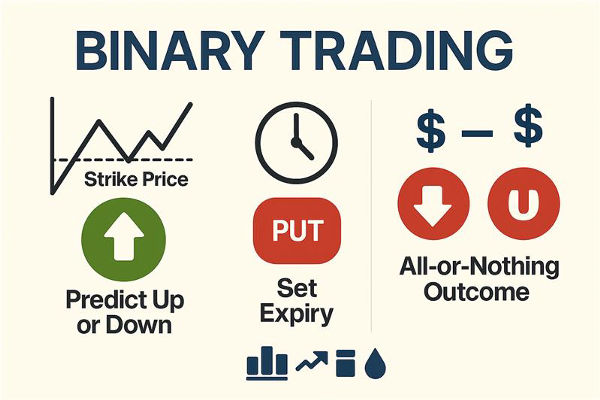

Contracts for Difference (CFDs) are popular trading instruments that allow traders to speculate on the price movements of assets without owning them. Instead of purchasing the asset itself, you agree to exchange the difference in its price between the opening and closing of a trade.

In simple terms, you profit if the market moves in your favour, and you lose if it moves against you. For example, if you buy a CFD on gold at $1,900 and sell it at $1,920, you earn the difference, excluding costs.

In this guide, we'll break down how CFDs work, show detailed examples, walk you through calculations, and explain both the upside and risks so you can trade with confidence.

How CFDs Work

When you trade CFDs, you enter into an agreement with your broker. You select:

The asset you want to trade, such as gold, index, stock or ETFs.

The direction (buy if you expect prices to rise, sell if you expect them to fall).

The trade size (measured in units, shares, or contracts).

Your leverage (how much you borrow to control a larger position).

Once you close the trade, the broker calculates the price difference between your opening and closing prices and either credits or debits your account accordingly.

Understanding Leverage in CFDs

Leverage enables you to manage a bigger position than the capital you have deposited.

For example:

If you have $1,000 and a leverage of 1:20, you can control $20,000 worth of an asset.

It amplifies potential profits but also increases potential losses.

Example:

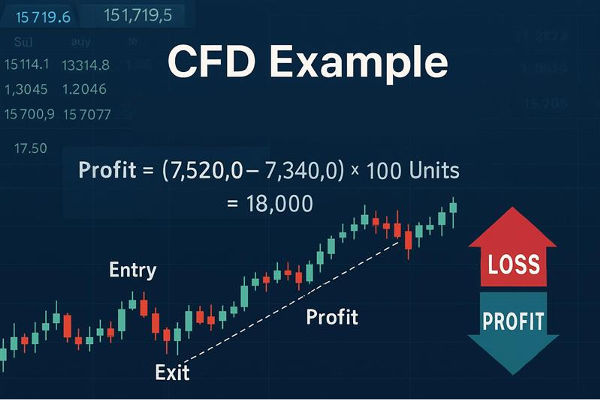

Calculating CFD Profit or Loss

The formula for CFD P/L is:

(For short trades, reverse the subtraction: Opening Price − Closing Price)

Don't forget to account for:

Spread: The difference between buy and sell prices.

Commissions: Some brokers charge per trade.

Overnight financing: Costs for holding leveraged positions overnight.

CFD Example: Long Trade Calculation

Let's say you believe gold prices will rise.

Trade Setup:

Asset: Gold

Entry Price: $1,900 per ounce

Position Size: 10 ounces

Leverage: 1:10

Total Position Value: $19,000

Margin Required: $1,900

Price Movement:

Gold rises to $1,920 per ounce.

Profit Calculation:

Price Difference = $1,920 − $1,900 = $20 per ounce

Profit = $20 × 10 ounces = $200

If the price had fallen to $1,880, your loss would be:

Loss = ($1,880 − $1,900) × 10 = −$200

CFD Example: Short Trade Calculation

You anticipate Tesla's stock will drop in value.

Trade Setup:

Asset: Tesla stock

Entry Price: $250 per share

Position Size: 100 shares

Leverage: 1:5

Total Position Value: $25,000

Margin Required: $5,000

Price Movement:

Tesla falls to $240 per share.

Profit Calculation:

Price Difference = $250 − $240 = $10 per share

Profit = $10 × 100 shares = $1,000

If Tesla rose to $260, your loss would be:

Loss = ($250 − $260) × 100 = −$1,000

Even if you predict the market correctly, trading costs can eat into your profits.

Spread: The difference between the bid and ask price.

Commission: Charged per trade (common in stock CFDs).

Overnight Financing Fee: Paid when you keep a leveraged position open overnight.

Currency Conversion Fee: If you trade in a currency different from the base currency of your account.

Example:

If your CFD profit is $500 but you paid $20 in spread and $10 in overnight fees, your net profit is $470.

Why Traders Still Use CFDs?

CFDs remain popular because they:

Allow both long and short trading.

Provide access to multiple markets from a single platform.

Offer high leverage for lower capital requirements.

Require no ownership of the asset.

Can be used for hedging existing positions.

If you own physical gold but expect a short-term drop, you could short a gold CFD to offset potential losses.

Frequently Asked Questions

Q1. How Do You Calculate Profit or Loss in a CFD Trade?

The formula is: Profit/Loss = (Closing Price − Opening Price) × Position Size (for long trades). For short trades, reverse the subtraction. Always factor in spreads, commissions, and overnight fees to get the net result.

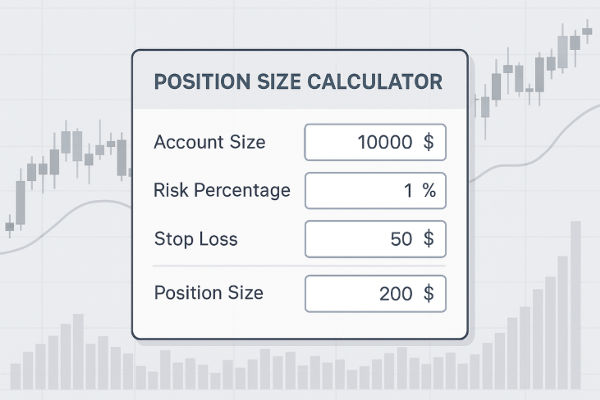

Q2. Do CFD Traders Lose More Than They Invest?

It's possible without proper risk management. Since CFDs are leveraged products, losses can exceed your initial deposit if the market moves significantly against you and you have no stop-loss orders in place.

Q3. How Can I Reduce Risk When Trading CFDs?

You can reduce CFD trading risk by using stop-loss orders, trading with lower leverage, diversifying, and practising on a demo account first.

Conclusion

In conclusion, CFDs can be powerful tools for traders who understand how they work. Utilising leverage judiciously, implementing risk management, and assessing profit and loss before executing trades can enhance your likelihood of success.

Always remember: while leverage can amplify profits, it can just as easily magnify losses. Trade responsibly and start small until you gain experience.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.