Every financial market breathes through its bond market. While equities roar and commodities surge, it is government debt that whispers the real story of an economy’s pulse. Bonds capture sentiment long before headlines do. They translate expectations about growth, inflation, and risk appetite into precise numerical form. In that language, the IEI ETF speaks softly yet authoritatively. It tells traders where confidence begins to waver and when caution quietly returns.

The IEI ETF, which tracks the performance of US Treasuries with three to seven years of maturity, has become a mirror of global rate expectations. When central banks move from tightening to easing, or when inflation data surprises, the IEI ETF reflects those shifts instantly. It is neither a purely defensive play nor a speculative bet. Rather, it sits in the market’s calm midstream, balancing yield with safety. In 2025, as traders navigate high debt issuance, resilient growth, and lingering inflation risk, the IEI ETF remains one of the clearest guides to how investors truly view the future.

What Is the IEI ETF?

The IEI ETF, officially known as the iShares 3–7 Year Treasury Bond ETF, is a fund managed by BlackRock. Its objective is simple but powerful: to track an index made up entirely of US Treasury bonds that mature between three and seven years. By doing so, it provides investors with a focused snapshot of the mid-term segment of the yield curve.

As of 2025, the fund manages around USD 13 billion in assets and charges a competitive expense ratio of 0.15 per cent. It holds more than 50 separate Treasury issues, with an average maturity of approximately 4.7 years and an effective duration near 4.5 years. That means a one per cent rise in yields would translate into about a 4.5 per cent decline in the fund’s price, a level of sensitivity considered moderate by fixed-income standards.

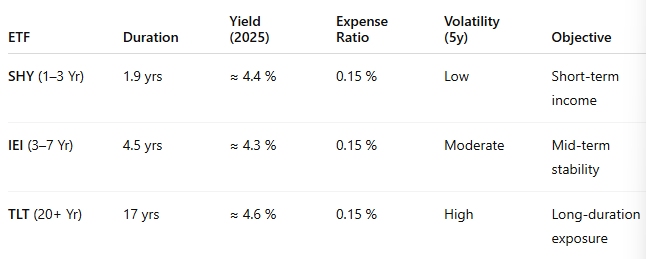

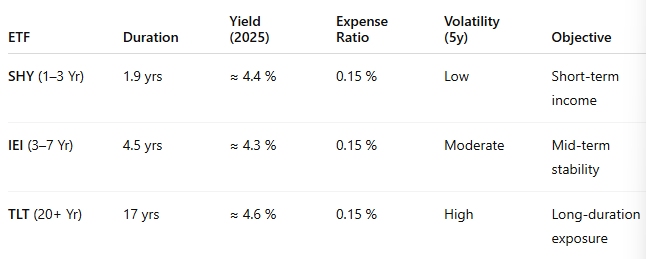

This maturity range makes IEI a favourite for traders and portfolio managers who want to position around Federal Reserve policy changes. Shorter-term funds such as SHY react too directly to overnight rate adjustments, while longer-term ones like TLT carry higher volatility. IEI, positioned in the middle, captures expectations for rates one to five years ahead, which is often where policy credibility is tested.

Why Mid-Term Treasuries Matter

Mid-term Treasuries occupy the most informative section of the yield curve. They reflect not only immediate policy but also how investors expect inflation and growth to evolve over several years. The IEI ETF’s holdings sit precisely at that intersection.

In 2025, the Federal Reserve’s benchmark rate stands at around 4.75 per cent. Market consensus anticipates one or two cuts by the second half of 2026 as inflation moves closer to the 2.3 per cent range. The five-year Treasury yield hovers near 4.1 per cent, while the two-year remains slightly higher, producing a yield curve still modestly inverted by roughly 30 basis points.

This inversion signals an economy in transition. Investors expect inflation pressures to moderate, but they are not yet ready to price in an aggressive easing cycle. In such an environment, the IEI ETF becomes the bond market’s interpreter. Rising prices in the fund usually signal that traders see easing on the horizon, while declines reflect revived fears of sticky inflation. For those monitoring cross-asset sentiment, the IEI ETF often moves a step ahead of equity volatility, providing an early warning when risk appetite starts to cool.

Inside the IEI ETF Portfolio

The IEI ETF’s portfolio is built entirely from US Treasury securities, ensuring zero credit risk. Its holdings typically span maturities such as the current three-year, five-year, and seven-year notes. The fund is market-value weighted, meaning larger bond issues receive greater representation. The average coupon rate is around 3.6 per cent, and the yield to maturity as of October 2025 sits near 4.3 per cent.

