The Federal Reserve’s October 28-29, 2025 FOMC minutes, released on 19 November, finally show what was really happening inside the room.

The Fed cut rates by 25 basis points and decided to stop shrinking its balance sheet on 1 December.

But the minutes reveal something more important: a deeply divided Committee trying to navigate high inflation, a softening job market, and a government data blackout.[1]

If you trade FX, indices, bonds, or commodities, these minutes are your blueprint for the December meeting and for how the Fed may move in 2026.

Why Did The Fed Cut Rates And End QT Now?

During this meeting, the FOMC lowered the federal funds target range by 0.25 percentage point, to 3.75-4.00 percent.

Members judged that the economic activity was still expanding at a moderate pace, but job gains had slowed and the unemployment rate had edged higher, even though it remained low through August.

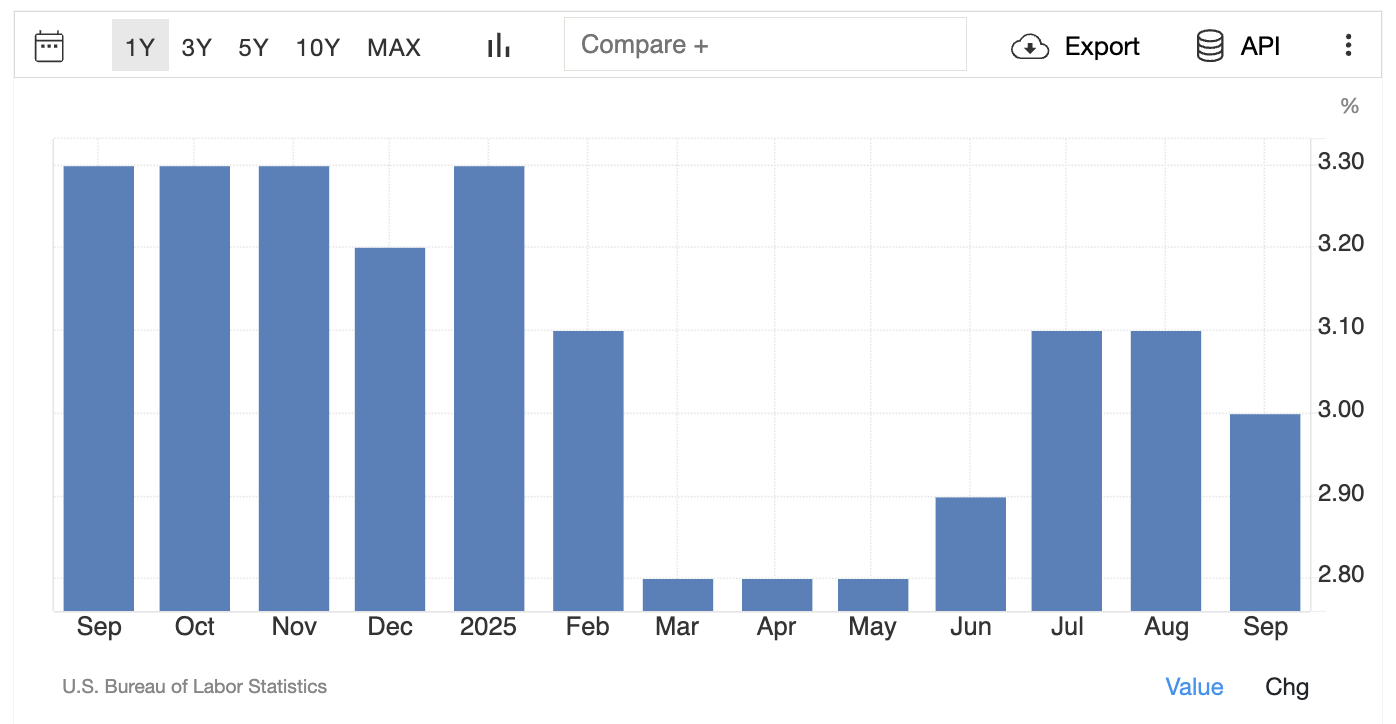

Inflation, meanwhile, had “moved up” since earlier in the year and stayed “somewhat elevated.”

