round level.

The RBI reference rate data show a recent cluster from 89.5467 (22 Dec 2025) to 89.9756 (29 Dec 2025), suggesting consolidation just below 90. Consolidations near major figures often resolve in the direction of the prevailing macro impulse, which right now is still yield-supportive for the dollar.

Key technical zones that matter for positioning and hedging decisions:

Resistance: 90.00 is the obvious first level. A sustained break above it typically draws in momentum hedgers and can push option prices higher.

Near-term support: 89.55 to 89.80, aligned with the recent reference-rate floor and mid-range congestion.

Deeper support (macro-confirmation zone): The high-88s area is where a meaningful “dollar pullback” would start to look credible, but it would usually require falling U.S. yields or a clear improvement in India’s capital inflow picture.

From a market microstructure angle, RBI liquidity operations matter for technicals because they can reduce “stress breaks” by smoothing funding conditions. The December statement announced OMO purchases of ₹1,00,000 crore and a 3-year USD/INR buy-sell swap of $5 bn to inject durable liquidity.

Easier INR liquidity can dampen abrupt spikes in USD/INR even if the longer-term trend remains higher.

USD To INR Forecast Scenarios

Base Case: Range With An Upward Bias

If U.S. 10-year yields stay around current levels and real yields remain firm, USD/INR is more likely to hold a broad ₹89 to ₹91 range over the coming quarters, with dips bought by import demand and risk-off hedging. This is consistent with a managed INR regime plus a dollar that still earns meaningful carry.

In this base case, INR strength tends to be capped unless India sees a sustained improvement in portfolio flows. The RBI notes net FPI outflows of $0.7 bn in 2025-26 so far (April to Dec 03), which is not the backdrop that usually generates a durable rupee rally.

Bullish INR Case: Falling U.S. Real Yields Plus Stable Oil

A stronger rupee path becomes plausible if U.S. real yields compress meaningfully and global risk appetite improves. That would reduce the dollar’s yield advantage and typically revive flows into higher-growth markets.

A supportive oil setup also helps: the U.S. Energy Information Administration expects Brent to average $55 per barrel in Q1 2026 and remain near that level through much of 2026, reflecting rising inventories. Lower oil prices reduce pressure on India’s import bill and can keep the current account deficit modest.

Under this scenario, USD/INR can drift toward the high-₹88s and potentially test deeper supports, but the move is likely to be gradual unless accompanied by a sharp re-pricing of U.S. yields.

Bearish INR Case: Yield Shock Or Risk-Off Plus Wider Trade Deficit

The clearest downside risk for INR is a renewed U.S. yield shock, especially in real yields, or a global risk-off episode that reduces EM inflows. In that environment, even strong domestic growth may not protect the rupee because the marginal investor prices dollars as a safe asset with high carry.

India’s trade dynamics can amplify this risk. The RBI statement notes that in October 2025, merchandise exports contracted year over year while imports rose, widening the trade deficit. If that pattern persists while U.S. yields stay elevated, USD/INR can spend more time above ₹90 and probe higher resistance zones.

Opportunities And Challenges For India And The U.S.

India: A Strong Growth Window With External Vigilance

India’s opportunity is clear: high real growth with sharply lower inflation creates room for investment-led expansion, productivity gains, and improved real incomes. The RBI’s own narrative is consistent with that setup, citing resilient demand and easing inflation pressures.

The challenge is that strong growth can pull in imports, while global yields can quickly turn capital flows. India can manage spot volatility with reserves, but reserves do not eliminate the underlying balance between the trade gap, services surplus, remittances, and net capital flows. That is why the current account and portfolio flow data remain central to any USD to INR Forecast.

U.S.: High-Yield Support Versus Policy And Inflation Uncertainty

The U.S. opportunity is that still-positive real yields and deep capital markets keep the dollar structurally attractive in global portfolios. Even with rate cuts, the Fed can keep policy restrictive enough to prevent an inflation re-acceleration, which supports real yields and USD carry.

The challenge is that inflation is not yet high enough to support aggressive easing without credibility risk. With CPI still rising 2.7% year over year, markets remain sensitive to any upside inflation surprise that pushes yields higher again. That sensitivity feeds directly into USD/INR.

Frequently Asked Questions (FAQ)

1. What is the most important input for a USD to INR forecast right now?

U.S. real yields. They transmit into USD strength, risk appetite, and hedging costs. With the 10-year inflation-indexed yield around 1.91%, the dollar’s “safe carry” remains meaningful, which tends to keep USD/INR supported.

2. How do U.S. Treasury yields affect the Indian Rupee day to day?

Higher Treasury yields raise the returns on dollar-denominated assets and can pull capital out of emerging markets. They also strengthen the dollar in global funding markets. For INR, the result is usually gradual depreciation pressure rather than sharp moves because FX volatility is often smoothed.

3. Is India’s rate advantage enough to strengthen INR?

Not by itself. India’s repo rate is 5.25% versus a 3.5% to 3.75% Fed funds target range, but foreign investors focus on hedged returns. If forward or swap costs rise, the carry advantage can shrink quickly.

4. What role do RBI Reserves play in USD/INR forecasting?

Large reserves allow the RBI to dampen volatility and reduce the probability of disorderly moves. The RBI reported reserves of $686.2 bn as of 28 Nov 2025, implying strong capacity to smooth shocks, even if the trend is influenced by yields and flows.

5. Why can USD/INR rise even when India’s inflation is very low?

Because FX is driven by relative returns and capital flows, not inflation alone. India’s headline inflation has been extremely low recently, but if U.S. real yields stay high or portfolio flows weaken, USD demand can still dominate and keep USD/INR near the top of its range.

6. What would confirm a more durable INR rally?

A sustained decline in U.S. real yields and a clear improvement in India’s net capital inflows. A supportive oil backdrop helps by keeping the current account deficit modest. Without those conditions, INR strength typically fades into range trading and managed depreciation.

Conclusion

The USD to INR Forecast is still primarily a yield story. With U.S. 10-year yields around 4.14% and real yields near 1.91%, the dollar remains well supported on a risk-adjusted basis, keeping USD/INR biased to the upside even as India’s domestic fundamentals look strong. [1]

India’s macro mix of strong growth, low inflation, and large reserves provides stability rather than automatic INR strength. The most realistic path is continued range trade near ₹90 with a slight upward drift, unless U.S. real yields fall decisively and India sees a clearer revival in portfolio inflows.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Sources

[1] https://www.federalreserve.gov/releases/h15/

[2] https://www.bls.gov/news.release/pdf/cpi.pdf