Daily trading volume exceeds one million shares, providing deep liquidity for both institutional and retail traders. The ETF distributes income monthly, making it a reliable vehicle for those seeking consistent returns without the complexity of managing individual bonds. Because it trades on the NYSE Arca, investors can enter or exit positions intraday just as easily as they trade equities.

IEI’s moderate duration makes it less volatile than long-bond ETFs while offering higher yield than short-term equivalents. In a world of uncertain inflation trajectories, this balance of stability and responsiveness has made it a staple in many diversified portfolios.

IEI ETF Performance: History and Recent Trends

The IEI ETF has experienced nearly every major bond-market cycle of the past decade. Between 2015 and 2020, it delivered an annualised return of around 1.7 per cent as yields drifted lower globally. During the 2020 pandemic crisis, as the Federal Reserve slashed rates, IEI surged by more than 6 per cent.

The picture changed dramatically in 2022 when the Fed undertook its fastest tightening in forty years. Yields soared, and IEI suffered a 9 per cent drawdown, one of the steepest on record for mid-term Treasuries. Yet the years that followed brought gradual recovery. As inflation cooled from above 7 per cent to around 2.8 per cent by mid-2025, bond prices stabilised. The IEI ETF has regained roughly 8 per cent since its lows, supported by steady coupon income and subdued volatility.

Year-to-date in 2025, the fund is up about 2 per cent including distributions. Its role as a stabiliser within portfolios has been reaffirmed, particularly as equity valuations stretched and traders sought protection from potential corrections. Compared with shorter-term funds, IEI offers higher yield; compared with long-term funds, it carries far less duration risk.

How Traders Use the IEI ETF

Traders employ the IEI ETF in several distinct ways, reflecting its unique position on the yield curve.

1. Expressing Rate Views

When traders expect yields to fall, they buy the IEI ETF to capture price appreciation. Conversely, if they expect higher yields, they may short the ETF or use CFDs to express a bearish view. In 2023 and early 2024, many hedge funds used IEI as a proxy for mid-curve steepening trades when they anticipated a shift away from aggressive Fed policy.

2. Diversifying Portfolios

IEI is popular with investors seeking to offset equity risk. Historically, mid-term Treasuries maintain a correlation of about -0.38 with the S&P 500, offering downside protection during market stress. In late 2022, when equities corrected sharply, IEI stabilised portfolio performance despite its own mild decline.

3. Yield-Curve Positioning

Sophisticated traders use IEI in pairs with short or long maturity ETFs. A long position in IEI and short position in TLT expresses the view that mid-term bonds will outperform long-term ones if yields rise moderately. Alternatively, pairing IEI with SHY allows a bet on curve steepening as policy rates fall faster than intermediate yields.

4. Managing Risk

For futures traders, IEI serves as a real-time gauge of duration exposure in five-year Treasury contracts. Its liquidity allows precise hedging before major data releases or policy meetings.

5. International Access

For non-US investors, IEI provides exposure to the world’s deepest bond market without currency-hedging complexity. It is often used as a lower-volatility way to maintain USD-denominated income streams.

Advantages of the IEI ETF

Several features make the IEI ETF a cornerstone of bond-based strategies.

Transparency: Holdings are published daily, giving investors full visibility into the fund’s composition.

Liquidity: Tight spreads and large daily volumes make entries and exits efficient.

Low Cost: The 0.15 per cent fee is among the lowest for bond ETFs.

Credit Safety: 100 per cent US government securities.

Steady Income: Monthly coupon distributions provide predictable cash flow.

Tax Efficiency: ETF structure minimises turnover and taxable events compared to mutual funds.

In periods of uncertainty, the combination of these traits often draws institutional capital into IEI as a parking ground for funds awaiting clarity on macro conditions.

Risks and Considerations

The IEI ETF, while stable, is not risk-free.

Interest-Rate Risk: The main driver of returns. A one per cent increase in yields typically causes a roughly 4.5 per cent decline in price.

Inflation Risk: If inflation rises faster than expected, real returns fall even if nominal yields hold steady.

Currency Risk: Non-US investors face potential losses if the dollar weakens.

Opportunity Cost: During strong equity bull markets, the IEI ETF can lag risk assets.

Liquidity Gaps: Although rare, spreads can widen during extreme volatility events.

The 2022–2023 experience served as a reminder that even high-quality bonds can generate negative returns when rates shift dramatically. Effective use of IEI involves recognising where it fits within a broader asset allocation.

