The U.S. Bureau of Labour Statistics is scheduled to release The Employment Situation for December 2025 today, Friday, January 9, 2026, at 8:30 a.m. Eastern Time.

This month's nonfarm payrolls print carries extra weight because recent labour data have been noisy. The federal government shutdown in autumn 2025 disrupted household survey collection, and the Bureau of Labour Statistics (BLS) has flagged that December reporting will also include annual revisions to seasonally adjusted household survey data.

Simply put, traders are not only trading the headline jobs number. They are also trading confidence in the dataset.

Nonfarm Payrolls Release Time Today

As mentioned above, the BLS will publish the Employment Situation for December 2025 on Friday, January 9, 2026, at 8:30 a.m. Eastern Time.

NFP Release Time by Major Trading Hubs

| City |

Local time |

Notes |

| New York |

8:30 a.m. |

Main release time (ET). |

| London |

1:30 p.m. |

UK is on GMT in January. |

| Frankfurt |

2:30 p.m. |

CET. |

| Dubai |

5:30 p.m. |

GST. |

| Singapore |

9:30 p.m. |

SGT. |

| Tokyo |

10:30 p.m. |

JST. |

| Sydney |

12:30 a.m. (Sat) |

AEDT. |

Trading Tips:

Spreads often widen in the final minutes before 8:30 a.m. ET, and the first 30–90 seconds after release can be jumpy because headlines, revisions, and wages hit the tape simultaneously.

