Many new traders spend hours studying indicators, chart patterns, and entry signals. Yet, the most common reason accounts blow up isn't a "bad signal"; it's poor risk management. That's where a position size calculator becomes essential.

This simple but powerful tool helps you balance risk and reward by calculating the optimal trade size based on account equity, risk tolerance, and stop-loss distance. Whether you trade forex, stocks, or crypto, position sizing is what separates sustainable traders from gamblers.

In this article, we'll explore what a position size calculator is, why it matters, how to use it effectively across different markets, and strategies to make sure your trading remains disciplined in 2025.

What Is a Position Size Calculator?

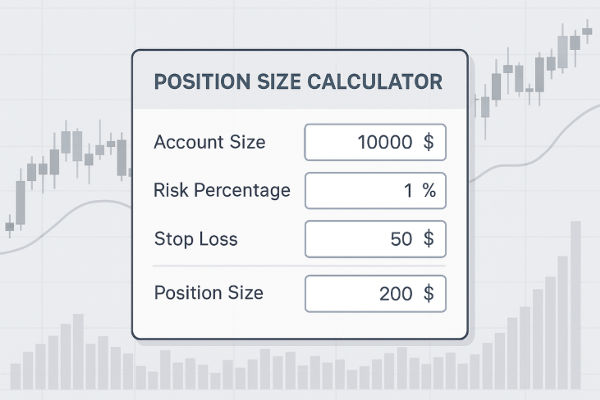

A position size calculator is a risk management tool that calculates the number of units, lots, or shares to trade based on your account balance, risk percentage, and stop-loss point.

For example:

The calculator instantly shows the correct lot size, ensuring you stick to your rules regardless of market volatility.

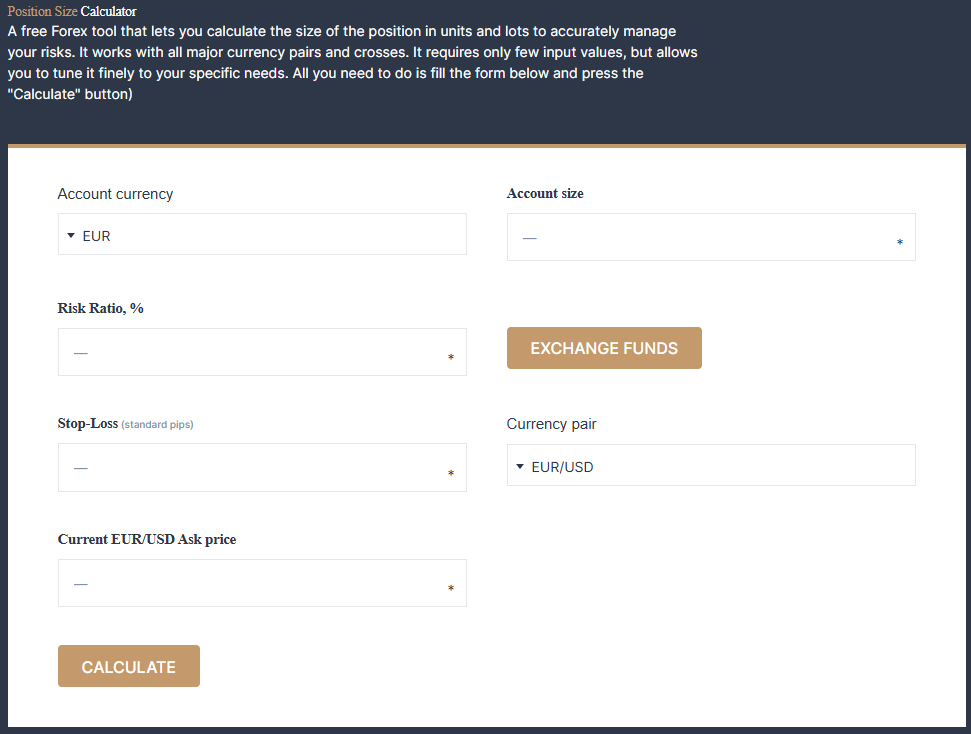

Today, most brokers, including EBC, provide free position size calculators. Thus, enter your account balance, risk percentage, and stop-loss distance, and the tool does the math for you.

Why Position Sizing Is Crucial in Trading

Position sizing is one of the most overlooked elements in trading psychology and strategy. Here's why it's so important:

Controls Risk: Ensures you don't risk too much on a single trade.

Promotes Consistency: Maintains a consistent risk percentage throughout all trades.

