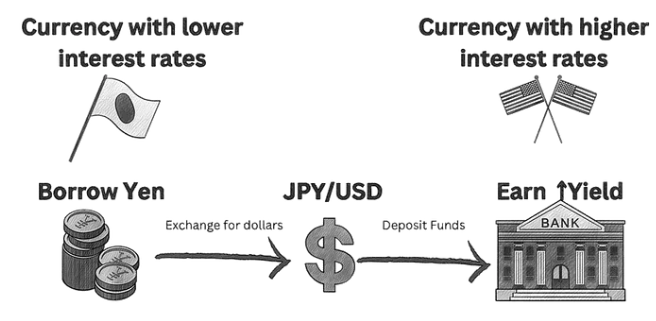

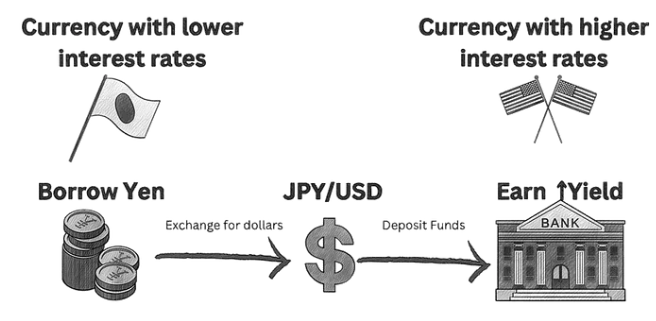

The yen carry trade is a simple concept: borrow yen at low interest rates and invest in assets that offer higher yields. With Japan's interest rate at just 0.1% in 2025, it presents an ideal opportunity for traders. This strategy allows them to unlock profits with relative ease.

This article explains the yen carry trade, how it works, and the steps necessary to succeed.

What Is the Yen Carry Trade?

It involves borrowing yen at low rates to invest in high-return opportunities. The interest rate difference works to your advantage. Japan's interest rates make this strategy appealing. It's a popular forex approach for consistent profits.

How the Yen Carry Trade Works

Borrow ¥10,000 at 0.1% interest. Convert it to USD at 4.25%. Invest in bonds or stocks and pocket the difference daily. This is a simple explanation of the yen carry trade.

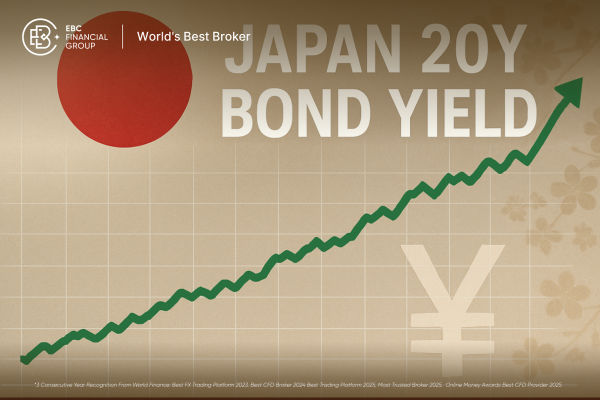

Why Japan's Rates Matter

The Bank of Japan maintains its interest rate at 0.1%. In 2024, this results in borrowing costs of $10 per $10,000 compared to the USD rate of 4.25%.

Yen Carry Trade Example

Step

|

Details |

| Borrow |

$20,000 at 0.1% |

| Invest |

USD $ at 4.25% |

| Annual Cost |

$20 |

| Annual Gain |

$850 |

| Net Profit |

$830 (4.15%) |

Top Pairs for Yen Carry Trade

USD/JPY: Reliable 4%+ gap.

AUD/JPY: Hits 4.35% yields.

GBP/JPY: Offers 4.5% returns.

Where to Invest Your Yen

In 2025, US bonds are expected to yield 4%, while Australian stocks are projected to average 5%. Gold tends to stabilise but does not generate yields. The yen carry trade is most effective with interest-earning assets, so choose wisely.

Why It's Profitable

Low yen interest rates reduce borrowing costs. In 2023, traders saved $50 for every $50,000 borrowed. High-yield currencies can significantly amplify returns. The yen carry trade transforms small investments into substantial profits.

Timing Your Entry

It's best to start the yen carry trade when yen rates are stable. Avoid entering during periods of high volatility, such as JPY spikes caused by crises. In the second quarter of 2024, the AUD/JPY pair provided a 5% return after achieving stability. Precise timing is crucial for success in the yen carry trade.

Risks of Yen Carry Trade Explained

Strengthening of the yen can erode profits. For example, a 3% increase in the JPY in 2023 reduced gains. Additionally, rate hikes in other countries can diminish profit differentials. Be aware that using leverage can amplify losses. It's important to understand these risks when engaging in the yen carry trade.

Managing Risks Smartly

Utilise stop-losses set at 2% below your entry point. Limit leverage to a maximum of 5:1. Consider hedging with gold if the yen experiences a sudden increase. In 2024, hedged trades showed an 8% lower loss rate. The yen carry trade requires careful attention.

Tools to Simplify Trading

Forex calculators can help identify rate gaps. It's essential to track Bank of Japan (BoJ) news daily. The Relative Strength Index (RSI) can indicate trends in yen pairs. Traders who utilized these tools in 2023 achieved 10% higher gains. Understanding the yen carry trade becomes easier with these resources.

Real-Life Success Stories

A trader from Cardiff made $2,000 on a USD/JPY trade in 2024 after borrowing $50,000 at a 4% interest rate. Another trader focused on AUD/JPY, earning a net of $1,800 monthly. The yen carry trade can be profitable when approached correctly.

Mistakes to Avoid

Avoid using excessive leverage—10:1 can lead to significant losses. Failing to monitor yen movements can result in financial setbacks. Skipping necessary research can also lead to failure; in 2022, 15% of attempts to execute the yen carry trade resulted in losses. Stay alert and informed.

The 2025 Outlook

Japan's interest rates may rise to 0.25%, while the U.S. could decrease to 4%. The yen carry trade is expected to remain viable with an anticipated rate of 3.75%. Global tensions may contribute to the yen's stability, which can help maintain profits.

Actionable Steps to Begin

Check USD/JPY rate diffs.

Open a forex account cheaply.

Test yen carry trade explained on demo.

Start with $3,000, scale up.

Watch BoJ weekly.

Conclusion

The yen carry trade explained reveals profits with low rates. Japan's interest rate of 0.1% compared to the USD's 4.25% is significant. Master this strategy in 2025.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.