Markets are heading into today's US ISM Services PMI with the dollar on the back foot and Treasuries still pricing in more Fed easing. DXY is trading just above 99, near recent lows, while the 2-year and 10-year Treasury yields are around 3.5% and 4.1%, respectively, well below their peaks earlier in the year.

Consensus sits just below the prior 52.4 print, with most desks looking for roughly 52.0–52.1, still safely in expansion.

For FX and rates traders, the question is simple: does this release reinforce a "soft-landing with cuts" story, or does it tip the balance toward a sharper growth slowdown?

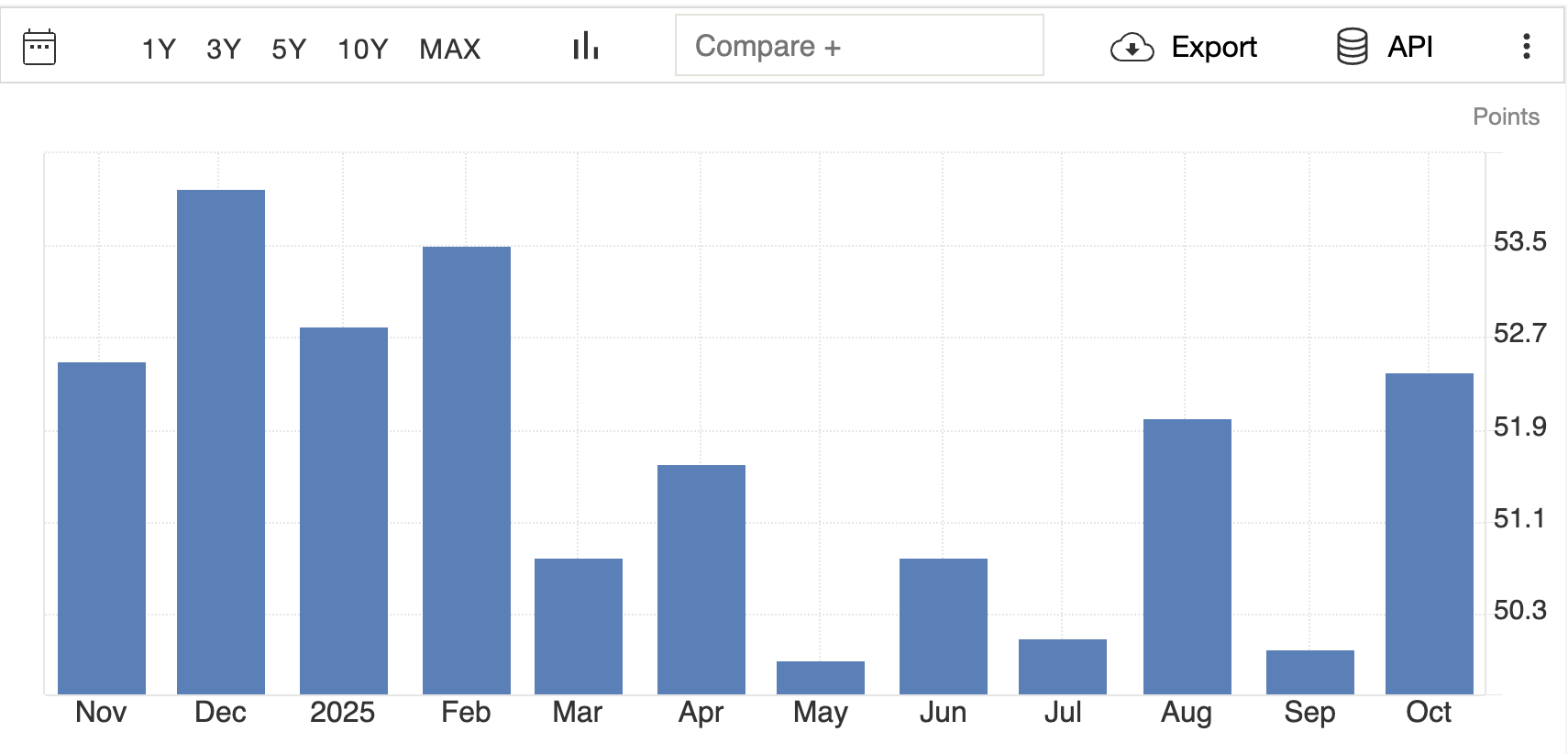

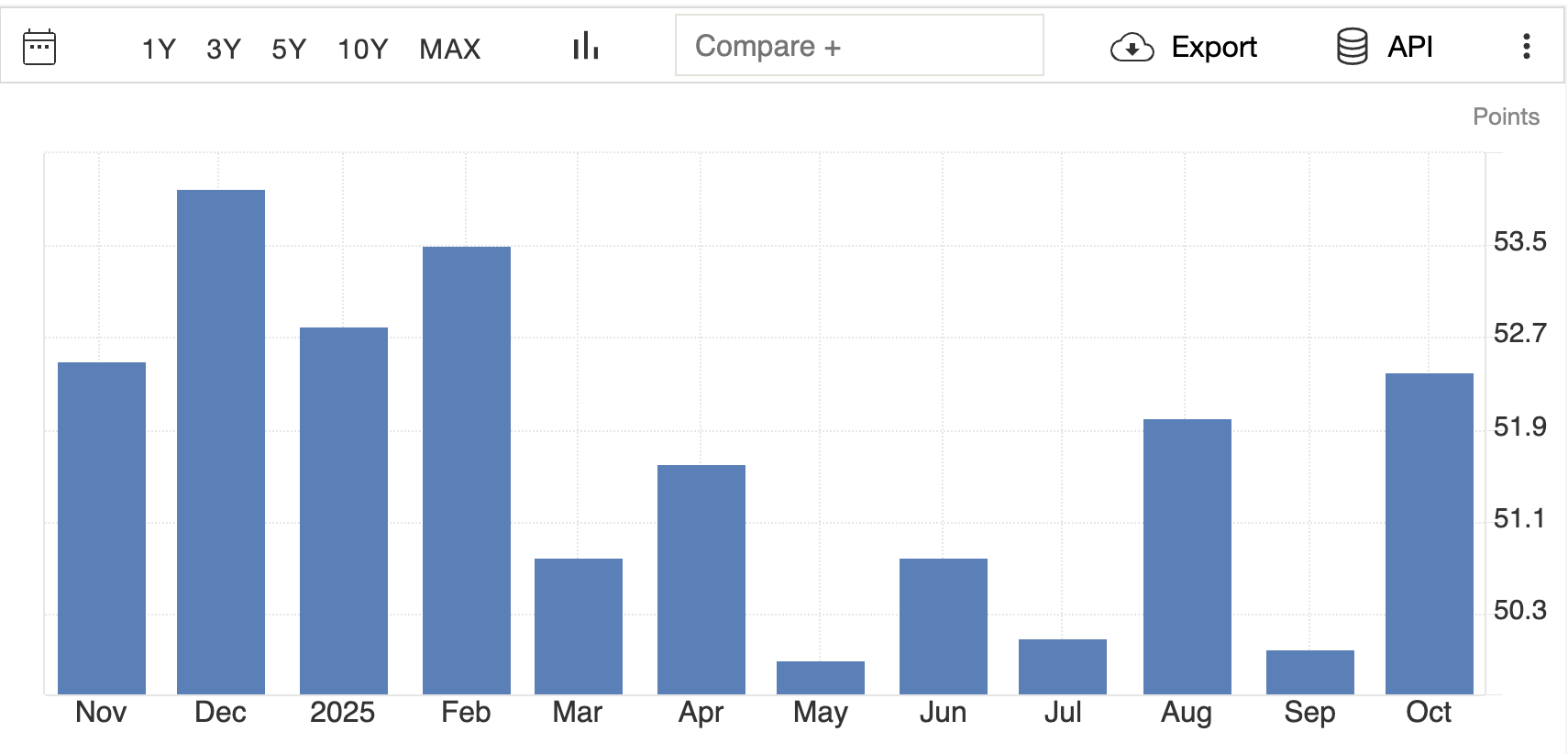

Where the US Services Sector Stands Before Today's Release

| Month 2025 |

Headline PMI |

vs 50 Level |

Brief Comment |

| Oct |

52.4 |

Above |

Back to decent expansion, 8-month high |

| Sep |

50.0 |

Flat |

Services sector stalled, new orders slowed |

| Aug |

52.0 |

Above |

Mild expansion resumes |

| Jul |

50.1 |

Barely above |

Essentially flat |

| Jun |

50.8 |

Above |

Modest growth |

| May |

49.9 |

Slightly below |

Marginal contraction |

| Apr |

51.6 |

Above |

Moderate expansion |

| Mar |

50.8 |

Above |

Soft growth |

| Feb |

53.5 |

Above |

Stronger start to the year |

| Jan |

52.8 |

Above |

Solid expansion to open 2025 |

The pattern is clear: the services engine is still running, but at a slower speed than in 2022–2023. A clean break below 50 would be new information; anything around 52 keeps the current narrative intact.

