The first full week of 2026 is starting with a familiar driver: U.S. data that can quickly change rate expectations. The ISM Manufacturing PMI for December 2025 is due today, Monday, January 5, 2026, at 10:00 a.m. Eastern Time.

Markets are watching it closely because it lands right before a heavy week that includes the NFP report.

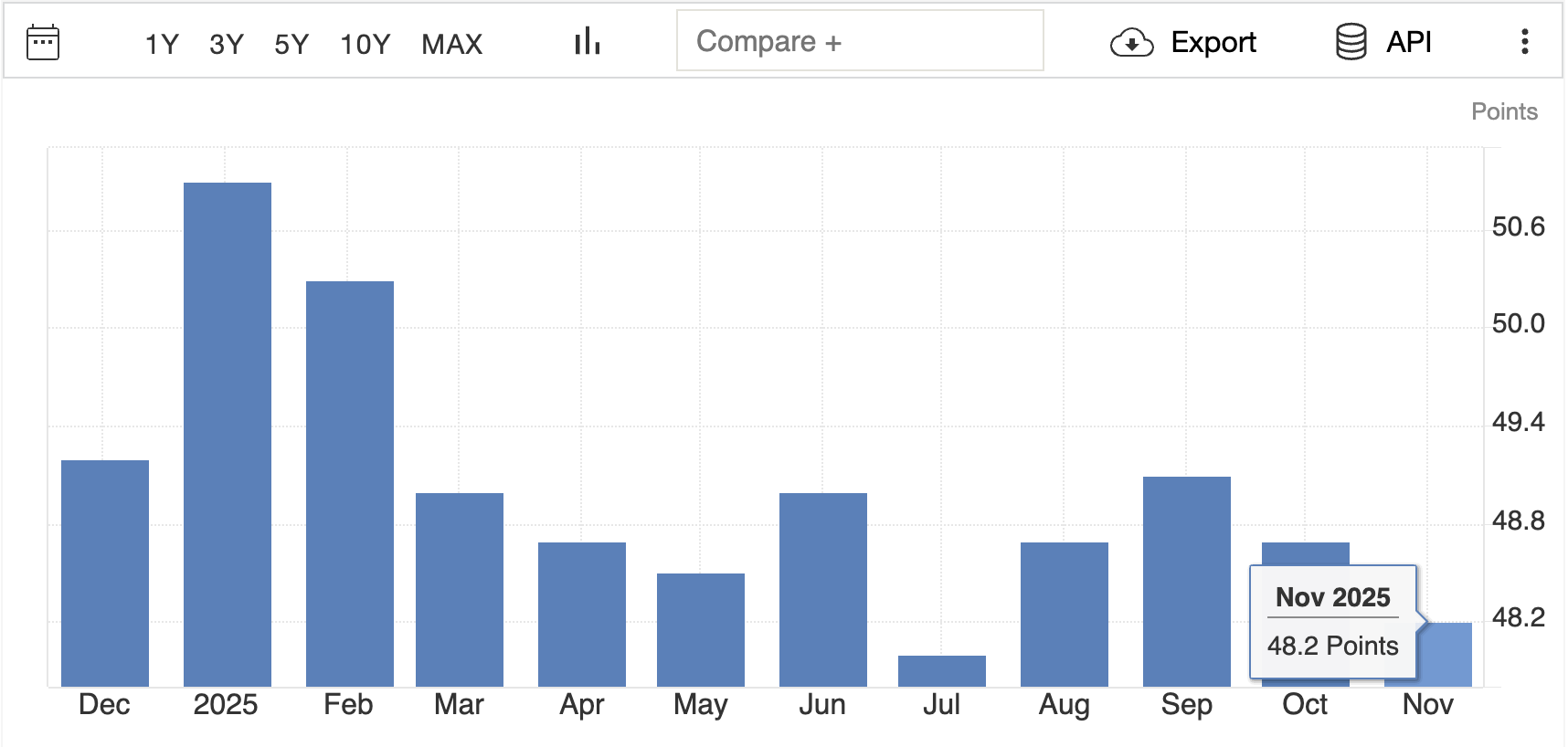

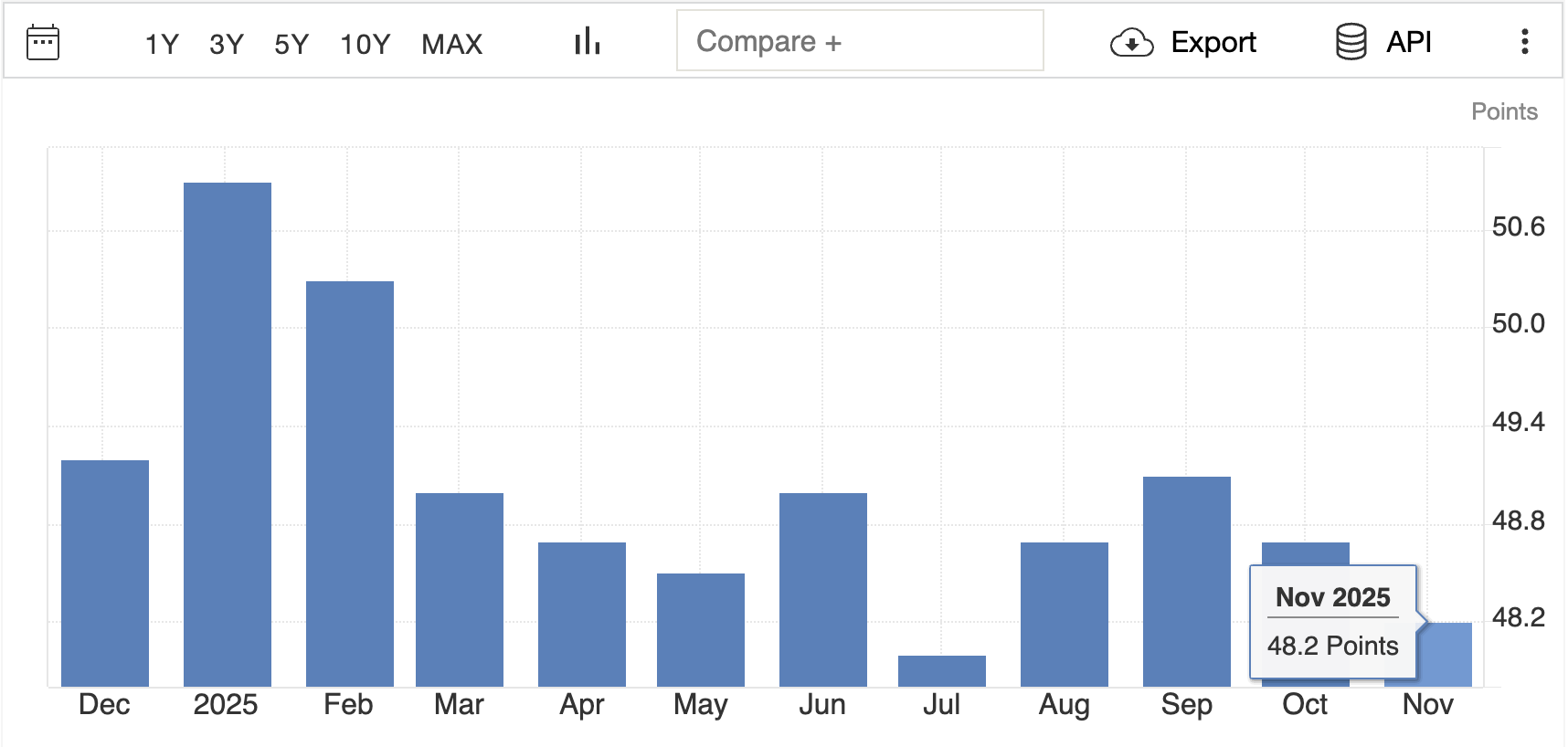

Additionally, U.S. manufacturing has remained in slight contraction for a significant part of 2025, and markets are assessing whether the downturn is stabilising or transitioning into a more extensive issue.

ISM Manufacturing PMI Release Time Today

| Location |

Local time |

Date |

| New York (ET) |

10:00 a.m. |

Mon, 5 Jan 2026 |

| London (GMT) |

3:00 p.m. |

Mon, 5 Jan 2026 |

| Frankfurt (CET) |

4:00 p.m. |

Mon, 5 Jan 2026 |

| Tokyo (JST) |

12:00 a.m. |

Tue, 6 Jan 2026 |

As mentioned above, the ISM Manufacturing PMI is released at 10:00 a.m. Eastern Time, covering the December 2025 activity.

The January release is an exception to the usual "first business day" rule, and this report is published on the second business day, which is why it is published today.

The November Setup Going into Today's PMI Print

The latest official reading for November 2025 was 48.2, which signalled contraction in manufacturing.

What made that report interesting was the internal mix:

New Orders: 47.4 (demand stayed weak)

Production: 51.4 (output improved, even with weaker orders).

Employment: 44.0 (factory hiring stayed under pressure).

Prices Paid: 58.5 (input price pressure stayed elevated).

That combination is the real story traders should carry into today. Manufacturing can be "contracting" in the headline while inflation signals remain sticky inside the report.

When prices remain high and demand stays weak, markets often struggle to decide whether the next move is "rates up because inflation" or "rates down because growth is cooling."

ISM also published a rule-of-thumb link between the PMI and GDP, noting that the November PMI level corresponded to about 1.7% annualised real GDP growth based on historical relationships.

Consensus Forecast for Today's ISM Manufacturing PMI Report

Ahead of the release, forecasts cluster around the high 48 area.

One widely followed consensus view points to about 48.4, slightly above 48.2.

CME Group tracker shows 48.3, with a range of 48.0 to 48.8, which still implies contraction but a modest improvement.

What that Forecast Implies

If the headline lands near consensus, the "big" market reaction will likely come from the sub-indexes, not the headline itself.

In practice, traders usually care most about prices paid and new orders, because those two lines map cleanly into inflation risk and growth risk.