In other words, growth is okay, but the labour market is losing momentum while inflation is still too high. That shifting balance of risks pushed most members toward easing.

Two members dissented. One wanted a larger 50 bps cut, arguing for a faster move toward a neutral stance. The other preferred no change, worried that progress on inflation had stalled and that more easing might damage the Fed’s inflation-fighting credibility.

Ending Quantitative Tightening On 1 December

Almost all members also agreed to end the reduction in the Fed’s securities holdings on 1 December.

Money-market signals tell the story. Repo rates moved higher relative to the interest rate paid on reserve balances, usage of the Fed’s overnight reverse repo (ON RRP) facility fell to its lowest since 2021, and the standing repo facility (SRF) was tapped more often.

Together, these pointed to reserves moving close to the “ample” zone.

The meeting concluded that continuing balance sheet runoff risked triggering unnecessary volatility in funding markets. The plan now is:

Stop shrinking the portfolio from 1 December

Reinvest all principal from Treasuries back into Treasuries

Redirect agency MBS principal into Treasury bills, gradually increasing the bill share of the Fed’s holdings

For traders, that means QT is effectively over and the Fed becomes a more consistent buyer at the front end of the curve.

How Does The Fed See Inflation, Growth And The Shutdown?

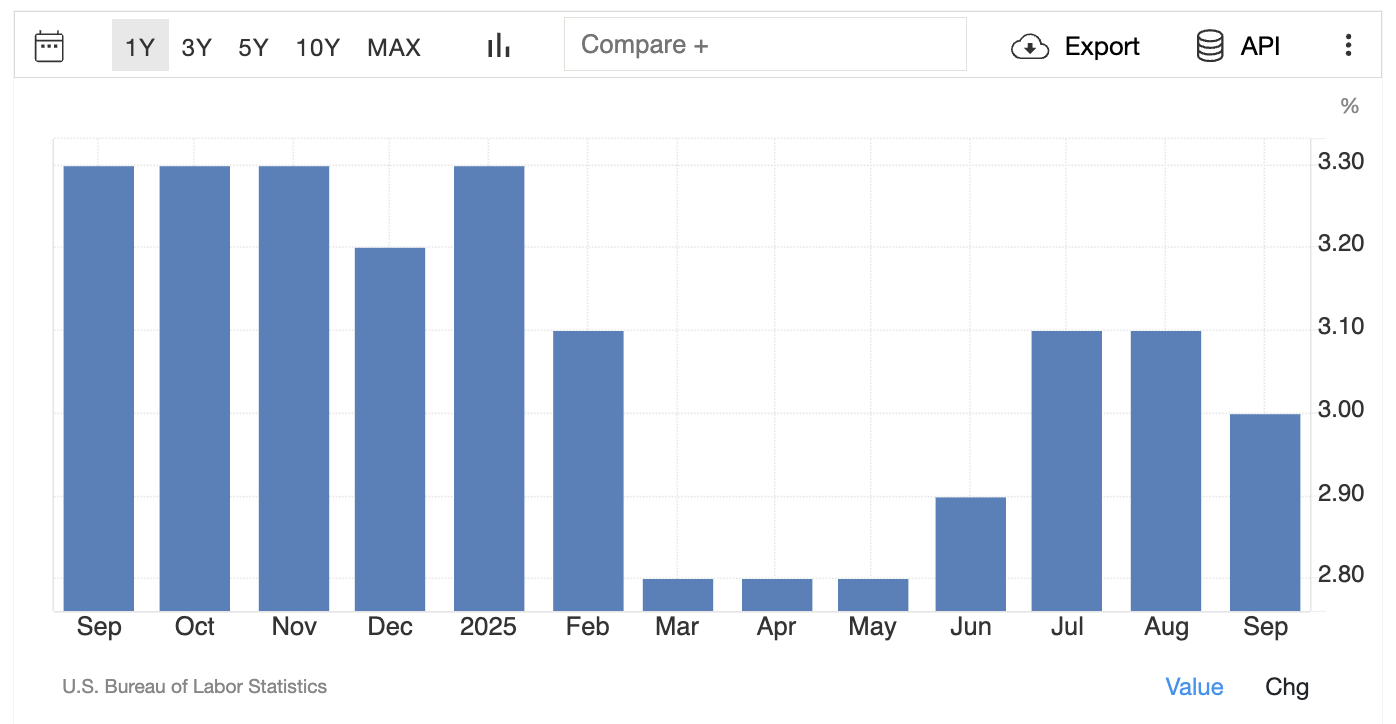

Inflation Stuck Around 2.8 Percent

The staff estimate headline PCE inflation at 2.8 percent year-on-year in September. Core PCE is also about 2.8 percent, unchanged from a year earlier but still above the 2 percent target.

Participants highlight a key detail:

Disinflation in housing is happening

But goods inflation is stronger, partly because of tariff increases earlier in 2025

Some policymakers think inflation would be close to target if you strip out tariff effects. Many others are uneasy, stressing that inflation has run above 2 percent for more than four years and has not convincingly turned lower.

