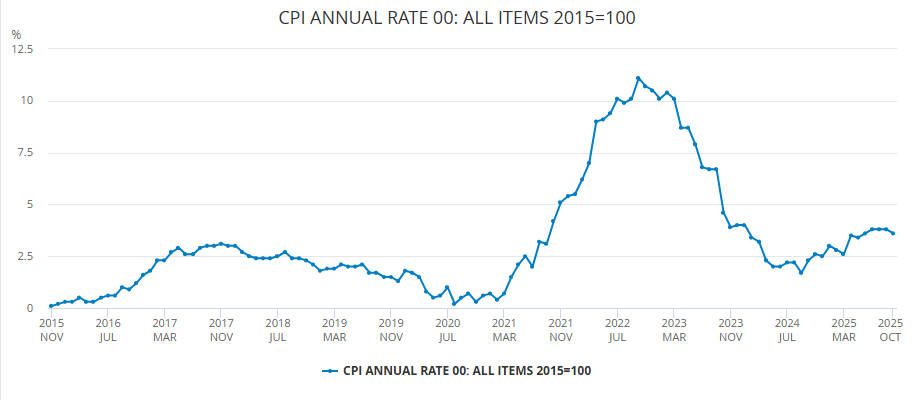

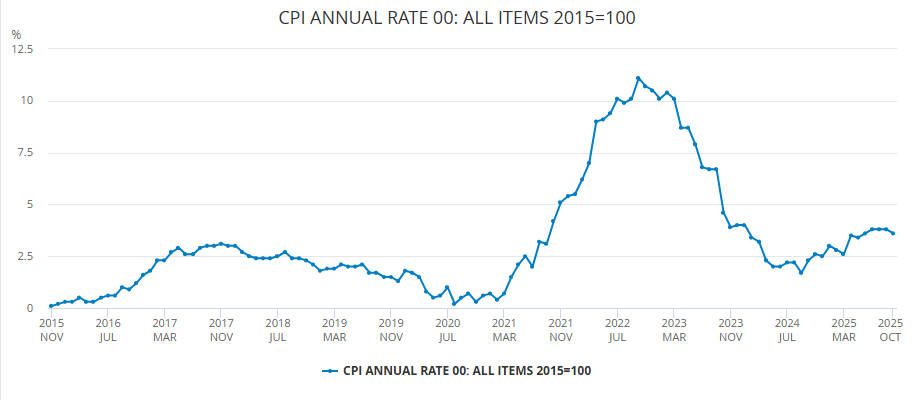

UK inflation eased to 3.6% year-on-year in October, falling from 3.8% in September, marking the first monthly decline since May. This drop has increased market anticipation that the Bank of England could start reducing interest rates at its December meeting.