What October's US ISM Services PMI 52.4 Reading Told Us

October marked a clear improvement after a flat 50.0 in September. The ISM report highlighted:

Headline Services PMI: 52.4 (from 50.0), the highest since February, the 8th expansion month of 2025

Business Activity: 54.3 (from 49.9), output back in solid growth

New Orders: 56.2 (from 50.4), strongest since October 2024

Employment: 48.2 (from 47.2), still contracting, but slightly less weak

So demand and activity are okay, but firms are cautious about hiring. That's exactly the mix that lets the Fed keep cutting without looking reckless on inflation, as long as it lasts.

Services vs Manufacturing: A Split Economy

While services bounced, manufacturing has stayed weak. The ISM manufacturing PMI for October was 48.7, its eighth straight month in contraction, and more recent readings show factories still struggling.

This split of resilient services and soft factories is why markets treat today's services print as a cleaner proxy for US domestic demand. If services start to roll over toward 50 again, the "soft landing" story begins to look brittle.

Inflation Pressure Inside the Survey

The October prices index at 70.0 signalled faster input-cost inflation for services firms, driven by labour and some materials. That's well above the long-run comfort zone and the highest since October 2022.

In other words, expansion is modest, yet the pricing pressure in services has not entirely dissipated. That's why the Fed is easing only gradually, and why a big downside surprise today would matter; it would hint that the growth side of the mandate is deteriorating faster than the inflation problem.

