Key Takeaways

A CFD allows you to mirror an underlying asset's price change without buying the asset.

You trade on leverage, meaning you commit only a fraction of the full exposure—this boosts potential gains and losses.

Many retail CFD accounts suffer losses. For example in the UK between 61 % and 72 % of retail clients lose money when trading CFDs.

Because of financing, overnight fees, margin calls and counterparty risk, CFDs are better suited for short-term trading or hedging rather than "buy and hold".

What is CFD Trading?

A CFD (Contract for Difference) is a financial agreement that enables you to speculate on the price movement of an asset—rising or falling—without actually owning it.

Although the concept sounds straightforward, the mechanics, costs and risks of CFDs carry real complexity and often surprising implications.

This article provides an in-depth analysis of CFD trading, examining its structure, leverage mechanisms, pricing models, risk management principles, regulatory framework, and key investor considerations.

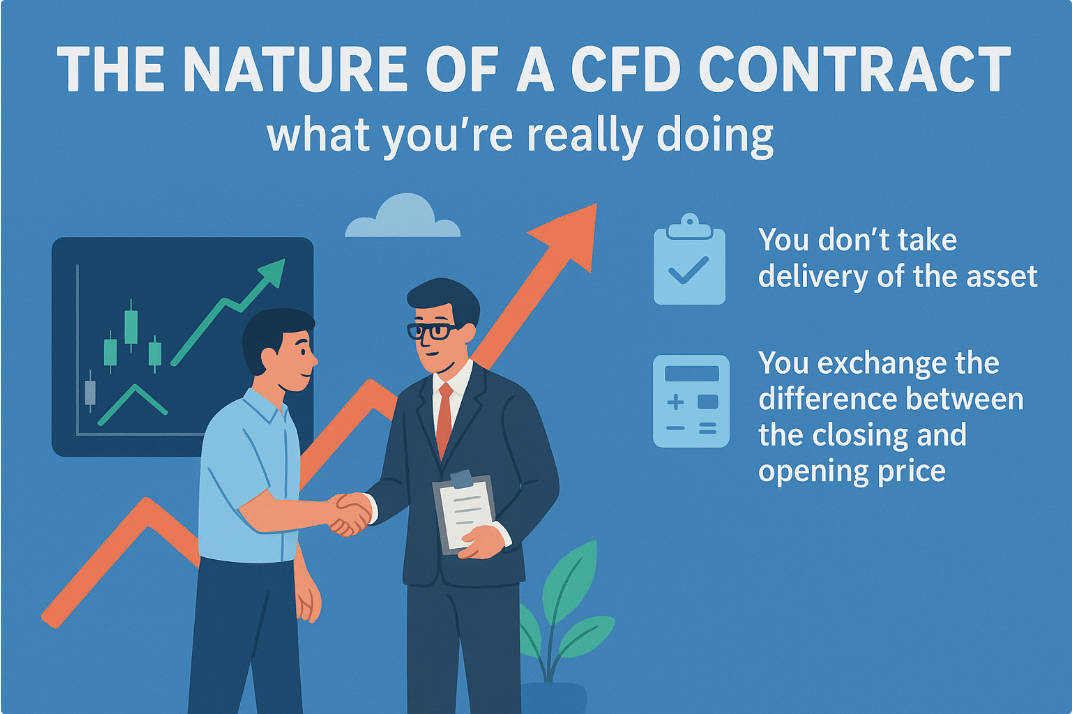

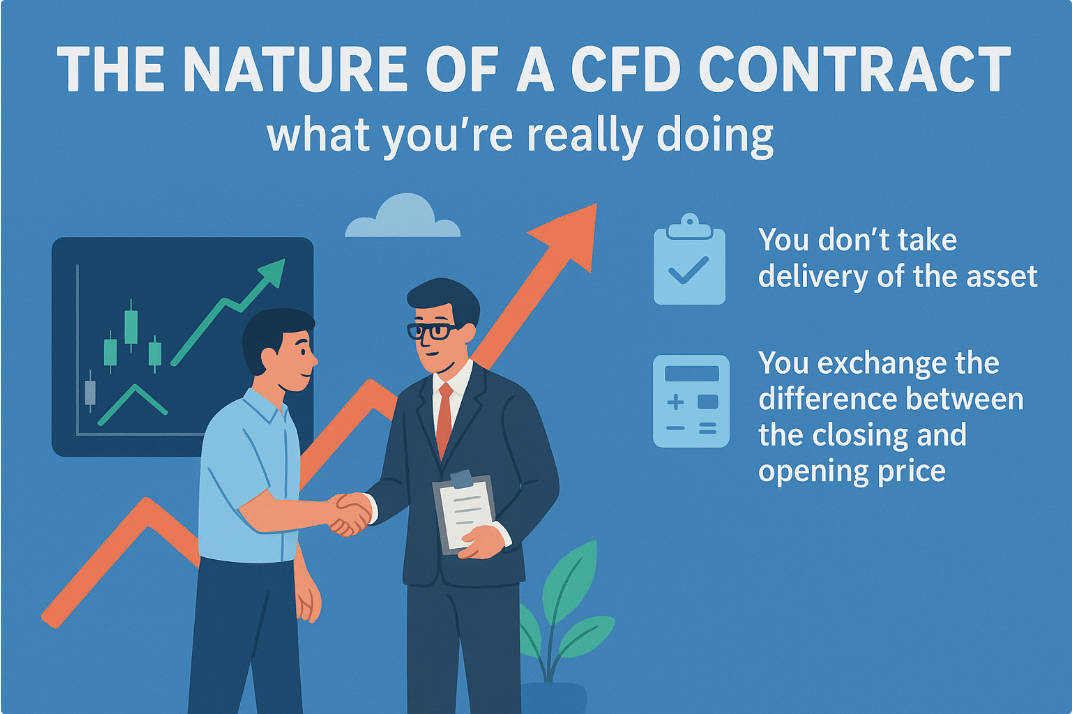

The nature of a CFD contract — what you're really doing

Imagine you and a broker agree that at time A you take a position on an asset. When you close at time B, you exchange the difference between the closing price and the opening price. That's a CFD in essence.

1. Definition and structure

You don't take delivery of the asset.

Your profit (or loss) equals the price change × size of the position (which may include a multiplier).

Because you're trading a derivative rather than buying the actual asset, you may avoid certain ownership costs (e.g., no stamp duty on a UK share CFD).

2. Broker as counter-party

3. Profit & loss calculation

Margin, leverage and sizing — managing the magnifying glass

Leverage is the magnifying glass that can make profits look large—or losses large too. Getting comfortable with margin and sizing is critical.

1. Margin basics

Initial margin is the amount you must post to open a leveraged position.

Maintenance margin is the minimum equity your account must maintain while the position remains open.

If your equity falls below this threshold, your broker may issue a margin call or automatically close (liquidate) your position.

2. How leverage works

