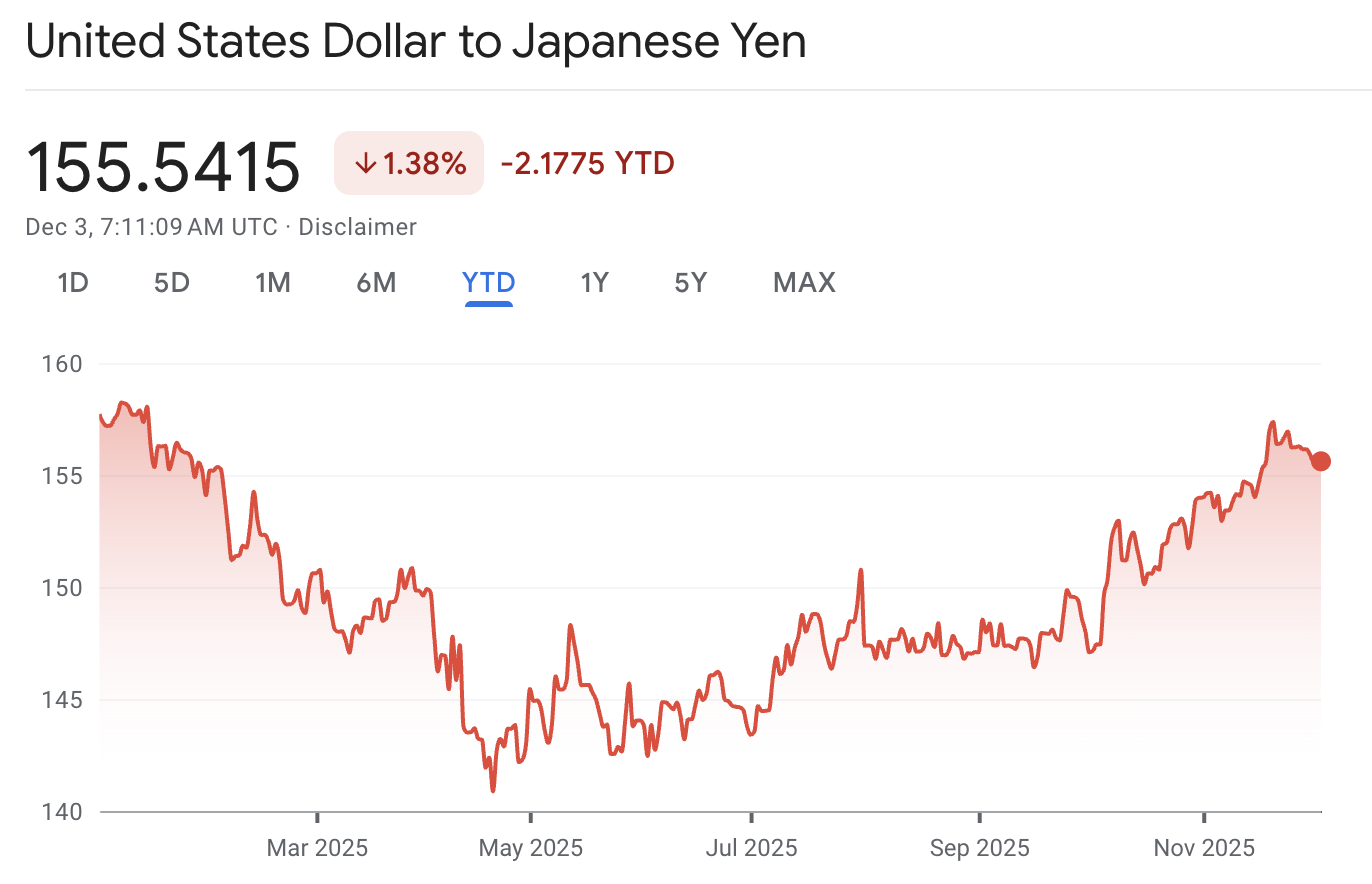

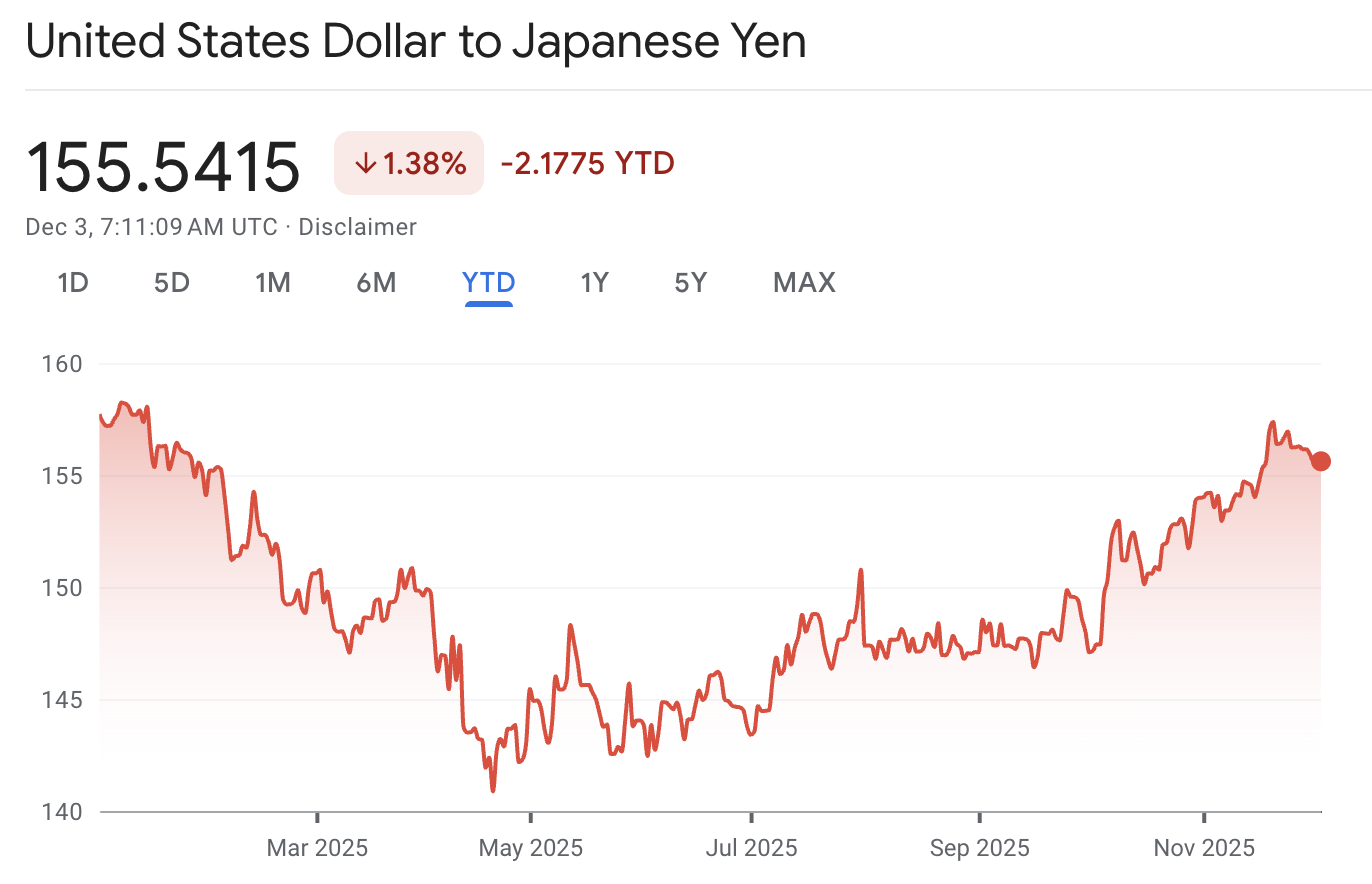

The yen has finally stopped being a one-way short. After spending most of 2025 pinned at historically weak levels, USD/JPY is now trading around ¥155.7, down from recent highs near ¥158 and well below the year's peak above ¥158.8.

At the same time, Japanese bond yields are at their highest since 2008, the Bank of Japan is openly talking about another rate hike, and Tokyo is waving the intervention flag again.

The big question for traders is whether this is just a pause in the dollar uptrend or the first real phase of a yen comeback.

Where USD/JPY Sits Now After a Wild 2025

| Metric |

Level / Comment |

| Year high (weakest yen) |

~158.87 on 10 Jan 2025 |

| Recent high (Nov) |

~157.9 on 20 Nov 2025 |

| Year low (strongest yen) |

~139.89 on 22 Apr 2025 |

| Current level (3 Dec) |

~155.7 |

| 2025 change (USD vs JPY) |

Dollar down slightly vs yen (USD/JPY about 1% lower on the year). |

| 1-month change (USD vs JPY) |

Yen weaker by ~1.3% over the month, but stronger vs last week’s high. |

On a full-year view, the yen is still weak:

2025 high in USD/JPY: about 158.87 on 10 January.