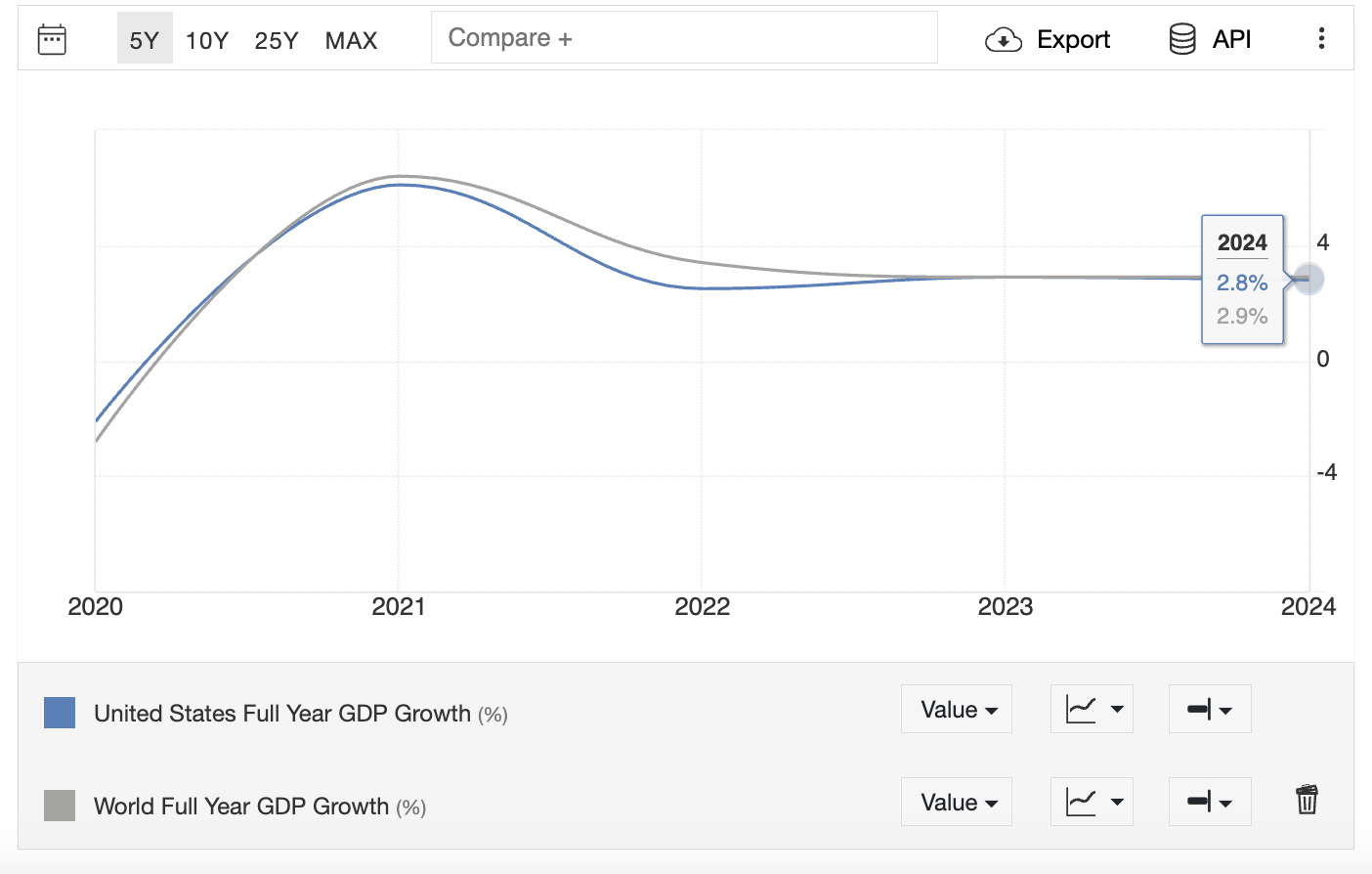

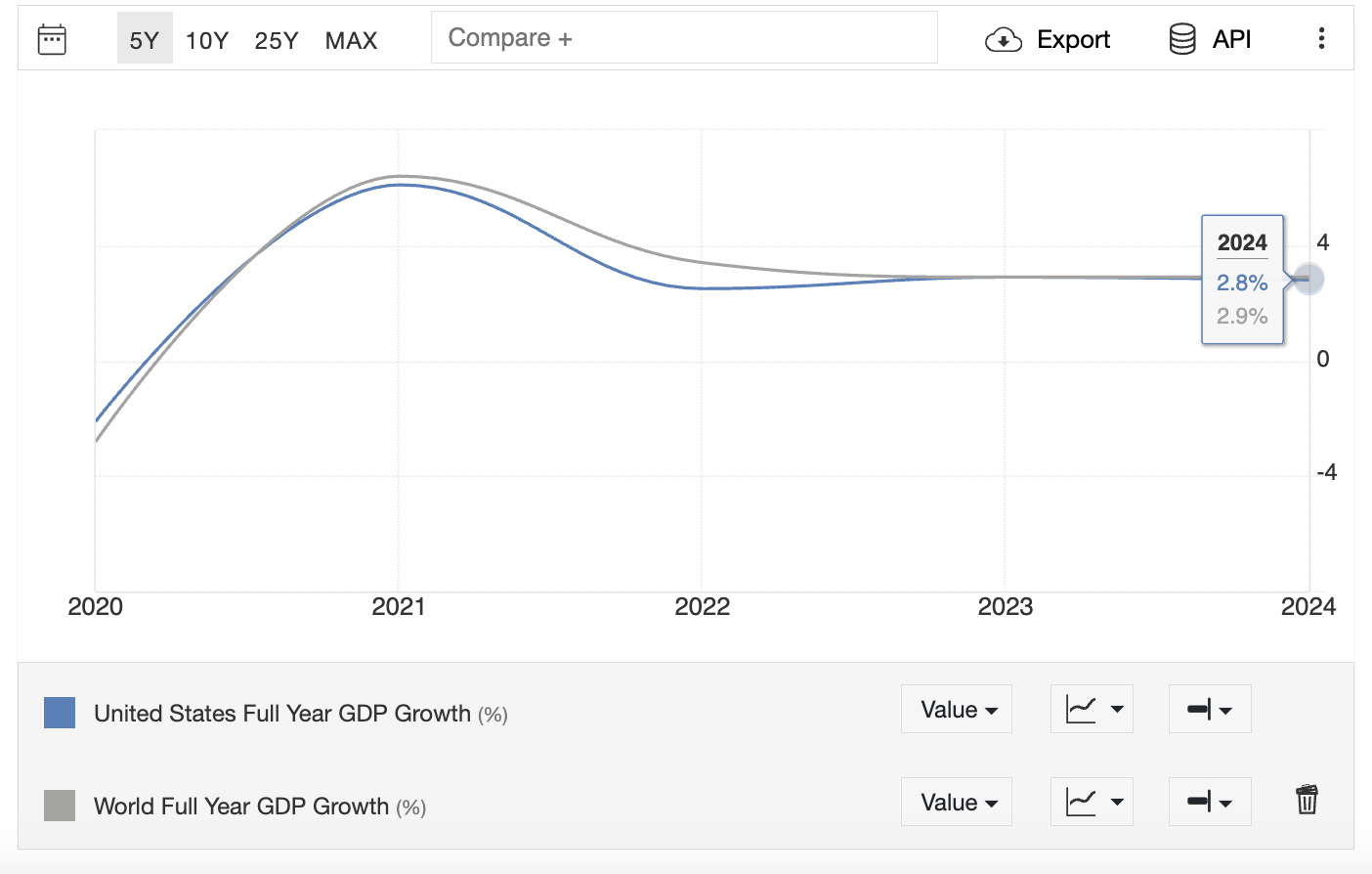

Growth Still Good, But Harder To Read

Real GDP rebounded strongly in Q2 after a weak Q1, and underlying private demand (consumption plus business investment) has grown faster than GDP, though slower than in 2024. Net exports likely helped Q3 growth as imports fell.

However, the federal government shutdown has reduced the amount of official data the Fed can use, especially for Q3. That makes it harder to judge how strong the economy really is right now.

Labour Market: Cooling With Limited Data

The minutes describe a labour market that is clearly softer but not yet in recession territory:

Because of the shutdown, the Fed did not receive the usual Employment Situation report for September and had to rely on private data, business surveys, and contact reports from the Beige Book.

Policymakers expect conditions to soften gradually, with firms reluctant to hire but also hesitant to fire. Several warn that if labour demand weakens further, unemployment could rise sharply, especially in cyclical sectors and among more vulnerable worker groups.