Leverage tells you how many times your deposit controls exposure.

If leverage is 20:1. £1 of margin controls £20 worth of position. That gives potential upside—but also lets losses exceed your margin.

In the UK, for example, retail leverage is capped (e.g., 30:1 for major currency pairs) under regulatory rules.

3. Position sizing: keeping it realistic

Costs, pricing and execution — every trade has a price

Trading isn't free. The following table summarises the main cost elements for CFD trading.

| Cost type |

What it is |

Who pays / effect |

| Spread |

The difference between the broker's buy and sell price |

Implicit cost on every trade—wider spreads raise cost |

| Commission |

Fixed fee per trade (often on single-stock CFDs) |

You pay it regardless—reduces effective return |

| Overnight financing (swap) |

The cost (or earning) for holding positions past market close |

Especially relevant for longer-term trades |

| Slippage & execution cost |

Difference between expected price and actual fill |

Can erode profitability, especially in volatile or illiquid markets |

| Platform/data/inactivity fees |

Subscription, data feed charges, dormant-account fees |

Minor individually but accumulate over time |

Points to note:

Holding a position overnight incurs financing charges; chains of nights multiply costs.

Low liquidity or volatile periods can increase slippage and widen spreads; this is risk in itself.

Cheap margin does not mean cheap trading when the under-the-hood hidden costs are included.

Markets & instruments available via CFDs

One of the attractions of CFDs is the broad access to markets you might not otherwise easily reach. But that also means different rules, liquidity and risk profiles.

Shares and indices

You can trade single-stock CFDs in major exchanges and whole indices (e.g., FTSE 100. S&P 500). For stocks you often pay commission; for indices perhaps just the spread.

Forex and commodities

Major currencies (GBP/USD, EUR/USD) and commodities (gold, oil, soft commodities) are common CFD underlyings.

These tend to have higher liquidity but still carry overnight/roll-costs.

Crypto and exotic instruments

Some brokers offer cryptocurrency CFDs.

These are more volatile and subject to tighter regulation in many places.

In the UK crypto CFDs for retail clients are restricted.

