China's Manufacturing Slump: RatingDog Analysis of November PMI

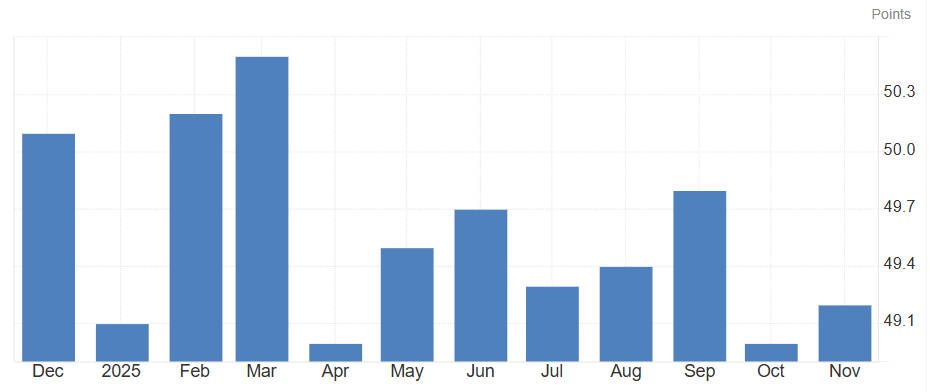

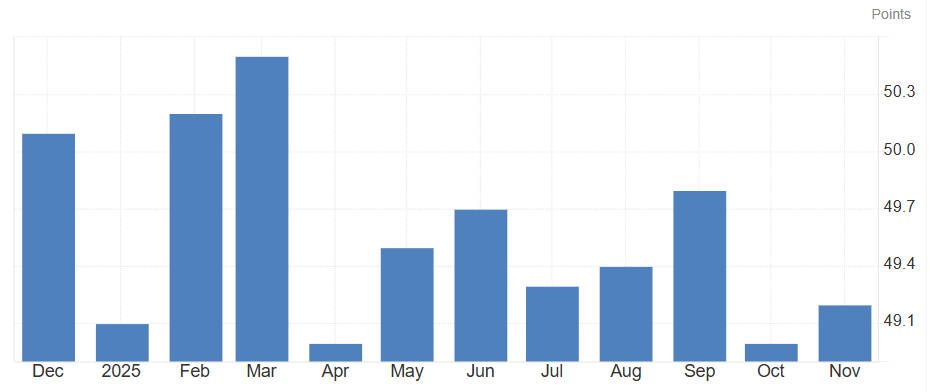

On 1 December 2025. China's private-sector manufacturing activity unexpectedly slipped back into contraction, defying analyst expectations. The Caixin China Manufacturing PMI fell to 49.9. below the forecast of 50.5. signalling renewed weakness in the sector. Meanwhile, the official NBS PMI rose slightly to 49.2 but remained below the critical 50 threshold for the eighth consecutive month.

Yao Yu, founder of RatingDog, emphasised that despite some support from government policies, the manufacturing sector remains in a "sluggish state," highlighting the fragility of China's industrial recovery.

RatingDog and Caixin Data: Private Sector Insights

The November contraction in the Caixin Manufacturing PMI marks the first decline since July 2025. dropping from 50.6 in October. RatingDog identifies several key stress points behind the slowdown:

Stagnant New Orders:

Domestic demand remains nearly flat, indicating weak momentum in the private sector.

Employment Shock:

Firms have resumed cost-cutting, leading to renewed job losses.

Inventory Destocking:

Companies are reducing inventories at the fastest pace in almost a year, reflecting caution about near-term demand.

Price Pressures:

Rising input costs, particularly metals, combined with falling output prices, are squeezing profit margins.

Despite these challenges, export orders expanded at the fastest pace in eight months, likely benefiting from a temporary trade truce and front-loading ahead of potential tariffs. This partial export boost, however, has not been enough to offset weak domestic demand.

Official NBS Data: Sector Divergence and Trends

The official NBS Manufacturing PMI remained in contraction at 49.2. maintaining an eight-month streak below 50. A closer look reveals divergence by firm size:

High-tech manufacturing remains a rare bright spot, with PMI at 50.1. suggesting that government support for strategic sectors is showing limited but positive results.

Expert Commentary: Yao Yu and RatingDog Insights

Yao Yu offered direct commentary on the November data:

"This trend failed to reverse the sluggish state of the manufacturing sector."

"Considering the need to sprint toward the annual 5% growth target, there may be strengthened efforts on both the supply and demand sides at the end of the year."

RatingDog interprets the contraction as a clear signal that the government may need to implement more aggressive measures in December to help achieve GDP targets.