What Financial Stability Risks Is The Fed Worried About?

The staff still label U.S. financial vulnerabilities as “notable.”

Key points from the minutes:

Equity valuations are elevated, with price-to-earnings ratios near the top of their historical range

AI-related optimism is driving gains in technology stocks and equity indexes

Hedge fund leverage is high and has increased, with exposure to Treasuries roughly doubling over the past two years

Private credit has grown rapidly, and recent bankruptcies raise concerns about loan quality and hidden leverage

The market value of stablecoins has grown significantly and is seen as a potential funding-risk channel

For the Fed, this means that a sudden shock, for example, a sharp reassessment of AI-related earnings or stress in private credit, could amplify any macro slowdown.

That risk feeds directly into its cautious approach to further rate cuts.

Why Is There So Much Debate About The December Meeting?

A Split Over The Next Cut

Participants strongly disagree about what to do at the December 9–10 meeting.

Most agree that some further reductions in the policy rate will likely be appropriate over time as the Fed moves from a restrictive stance toward neutral. But:

Several think another 25 bps cut in December “could well be appropriate” if the economy evolves as expected

Many suggest it would be better to keep rates unchanged for the rest of 2025, given still-elevated inflation and concerns about credibility.

All agree that policy is not on a preset course and will depend on incoming data, the outlook, and the balance of risks.

Two-Sided Risks: Inflation vs Jobs

In their risk-management discussion, participants noted that upside risks to inflation remain elevated, particularly after more than four consecutive years above 2 percent, while downside risks to employment have increased as job gains slow and uncertainty rises.

