Fintech is regaining leadership because business models that previously relied on cheap capital are now generating sustainable earnings, measurable operating leverage, and stronger balance sheets. Recent results show that scale is now driving GAAP profits, expanding margins, and providing reliable forward guidance.

This rotation is happening in a macro backdrop that still rewards discipline. The Federal Reserve’s target range for the federal funds rate is 3.50% to 3.75%, and January CPI was 2.4% year over year. With the cost of capital no longer near zero, the market is paying for provable profitability, not speculative addressable-market narratives.

2026 Fintech Disruptor Stocks Snapshot

The common factor among the three companies below is monetization: expanding revenue streams, improving unit economics, stronger cash generation, and management teams committed to clear profitability targets.

Company |

Latest Reported Proof Point |

Profitability Signal |

2026 Catalyst To Watch |

Primary Risk Variable |

|

Q4 2025 GAAP net revenue $1.025B; members 13.7M (+35% YoY) |

Ninth consecutive quarter of GAAP profitability; Q4 GAAP net income $173.5M |

Bank-backed crypto trading plus accelerating fee mix |

Credit performance if unemployment rises |

Block, Inc. (XYZ) |

Preliminary 2026 gross profit guide $11.98B (+17% YoY) |

Preliminary 2026 adjusted operating income $2.70B (+31% YoY) |

Cash App Borrow expansion and higher engagement density |

Consumer spend and loss rates in small-dollar credit |

Adyen N.V. (ADYEY) |

H2 2025 net revenue +17% YoY (+21% constant currency) |

EBITDA margin 55% in H2 2025 |

Expansion inside existing enterprise customers, plus issuing growth |

Enterprise volume sensitivity in a global slowdown |

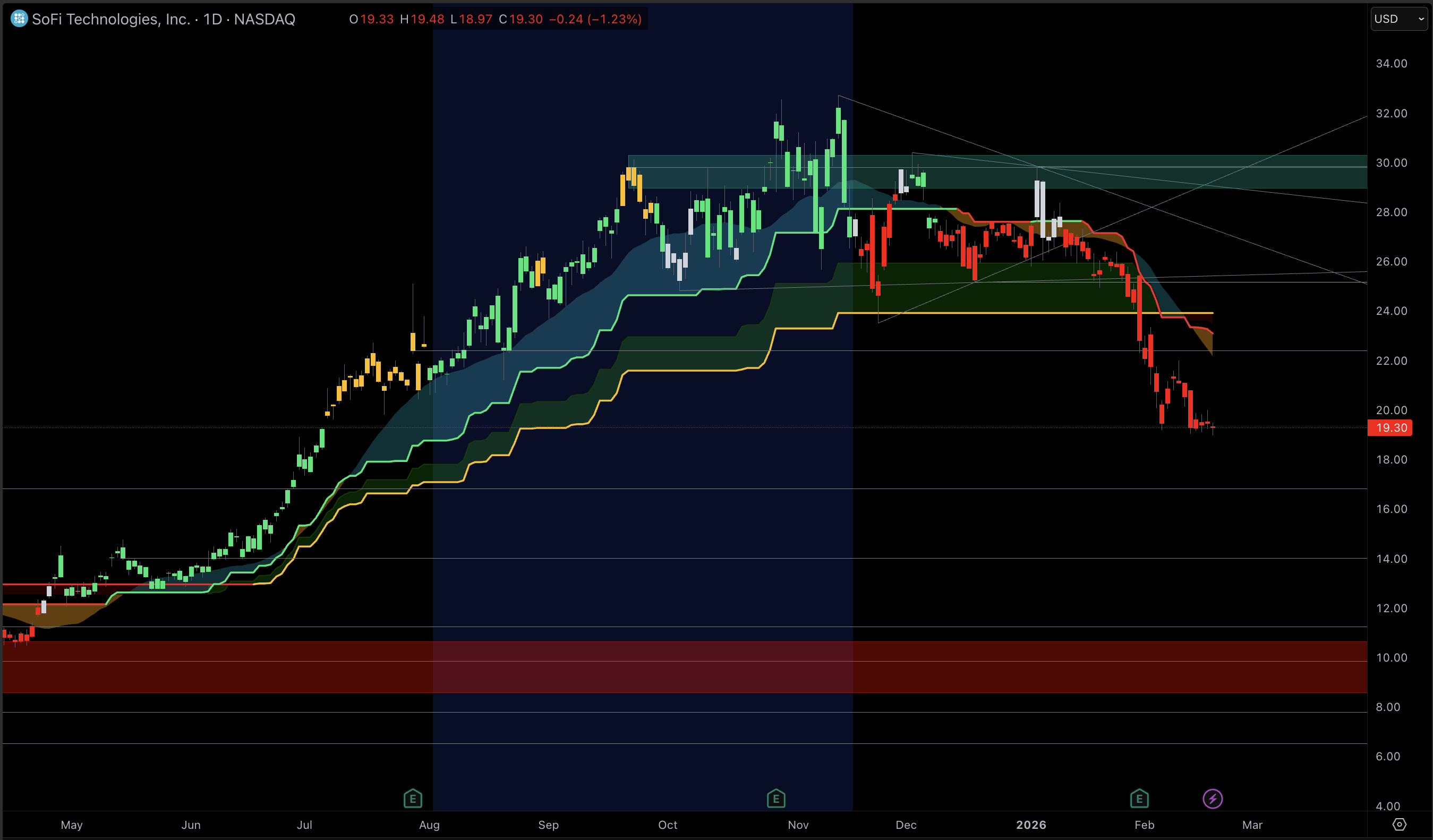

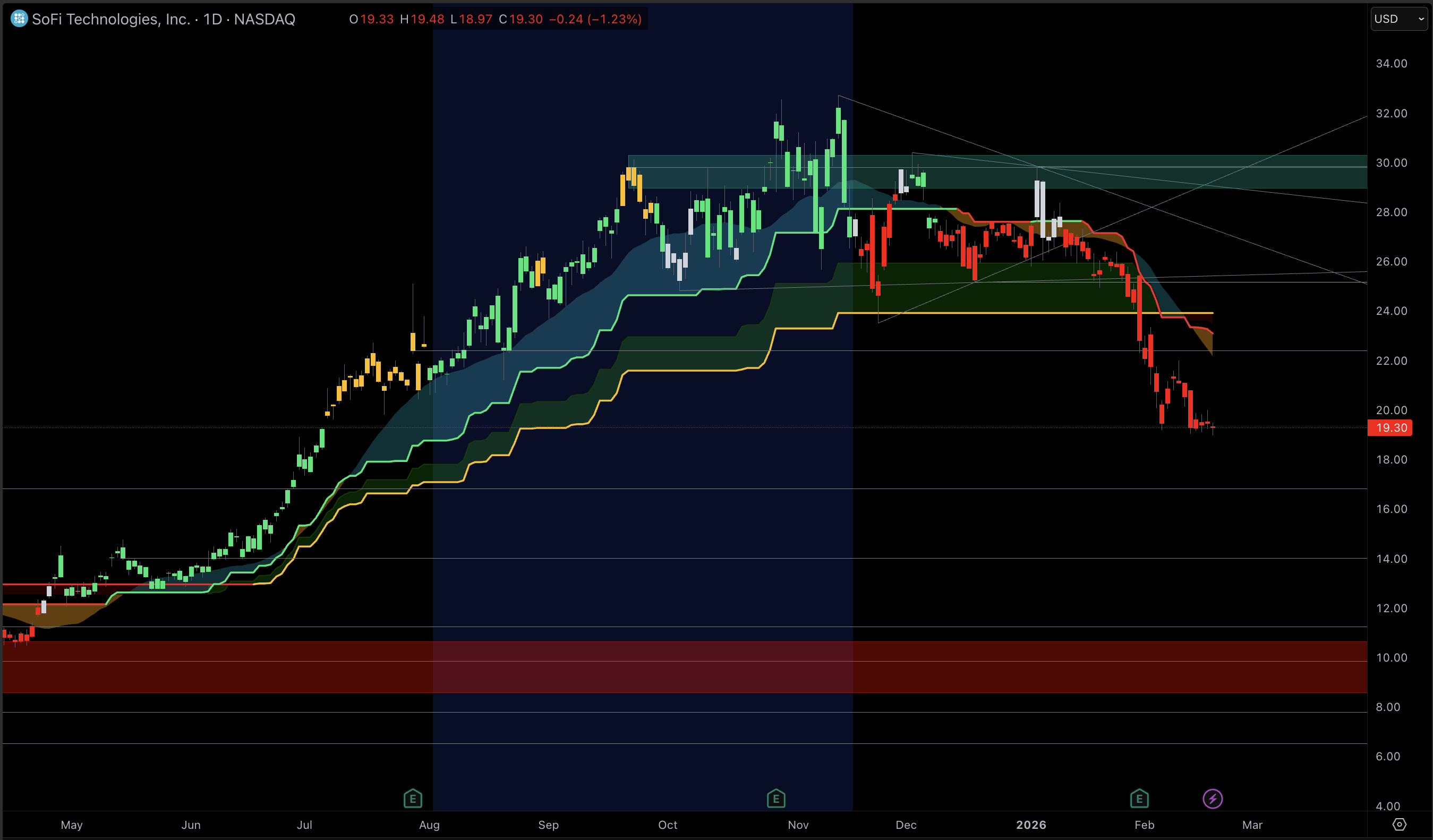

SoFi Technologies (SOFI): A Regulated Growth Bank Turning Scale Into Earnings

Q4 2025 Showed A Full-Stack Fintech With Real Operating Leverage

SoFi’s Q4 2025 results met a key investor milestone by delivering profits. GAAP net revenue reached $1.025B, up 40% year over year, while adjusted net revenue was $1.013B. The company added 1.0M members, bringing the total to 13.7M, and increased products to 20.2M, up 37% year over year.

More importantly, SoFi reported its ninth consecutive quarter of GAAP profitability, with Q4 GAAP net income of $173.5M. This shifts the narrative from future potential to current, compounding earnings power.

The Funding Mix Is A Margin Engine, Not A Footnote

SoFi’s structural advantage is its bank charter, which allows it to replace higher-cost wholesale funding with deposits. In Q4, the average rate paid on deposits was 181 basis points lower than on warehouse facilities, resulting in approximately $679.8M in annualized interest expense savings. This demonstrates how fintechs can achieve durability in a higher-rate environment by improving funding costs as they grow.

That funding edge is showing up alongside disciplined credit. SoFi reported a record. This funding advantage is complemented by disciplined credit performance. SoFi reported record Q4 originations of $10.5B, up 46% year over year, driven by $7.5B in personal loans and $1.9B in student loans.

Management noted that credit performance met expectations, with personal-loan charge-offs down 57 basis points year over year. It's the revenue mix that public markets increasingly reward: fee-driven, capital-light activity. In Q4, fee-based revenue hit $443M, up more than 50% year over year. More importantly, the company used its banking framework to re-enter crypto, positioning the offering around bank-grade safety while adding new transactional and engagement loops that do not require balance-sheet risk to scale.

SoFi stands out as a 2026 disruptor stock due to its regulated funding, growing fee-based revenue, and consistent GAAP profitability, which convert member growth into earnings growth. This profile is attractive to institutions, especially when liquidity is selective.