UK Inflation Snapshot

| Indicator |

October 2025 |

September 2025 |

Notes |

| Headline CPI (YoY) |

3.6% |

3.8% |

Annual inflation rate fell 0.2pp |

| Core CPI (ex. food & energy) |

~3.4% |

3.5% |

Sticky services inflation remains |

| Food & Drink Inflation |

4.9% |

4.7% |

Continues to put pressure on households |

| Bank of England Rate |

4.0% |

4.0% |

MPC vote: 5–4 to hold |

| Market-Implied December Cut |

~60% |

50% |

Probability of 25bp cut |

Headline Fall Masked by Sticky Core and Rising Food Prices

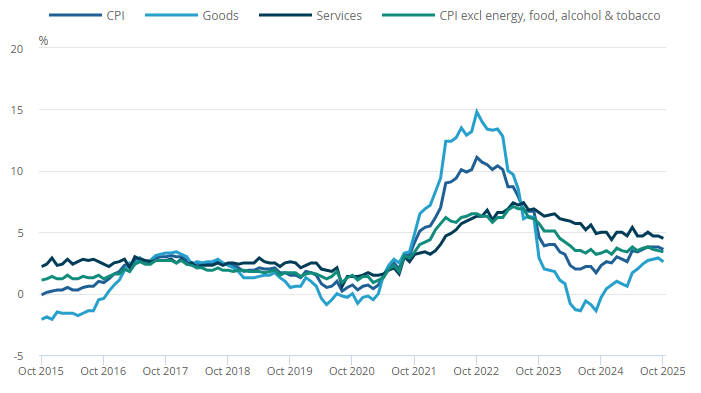

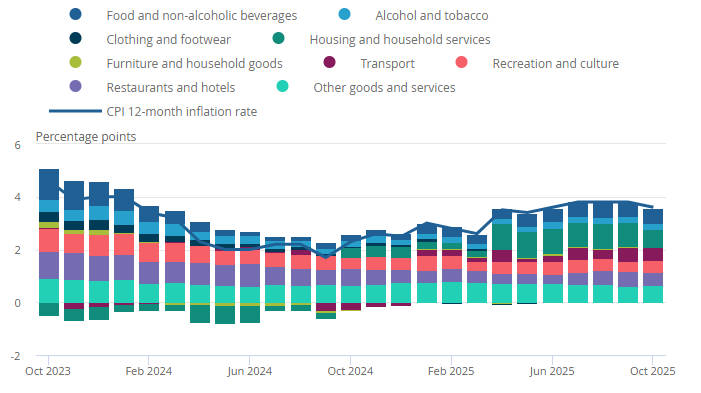

The Office for National Statistics' latest consumer price figures show headline inflation easing by 0.2 percentage points in October. That moderation was principally driven by smaller increases in energy-related items, notably the effect of recent adjustments to Ofgem's price cap and softer transport and hospitality prices, but the underlying picture is mixed. [1]

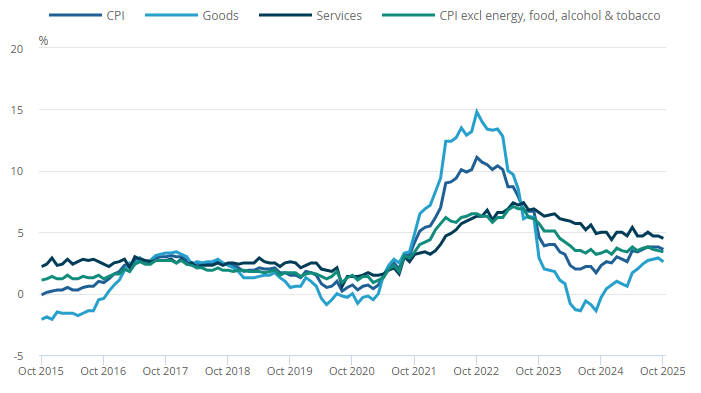

Core inflation, which strips out volatile food and energy costs and is watched closely by the Bank of England, fell only modestly to about 3.4%, signalling that domestic price pressures remain persistent. Meanwhile, food and drink inflation rose further to around 4.9%, continuing to squeeze household budgets.