The Key Signals to Watch Inside Today's PMI Report

| ISM sub-index |

Last reading (Nov 2025) |

What it usually signals |

| PMI (headline) |

48.2 |

Overall factory contraction below 50. |

| New Orders |

47.4 |

Forward demand is shrinking. |

| Production |

51.4 |

Output is expanding. |

| Employment |

44.0 |

Factory hiring is contracting. |

| Prices Paid |

58.5 |

Input prices are rising. |

| Supplier Deliveries |

49.3 |

Deliveries are faster, which often means less strain. |

| Inventories |

48.9 |

Firms are still running down inventories. |

| Backlog of Orders |

44.0 |

Backlogs are shrinking, which can cap production later. |

| New Export Orders |

46.2 |

Export demand is weak. |

| Customers’ Inventories |

44.7 |

Customers’ stock levels are "too low", which can support future production. |

The headline number is the first shock, but the sub-indices often decide whether the first move in the dollar and yields sticks.

1) New Orders: The Best Short-Term Demand Tell

The New Orders Index stood at 47.4 last month, indicating that demand continued to decline, and companies were not noticing a definite change in orders.

If new orders rise meaningfully, traders will read it as the first real sign that the factory cycle is bottoming.

What Traders Should Look for Today:

2) Employment: The Cleanest "Pain Point" in the Survey

The Employment Index fell to 44.0 last month, signalling another contraction in factory payrolls as manufacturers continued to cut jobs or leave vacancies unfilled.

This element is significant as it relates closely to payroll risk and consumer trust.

A large share of forecasters are watching this sub-index closely today because job losses, if they deepen, can change how markets price the next step in policy.

3) Prices Paid: The Pipeline Inflation Test

The Prices Index was 58.5 last month, which indicated that input costs were still rising at a firm pace.

Some market forecasts indicate a modest price increase today, around 59.0.

This is the part that can flip the market reaction. A PMI that improves because demand is recovering is supportive for equities. A PMI that improves because prices are surging can push yields up and hurt rate-sensitive stocks.

4) Production: Whether Factories Are Actually Building More

Production was 51.4 last month, which was a rare bright spot, because it showed output expanding even while demand stayed soft.

If production remains above 50 and new orders drop below 50, the market typically infers that output is sustained by backlog projects instead of new demand.

5) Supplier Deliveries: Do Supply Chains Look Tight Again?

Supplier Deliveries were 49.3 last month.

This index is inverted, so a reading below 50 suggests deliveries are faster, which usually implies easing bottlenecks and softer demand pressure.

6) Inventories and Backlogs: Whether Firms Are Rebuilding or Running Down Stock

Inventories were 48.9 last month, which signalled contraction but at a slower pace than before.

The backlog of orders stood at 44.0, indicating that backlogs were continuing to decrease significantly.

An increasing inventory index isn't consistently positive. If inventories rise because demand is weak, it can be a warning sign. If inventories rise because new orders are rising, it can be a healthy restocking signal.

7) Exports and Imports: The Global Demand Check

New Export Orders were 46.2 last month, which meant exports were still shrinking.

Imports reached 48.9, indicating contraction but less intense than previous measurements.

If exports improve, it suggests global demand is less of a drag. If exports weaken further, cyclical sectors are likely to stay under pressure.

Why a "Bad PMI" Can Still Be Good for Risk Assets?

It sounds odd, but a weak manufacturing number can sometimes support equities and credit in the short run if it pushes yields lower and strengthens the view that policy will stay supportive.

The market tension today is straightforward:

If the report shows demand is weak and price pressure is easing, markets can price a gentler path for rates.

If the report shows demand is weak but prices paid remain hot, it becomes the worst mix, because it keeps the inflation worry alive while growth softens.

That is why "PMI up" is not always bullish, and "PMI down" is not always bearish.

What to Monitor Next After Today's PMI Report?

Today's release is only the opening act for the first full trading week of 2026.

The economic calendar indicates that the Services PMI for December 2025 will be released on Tuesday, and it typically holds greater significance for the U.S. outlook since services constitute the majority of the economy.

You should also keep your focus on the upcoming NFP report this Friday, because the PMI employment sub-index tends to move earlier than headline payroll data, but it does not replace it.

Frequently Asked Questions

1. What Time Is the ISM Manufacturing PMI Released Today?

The ISM Manufacturing PMI for December 2025 is scheduled for 10:00 a.m. ET on Monday, January 5, 2026.

2. What Is the Forecast for Today's ISM Manufacturing PMI?

Consensus expectations cluster around 48.3 to 48.4, compared with 48.2 previously.

3. What Does a PMI Below 50 Mean?

A reading below 50 usually means manufacturing activity is contracting, while a reading above 50 usually means it is expanding.

Conclusion

In conclusion, the ISM Manufacturing PMI will be released today at 10:00 a.m. ET, and it covers December 2025 activity.

The market expects a reading around 48.3–48.4, which would still signal contraction, but it would hint that the slump is not worsening quickly.

The cleanest way to trade this release is to focus on the mix and watch whether new orders stabilise, whether employment remains deeply negative, and whether prices paid stay hot or cool.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.