The first full "jobs week" of 2026 is arriving with markets already jumpy about growth, inflation, and the next move from the Federal Reserve. With the ADP Employment Report out, markets get their first clean snapshot of U.S. private-sector payroll momentum for December.

The next ADP National Employment Report (December 2025) is scheduled for Wednesday, January 7, 2026, at 8:15 a.m. Eastern Time.

It is not perfect, and it is not designed to mirror the official government payroll report. Even so, it often moves prices because it hits the tape when positioning is still fresh, and expectations for Friday's jobs report are still flexible.

December ADP Employment Report Release Time

As mentioned above, the ADP Employment Report for December 2025 is set to be released on Wednesday, January 7, 2026, at 8:15 a.m. Eastern Standard Time.

| Location |

Local time |

| New York (ET) |

8:15 a.m., Wednesday, January 7 |

| London (GMT) |

1:15 p.m., Wednesday, January 7 |

| UTC |

1:15 p.m., Wednesday, January 7 |

*The U.S. Bureau of Labour Statistics confirms the official Employment Situation release timing.

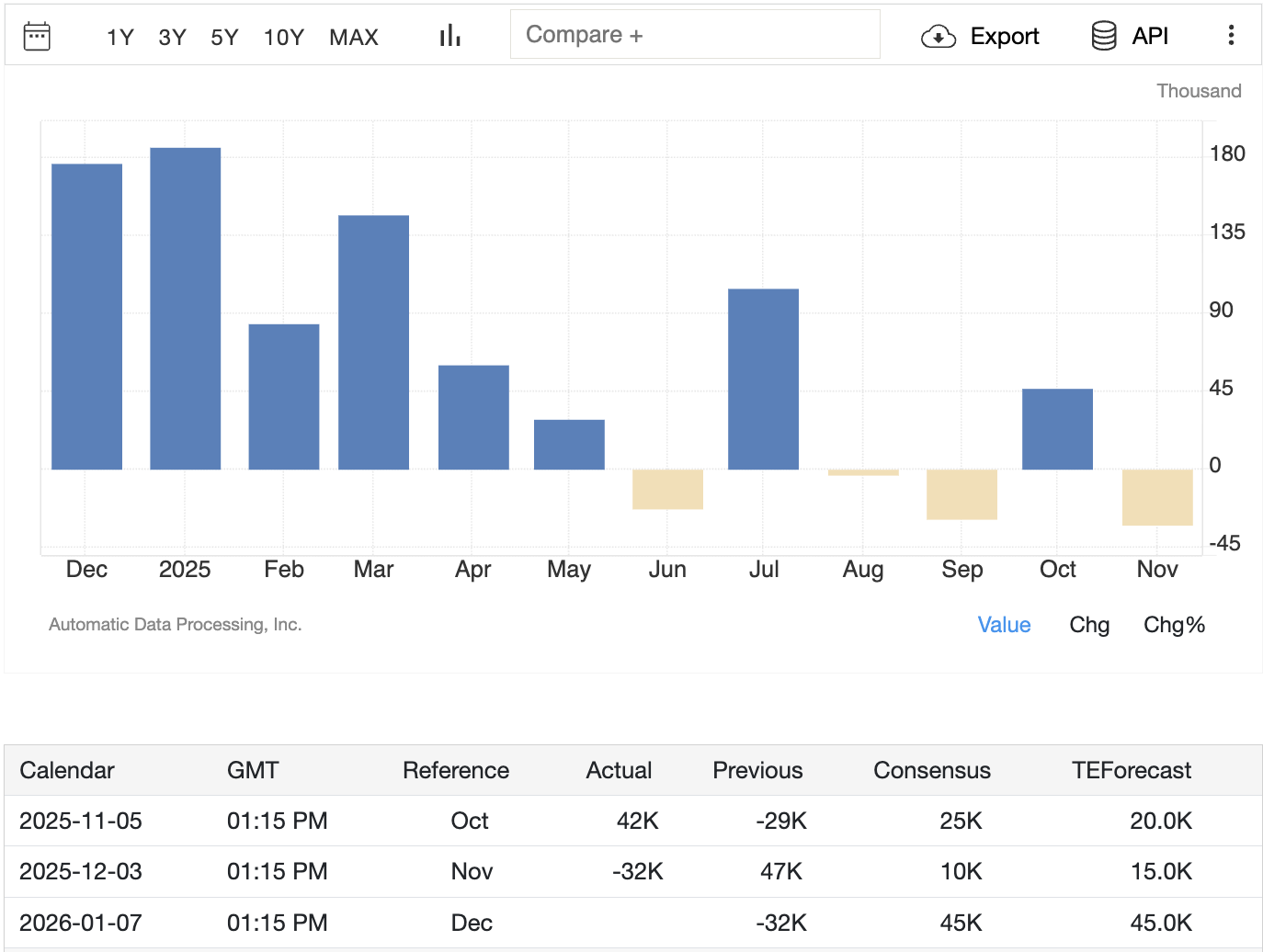

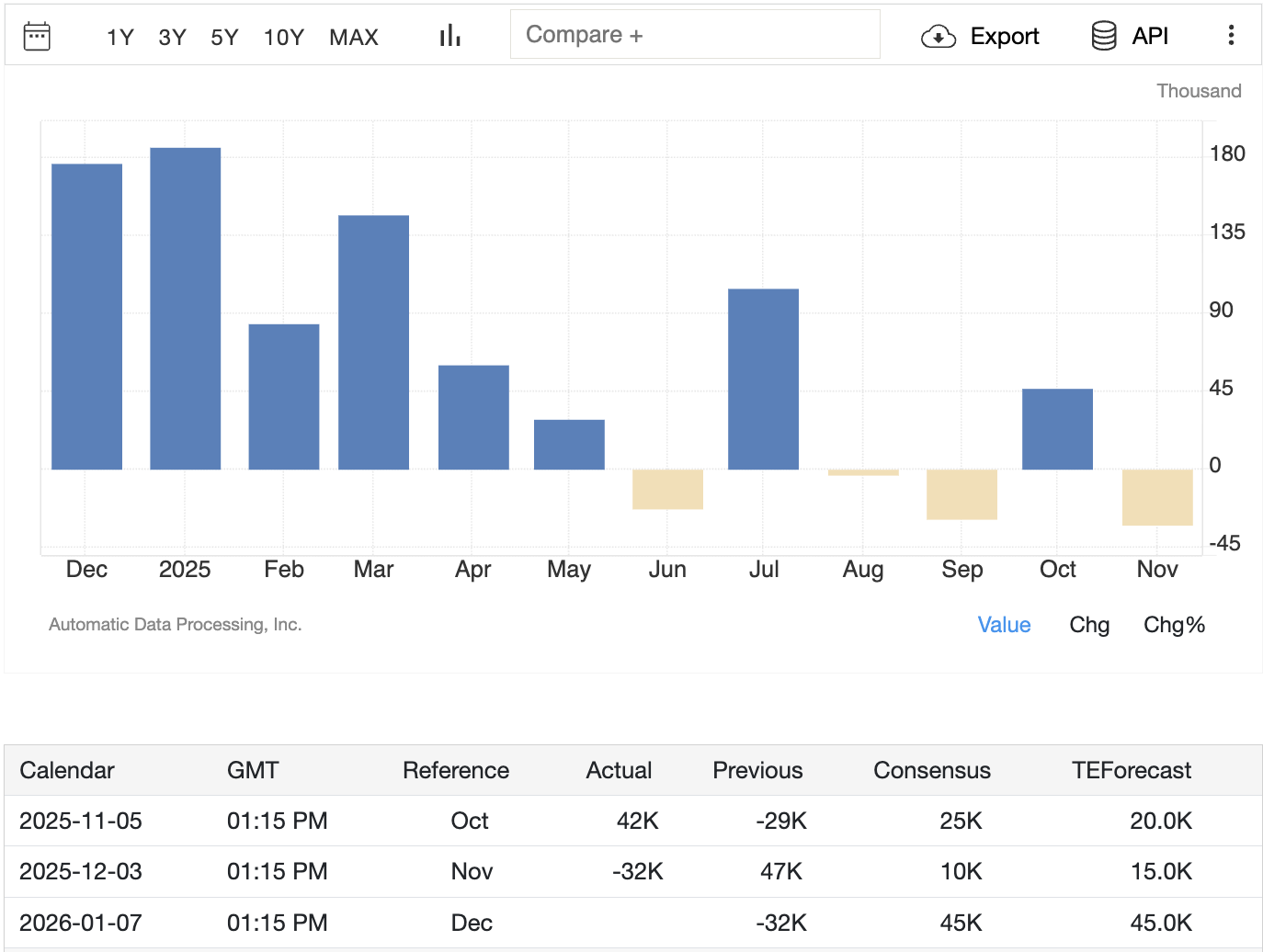

ADP Forecast: What the Market Expects

Consensus Snapshot

Market consensus is clustered around a modest rebound in private payroll growth after the prior month's drop, with consensus near +45,000 jobs.

An Economist's "Reality Check" Using ADP's Own Weekly Pulse

ADP's weekly NER Pulse showed private employers added an average of 11,500 jobs per week over the four weeks ending December 6.

A simple translation to a monthly pace is: 11,500 x 4 = 46,000

That is not a forecast model, and it will not line up perfectly with the monthly reference week. However, it remains a useful anchor because it says the private labour market likely turned modestly positive again after November's negative print.