Reduces Emotional Pressure: Knowing your risk is capped makes decision-making easier.

Protects Your Account: Even after losing streaks, your account won't be wiped out.

Without proper position sizing, traders may over-leverage, chase losses, or risk more than they can afford, which often leads to emotional mistakes.

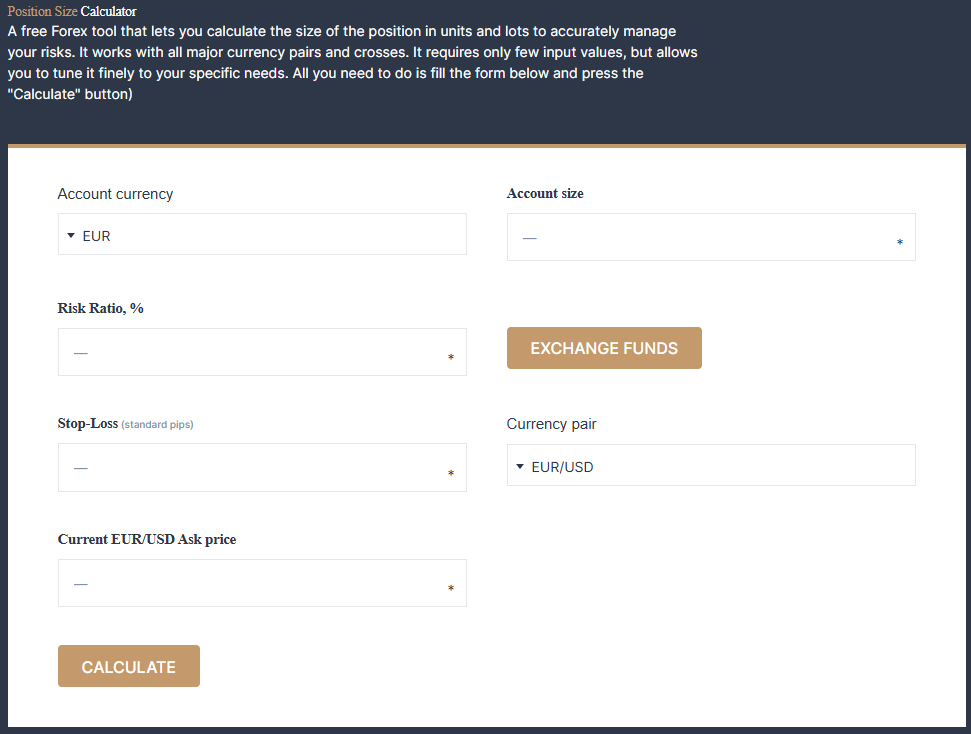

How to Use a Position Size Calculator in Forex

Forex is one of the most common markets where traders use position size calculators due to varying lot sizes and pip values.

Steps to use it:

Enter your account balance.

Choose your risk percentage (1 to 2%).

Input your stop-loss distance in pips.

The calculator provides the correct lot size.

The formula is:

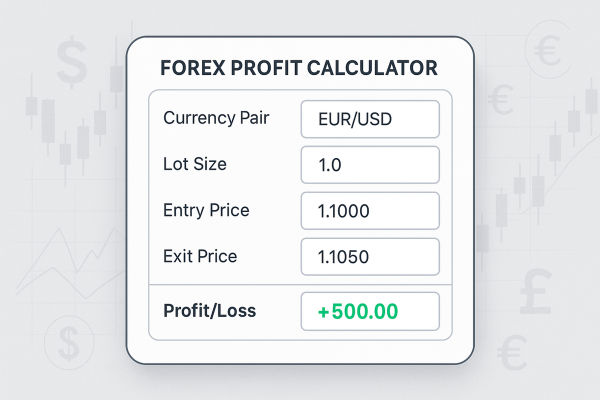

Example:

Account Balance = ₹5,000

Risk = 2% (₹100 per trade)

Stop Loss = 50 pips

Pip Value = ₹10 (for 1 lot of EUR/USD)

Position Size = ₹100 ÷ (50 × ₹10) = 0.20 lots

It means you should enter with 0.20 lots to keep risk within 2% of your account.

How to Use the Position Size Calculator in Stocks and Indices

In stocks, position sizing typically relies on share price and stop-loss distance.

Example:

Account Balance = ₹20,000

Risk = 1% (₹200 per trade)

Stop Loss = ₹5 below entry

Share Price = ₹100

Position Size = ₹200 ÷ ₹5 = 40 shares

This guarantees that regardless of the stock's price, you only risk your set percentage.