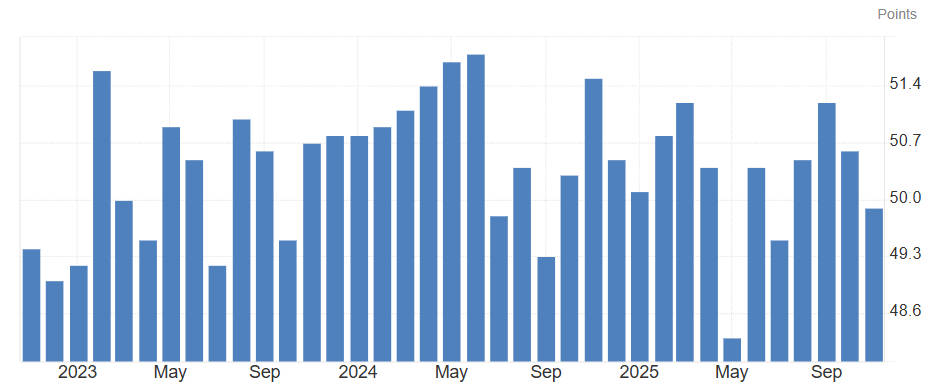

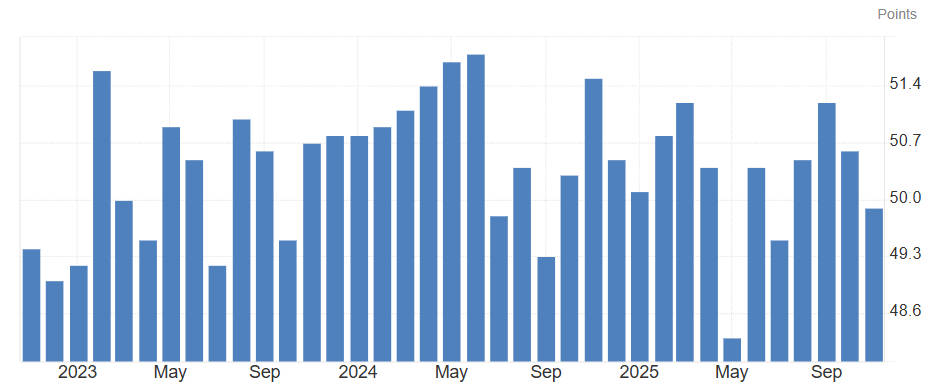

Historical Perspective: Comparing PMI Trends

China's manufacturing sector has experienced gradual slowdown since mid-2024. influenced by weakening domestic demand, cooling property markets, and structural shifts toward services and high-tech industries. [2]

The November contraction in private-sector PMI, coupled with eight consecutive months of official PMI contraction, signals that China's industrial activity is not yet stabilised.

RatingDog notes that historical trends indicate private surveys often provide an earlier signal of stress than official data, underscoring the importance of monitoring Caixin PMI for early warning signs.

Policy Analysis: Government Response and Implications

With the year-end approaching, policymakers are under pressure to stimulate growth. Potential measures include:

Monetary Support:

Liquidity injections and adjustments to benchmark interest rates to support credit availability.

Fiscal Measures:

Consumption vouchers, tax incentives, and targeted subsidies for strategic manufacturing sectors.

Industrial Policies:

Support for high-tech and export-oriented industries to offset domestic demand weakness.

RatingDog suggests that without timely and targeted interventions, the sector may struggle to meet the annual GDP growth target of 5%. The November PMI data may serve as a catalyst for more aggressive policy actions in December.