Practical takeaway: A headline near +45k to +55k would be consistent with the weekly signal and the consensus range.

Market Recap: What the November ADP Report Said

| Category |

What November showed |

| Headline private payrolls |

-32,000 |

| Business size |

Small down sharply; medium and large up |

| Pay (job-stayers) |

4.4% year on year |

| Pay (job-changers) |

6.3% year on year |

In November 2025, ADP reported that private sector employment fell by 32,000, while pay growth cooled again.

What Stood Out

Small establishments were hit hardest, with a large net decline, while medium and large firms still added jobs.

Weakness was broad-based across several service industries, while education and health services continued to provide key support.

Pay growth cooled, with wages rising 4.4% YoY for job-stayers and 6.3% YoY for job-changers.

What to Watch Inside the December ADP Report?

Most traders react to the headline number first, then the market "re-prices" once the details sink in. The details that matter most are:

1) Pay Trends

If wage growth continues to cool, it strengthens the case that salary-driven inflation pressures are easing. November already indicated a moderation in salary increases for both employees who remain in their positions and those who switch jobs.

2) Industry Mix

A moderate headline can still be market-positive if gains are broad and concentrated in steady hiring sectors. A recovery led by a single sector is more vulnerable and thus simpler for traders to counteract.

3) Firm-Size Stress

The November report narrative leaned toward small business strain. If December shows stabilisation, it can improve risk sentiment because small firms often turn before the broader labour market does.

How ADP Sets Up Friday's NFP Report