For indices like S&P 500 or NASDAQ, the principle remains the same, but with contracts or CFD lot values.

Position Sizing in Crypto Trading

Crypto markets are highly volatile, making position sizing even more critical. Traders often face sudden swings of 5 to 10% in a single session.

Using a calculator here ensures that you don't risk too much of your capital on a single Bitcoin or Ethereum trade. Since many exchanges allow leverage, traders can use position size calculators to avoid liquidation.

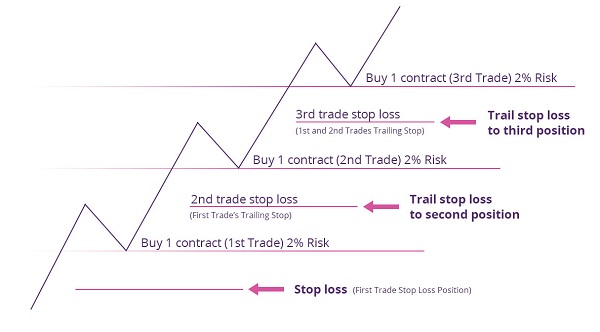

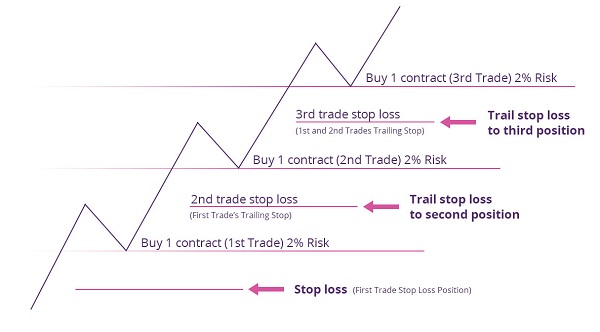

How to Balance Risk and Reward with Position Sizing

Position sizing is not just about limiting risk; it also ties into your reward strategy. A good trader balances both sides of the equation.

For example:

This means even if you lose 50% of your trades, you can remain profitable. The calculator ensures you risk the same percentage each time, making your risk-to-reward strategy sustainable.

Stop-Loss Placement and Position Size

The size of the position is always connected to the distance of the stop-loss. A narrower stop-loss results in a larger position size, whereas a broader stop-loss decreases it.

Example:

₹10,000 account, 1% risk = ₹100

20 pip stop-loss → Position Size = 0.50 lots

50 pip stop-loss → Position Size = 0.20 lots

It demonstrates why traders must align their stop-loss with position sizing to avoid oversized positions.

Forex Position Sizing Strategies for Different Traders

For Beginners

Beginners should stick to 1% to 2% risk per trade. This conservative approach helps them survive early mistakes and gain experience.

For Experienced Traders

Experienced traders sometimes risk more (2% to 3%) when they have a strong edge, but they still calculate size carefully.

For Scalpers

Scalpers may use larger lot sizes with very tight stop-losses, but strict discipline is required.

For Swing Traders

Swing traders use smaller lot sizes because stop-loss levels are wider, especially on higher timeframes.

For Crypto Traders

Extra caution is required due to volatility; smaller sizes are often safer.

Position Size Calculator Pros and Cons

| Pros |

Cons |

| Removes guesswork |

Requires accurate stop-loss input |

| Keeps risk consistent |

Can create false confidence if % risk is too high |

| Works across forex, stocks, crypto, indices |

Doesn’t guarantee profits |

| Encourages sustainable trading |

Still relies on trader discipline |

Frequently Asked Questions

1. What Is a Position Size Calculator in Trading?

A position size calculator is a tool that helps traders determine the correct trade size based on account balance, risk percentage, and stop-loss distance, ensuring proper risk management.

2. How Do I Calculate Position Size Manually?

You divide the amount you're willing to risk by the trade's stop-loss in points or pips, then adjust based on the market's pip or tick value. However, using an online calculator is faster and reduces slip-ups.

3. Can a Position Size Calculator Be Used for Stocks, Forex, and CFDs?

Yes. A position size calculator functions across various asset classes, such as forex, stocks, indices, and CFDs, provided you input the correct market variables.

Conclusion

In conclusion, a position size calculator is one of the most powerful yet underused tools in a trader's toolkit. It ensures consistency, preserves capital, and helps traders balance risk and reward, the foundation of long-term success.

Whether you trade forex, stocks, indices, or crypto in 2025, smart position sizing could be the difference between blowing an account and becoming consistently profitable. Try the free EBC Position Size Calculator today and start managing your trades like a professional.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.