The flash Eurozone PMI November release provides an early snapshot of business activity across the currency area. The composite PMI arrived at 52.4. signalling modest expansion overall but concealing notable weakness in the industrial sector.

Germany and France, two of the bloc's largest economies, posted manufacturing readings below 50. indicating contraction that could weigh on exports, investment and the euro.

The Latest PMI Numbers Explained[1]

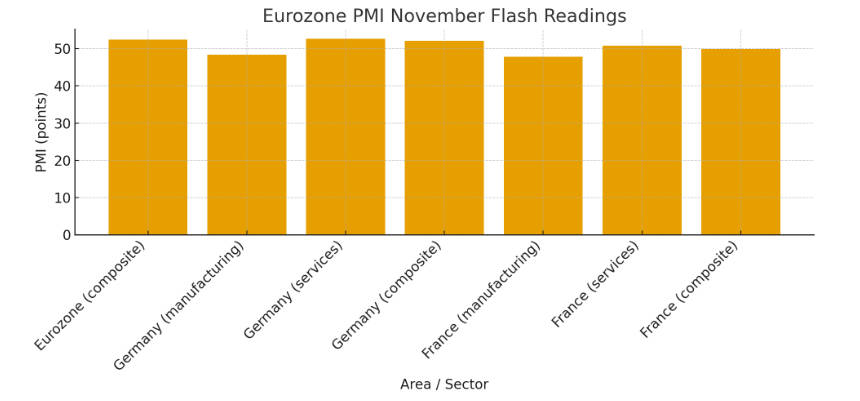

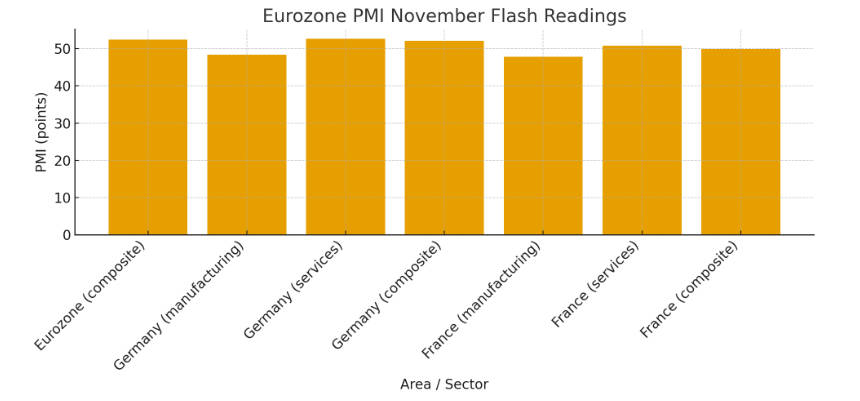

The key flash figures for November are as follows:

Eurozone composite PMI 52.4.

This shows the overall private sector remains in expansion but with a slight cooling.

Germany manufacturing PMI 48.4.

Manufacturing returned to contraction with weaker new orders.

Germany services PMI 52.7.

Services continued to expand but at a slower pace than in October.

France manufacturing PMI 47.8.

France reported a nine month low in manufacturing.

France services PMI 50.8.

Services moved back above 50 for the first time in 15 months.

Why Manufacturing PMI Weakness Matters

Manufacturing is more cyclical and trade-sensitive than services. A sub-50 reading signals weaker export demand, reduced capital spending and pressure on industrial margins.

Even if services stay resilient, broad manufacturing slowdown can weigh on headline growth, ease input prices and influence ECB policy expectations. Investors treat such weakness as a red flag for cyclical exposures.