2025 low in USD/JPY: about 139.89 on 22 April (yen strongest).

Average for 2025: roughly 149.1.

As of 3 December 2025, USD/JPY is around 155.7, down slightly on the day and a few big figures below the recent 157–158 area.

So yes, the yen has strengthened from the recent highs, but it's still far weaker than it was in April and far above levels that used to trigger panic a few years ago.

The Recent move: From 157.9 back into the Mid-150s

Short-term, the shift is clearer:

Data note USD/JPY topped around 157.89 on 20 November and then slid to an intraday low near 155.3 at the start of December.

Data suggest that the pair dipped below 155.5 as BoJ Governor Ueda hinted at a December rate hike.

In other words, from the 157–158 zone, yen buyers finally showed up. The move isn't huge in percentage terms, but after months of one-way traffic, it matters.

USD/JPY Technical Picture: Is a Top Forming?

Still an Uptrend, but Momentum Is Fading

Most major technical desks still frame USD/JPY as long-term bullish but short-term tired:

The USD/JPY pair surged above 156.5–157 in November, retesting and then retreating from the 157.8–158 zone, which marked a ten-month high.

Recent data shows a rejection above 157 and a pullback into the 155–156 area, with dips below 155 bought so far.

It points to dense support between 155.7 and 155.0, with deeper support around 154.4–154.7 and then 153.0–153.7. Resistance is clustered at 157.9 and the prior high around 158.2–159.0.

Technical Levels to Watch

Table: USD/JPY Technical Map (Daily / 4H)

| Zone / Level |

Type |

Why it matters |

| 158.8–159.0 |

Major resistance |

Year high area and latest spike zone; break above reopens talk of ¥160 and intervention risk. |

| 157.8–158.0 |

Resistance |

Ten-month high region repeatedly flagged by FX desks; failed break in November. |

| 156.5–157.0 |

Near-term pivot |

Zone where bulls lost steam; old breakout level. |

| 155.7 (spot) |

Current area |

Trading Economics shows ~155.7 on 3 Dec |

| 155.7–155.0 |

Support cluster |

Multiple analyses mark this as first serious demand zone; also aligns with short-term Fib retracements. |

| 154.4–154.7 |

Secondary support |

Old resistance turned support; several H4 charts highlight it as key for bulls. |

| 153.0–153.7 |

Deeper support |

Next downside objective if 155 breaks |

| 150.0–150.9 |

Strategic support |

Confluence of 100/200-day MAs and prior breakout; long-term bulls really don’t want to lose this zone. |

Right now, the price is sitting on that 155 support shelf. If the support holds, markets can dismiss the yen's recent bounce as merely a correction within the broader USD/JPY uptrend. If we start closing cleanly below 154–153, the argument shifts toward a medium-term top forming.

Macro Drivers Behind the Yen's Recent Bounce

1. BoJ's Slow Exit From Ultra-Easy Policy

The structural story starts with the Bank of Japan finally leaving negative rates behind:

The Bank of Japan has raised its short-term policy rate from near 0% to 0.5% through a series of hikes across 2024–2025.

In January 2025, it raised the rate from 0.25% to 0.5%, the highest since 2008, on the view that inflation and wages are finally on a sustainable path above 2%.

By July 2025, the BoJ held at 0.5% but clearly said it could resume hikes if inflation and wages stayed firm.

That's a complete regime shift from the decade of zero rates and yield-curve control that crushed the yen earlier in the 2020s.

2. Inflation Is Doing Its Job

Recent data support more tightening:

Japan's core CPI rose 3.0% year-on-year in October, remaining above the Bank of Japan's 2% target for over three consecutive years.

Tokyo inflation: local CPI in the capital beat forecasts and stayed well above 2%, with core measures around 2.7–2.8%.

3. JGB Yields at 17-Year Highs

Bond markets have taken the hint:

The 10-year JGB yield is around 1.88%, the highest since 2008.

2-year and 5-year yields are near 1.0–1.4%, also at 2008 levels.

Higher domestic yields reduce the incentive to park money overseas unhedged, and they make it costlier to stay in short-yen carry trades.

4. Ueda's December Hint: The Key Short-Term Catalyst

The latest leg of yen strength came from Governor Ueda's comments:

On 21 November, he said the BoJ will debate the "feasibility and timing" of a rate hike at upcoming meetings, warning that a weak yen could lift underlying inflation. Markets took this as the strongest signal yet of a live December meeting.

