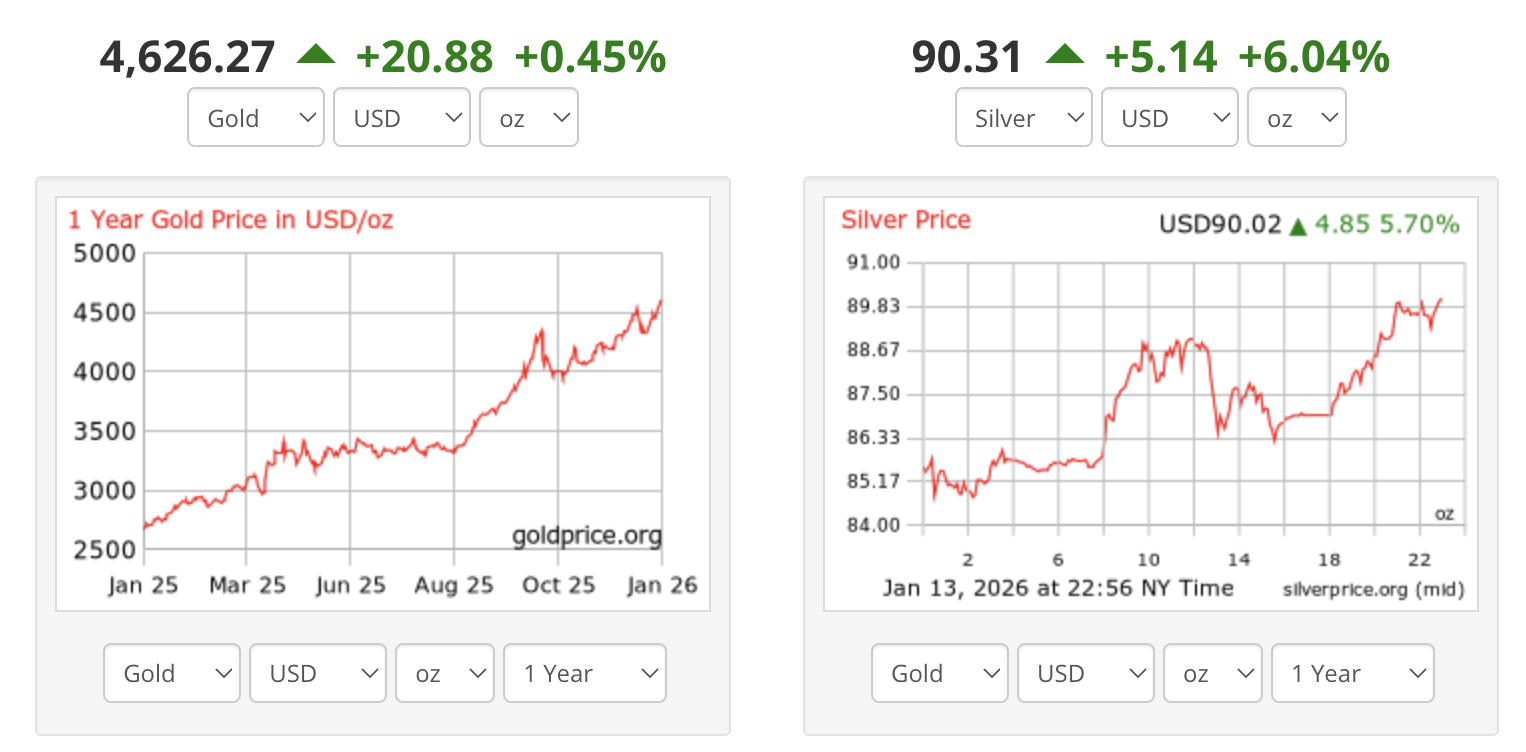

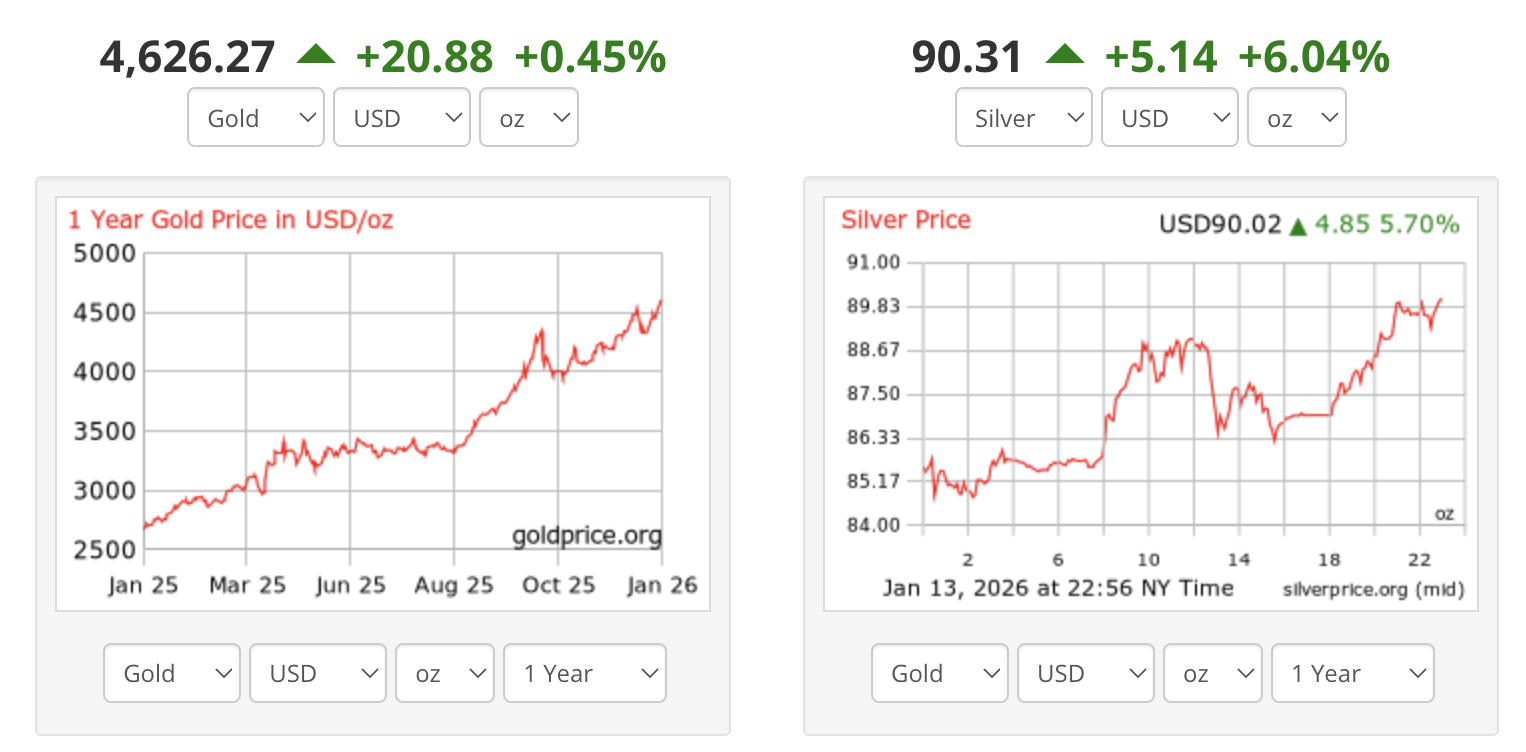

Gold and silver are not just rising; they are breaking records. In the latest session, spot gold hit a record $4,634.33 before easing back, while spot silver has now broken above $90/oz for the first time, setting a fresh all-time high after last week's record run.

This type of action typically requires two fuels together. One is macro, meaning a clear shift in rate expectations. The other is emotion, meaning investors feel they need real assets because policy and geopolitics look less predictable than normal. Right now, both are in play.

The immediate trigger was inflation data that kept the disinflation story alive where it matters most. Core CPI rose 0.2% in December and 2.6% over the year, which came in softer than many expected, helping investors lean back into the idea that cuts are still on the table in 2026.

Gold and Silver Prices Today: Market Snapshot

| Topic |

Gold (spot) |

Silver (spot) |

| Record highs cited |

$4,629.94 (Mon) → $4,634.33 (Tue)

|

$86.22 (Mon) → $90.00 (Tue)

|

| Mon → Tue change |

+$4.39 (+0.09%) |

+$3.78 (+4.38%) |

Gold: A Fresh Record, Then a Steady Hold

Gold's breakout has been fast. For example, spot gold reached a peak of $4,629.94 on Monday and climbed to $4,634.33 on Tuesday, setting a new record high.

Gold has risen over 6% in just the first 13 days of 2026, following a 64% increase in 2025.

Moves like that do not happen because of one data print. They occur when investors feel the regime has changed.

Silver: The Breakout

Silver has regained the top position once more. After printing a record near $89.10 earlier in the week, it has now broken through $90/oz for the first time, which is a major psychological level for both momentum funds and short-term traders.

Silver often exaggerates gold's moves because it is smaller and less liquid, and because it has a large industrial demand side that can amplify price swings.

Silver's pullback from the highs is not a sign of weakness by itself. Silver often overshoots, then retraces, because liquidity is thinner and positioning is more reactive.

Why Fed Cuts Lift Gold and Silver?

Gold and silver do not pay interest. That means they usually do best when the return on cash and bonds looks less attractive.

Fed cut expectations can support gold and silver through three simple channels:

Lower real yields: When bond yields fall faster than inflation expectations, real yields drop, and gold usually becomes more attractive.

A softer dollar: Rate cuts can weaken the $, which often pushes dollar-priced metals higher.

Higher uncertainty: Rate-cut cycles typically emerge when growth appears uncertain, which can increase the demand for defensive assets.

This week's rally has all three ingredients, with the extra spark coming from political headlines that have raised fresh questions about the Fed's independence.

What's Driving Gold and Silver This Week?

1) Core Inflation Cooled

December CPI delivered two messages at once:

Gold reacts most to the second line because it affects the path of real yields.