Reduced data availability from the shutdown also makes it harder to gauge conditions in real time. Many participants warned that further rapid cuts could risk entrenching higher inflation or be interpreted as the Fed stepping back from its 2 percent target.

Others argued that easing could help prevent a sharper labor-market downturn, leaving genuine two-way uncertainty heading into December.

What Does All This Mean For Markets And Traders?

Rates And The Yield Curve

Front-end yields now reflect a policy rate of 3.75-4.00 percent, with a live debate over whether December brings another cut or a pause.

Ending QT and reinvesting into Treasuries, especially bills, should gradually support the short end and remove part of the “QT premium” on longer maturities compared with a scenario of continued runoff.

For rates traders, that argues for less aggressive bear-steepening risk than earlier in the year, but with volatility around each new data release.

The US Dollar

The Fed notes that the broad dollar index rose modestly over the intermeeting period, supported by relatively resilient U.S. data.

A central bank that is easing cautiously and not racing toward zero tends to keep the dollar supported against currencies where central banks are already cutting more deeply or where growth is weaker.

Equities And Risk Assets

Equity markets benefit from:

But the minutes stress high valuations, elevated hedge-fund leverage and vulnerabilities in private credit and stablecoins. That combination creates a fragile risk backdrop: strong while the narrative holds, but vulnerable to a negative shock or a hawkish surprise from the Fed.

For traders, this means respecting both directions: the upside linked to easier policy, and the downside linked to any sign that December cuts are off the table or that financial-stability concerns are escalating.

What To Watch For Next

Here are the main triggers to monitor going into the December meeting:

Incoming inflation data (PCE, and any CPI releases once the shutdown issues are resolved)

Labour-market indicators, especially private payroll surveys, jobless claims, and wage trackers

Money-market conditions, to see whether reserves truly stabilise after QT ends

Fed speeches, which may signal whether the Committee is leaning toward a December cut or a longer pause

Risk-asset behaviour, particularly in AI-heavy tech and private credit

Note: We should see the Fed as being in transition rather than in full easing mode: conditions are loosening, but every additional cut has to be justified against the risk of letting inflation stay too high for too long.

Frequently Asked Questions

1. What is the single most important takeaway from the October 2025 FOMC minutes?

The Fed started easing with a 25 bps cut and early end to QT but isn’t committing to fast future cuts. Inflation is around 2.8%, and there’s disagreement on a December move.

2. How likely is another Fed rate cut in December 2025?

Opinions are split as some see a cut as possible, while the others prefer holding rates. December is uncertain.

3. What does ending QT mean for bonds and yields?

Stopping balance sheet runoff eases selling pressure on Treasuries and stabilizes money markets. Long-term yields still react to growth and inflation.

4. How might these minutes affect the US dollar and major FX pairs?

A slow, cautious Fed supports the dollar versus weaker or already-dovish currencies, but aggressive cuts could reverse that.

5. Are risk assets safe with the Fed cutting rates?

Not entirely. High valuations, leverage, and private-credit risks mean equities and credit could correct if growth disappoints or the Fed tightens again.

Conclusion

The October FOMC minutes show a Fed cautiously easing, with a 25 bps rate cut and QT ending 1 December. Inflation remains above target while the labor market cools, creating genuine uncertainty for December.

Financial vulnerabilities such as high valuations, leverage, and private credit, limit the scope for aggressive cuts.

Markets should expect a data-driven approach, with potential upside from easing balanced against downside from shocks or a hawkish pivot.

Disclaimer: This material is for general information purposes only and does not constitute financial, investment or other advice. No opinion here is a recommendation that any specific investment, strategy or transaction is suitable for any particular person. Always assess your own risk tolerance and financial situation before making trading decisions.

Sources

[1] https://www.federalreserve.gov/monetarypolicy/fomcminutes20251029.htm