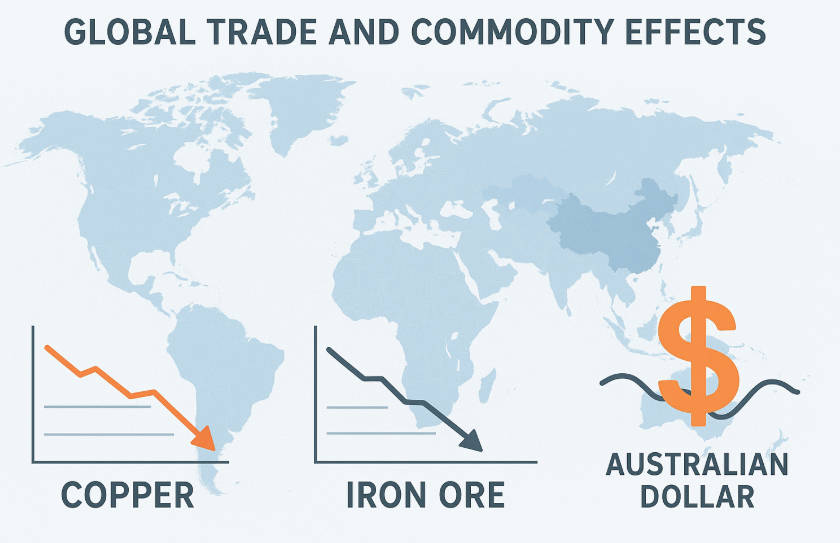

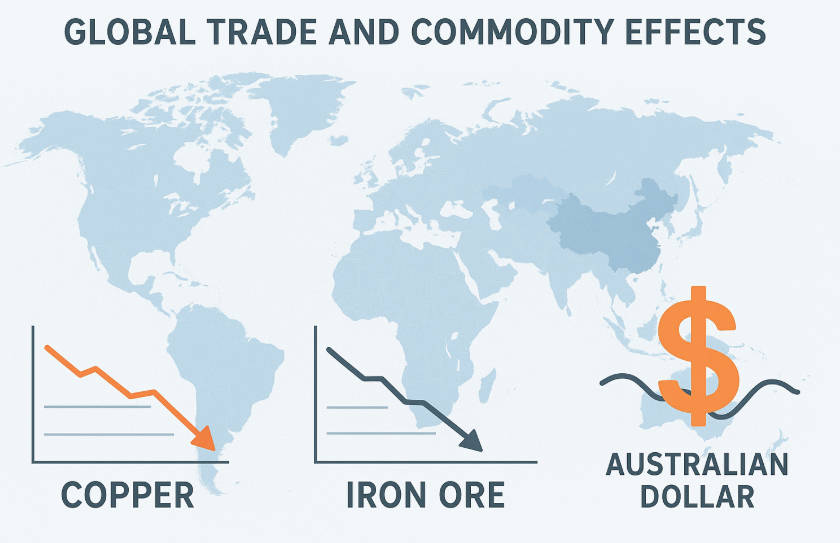

Global Implications: Trade and Commodity Markets

China's manufacturing slowdown has broader global ramifications:

Currency Markets:

The Australian Dollar (AUD) remains sensitive to China's industrial data, given its trade exposure.

Commodity Prices:

Reduced domestic demand may put downward pressure on copper, iron ore, and other industrial metals.

Global Supply Chains:

Export strength may partially offset domestic weakness, but uncertainty in China could disrupt production timelines and trade flows.

Investment Implications: Opportunities and Risks

Investors should consider the following:

Sector Selection: High-tech manufacturing and export-oriented companies may offer resilience.

Currency Risk: AUD and other commodity-linked currencies are exposed to China's slowdown.

Global Diversification: Weak domestic demand in China reinforces the importance of geographic diversification in portfolios.

RatingDog recommends close monitoring of December PMI data and policy announcements to evaluate the potential for a late-year "sprint" in growth.

China Manufacturing Performance Indicators

| Indicator |

November 2025 |

October 2025 |

Status |

| Caixin Manufacturing PMI |

49.9 |

50.6 |

Contraction (unexpected) |

| Official NBS Manufacturing PMI |

49.2 |

49.0 |

Contraction (8th month) |

| NBS Non-Manufacturing PMI |

49.5 |

50.2 |

Contraction |

| Caixin Export Orders |

Rising |

-- |

8-month high |

Frequently Asked Questions

1. What is China's Caixin Manufacturing PMI for November 2025?

China's Caixin Manufacturing PMI fell to 49.9 in November 2025. indicating a contraction in private-sector manufacturing activity. This decline reflects weak domestic demand despite a temporary boost in export orders, highlighting ongoing challenges for the industrial sector.

2. What does the official NBS Manufacturing PMI indicate?

The official NBS Manufacturing PMI stood at 49.2. remaining below 50 for the eighth consecutive month. This persistent contraction signals slow overall industrial growth, with small firms showing some resilience, while large enterprises continue to face operational pressures.

3. What insights does RatingDog provide on the November data?

RatingDog, led by Yao Yu, highlights the sluggish state of China's manufacturing sector. Despite export growth, weak domestic demand, employment pressures, and margin squeezes indicate structural challenges, prompting potential government intervention to support end-of-year economic targets.

4. Which sectors performed better in November 2025?

High-tech manufacturing showed modest expansion, reaching a PMI of 50.1. reflecting targeted government support and strategic prioritisation. Export-oriented firms also benefited temporarily, but most other sectors, particularly traditional manufacturing, experienced contraction amid weak domestic consumption.

5. How might the November PMI affect global markets?

The slowdown in China's manufacturing could influence global commodity prices, including copper and iron ore, and affect trade-linked currencies such as the Australian Dollar. Investors should monitor PMI trends closely for insights into China's economic momentum and policy responses.

Conclusion

November's data confirms that China's economic recovery remains uneven. While exports continue to provide support, the domestic economy, particularly consumption and property, remains weak. Investors should monitor December PMI releases closely, as RatingDog highlights the urgent need for a year-end "sprint" to stabilise growth.

Sources:

[1] https://tradingeconomics.com/china/business-confidence

[2] https://tradingeconomics.com/china/manufacturing-pmi

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.