Consensus for Today's ISM Services PMI

Market calendars show the November ISM Services PMI due at 10:00 ET on 3 December 2025, with:

Thresholds to watch:

Above 53: clear signal of resilient demand

51–52: "Okay, but slowing"

50 or below: effectively a stagnation/early contraction signal

Where the Dollar Stands Before the Print

The US Dollar Index (DXY) has been under pressure as traders lean into a 2025–2026 easing cycle. It's trading in the 99.2–99.4 area, after logging its worst week in about four months and breaking below recent highs near 100.25.

Recent technical commentary notes that DXY is hovering just above an ascending trendline and a confluence zone around 99.35, where the 50-day moving average and prior swing lows line up.

If that shelf gives way, the next meaningful support sits around the November lows, slightly below 99.00.

US Yields: 2-Year and 10-Year in Focus

On the rates side:

The 2-year Treasury yield is about 3.51% (as of 2 December), down from over 4.1% a year ago and near the lower end of its recent range.

The 10-year yield is trading around 4.08%, after oscillating between roughly 3.96% and 4.17% over the last couple of weeks.

The 2-year yield serves as the market's key proxy for Federal Reserve policy, while the 10-year yield reflects a blend of growth expectations and term premium. A strong ISM print tends to push both higher, but the front end usually reacts more.

Technical Dashboard: Dollar and Yields Around the Release

Here's a compact technical map you can drop straight into your notes:

| Instrument |

Last Level* |

Short-Term Trend |

Key Support Levels |

Key Resistance Levels |

Trading Note |

| DXY Index |

~99.3 |

Pullback from 100+ |

99.00, then 98.50 |

99.80, then 100.25–100.40 |

99.0–99.3 is a decision zone; a strong ISM print could squeeze shorts back toward 100, a weak one risks a clean break lower. |

| US 2Y Yield |

3.51% |

Gentle drift lower |

3.45%, then 3.40% |

3.60%, then 3.70% |

Front-end is pinned by Fed-cut expectations; a hot ISM reading could steepen odds of fewer or later cuts and pop yields 5–10bp. |

| US 10Y Yield |

~4.08% |

Sideways |

4.00%, then 3.96% |

4.15%, then 4.20% |

Long end reacts more to growth tone; a sub-50 reading would favour a test below 4.0%, while a firm print keeps 4.15–4.20% in play. |

*Levels as of the US close on 2–3 December 2025; they will move into the release.

Trading Playbook: Three Paths After the ISM Print

1. Strong Upside Print (≈53 or Higher)

If the headline prints clearly above consensus, with firm new orders and business activity:

Dollar: DXY likely bounces off the 99 handle and pushes back toward 99.8–100+. Short-term dollar shorts in EUR/USD and GBP/USD may get squeezed.

2-year yield: Front-end rates could rise by 5–10 bp as traders trim December and early-2026 cut expectations.

10-year yield: Moves higher but more modestly; curve could flatten slightly if the market reads this as "growth okay, but Fed still cautious."

Risk sentiment: Equities might initially like the growth signal but fade if higher yields bite; high-beta FX (AUD, NZD) could underperform the dollar.

2. Soft but Still Expansion (≈51–52)

This is the "muddle through" outcome, close to consensus, small drift lower from 52.4, no drama in the sub-indices.

Dollar: Likely range-bound; DXY chops between 99.0–99.8.

Yields: Minor moves; 2-year stays anchored near 3.4–3.6%, 10-year in the 4.0–4.15% band.

Fed pricing: The market keeps leaning toward a December cut, but the release doesn't force a reprice in either direction.

3. Clear Downside Surprise (≤51, Especially Sub-50)

If the data show a sharp slowdown, particularly if new orders or business activity slip toward 50 and employment stays weak:

Dollar: The DXY risks breaking below 99.0, potentially opening the path toward the 98.5 area and reinforcing the broader downtrend.

Yields: The 2-year yield could drop 10 bps or more as traders price in an accelerated easing path, with the 10-year likely following at a slightly lesser intensity, thereby steepening the yield curve.

Risk assets: Equities and credit might rally on "more cuts", but if the market reads it as genuine recession risk, the move could flip into classic risk-off with USD strength vs EM and high-beta FX.

Frequently Asked Questions

1. What Time Is the US ISM Services PMI Released, and How Often?

The ISM Services PMI is published once a month, usually on the third business day, at 10:00 a.m. Eastern Time.

2. Does a Higher ISM Services PMI Always Strengthen the US Dollar?

Not always, but relative to expectations, it usually matters. A stronger-than-forecast print is often dollar-positive because it nudges Fed cut odds lower or further out.

3. Is ISM Services PMI More Important than Nonfarm Payrolls for markets?

Nonfarm Payrolls remains the most closely watched US economic data point, but in months with unremarkable jobs figures, a significant surprise in the ISM Services PMI can move the USD and yields nearly as much.

Conclusion

Heading into today's release, the picture is fairly clean: the Fed is easing, the dollar is weak but not collapsing, and services are growing at a slower but still positive pace. A print near consensus keeps that story intact and probably leaves DXY chopping around 99 while the curve drifts sideways.

For dollar and rates traders, today's ISM Services PMI is one of those prints that can reset the conversation for the rest of the month.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.