Nigeria’s retail trading community is rapidly expanding. More Nigerian traders now seek platforms offering forex and global stock access in one account. They demand transparency, rapid withdrawals, and local payment support.

EBC Financial Group meets these needs effectively by delivering a professional trading ecosystem tailored for Nigerian clients.

The broker received dual honors as “Most Trusted Broker” and “Best Trading Platform” at the 2025 World Finance Forex Awards, underscoring its excellence in technology and client trust.

Why Nigerian Traders Choose EBC Financial Group

EBC Financial Group offers a reliable trading ecosystem tailored to Nigerian clients. Here is what stands out:

Verified account access for Nigerian residents

Provides Meta 4 and Meta 5 trading platform

Real-time execution with no requotes

Regulated under FCA, ASIC, and CIMA for client fund safety

Naira and crypto funding options

No deposit or withdrawal fees

Comprehensive asset selection across forex, stocks, and ETFs

EBC Financial Group gives Nigerian traders a competitive edge with ultra-low latency execution. Orders are filled in under 20 milliseconds via dedicated servers in London and New York, ensuring minimal slippage and precise execution in fast-moving markets.

Traders can access over 60 forex pairs, including African-relevant exotics, more than 200 global stock CFDs, key commodities like oil and gold, and major indices such as the S&P 500 and FTSE 100.

Unified margin requirements also make cross-asset strategies seamless, allowing clients to manage risk efficiently.

By combining speed, market diversity, and strong risk management, EBC Financial Group empowers Nigerian traders to confidently access global markets and capitalize on every opportunity.