On 1 December, speaking in Nagoya, Ueda said the BoJ would weigh a hike at the 18–19 December meeting, sending USD/JPY below ¥155 at one point and pushing JGB yields higher.

Markets now price roughly 70–80% odds of a December hike.

For yen traders, that changed the tone from "BoJ might hike someday" to "BoJ might move this month."

5. Intervention Threats and Political Pressure

Monetary policy isn't the only thing on the table.

Japan's finance minister Satsuki Katayama said the yen's recent rapid fall was "clearly not driven by fundamentals", warning against speculative moves and reiterating that FX intervention is possible.

Markets widely view ¥160 per dollar as the critical threshold before Tokyo intervenes, drawing from past actions when the yen approached similar levels.

Prime Minister Sanae Takaichi has also said the government is ready to act against speculative currency moves, tying yen volatility to her big fiscal stimulus plans.

Put simply, policymakers hate the optics of a runaway weak yen. That alone makes fresh shorts more nervous than earlier in the year.

The Other Side: Fed Cuts and a Softer Dollar

1. Fed Has Already Cut Rates Twice

The Federal Reserve implemented two rate cuts in 2025: first in September, followed by another 25 bps reduction in late October, lowering the target range to 3.75–4.00% from 4.00–4.25%.

While this did not immediately weaken the dollar, it halted the widening of US-Japan interest rate differentials that had primarily driven USD/JPY above 150.

2. December Cut Odds Are Still High

Going into the 9–10 December FOMC, markets lean towards another 25bp cut:

The greater the market's conviction in further Fed rate cuts relative to BoJ hikes, the narrower the policy gap becomes, making bets on a stronger yen increasingly attractive.

3. DXY Is Off Its Highs

The US Dollar Index (DXY) has backed away from its 2025 peaks:

It recently sat near 99.2–99.4, after its worst week since July, and is down around 6–7% over the last year.

That broader dollar softness helps all major currencies, but it matters more for the yen when combined with the BoJ shift.

Key Factors That Decide if the Yen Keeps Strengthening

1) BoJ's December meeting

The single biggest near-term driver is what the BoJ does on 18–19 December.

If BoJ hikes (0.5% → 0.75%) and sounds open to more:

JGB yields likely push even higher, curve stays steep.

USD/JPY can break below the 155 shelf, with 153 then 151 in view as carry trades get trimmed.

If BoJ stays on hold and sounds cautious:

Markets may unwind some hike bets; JGBs rally, yields ease.

USD/JPY could retest 157–158, especially if the Fed disappoints doves in the same week.

2) Fed's Path After December

On the US side, the key question is how far the Fed goes:

Markets are already looking beyond December to how many cuts might come through 2026, with talks about 90 bps of easing priced in by the end of next year.

If US data roll over hard, the 2-year yield has plenty of room to fall, narrowing the US-Japan gap further and helping the yen.

If growth stays resilient and the Fed signals a pause after December, the dollar may stabilise, and USD/JPY could hold the higher ranges.

In short, BoJ direction + Fed speed will write the medium-term script.

3) Intervention and Risk Sentiment

Two more moving pieces:

Intervention risk: authorities have said outright that FX intervention is on the table if moves are "excessive" and "not driven by fundamentals," with ¥160 widely seen as the informal line.

Global risk appetite: The yen typically strengthens during major risk-off episodes as carry trades unwind, and investors rebuild hedges. The recent wobble in global bonds after BoJ hike talk is a reminder that Japan can trigger global risk-off, not just react to it.

If we get a combination of BoJ tightening, Fed cuts, and genuine risk-off, the conditions are there for a much deeper yen move than we've seen so far.

Frequently Asked Questions (FAQ)

1. Has the Yen Actually Strengthened in 2025?

Over the full year, the yen is slightly stronger vs the dollar than it was in January. USD/JPY is down less than 2% year-to-date.

2. Does a BoJ Rate Hike Guarantee a Stronger Yen?

No. A hike that is fully priced and wrapped in a dovish message can even see the yen weaken.

3. Is Yen Strength Bad for Japanese Stocks?

In the short run, a stronger yen and higher JGB yields tend to hit exporters and rate-sensitive sectors. Over time, though, a more normal rate structure and less extreme currency moves can support a healthier equity market.

Conclusion

In conclusion, the yen is strengthening off its late-2025 lows, but from a very weak starting point.

For now, think of USD/JPY around 155 as a decision zone. Hold above it, and the market can keep treating this as a pause before another push higher. Break and hold below 154–153, and the narrative flips towards the yen, finally starting its long-awaited comeback from the 2025 lows.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.