If core inflation remains steady, traders can more confidently argue that the next policy move is more likely to be a cut rather than a hike, even if the central bank remains cautious.

2) The Market Is Now Openly Pricing Multiple Cuts in 2026

Investors are anticipating two interest rate cuts this year, even if the Fed is expected to hold steady at the January meeting.

For example, rate futures suggest the highest odds of a cut by June, with meaningful odds that easing could begin as soon as April.

This is important because gold doesn't require immediate rate cuts; it typically reacts to expectations that cuts will occur and to the belief that real rates are likely to decrease.

3) Safe-Haven Demand Has Returned in Force

The recent increase in gold prices is also connected to broader geopolitical tensions and increased political instability, as this combination has enhanced gold's attractiveness as a safe haven.

When investors feel the "rules" are shifting, they often seek hard assets with no credit risk attached.

4) Central Bank Buying and ETF Flows Are Supporting the Trend

This rally also has a steady, long-term buyer base behind it.

For example, China's central bank extended its gold-buying streak to a 14th month, taking holdings to 74.15 million fine troy ounces. Reuters

The World Gold Council also estimates that physically backed gold ETFs experienced inflows of $89 billion in 2025, marking it as the largest ever recorded.

Those flows matter because they turn rallies into trends. Short-term traders can drive spikes, but long-term allocation often keeps pullbacks shallow.

5) Silver Has Its Own Supply Story

In contrast, the rise in silver has been supported by strong investment demand, a basic market deficit, delays in refining, and changes in flow associated with policy alterations such as the classification of critical minerals.

When gold is strong, and silver's market is tight, silver can move in violent steps.

Gold and Silver Technical Analysis

These levels are built around the latest recorded highs and the psychological zones that traders typically defend.

Gold (Spot) Key Levels

| Zone |

Level |

Why it matters |

| Resistance |

$4,700 |

Round-number target if momentum stays hot |

| Resistance |

$4,634 |

Latest all-time high; breakout reference |

| Support |

$4,600 |

Psychological level and recent "hold" area |

| Support |

$4,564 |

Prior record from Monday |

| Support |

$4,500 |

Big round number; likely dip-buyer zone |

How to read it: If gold holds above $4,600 on pullbacks, the market is still in breakout mode. If gold starts closing back below the old highs, the breakout can turn into a shakeout.

Silver (Spot) Key Levels

| Zone |

Level |

Why it matters now |

| Resistance |

$95.00 |

Next big round-number magnet if $90 holds. |

| Resistance |

$100.00 |

Major psychological target that often attracts headlines and option flow. |

| Pivot / Decision level |

$90.00 |

New breakout line; bulls want daily closes above it. |

| Support |

$89.10 |

Prior session peak zone; common "retest" area after a breakout. |

| Support |

$86.22 |

Earlier record reference point from this rally leg. |

| Support |

$85.00 |

Round-number cushion; below here the move starts to look like a deeper reset. |

How to read it: Silver can rip higher, but it can also drop $3–$5 quickly when positioning flips. That is why risk control matters more in silver than in gold.

What Traders Should Watch Next on the Calendar?

Fed meeting (late January): The tone matters more than the decision if the decision is a hold.

Inflation follow-through: Today's CPI helped, but markets will want confirmation in the next prints.

ETF and central bank flow headlines: These shape the "floor" narrative.

Frequently Asked Questions

1) Why Did Gold Hit a New All-Time High?

Gold reached a new record level as easing US inflation bolstered expectations for Fed rate cuts, while increasing uncertainty enhanced the demand for safe-haven assets. Spot gold touched $4,634.33 in the latest session.

2) Why Did Silver Surge to a Record of $90?

Silver rose on the same rate-cut and safe-haven drivers as gold, but it also has a tighter market structure. Silver hit $90 after earlier supply and deficit factors supported the uptrend.

3) What Did the Latest US CPI Report Show?

US CPI rose 0.3% month on month in December 2025 and held at 2.7% year on year, while core inflation was 2.6% year on year.

4) How Many Fed Cuts Are Markets Expecting in 2026?

Investors anticipate two rate cuts in 2026, even if the Fed is expected to hold steady at the January meeting.

5) Is This Move Mainly About Geopolitics or Interest Rates?

It is both. Geopolitics boosts demand for safe havens, while lower rate expectations reduce the opportunity cost of holding bullion.

Conclusion

In conclusion, gold and silver have pushed to new all-time highs because the market is building a single, powerful narrative: inflation is cooling enough to bring Fed cuts into view, while uncertainty is rising enough to keep safe-haven demand strong.

US CPI for December 2025 increased by 0.3% from the previous month and remained at 2.7% annually, with the market interpreting this as favorable for anticipated rate cuts in 2026.

Gold's surge past the low-$4,600s serves as a sign of confidence, whereas silver's leap above $90 indicates that volatility is increasing. Traders should respect the upside momentum, but they should also plan for sharp pullbacks, especially in silver, because crowded positioning and volatility controls can trigger fast reversals.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.