Jim Simons didn't win by finding a single secret signal. He built a research machine that approached markets as a noisy dataset, then harvested tiny, repeatable edges at scale, day after day, across many instruments.

That is why people still talk about Renaissance as a once-in-a-generation trading shop and one of the most successful hedge funds, even though almost nobody outside the firm has ever seen the actual code.

This article explains the strategy in a way that is honest about what we know, clear about what we do not know, and provides tips for traders who want to learn the mindset without falling for copycat myths.

Key Takeaways

Medallion's reported performance is exceptional, but the fund is also highly closed, capacity‑constrained, and opaque by design, making it difficult to copy in practice.

The applicable lessons include research discipline, risk management, and cost awareness, rather than a specific configuration on a chart.

Who Was Jim Simons, and What Did He Build?

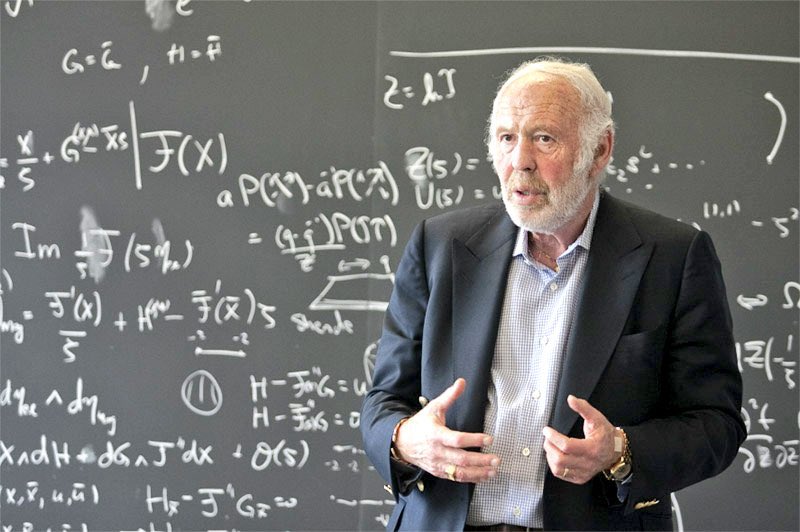

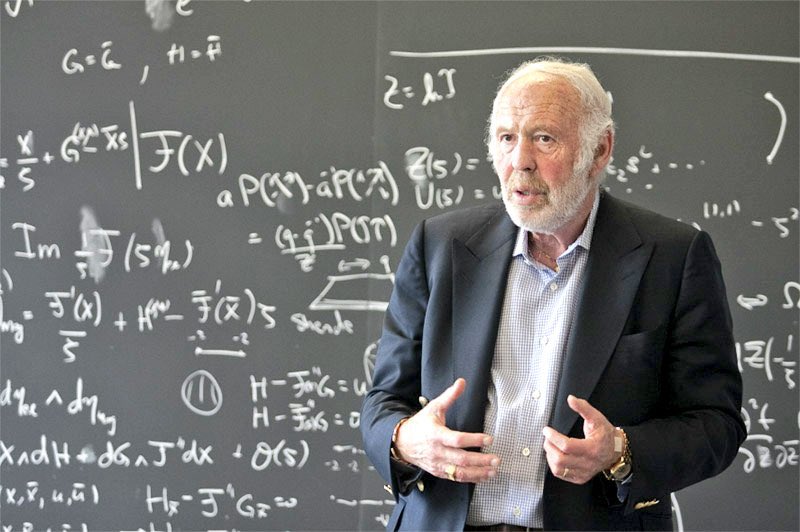

Simons was a working mathematician long before he became a famous investor, and he was comfortable doing what most discretionary traders struggle with: trusting a process more than a feeling.

He approached markets like an engineering problem, where the objective was to find signals that were small but statistically reliable, and then size them correctly.

He also built a culture unlike the typical trading floor. In a 2007 talk, Simons stated the firm hired physicists, mathematicians, astronomers, and computer scientists, and that they typically knew nothing about finance.

That hiring choice is not a fun detail, because it is the core strategy. If your advantage lies in data and pattern recognition, you need individuals who have dedicated their lives to data and pattern recognition.

Simons died on May 10, 2024, at age 86, and tributes flooded in, focusing on how he helped define modern quantitative trading.

What We Know About Medallion

Renaissance does not publish Medallion's playbook, so the best approach is to start with what credible reporting and filings do say.

| Topic |

What is publicly reported |

Why it matters |

| Launch |

Medallion was established in 1988. |

It has enough history to cover multiple market regimes. |

| Investor access |

Medallion has been closed to external investors since 2005 in widely cited reporting. |

Closure signals capacity limits and a desire to protect the edge. |

| Strategy style |

It is described as a short-term, quantitative trading strategy across multiple asset classes. |

Short horizon plus diversification often implies many small edges. |

| Long-run returns |

Public reporting has cited about 66% annualized before fees and about 39% after fees over long stretches (for example, 1988–2021). |

The numbers are extreme, which is why "how" matters so much. |

| Fees |

Public sources have cited high fees, including a management fee in the mid-single digits and incentive fees that can be very large. |

High fees can still be rational if net performance is exceptional. |

The Repeatable Core Of The Jim Simons Trading Strategy

1) Data Quality Beats Cleverness

Most people focus on fancy models, but the quiet advantage is usually cleaner inputs.