Comparing IEI with Other Treasury ETFs

The comparison highlights IEI’s position as the balance point between safety and opportunity. SHY focuses on liquidity preservation, TLT on long-duration speculation. IEI offers an intermediate duration that reacts enough to policy change to produce returns but not enough to cause deep drawdowns. Many traders use it as a neutral core holding while taking tactical trades elsewhere.

Market Outlook for 2025–2026

Bond markets enter 2026 with cautious optimism. Inflation, which ran hot in 2022 and 2023, has cooled to below 3 per cent in most major economies. The Federal Reserve is expected to make its first rate cut by mid-2026, assuming labour markets continue to soften. Bloomberg consensus sees 10-year Treasury yields around 3.8 per cent by the end of 2026 and five-year yields near 3.9 per cent.

For the IEI ETF, this scenario implies moderate total returns of around 3 to 4 per cent per year, driven by coupon income and small capital gains as yields drift lower. Investors are watching closely how the US Treasury manages its issuance schedule, as record deficits have increased supply. Foreign demand, particularly from Japan and Europe, remains strong, keeping mid-term yields contained.

For CFD traders, the IEI ETF’s stable yield profile and consistent response to macroeconomic data make it a valuable instrument for tactical positioning around Federal Reserve meetings and key inflation releases.

Practical Application Example

Consider an investor who anticipates the Federal Reserve will begin cutting rates in mid-2026. To benefit from falling yields, they might buy IEI in early 2025. Over the following year, as market expectations adjust and five-year yields decline by 50 basis points, the fund could gain roughly 2.2 per cent in price, plus a 4.3 per cent yield, producing a total return near 6.5 per cent.

Alternatively, a trader expecting rates to rise further might short IEI or offset the position with long exposure in short-duration ETFs such as SHY. This flexibility, combined with its liquidity, explains why IEI remains one of the most traded mid-term bond ETFs globally.

The Broader Role of IEI in Modern Portfolios

Institutional investors often use the IEI ETF as a benchmark for intermediate bond performance. Its data feed forms part of the calculation for numerous risk-parity and balanced funds. Because its duration is close to the five-year Treasury, it aligns naturally with models that allocate across equities, credit, and sovereign bonds.

In multi-asset portfolios, holding IEI helps reduce volatility without sacrificing too much return potential. During 2025, as equity markets pushed record highs and credit spreads narrowed, institutions rebalanced into mid-duration bonds to lock in yields before the expected easing cycle. That rotation is visible in the steady inflows IEI has received since April, with assets under management rising nearly 10 per cent year-to-date.

Investor Sentiment and Behaviour

Sentiment towards the IEI ETF reflects broader confidence in US fiscal and monetary stability. When political brinkmanship threatens government funding or debt-ceiling debates resurface, flows briefly pause but quickly resume once resolutions appear. The ETF’s consistency makes it one of the few instruments investors trust to preserve value through cycles of uncertainty.

Data from Bloomberg Intelligence show that by mid-2025, IEI ranked among the top five Treasury ETFs for inflows, alongside TLT and SHY. Institutional buyers included pension funds and insurance companies looking to rebalance after strong equity gains. This demand supports stable pricing and tight spreads, reinforcing its reputation as a benchmark vehicle.

FAQs About IEI ETF

Q1. What index does the IEI ETF track?

It tracks the ICE US Treasury 3–7 Year Bond Index, a portfolio of government bonds representing the mid-section of the yield curve.

Q2. Who should consider investing in the IEI ETF?

Investors seeking predictable income, moderate interest-rate exposure, and diversification away from equities may find it suitable.

Q3. How does the IEI ETF respond to interest-rate cuts?

Falling policy rates lower yields, pushing bond prices higher. IEI typically benefits moderately from such shifts because of its mid-range duration.

Conclusion

The IEI ETF is more than a passive tracker of US Treasuries; it is a living reflection of how global markets interpret policy and risk. In the intricate dialogue between inflation data, central-bank action, and investor psychology, IEI translates complexity into a single tradable instrument.

In 2025’s environment of uncertain growth and cautious optimism, the IEI ETF provides traders with a calm middle ground. It reacts meaningfully to economic change but not violently, delivering yield with steadiness. Whether used to hedge, diversify, or speculate on the path of interest rates, it stands as the definitive mid-term Treasury benchmark.

Understanding the IEI ETF is, in essence, understanding how global capital feels about the future. Its movements may be subtle, but its message is constant: confidence, caution, and the ever-shifting rhythm of the world’s most watched bond market.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.