Binary trading, also known as binary options trading, has attracted significant attention from traders worldwide. With the promise of fixed returns and simplified outcomes—profit or loss—it's often marketed as an easy entry point for beginners in the financial markets.

However, this form of trading comes with unique mechanics, regulatory concerns, and considerable risks that both novice and experienced traders must take note of.

In this comprehensive guide, we break down what binary trading is, how it works, common strategies, major risks, and whether it is suitable for you in 2025.

What Is Binary Trading?

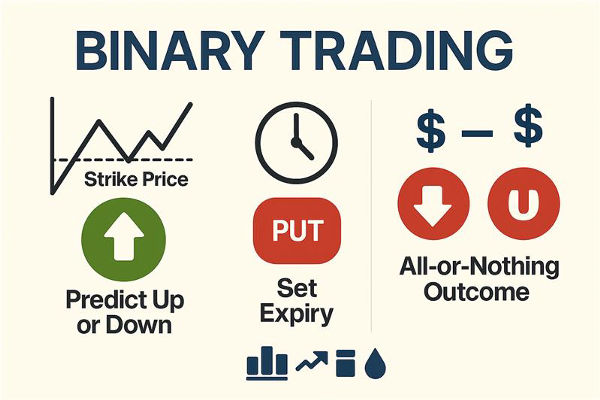

Binary trading is a type of financial trading where the trader predicts the outcome of a specific event, most often related to the price movement of an asset. The term "binary" reflects the two possible outcomes: you either make a fixed profit or lose your investment.

For example, you might speculate that the price of EUR/USD will be above 1.0800 at 3:00 PM today. If you're correct, you win the predetermined payout. If not, you lose your initial stake. The simplicity of these outcomes—"yes or no," "win or lose"—is what defines binary options.

Binary options are not about the size of the price movement but about direction within a set timeframe.

Types of Binary Options

High/Low (Call/Put) Options

It is the most basic type. You predict whether the asset's price will be above (call) or below (put) a certain level at the time of expiry.

One Touch Options

Here, the trader predicts whether the asset price will touch a predetermined price level at least once before expiry.

No Touch Options

The opposite of one-touch, where you profit if the price doesn't touch a specific level before expiration.

Boundary or Range Options

You forecast whether the asset's price will remain within a defined range or break out of it.

Each type may appeal to different trading styles, but all rely heavily on timing and price prediction within narrow windows.

Binary Options vs Traditional Options

While both involve speculation on asset prices, binary options and traditional options differ in complexity, risk, and reward structure.

Traditional options give the right (but not obligation) to buy or sell an asset at a set price before expiry, and profits can be theoretically unlimited.

Binary options have capped rewards and losses and do not involve ownership of the underlying asset.

This difference makes binary trading simpler but riskier from a statistical standpoint, as the payout structure generally favours the broker.

How Binary Trading Works

Binary options function through a simple workflow. First, you select an asset such as a currency pair, stock, commodity, or index. Then you decide:

The direction of the price (up or down)

The expiry time (ranging from 30 seconds to several hours or even days)

The amount you want to invest

You place your trade based on these choices. If your prediction is correct when the expiry time hits, you receive a fixed payout, often around 70-90% of your investment. If your prediction is wrong, you lose your entire invested amount.

This fixed-risk, fixed-reward model makes binary trading appealing, but also deceptive in terms of the probability of success and long-term profitability.

Key Strategies for Binary Trading

Trend-Following

It involves identifying a market trend using technical indicators and entering trades in the direction of that trend. It reduces the chance of betting against momentum.

Support and Resistance

Traders look for key price levels where the asset has historically reversed. These psychological barriers help traders predict price changes.

News-Based Trading

Major economic announcements can create predictable price volatility. Traders speculate on direction based on expected outcomes from events such as Non-Farm Payrolls or central bank interest rate decisions.

Candlestick Patterns

Strategies for price action that utilise candlestick patterns such as Doji, Engulfing, or Hammer formations are widely favoured for forecasting short-term movements in binary trading.

These strategies, while effective, don't guarantee profits. They require backtesting, charting tools, and an understanding of market sentiment.

Why Binary Options Are Popular

Simplicity

The "yes/no" outcome is easier to understand than calculating pip movements, leverage, or margin. It attracts beginners looking for a straightforward entry into trading.

Fast Results

With expiry times ranging from seconds to minutes, traders receive quick feedback on their trades, making binary trading feel dynamic and exciting.

Fixed Risk and Reward

The amount you risk and the potential payout are both known before placing a trade. This clarity appeals to risk-conscious traders.

Low Barrier to Entry

Many platforms allow trading with as little as $5 or $10, making it accessible to those with limited capital. Despite these perceived advantages, traders must be aware of the darker side of binary trading.

Key Risks to Understand

High Loss Rate

Most binary traders lose money over time. With average payouts at 70–80% on wins but a 100% loss on losing trades, you need to win a high percentage of your trades to break even.

Broker Conflicts

Many binary options brokers profit when you lose. This conflict of interest has led to widespread manipulation and fraud on unregulated platforms.

Psychological Pressure

Fast-paced trading can become addictive, leading traders to overtrade or participate in revenge trading, especially after experiencing losses.

Lack of Regulation

Many binary trading platforms operate offshore without oversight. It implies that traders affected by scams or withdrawal problems have no legal options available.

No Ownership or Long-Term Investment

Unlike traditional investing, binary options do not allow you to build a portfolio or benefit from dividends or long-term capital gains.

Who Should Consider Binary Options?

Binary options are best suited for:

Experienced traders looking to diversify

Individuals with strict risk control and discipline

Traders who understand the odds and are prepared for losses

They are not ideal for:

A demo account can be a good way to test binary trading strategies without financial risk.

Alternatives to Binary Trading

If you're looking for short-term speculative trading with more transparency, you might consider:

Forex Trading: Offers greater control, flexibility, and regulation.

cfd trading: Allows speculation on asset prices with leverage and stop-loss tools.

Options Trading: Though more complex, it offers flexible strategies and greater payout potential.

Day Trading: Involves real assets, regulated exchanges, and more educational resources.

Each alternative comes with its own learning curve but provides a more sustainable path to building trading expertise.

Conclusion

In conclusion, binary trading simplifies the trading process but comes with a trade-off: high risk and limited long-term profitability.

In 2025, traders must approach binary options with caution. Do your research, choose regulated platforms, and understand that while the mechanics are simple, success requires discipline, education, and strategy planning.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.