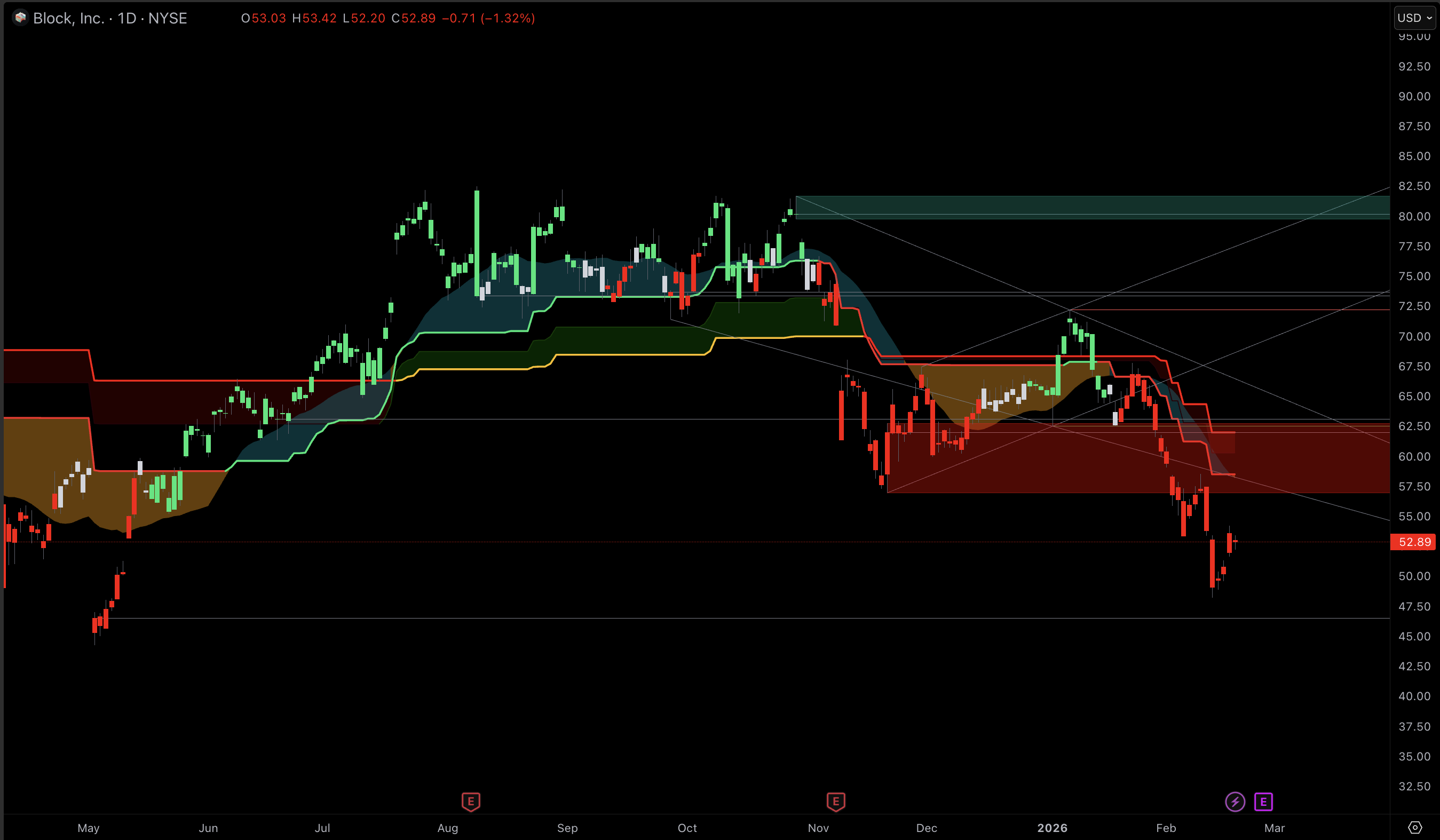

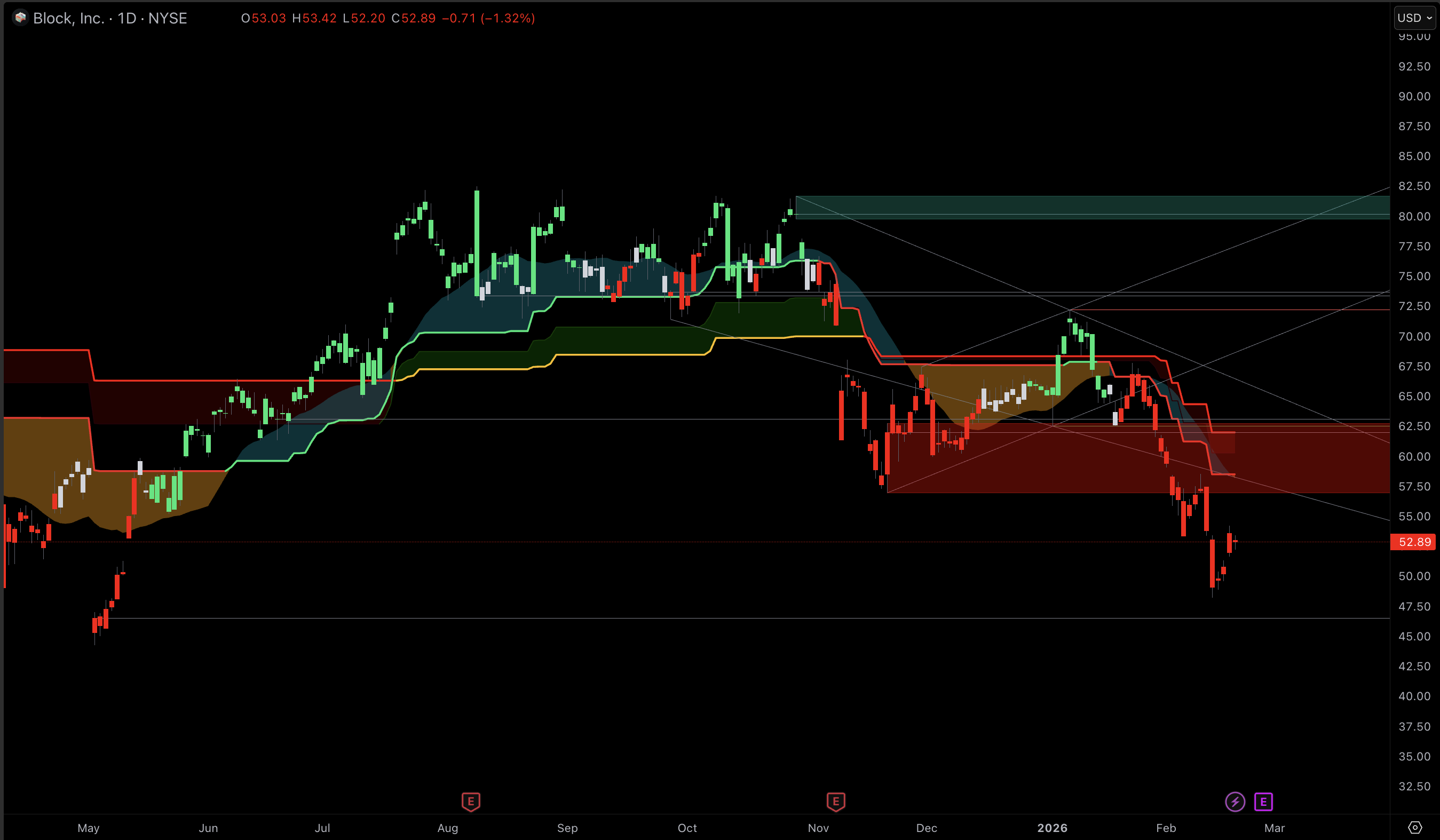

Block, Inc. (XYZ, Formerly SQ): The Reversal Setup Is Gross Profit Plus Embedded Credit

Management Put A 2026 Marker In The Ground

Block’s stock has spent long stretches trading like a “past cycle” fintech, even as the company has been reframing itself around profitability and efficiency. The cleanest way to track this is the metric Block emphasizes: gross profit. At Investor Day, Block laid out preliminary 2026 guidance calling for 17% gross profit growth to $11.98B, alongside 31% adjusted operating income growth to $2.70B and adjusted EPS of $3.20, while reiterating a commitment to a Rule of 40 profile in 2026.

For investors, this is the fulcrum. If the market continues to discount the name as a low-growth payments company, the upside is limited. If Block executes against those profitability targets, the multiple the market is willing to pay can change quickly because the earnings stream becomes easier to underwrite.

Cash App Borrow Is Becoming A Monetization Lever, Not A Side Product

A key growth driver is credit, particularly small-dollar, short-duration lending within Cash App. Block has stated that Cash App Borrow will expand to millions more users following FDIC approval for Square Financial Services to issue consumer loans nationwide, nearly doubling its addressable user base. This approval is significant because it strengthens the connection between underwriting, servicing, and unit economics.

Block’s unit economics are notable. For a $100 Borrow loan, the company projects $5 in gross profit, $3 in recurring costs, and a $2 margin over 21 days, implying a 34% ROIC and an ROE of over 100%. While the sustainability of these returns at scale is uncertain, this high-velocity credit can increase gross profit per active user without significant new user acquisition.