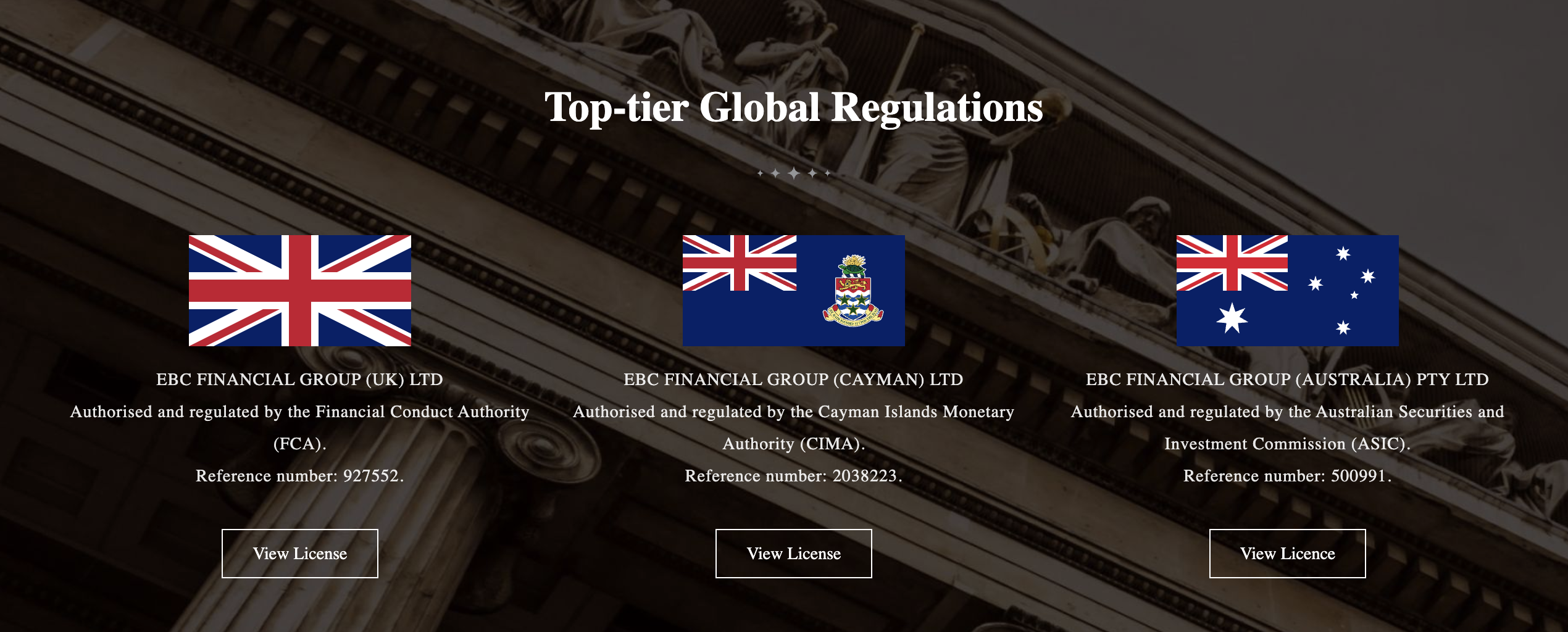

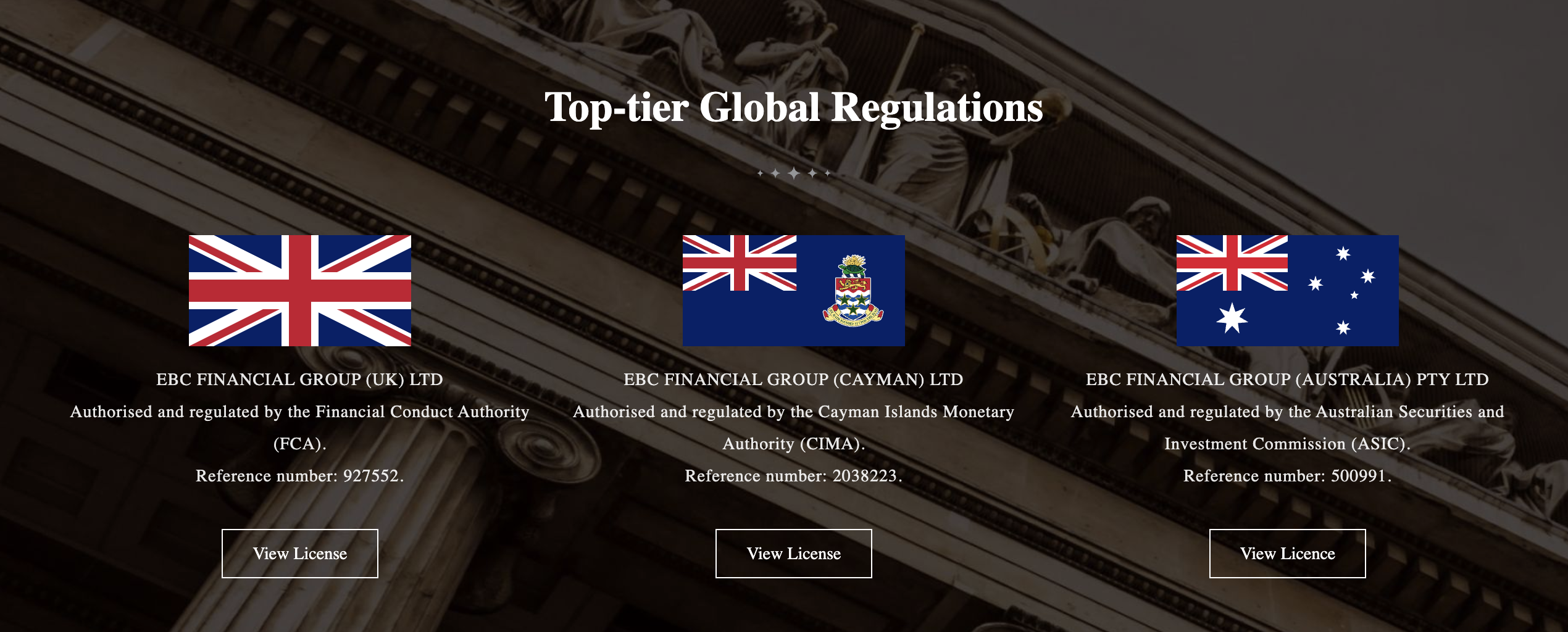

EBC Financial Group’s Security & Regulation

EBC Financial Group operates under multiple top‑tier regulatory licences ensuring that Nigerian clients can trade via a broker with global oversight, robust funds‑protection protocols, and transparent operational practices. Its regulatory credentials include:

EBC Financial Group operates under multiple top‑tier regulatory licences ensuring that Nigerian clients can trade via a broker with global oversight, robust funds‑protection protocols, and transparent operational practices. Its regulatory credentials include:

The Financial Conduct Authority (FCA) in the United Kingdom

The Australian Securities & Investments Commission (ASIC) in Australia

The Cayman Islands Monetary Authority (CIMA) in the Cayman Islands, granted as a full regulatory licence in March 2024.

Client Fund Protection Mechanisms

Segregated client accounts: Client funds are held in separate bank accounts at tier‑1 global banks, distinct from the company’s operational funds. In the event of insolvency of the broker, client funds are not mixed with corporate assets.

Robust framework compliance: Through its FCA, ASIC and CIMA licences, EBC adheres to major regulatory requirements: capital adequacy rules, regular financial audits, anti‑money‑laundering (AML) programs, and client money (funds) protection standards.

How to Start Trading with EBC Financial Group

Create Your Account: Visit EBC’s official website and sign up using your email or mobile number. Select Nigeria as your country of residence.

Complete KYC Verification: Upload a valid ID and proof of address to activate funding and withdrawals.