The U.S. Bureau of Labour Statistics will publish the Employment Situation for December on Friday, January 9, 2026, at 8:30 a.m. Eastern Time.

Here is the practical way professionals use ADP:

If ADP is moderately above expectations, it nudges the market to price a firmer official payroll number.

If ADP is moderately below, it nudges the market toward a softer payroll outcome.

If ADP is an extreme outlier, traders typically wait for confirmation from jobless claims, wage prints, and Friday's release before committing fully.

What Economists Will Focus On in the Official Report

Payroll growth

The unemployment rate

Wage growth and hours worked

The Chicago Fed's estimate put December unemployment near 4.6%, while economists expect the official rate to ease toward 4.5%.

Frequently Asked Questions

1) What Time Is the ADP Employment Report Released?

The ADP Employment Report is scheduled for Wednesday, January 7, 2026, at 8:15 a.m. Eastern Time.

2) What Is the Forecast for the ADP Jobs Report?

Consensus expectations are near +45,000 for December private payrolls.

3) Does ADP Predict the Official Jobs Report?

No. ADP describes the report as an independent measure of private-sector employment and pay, and it is not intended to forecast the government's payroll report.

Conclusion

In conclusion, the ADP Employment Report will be published on January 7, 2026, at 8:15 a.m. ET, marking it as the initial significant labour-market indicator of the year.

Consensus points to a modest rebound near +45,000 after November's -32,000, and ADP's own weekly pulse data supports a similar pace.

Friday's official report is still the main event, with payrolls expected near +55,000, so ADP mostly matters now because of how it reshapes expectations for that release.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.