Engagement Density Is The Real Moat

Cash App monthly transacting actives have hovered around the high-50M range, and Investor Day materials show Q3 2025 at roughly 58M. In a mature user base, the growth lever becomes product density and monetization per active, not raw signups. Borrow, direct deposit engagement, and commerce integrations are designed to increase that density.

Block is a 2026 disruptor stock due to its clear path to accelerating gross profit and operating income, supported by embedded lending economics and an engagement-focused monetization strategy. The primary risk is a potential decline in consumer strength, which could impact spending and loss rates.

Adyen N.V. (ADYEY): Enterprise Payments With A 50%+ Margin Profile

Profitability Is The Product

Adyen’s appeal in a “fintech revival” is that it does not need a narrative reset. The company already operates like a high-margin enterprise infrastructure provider. In H2 2025, Adyen reported net revenue up 17% year over year (21% on a constant currency basis) and an EBITDA margin of 55%, while capital expenditure ran at 5% of net revenue. Those are not fintech-adjacent numbers. They are core enterprise software economics applied to payments processing.

This is important because enterprise processors succeed through reliability, authorization performance, risk intelligence, and global routing efficiency. In an environment that values cash generation, Adyen’s margin profile serves as a portfolio anchor within fintech allocations.

The Moat Is Data, Routing, And Decisioning At Scale

Adyen highlighted “Dynamic Identification” as an intelligence layer operating across trillions of interactions, with peak-event validation showing about 95% of Black Friday and Cyber Monday shoppers recognized across online and in-store channels. This real-time decisioning is a platform advantage that improves conversion rates and reduces abuse, strengthening customer retention without additional promotional spending.

Growth Optionality Comes From Financial Products, Not Consumer Hype

Adyen’s issuing business also stood out, with volumes growing 8x year over year in 2025 as platforms embedded cards into workflows. That is a structural shift: payments companies that can move from pure processing into broader money movement and embedded finance tend to expand wallet share inside existing customers, which is the highest-quality growth available in enterprise fintech.

Adyen is a 2026 disruptor stock due to its enterprise-focused model, high margins, and clear opportunities for expansion within existing customers. The main risk is cyclical; if global commerce slows, volume-based growth may decelerate even with strong execution.

Frequently Asked Questions

What Is Driving The Fintech Revival In 2026?

The market is rewarding fintech companies that demonstrate both growth and real profitability. With policy rates remaining restrictive and inflation moderating, investors are prioritizing margin structure, cash generation, and balance-sheet resilience over growth alone.

Why Is SoFi Viewed As A Disruptor Stock Instead Of A Traditional Bank?

SoFi is scaling as a platform, with rapid member and product growth, an increasing fee-based revenue mix, and consistent GAAP profitability. Its bank charter reduces funding costs, directly improving the lending unit's economics and supporting new revenue streams, such as crypto trading.

What Does Block Mean By “Gross Profit” Being The Key Metric?

Block uses gross profit as the primary measure of ecosystem monetization because it excludes pass-through revenue and highlights the platform’s true earnings from payments, lending, and services. Its 2026 guidance is explicitly based on gross profit and operating income growth.

Is Cash App Borrow A Meaningful Catalyst Or A Risky Credit Bet?

It is both. Borrow increases monetization per active user, and FDIC approval for nationwide origination can improve economics. The risk is that rapid growth in small-dollar credit could lead to volatility in loss rates if consumer conditions deteriorate.

Why Do Investors Like Adyen Even When Growth Is Not Explosive?

Adyen’s value lies in its margin structure and high-quality enterprise customer base. A 55% EBITDA margin, combined with steady net revenue growth, makes it one of the few fintech companies that operates like infrastructure: durable, scalable, and less dependent on consumer sentiment.

Conclusion

The fintech revival is not a broad revaluation of all disruptive companies. It is a targeted repricing of business models that convert technology into earnings. SoFi demonstrates that a regulated digital bank can generate sustained profits while expanding into new fee streams. Block is positioning for a turnaround by focusing 2026 expectations on gross profit and operating leverage, with Borrow as a key monetization driver. Adyen remains the enterprise benchmark, combining steady growth with a margin profile that most fintechs cannot match.

In 2026, the market’s message is clear: innovation is rewarded only when it results in consistent, repeatable profitability.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.