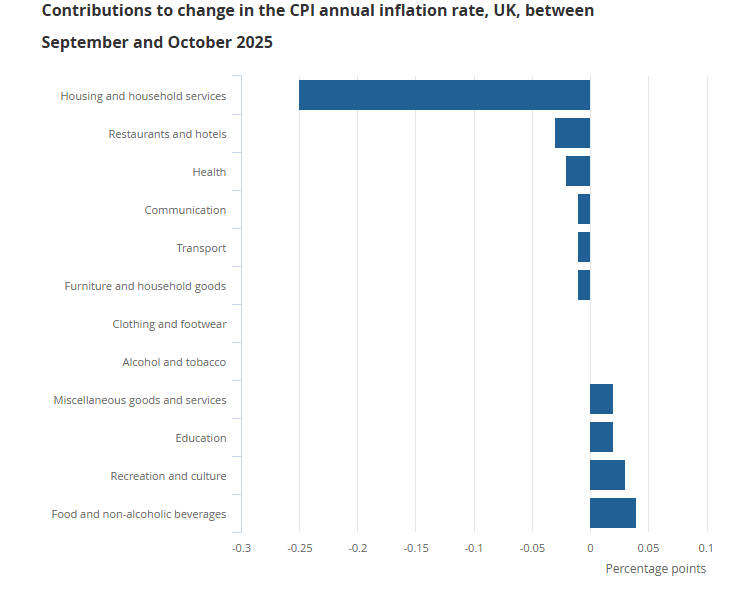

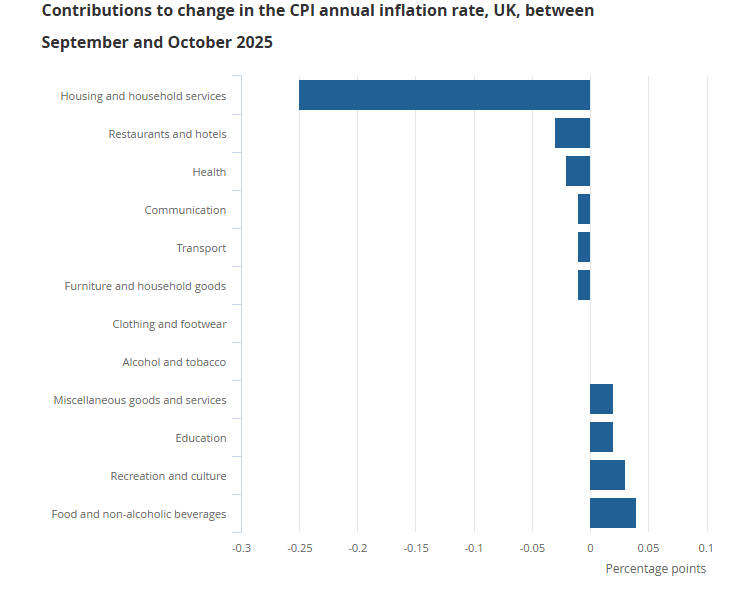

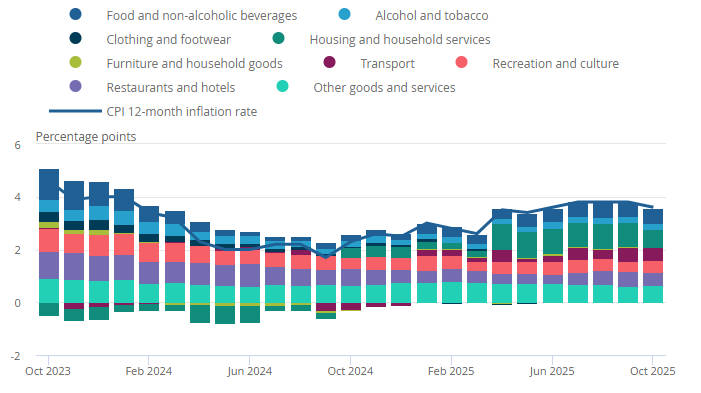

UK Inflation Drivers: Sectors Influencing the October CPI Decline

Analysing the month-on-month movements, the main downward contributions came from energy and several travel-and-leisure categories including airfares, hotel bookings, and certain discretionary services, which eased following previous surges.

By contrast, staples such as food, and services that are closely linked to wage costs, remained elevated. That split matters because a sustained drop in headline CPI driven by energy is less reassuring to policymakers than a broad-based disinflation that includes services.

| Sector |

Contribution to CPI Change (Oct 2025) |

| Energy & Utilities |

-0.15 pp |

| Transport & Travel |

-0.05 pp |

| Food & Drink |

+0.12 pp |

| Services (wage-driven) |

+0.08 pp |

| Housing (rents) |

+0.06 pp |

UK Inflation and Labour Market Pressures

The Bank of England's Monetary Policy Committee has repeatedly emphasised that services inflation and wage growth are the "sticky" components that could keep inflation above target for longer.

The small decline in core CPI will be noted at Threadneedle Street, but it does not yet remove the risk that sustained pay growth will feed through into service prices. That is one reason why some policymakers urged caution at November's policy meeting despite mounting market bets for a pre-Christmas cut.

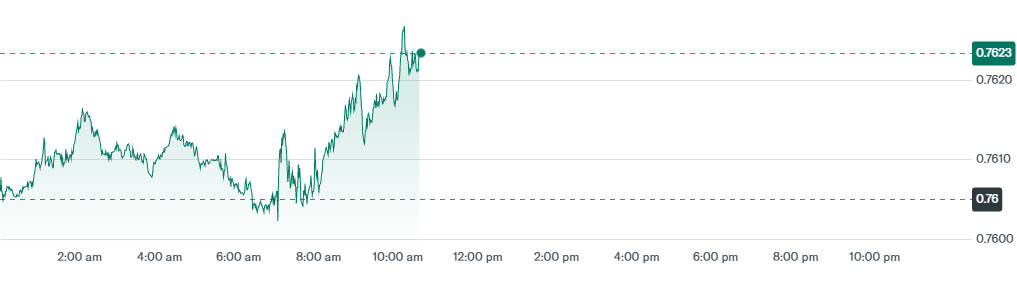

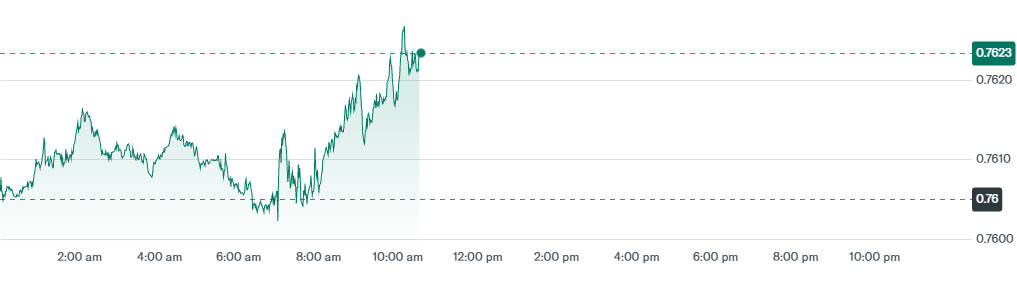

Market Reaction: Sterling, Gilts and Rate Odds

Financial markets reacted quickly to the ONS release. Sterling slipped modestly against major currencies and short-dated gilt yields eased as traders increased the probability assigned to a December 25-basis-point cut to roughly 60%.