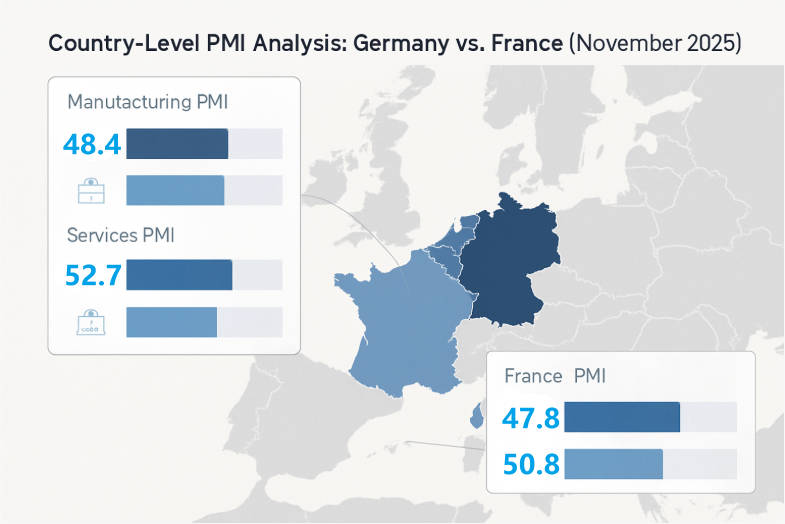

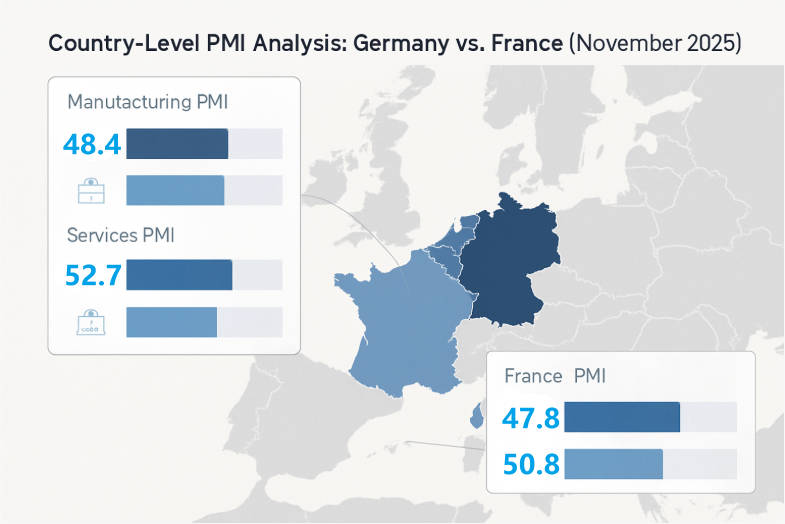

Country Level PMI Analysis

Germany

Germany's manufacturing PMI at 48.4 points to contraction in the industrial heartland. New orders and export order subindices weakened, reflecting softer external demand. The services sector at 52.7 cushions the overall outcome but cannot fully offset industrial weakness.

For German corporates in autos, machinery and capital goods, downside risks to revenue and margins increase if order books do not recover.

France

France shows a sharper split. Manufacturing at 47.8 marked a nine month low for factories while services rose to 50.8. returning to expansion. The composite reading for France sits near neutral, underlining how domestic consumption and services are supporting growth even as factories struggle with external demand.

Investors should watch whether services momentum can offset manufacturing weakness in coming months.

Other Member States

Full national breakdowns vary, and the final S&P Global national table will provide greater granularity. Early signals from Spain and Italy suggest mixed outcomes, with export orientated sectors in several countries showing strain while domestic services remain more resilient. Investors should monitor the full national releases for confirmation and sector detail.

Growth versus inflation dynamics

A manufacturing slowdown eases near-term input price pressures in many industrial subsectors, which can reduce core inflation momentum. That dynamic matters for the ECB's policy calculus and the shape of yield curves.

Market Implications of the PMI

1.Euro Outlook

While the composite reading signals expansion, industrial weakness increases the likelihood of investors repricing ECB expectations. Reduced tightening expectations tend to weigh on the euro, especially if the US or other economies show stronger momentum.

2.Fixed Income Reaction

Softer manufacturing lowers the probability of aggressive ECB tightening. Short- to medium-dated euro-area yields moved lower as markets priced a more dovish stance. This environment usually favours high-quality duration exposure.

3. Equity Sector Rotation

Weak manufacturing and exports pressure industrial, machinery, automotive and materials names. Meanwhile, domestic services and defensive sectors—consumer staples, healthcare, selected growth segments—tend to demonstrate greater resilience.

Sectoral and Corporate Implications of PMI

Manufacturing contraction tends to hit these areas hardest:

Industrial capital goods and machinery manufacturers.

Automotive supply chains and parts producers.

Basic materials and chemicals where order volumes moderate.

Consequently, revenue downgrades and margin pressure are plausible outcomes for firms reliant on foreign demand.

By contrast, consumer staples, healthcare and certain software and digital services firms usually show more stable demand and are natural defensive tilts during such cycles. Active managers should run scenario stress tests on earnings forecasts for cyclical companies.

Practical Takeaways For Global Investors

1. Reassess exposure to eurozone cyclicals

Reduce positions in manufacturers and exporters where earnings are sensitive to order flows and global demand.

2. Increase currency risk controls

Use hedging if you hold sizeable euro exposures and are wary of further euro downside.

3. Consider higher quality duration as a hedge

High quality sovereign bonds may provide protection if risk assets reprice on growth worries.

4. Tilt regionally where growth is stronger

If US or Asia PMIs remain stronger, rebalance toward regions with better activity momentum.

5. Run earnings stress tests

Update EPS assumptions for industrial companies to reflect lower new orders and potential margin pressure.

Conclusion

The Eurozone PMI November flash reading offers a nuanced picture. The composite PMI at 52.4 signals overall modest expansion but conceals material industrial weakness as both Germany and France reported manufacturing contraction.

For investors the key priorities are sector and currency risk management, close monitoring of subsequent national PMI details and ECB communications, and scenario testing for earnings in cyclical companies.

Frequently Asked Questions

Q1: What does the Eurozone November PMI flash indicate?

The composite PMI at 52.4 signals modest expansion in the Eurozone, but underlying industrial weakness, especially in Germany and France, suggests slower growth ahead, impacting exports, capital spending, and investment sentiment.

Q2: Why is manufacturing weakness important for investors?

Manufacturing is trade-sensitive and cyclical. Contraction points to lower export demand, weaker capital spending, and potential margin pressure. Even with growing services, industrial slowdown can affect overall growth, inflation expectations, and sector performance for cyclical companies.

Q3: How did markets react to the PMI flash?

The euro weakened as ECB rate expectations were adjusted downward. Short-term yields eased, and equities diverged by sector, with industrial and export-focused companies underperforming while domestic services and defensive sectors outperformed.

Q4: Which sectors are most affected by manufacturing contraction?

Industrials, machinery, automotive, and basic materials firms face revenue and margin pressure. By contrast, consumer staples, healthcare, software, and digital services remain more resilient, serving as defensive options during manufacturing slowdowns.

Q5: What should investors consider for fixed income and currency?

Slower manufacturing may ease inflation pressure, prompting ECB caution. Euro yields could decline, supporting high-quality sovereign bonds. Currency-wise, the euro may weaken against the dollar, requiring careful hedging strategies for portfolios exposed to euro risk.

Sources:

[1] https://www.hcob-bank.com/en/insights/pmi/

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.