Renaissance's own advisory disclosure describes a quantitative modelling process that scores and ranks securities using predictive factors that can include financial strength, historical growth, future earnings expectations, and valuation, before further review.

Although Medallion's models vary, the underlying philosophy remains the same: messy inputs lead to noisy outputs.

Practical takeaway: A trader who keeps a clean journal and a consistent dataset often outperforms the trader who changes indicators every week.

2) Many Small Edges Beat One Big "Conviction Trade"

Many legendary trading stories are built around one great call. Renaissance's story is built around scale.

Medallion's system relies on buying and selling that work in concert to generate high returns at low risk across asset classes, with patterns that remain hidden to other traders.

It is an "ensemble," where dozens or hundreds of small signals each contribute a little.

Practical takeaway: You should aim for repeatable, testable ideas that you can execute many times, because one trade does not create a track record.

3) Holding Periods Are Short Because the Edge Is Small

Short-term strategies are not a lifestyle choice. They are a business choice.

When your edge is tiny, you generally have two ways to make it matter: repeat it many times, or size up and tolerate larger drawdowns.

Medallion is widely characterised as a short-horizon, multi-asset program, which aligns more with high-frequency repetition and diversification, many small bets spread across instruments, than with a single, concentrated "big call."

Practical takeaway: A short-term edge only survives if your costs are low and your execution is disciplined.

4) Costs and Execution Are Part of the Strategy, Not a Footnote

For systematic trading, "transaction cost" is not a line item. It is the difference between a profitable model and a dead model.

It is one reason Medallion is hard to copy. Retail traders pay wider spreads, face more slippage, and cannot route orders as institutions can.

Practical takeaway: If you want to trade frequently, you should be obsessed with spreads, liquidity, and discipline, because they decide whether your edge exists.

5) Risk Control Is the Real Magic Trick

Most traders fail because of excessive positions or correlated bets.

Public reporting frames Medallion as generating high returns with low risk through coordinated buying and selling across asset classes. That description matters because it implies risk is engineered, not hoped for.

Practical takeaway: You should define risk first and returns second, because returns are uncertain while risk is a choice.

6) The Research Loop Is Continuous, Not Seasonal

A discretionary trader often has a "setup." A quant shop has a pipeline.

A model gets tested, traded, monitored, and either improved or retired. In a regime shift, what matters is not that a model fails, but how fast you detect failure and reduce exposure.

Practical takeaway: You should treat strategy changes like software updates, because markets change, and your approach must adapt.

Why Is It So Hard to Copy Medallion?

People try to copy Renaissance by searching for a secret indicator. That is the wrong target.

The hard-to-copy parts are structural:

You need research talent and infrastructure that can run thousands of experiments without fooling itself.

You need execution quality that keeps costs below the edge.

You need scale and diversification, but not so much scale that you kill the inefficiency you are harvesting.

You need the emotional discipline to follow models during boredom and during stress, which is harder than it sounds.

How to Apply Jim Simons Trading Strategy Without Pretending to Be Renaissance?

| Layer |

What it is |

What it does for performance |

What retail traders can copy |

| Data |

Large, clean, consistent datasets. |

It reduces noise and improves signal reliability. |

You can maintain a consistent watchlist and a clean journal. |

| Research |

A scientific method for testing. |

It prevents "story trading" and overconfidence. |

You can backtest simply and record results honestly. |

| Models |

Many signals working together. |

It diversifies sources of edge. |

You can use a rules-based checklist instead of impulses. |

| Portfolio |

Many small positions, not one hero bet. |

It lowers reliance on any single outcome. |

You can cap position size and avoid correlated trades. |

| Execution |

Cost control and discipline. |

It keeps small edges alive. |

You can avoid illiquid names and avoid market orders in thin conditions. |

| Risk |

Tight exposure limits and monitoring. |

It protects compounding. |

You can set max daily loss and stick to it. |

You can pull practical lessons from the Renaissance story even if you will never run a quant fund.

A "Simons-Style" Trader Checklist

You should treat every trade as a hypothesis that can be wrong.

You should measure outcomes, because your memory fluctuates when you are under stress.

You should build rules you can follow on your worst day, not on your best day.

You should diversify your ideas, because one setup going cold should not end your year.

You should size smaller when you are uncertain, because uncertainty is always present.

These habits seem boring, but they are often what produce consistent results.

Frequently Asked Questions

1. What Was Jim Simons' Trading Strategy?

Jim Simons developed a methodical, data-driven approach that searched for small, repeatable patterns in prices and other signals, then applied them systematically at scale.

2. Did Jim Simons Personally Pick Stocks?

No. Renaissance's approach was an automated trading system driven by mathematical and statistical research rather than discretionary stock picking.

3. Why Is Medallion Closed to Outside Investors?

If a strategy relies on small inefficiencies, too much capital can erase the edge through market impact and crowding.

4. Can Individual Traders Copy the Jim Simons Trading Strategy?

Retail traders can copy the mindset, but not the machinery. You can implement rules-based trading, establish prudent risk limits, and monitor performance.

Conclusion

In conclusion, Renaissance wins because it treats trading like applied science. It collects information, experiments with concepts, merges minor advantages, and controls risk with a consistency that is not influenced by emotions or stories.

Jim Simons' trading strategy and real legacy are not a secret setup. His legacy is the idea that consistency comes from process, not prediction.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.