December NFP Forecast: What the Market Expects Today

| Metric |

Forecast (Dec) |

Prior (Nov) |

Why it matters |

| Nonfarm payrolls |

+60,000 |

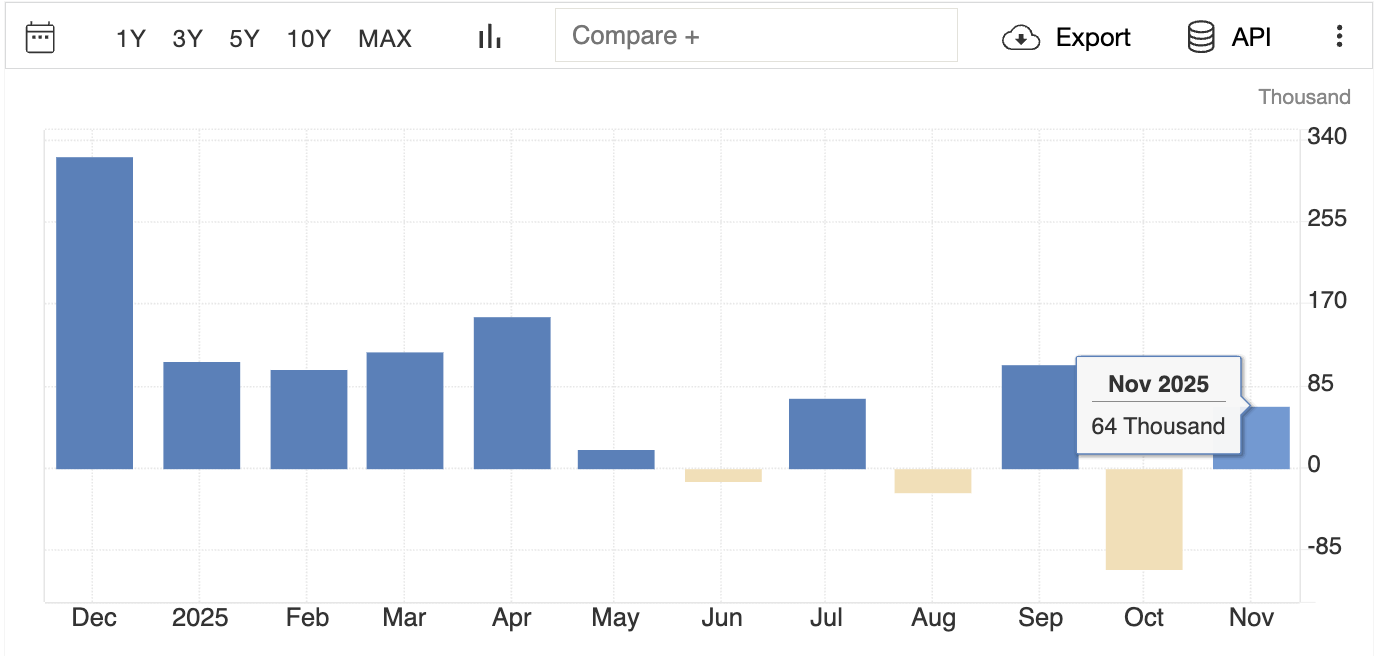

+64,000 |

Sets the growth tone and drives the first market move. |

| Unemployment rate |

4.5% |

4.6% |

Often matters more than payrolls when the trend is turning. |

| Private payrolls |

+64,000 |

+69,000 |

Helps separate private demand from government noise. |

| Avg hourly earnings (m/m) |

+0.3% |

+0.1% |

Moves yields because it feeds the inflation debate. |

| Avg hourly earnings (y/y) |

3.6% |

3.5% |

Tells you whether wage pressure is cooling or stabilising. |

| Avg weekly hours |

34.3 |

34.3 |

A quiet but powerful signal for labour demand. |

Market consensus approaching today indicates gradual, stable job growth, neither a downturn nor a surge.

Simply put, the market expects hiring to remain sluggish, while wage growth stays contained enough to keep rate-cut pricing alive later in 2026.

A Useful Cross-Check Before the Print

ADP private payrolls: +41,000 in December.

ISM Services employment index: 52.0 (back in expansion).

ISM Manufacturing employment index: 44.9 (still contracting).

ADP is softer than the NFP "lean", while services hiring signals have improved. That split is exactly why traders should focus on the mix of jobs, not only the headline.

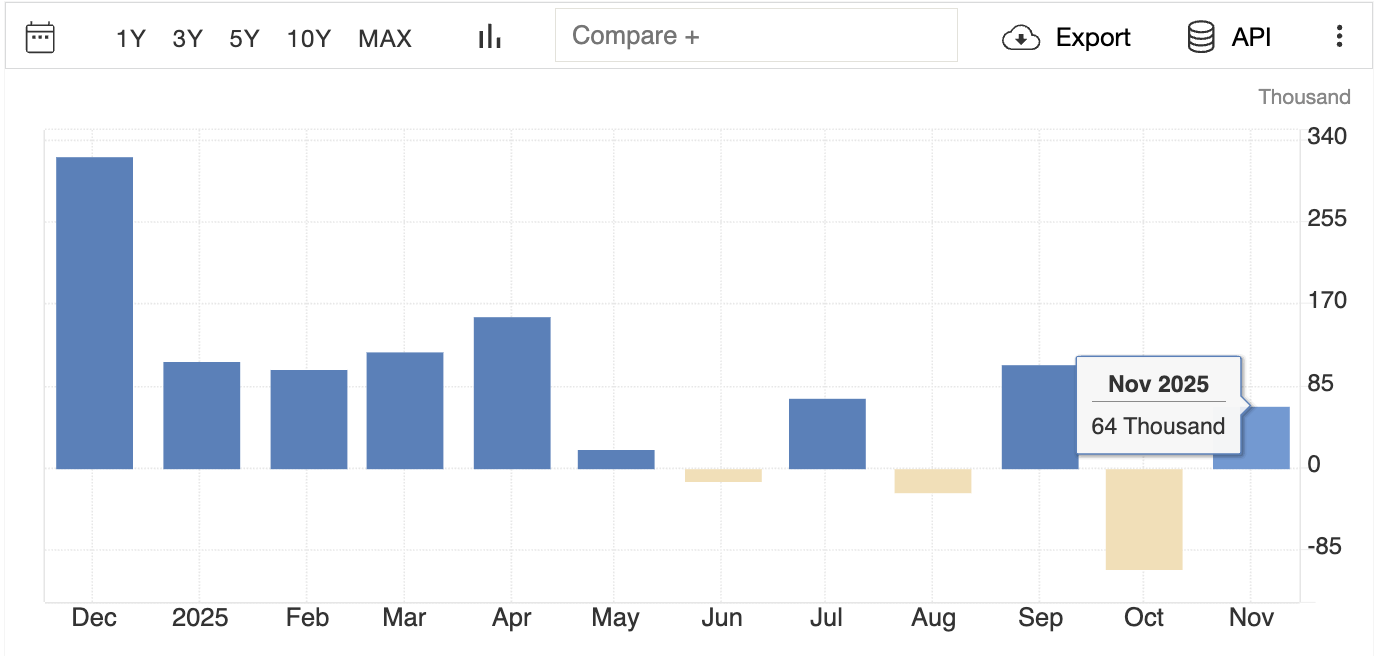

Market Recap: What Happened in the November NFP Report?