Select Account Type: Choose between Standard or ECN depending on your trading strategy and capital size.

Fund Your Account: Deposit using Naira through local payment partners, e-wallets, or cryptocurrency (USDT or BTC) such as Chippay and Help2Pay. Minimum deposit is USD 50.

Start Trading: Access MT4, MT5 and trade forex, stocks, gold, or index CFDs with real-time liquidity and execution speed under 50 ms.

Withdraw Profits: Use the same funding channel. Most withdrawals are processed within 1-2 business days, ensuring convenience for Nigerian users.

Case Study: How Nigerians Trade with EBC

A trader in Abuja opened an EBC account in July 2025 with a USD 100 deposit. He used the platform to buy a U.S. tech stock CFD and held the position for three months.

During this time, the stock rose by 8 percent while the Naira slightly weakened against the USD. His final withdrawal reflected profit both from the asset appreciation and currency movement.

This example shows how Nigerian traders capture dual opportunities. They leverage global stocks and forex in one account.

Risks in the Nigerian Trading Environment

Market Volatility Exposure

Leverage can significantly amplify both profits and losses in forex trading. For example, a 1% adverse price move with 1:100 leverage can wipe out 100% of capital if no protective stops are in place.

Nigerian traders must fully understand margin requirements and liquidation levels before executing trades.

Geopolitical events can trigger sudden price gaps that bypass stop orders, while flash crashes in low-liquidity conditions have historically caused 5–8% slippage. Careful position sizing relative to account equity is essential to prevent catastrophic losses during black swan events.

Currency Conversion Considerations

Funding accounts in Naira involve conversion spreads averaging 2–3%, and the timing of withdrawals can affect realized returns when converting profits back to local currency. Nigerian traders should actively monitor NGN exchange rates to optimize repatriation of funds.

Interest rate differentials also impact overnight swap charges on leveraged positions. For example, holding long EUR/USD positions incurs daily costs when European rates exceed U.S. rates.

Swing traders should factor these financing charges into their profit calculations to manage costs effectively.

Technical & Operational Risks

Platform familiarity prevents execution errors during volatile markets. Demo account practice builds muscle memory for order types and risk parameters. Nigerian traders should complete 100+ demo trades before risking live capital.

2025 Outlook: The Future of Forex and Stock Trading in Nigeria

The future of trading in Nigeria will be shaped by hyper-personalization and AI-driven analytics. The era of “one-size-fits-all” platforms is over, as discerning traders increasingly demand bespoke tools that deliver a measurable, data-driven edge.

EBC Financial Group is already leading this transformation. Their proprietary technology includes innovations such as the “Trading Black Box” and “Private Room,” offering unparalleled data transparency and performance auditing that allow traders to analyze strategies with the rigor of a quantitative fund.

Meanwhile, Nigeria’s online trading volume is projected to grow at a 5–8% CAGR through 2026, driven by fintech adoption and improved digital payment infrastructure.

As more Nigerian traders diversify into multi-asset trading such as spanning forex, U.S. equities, and commodities, EBC enables global market access with seamless local payment integration, empowering traders to compete alongside international participants.

Frequently Asked Questions (FAQ)

1. Can Nigerians legally trade with EBC?

Yes, EBC officially accepts Nigerian clients with verified local funding options.

2. What is the minimum deposit to trade with EBC?

USD 50, allowing traders to start small and test execution.

3. Which trading platforms are available on EBC?

MetaTrader 4 and 5 for manual and automated trading.

4. How fast are deposits and withdrawals?

Deposits are instant; withdrawals usually arrive in 1–2 business days.

5. Can I trade forex and global stocks in one account?

Yes, EBC allows access to forex, stocks, indices, ETFs, and commodities in one account.

Summary

Choosing the right broker is crucial for trading forex and stocks smoothly from Nigeria. EBC Financial Group offers the ideal balance of regulation, market access, and funding convenience.

With Naira deposit options, low spreads, and access to multiple asset classes, EBC provides Nigerian traders professional-grade execution without unnecessary complexity.

Whether your goal is to trade forex, global stocks, or both, EBC Financial Group equips you with the tools, security, and local accessibility needed to trade confidently in 2025.

Disclaimer: This article is for informational purposes only and should not be taken as investment or financial advice. Always conduct your own due diligence before trading with real money.

EBC Financial Group operates under multiple top‑tier regulatory licences ensuring that Nigerian clients can trade via a broker with global oversight, robust funds‑protection protocols, and transparent operational practices. Its regulatory credentials include:

EBC Financial Group operates under multiple top‑tier regulatory licences ensuring that Nigerian clients can trade via a broker with global oversight, robust funds‑protection protocols, and transparent operational practices. Its regulatory credentials include: