The Bureau of Labor Statistics will publish the December 2025 US CPI on Tuesday, January 13, 2026, at 8:30 a.m. ET.

Markets are entering the January CPI print with key concerns and one significant opportunity. The problem is that the October data collection gap distorted the last report, so the inflation story has had more noise than usual.

The opportunity is that December's report can reset the narrative, since it's the next clear checkpoint for inflation, and, by extension, rate expectations.

US CPI Release Time (December 2025 Report)

As mentioned above, the Bureau of Labor Statistics has scheduled the December 2025 CPI release for Tuesday, January 13, 2026, at 8:30 a.m. Eastern Time.

| Location |

Local release time |

Date |

| New York (ET) |

8:30 a.m. |

Tue, 13 Jan 2026 |

| London (GMT) |

1:30 p.m. |

Tue, 13 Jan 2026 |

| Frankfurt (CET) |

2:30 p.m. |

Tue, 13 Jan 2026 |

| Singapore (UTC+8) |

9:30 p.m. |

Tue, 13 Jan 2026 |

Above is a brief schedule summary for international traders.

December CPI Forecast: What the Market Is Pricing For

| Measure |

Street “lean” |

Nowcast signal |

Why this is messy |

| Headline CPI (m/m) |

~0.2% to 0.4% |

0.20% |

November pricing likely captured heavier holiday discounts than usual, so December can rebound. |

| Core CPI (m/m) |

~0.2% to 0.4% |

0.22% |

Core is sensitive to shelter and services, and seasonal effects can dominate one month. |

| Headline CPI (y/y) |

~2.6% to 2.8% |

2.57% |

Base effects and the October gap still complicate the "true" trend. |

| Core CPI (y/y) |

~2.7% to 2.9% |

2.64% |

Core is still being pulled by shelter and services pricing. |

Forecasts are wider than normal because the shutdown affected how October and November were measured, and several analysts expect a mechanical "payback" in December.

So the debate is not simply "inflation heating up or cooling down," but whether we see a one-off payback bounce or continued moderation.

Why the December US CPI Print Is Trickier Than Usual?

The November CPI release came with a major caveat: survey data for October 2025 were not collected due to a lapse in appropriations, and the monthly changes were presented across a two-month window instead of a standard single-month move.

Additionally, the BEA has signaled it will average September and November CPI components to estimate October inflation in its delayed PCE report, keeping CPI at the forefront as the market's primary inflation gauge this month.

The second reason is that the central bank cut the target range to 3.50%–3.75% in December, and officials have been debating how much more easing is appropriate in 2026.

A CPI that looks hotter than expected can quickly force markets to price fewer cuts, while a softer CPI can reopen the easing narrative.

Market Recap: What the Last CPI Reading Said?

In November 2025, CPI inflation looked softer on the surface:

Markets did not completely rejoice as the shutdown caused distortions. Additionally, the moderation was partially linked to technical aspects related to the shutdown and the schedule of holiday discounts, and October's CPI release was called off for the first time in history.

What Is Driving Inflation Into This US CPI Release?

1) Shelter Remains the Biggest Single Swing Factor Inside Core CPI

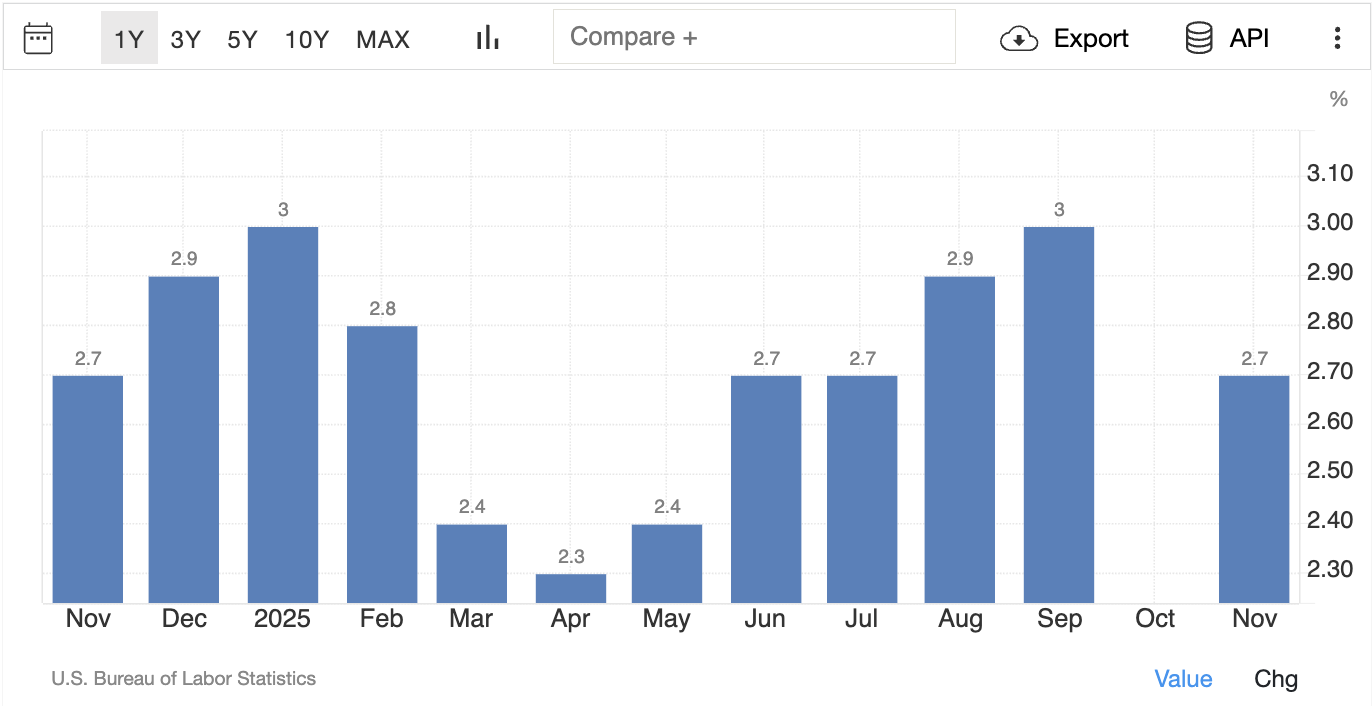

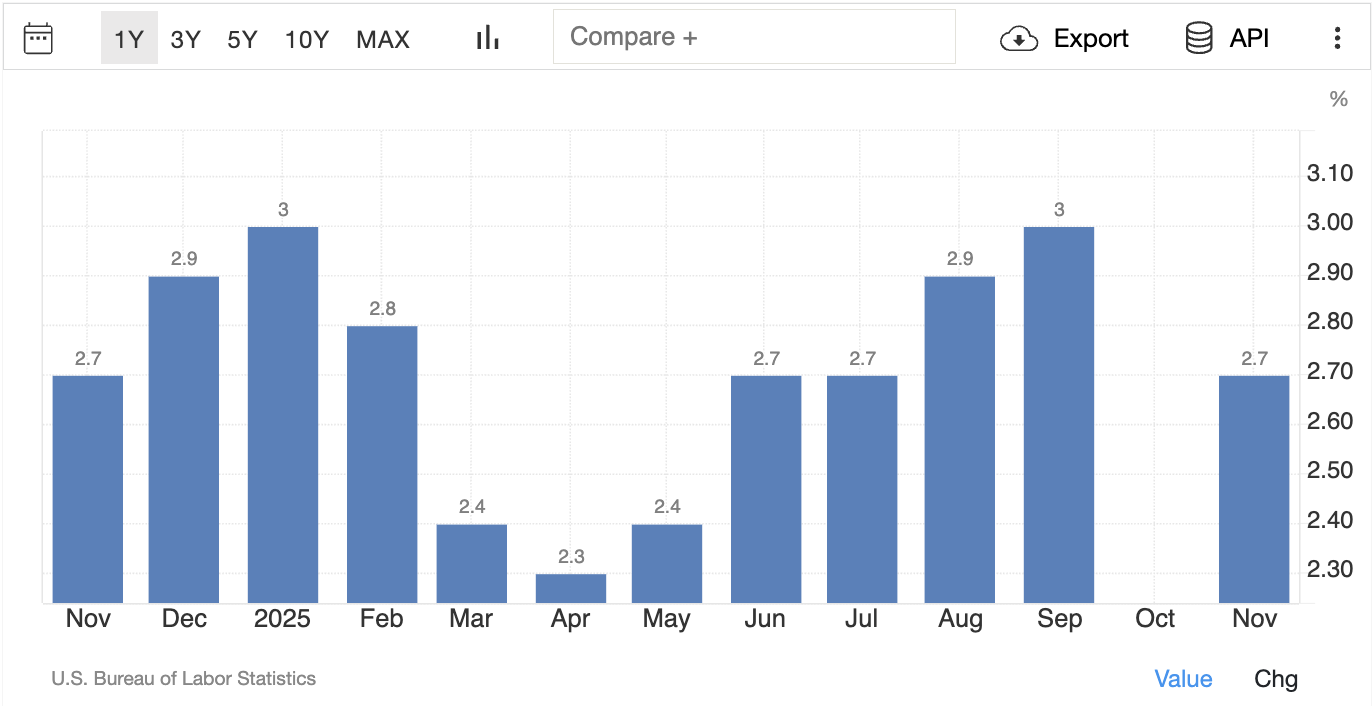

Shelter has been one of the most persistent sources of core inflation pressure. The November CPI report indicated an increase in shelter costs for the month, maintaining an annual rate of approximately 3.0%.

If shelter remains firm, core CPI usually struggles to fall quickly.

2) Goods Prices May Be Rebounding After Unusual Discount Timing

One reason several analysts anticipate a greater monthly report is that the shutdown altered data-gathering schedules, and certain November prices probably reflected steeper holiday discounts than usual.

For example, Wells Fargo explicitly expects a December "payback" in core goods.

3) Energy Can Swing the Headline

Energy drives headline CPI volatility. Even if the core is steady, a sharp move in petrol and utilities can dominate the headline and drive the initial market reaction.

4) Policy and Tariff Uncertainty Is a Background Risk

Several commentaries and forecasts in late 2025 linked persistent inflation pressure to tariff pass-through in goods-producing sectors.

This is important because tariffs don't always affect CPI immediately, but they can support the baseline for core goods once stock levels adjust.

5 Key Signals Traders Should Watch Inside the December US CPI Report

1) Core CPI MoM

Core CPI m/m is the market's favourite "clean" signal because it strips out food and energy. The nowcast forecasts point to 0.22% for December core CPI, while some bank previews are closer to the mid-0.3% range.

How to Read It:

2) Core CPI YoY

Core CPI YoY progresses more gradually, yet it influences the story. The current estimate is approximately 2.64%, while other predictions group around the high-2% level.

3) Shelter and Rent Measures

Shelter is the "engine room" of core CPI. The BLS shutdown impact page explains how rent data were handled in October and then resumed in November, which is why traders will scrutinise the shelter line for signs of stability or renewed heat.

4) Services Inflation Outside Housing

When service costs remain stable, inflation usually stays above the target despite a slowdown in goods. S&P Global's note for the upcoming week indicates that markets approached the November cooling with caution due to worries about data accuracy.

A solid services print in December would matter more than a soft headline driven by energy.

5) "Payback" Evidence in Core Goods

If core goods rise while housing remains stable, the market might view the change as a seasonal fluctuation.

If core goods jump and shelter also stays hot, the market will take the upside risk more seriously.

What Comes After the US CPI Report?

CPI will not be the only inflation story in January.

The delayed October and November PCE inflation report is scheduled for January 22, 2026. Furthermore, the Bureau of Economic Analysis has signaled it will estimate October inflation in its delayed PCE report by averaging the September and November CPI components.

That creates the risk of a second inflation repricing later in the month, especially if the PCE prints don't align with the tone investors took from CPI.

Frequently Asked Questions (FAQ)

1. What Time Is the US CPI Release?

The US CPI report for December 2025 is set to be released on Tuesday, January 13, 2026, at 8:30 a.m. Eastern Standard Time.

2. What Is the Forecast for the December Us CPI?

Current consensus forecasts anticipate headline CPI at 0.3% MoM and 2.7% YoY, alongside core CPI also at 0.3% m/m and 2.7% y/y. A nowcast model indicates a milder forecast, approximately 0.20% for the headline and 0.22% for the core in December.

3) What Is the Most Important CPI Line to Watch?

Core CPI MoM is usually the fastest market mover. Traders use it to judge whether inflation is trending towards 2% or drifting away again.

Conclusion

In conclusion, the US CPI for December 2025 is due for release on Tuesday, January 13, 2026, at 8:30 a.m. ET.

Markets broadly expect inflation to hold in the high-2% range YoY. However, month-on-month forecasts are split as some analysts look for a rebound following shutdown-related noise and holiday-discount distortions.

For the cleanest signal, focus on core CPI m/m first, then drill into shelter and services to judge whether any upside or downside surprise is likely to persist.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.