| Asset |

Reaction |

Notes |

| GBP vs USD |

-0.2% |

Sterling weakened slightly |

| 2-Year Gilts |

-3bps |

Yields eased as markets priced in rate cut |

| Implied December BoE Cut |

~60% |

Probability of 25bp cut rose |

Broker notes and LSEG data compiled after the release pushed December cut odds higher, though commentators stress that the Bank will want to see further evidence of durable disinflation before moving.

UK Inflation and the Bank of England's Policy Considerations

The Bank of England sits in a delicate position. At its early-November meeting the MPC voted 5–4 to keep Bank Rate at 4.0%, a slim majority that underlined the committee's division and flagged the possibility of easing once fresh data and the government's fiscal plans are clear.

The Chancellor's Autumn Budget, scheduled for 26 November, represents the next key factor that could influence the Bank's stance. A fiscally cautious Budget may support a rate cut, while one perceived as inflationary could postpone it.

Government Response and the Political Angle

Chancellor Rachel Reeves has welcomed the headline CPI easing but stresses targeted measures to support households without undermining disinflation. Analysts suggest the Budget could influence the BoE's decision:

What This Means for Households and Businesses

For households, the picture is ambiguous. Softer headline inflation should help limit further erosion of real incomes, but rising food prices mean many families will still feel acute pressure.

Mortgage borrowers face a mixed outcome: those on fixed rates will be insulated from immediate moves, whereas holders of tracker mortgages will respond more quickly to any future rate cuts.

For businesses, particularly in services, persistent wage and input-cost pressures mean margins remain under strain and pricing power is fragile.

UK Inflation Forecasts and Expected Path for Monetary Policy

Economists and brokers project:

Inflation likely around 3.6% into Q4 if trends continue.

Bank of England may begin cutting rates in December 2025. with further cuts possible in early 2026.

| Forecast Source |

Expected CPI Trend |

Expected Rate Action |

| Morgan Stanley |

Stable 3.5–3.6% |

25bp cut in Dec 2025 |

| Goldman Sachs |

Slight dip |

Probable Dec cut, follow-up in 2026 |

| Bank of England |

Data-dependent |

Easing likely if disinflation continues |

Risks To The Outlook about UK Inflation

The balance of risks is two-sided. Downside risks to inflation include a sharper fall in global energy costs or an unexpectedly weak domestic demand backdrop.

Conversely, upside risks persist: continued elevation in food inflation, an unexpected pickup in services pricing, or a Budget perceived as fiscally loose could delay or reverse the easing cycle. The Bank will therefore treat incoming data with caution before changing policy.

Frequently Asked Questions

Q1: What was the UK inflation rate in October 2025?

UK inflation fell to 3.6% year-on-year in October 2025. down from 3.8% in September. The moderation was driven mainly by smaller increases in energy and transport costs, although food and core inflation remained elevated.

Q2: What is core UK inflation, and why is it important?

Core inflation excludes volatile items like food and energy. In October 2025. it was roughly 3.4%. Policymakers focus on core inflation as it reflects persistent domestic price pressures, including wages and services, which influence monetary policy.

Q3: How did the Bank of England react to the latest UK inflation data?

The BoE maintained its Bank Rate at 4.0% in November, with a 5–4 vote. Policymakers noted the headline decline but highlighted sticky core inflation, indicating they will monitor upcoming data before adjusting rates.

Q4: How did markets respond to the October UK inflation report?

Sterling weakened slightly, two-year gilt yields eased, and futures markets increased the probability of a December 25bp rate cut to around 60%. Investors interpreted the data as supporting potential easing while awaiting further confirmation.

Q5: Which sectors contributed most to the fall in UK inflation?

The decline in headline CPI was primarily driven by energy and utilities and transport/travel services, partially offset by rising food and drink prices and persistent services inflation, keeping the core CPI relatively steady.

Conclusion

October's fall in UK inflation to 3.6% is a welcome development for consumers and the government, and it has materially increased the chance that the Bank of England will begin cutting rates in December.

However, the persistence of core inflation and the rise in food prices mean the disinflation story is far from complete.

Policymakers are likely to wait for a more evident and widespread reduction in price pressures before launching a sustained easing cycle, making the next few weeks, including the Chancellor's Budget on 26 November, crucial for future decisions.

Sources:

[1]https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/october2025#toc

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.