In the last published Employment Situation (November 2025):

Hiring strength was concentrated in health care and construction, while federal government employment declined.

The BLS also highlighted that the shutdown disrupted data collection, including the absence of household survey estimates for October 2025, and that it adjusted its methodology to cope with missing data.

That background matters because markets tend to reward "clean" data. If the December release looks internally consistent, traders will trust it more and price it more aggressively.

What NFP Is Saying in 2026

The U.S. labour market is increasingly described as "low hire, low fire." Employers are not hiring quickly, but they are also not laying off people in large numbers.

Recent signals fit that narrative:

Weekly initial jobless claims: 208,000 (still low).

Continuing claims: 1.914 million (a sign that re-hiring is slower for some workers).

Job openings (JOLTS): 7.146 million, with hiring at 5.115 million.

If that trend holds, the December payroll number may look small, while the unemployment rate stays contained because layoffs remain limited.

December Nonfarm Payrolls: 6 Key Signals to Watch Today

1) Payrolls Headline, Plus the Revisions

The market's first reaction is usually to the headline. The second reaction is often to the revisions to prior months.

What to look for:

2) Unemployment Rate (U-3) and Participation

The unemployment rate can move markets even when payrolls are close to forecasts.

Why this line is so powerful:

It is a key input into how traders price the next few central bank meetings.

A drop toward 4.5% is the consensus expectation, but a print nearer 4.6% would read as progress stalling rather than improving.

Participation matters because unemployment can fall for "good" reasons (additional hiring) or "bad" reasons (people leaving the labour force). A lower participation rate can make the headline look better than the reality.

3) Wage Growth (Average Hourly Earnings)

Wages are the bridge between jobs and inflation.

Market logic:

Strong wage growth can push yields up and lift the $ because traders fear stickier inflation.

Soft wage growth can send the opposite signal, especially if payrolls are weakening too, because it starts to look less like "disinflation" and more like demand cooling.

KPMG preview expects +0.3% m/m and ~3.6% y/y for earnings.

4) Average Workweek (Hours)

Hours often act as a leading indicator because companies typically trim hours (and overtime) to manage labour costs before resorting to layoffs.

If hours hold around 34.3, it suggests firms are not in panic mode.

5) Sector Mix: Services Jobs vs Goods Jobs

The market cares about where jobs are created.

Right now, the pre-release signals suggest:

A December report showing job gains concentrated in health care, leisure and hospitality, and education would extend the recent trend of services-led hiring.

6) Underemployment and "Hidden Softness"

Headline unemployment can stay steady even as underlying labour-market stress builds.

In November, the BLS observed a rise in the number of people working part-time due to economic reasons in comparison to earlier months.

If that worsens again, it can change the market narrative from "cooling" to "cracking."

Risks and Curveballs: Why This NFP Release Can Surprise

Annual Revisions Can Move the Goalposts

The BLS has stated that the December release will incorporate annual revisions to seasonally adjusted household survey data, with seasonally adjusted data for the most recent five years subject to revision.

That means:

Holiday Seasonality Can Distort the Signal

December hiring depends heavily on retail and leisure jobs. Minor changes in the timing of seasonal worker hiring can significantly alter the overall payroll statistics by tens of thousands.

Shutdown Effects Can Still Persist

The BLS has already described how the shutdown affected collection and weighting.

If the December data look cleaner, markets may react more decisively than they did to the messy autumn prints.

Frequently Asked Questions (FAQ)

1) What Time Is the Nonfarm Payrolls Released Today?

The U.S. Employment Situation report for December 2025 is released on Friday, January 9, 2026, at 8:30 a.m. ET, which is 9:30 p.m. in Kuala Lumpur.

2) What Is the Consensus Forecast for This Report?

The market baseline is around +60,000 jobs, following +64,000 previously, with unemployment seen near 4.5%.

3) What Is the Most Important Signal Inside the Jobs Report?

Wage growth often matters most because it feeds inflation expectations.

Conclusion

In conclusion, the Employment Situation report for December 2025 is scheduled for 8:30 a.m. Eastern Time on Friday, January 9, 2026.

Markets are leaning toward modest job growth (~+60k) and unemployment easing toward ~4.5%, but forecast dispersion is high.

Traders should focus on the unemployment rate, wage growth, and revisions, not only the headline jobs number. With seasonal noise and annual revisions in play, the first reaction may not be the final move.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.