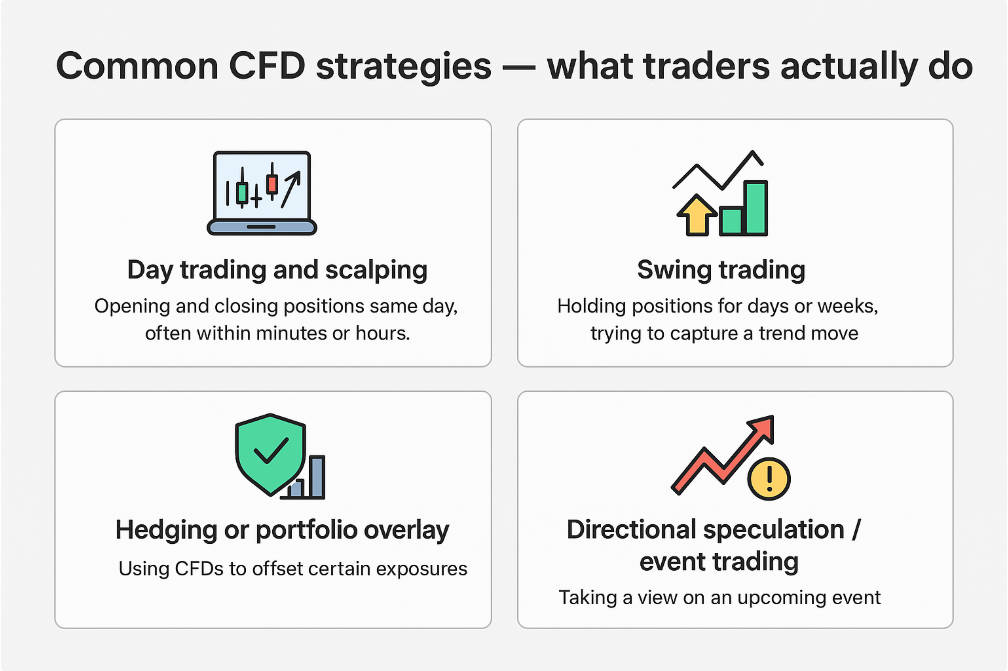

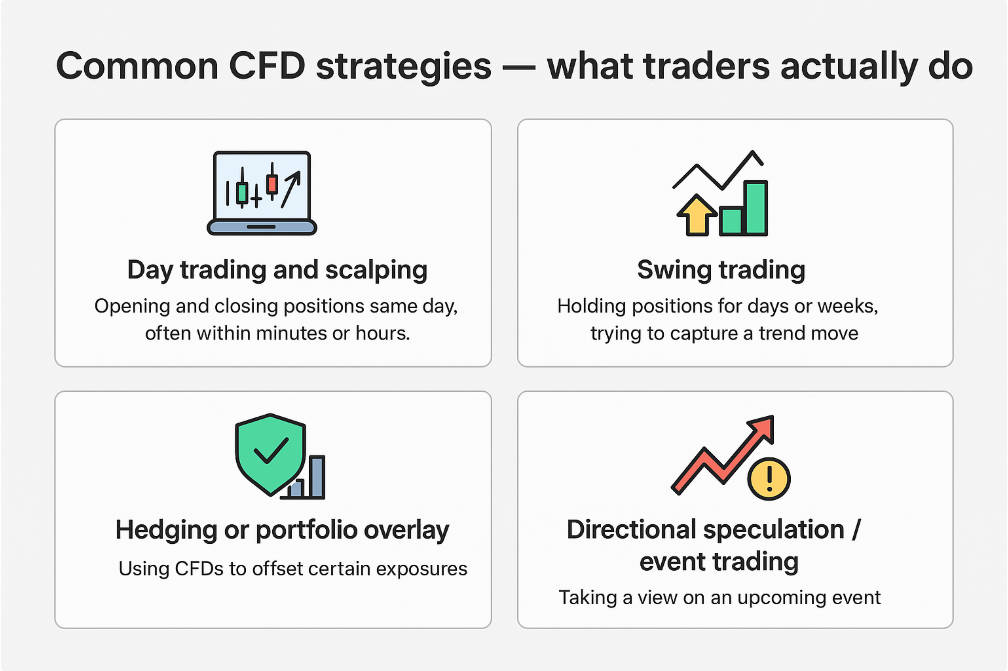

Common CFD strategies — what traders actually do

Here are four popular ways people use CFDs, with commentary on suitability and caveats.

Day trading and scalping

Opening and closing positions same day, often within minutes or hours. Requires tight spreads, fast execution and disciplined risk limits.

Swing trading

Holding positions for days or weeks, trying to capture a trend move. Good for assets with momentum but you must budget for overnight costs and news-gaps.

Directional speculation / event trading

Taking a view on an upcoming event (earnings, macro data, commodity shock) and using CFDs to express that view. High risk, high reward if you are correct; catastrophic if not.

Important caveat: None of these remove the need for a plan, stop-loss, awareness of execution cost and the chance of being wrong. Many beginners pick one of these without fully understanding the risks.

Risk-management essentials — protect the downside

Trading gains attention; protecting against losses earns respect.

1. Stop-loss and order types

Use stop-loss orders and consider brokers that offer guaranteed stops (though these cost extra). Without them a large adverse gap (e.g., weekend) may blow past your planned loss.

2. Leverage control and diversification

Using high leverage might look tempting but it also amplifies mistakes. Limit individual trades to a small percentage of your account, and avoid putting all capital into one position.

3.Counterparty, liquidity and gap risk

Because many CFDs are OTC, if your broker has issues your positions may be at risk. In low-liquidity times or during major events, you may incur slippage—closing at worse prices than you expect.

4. Behavioural risks

Frequent checking, over-trading, revenge trading after losses—they all erode performance. Regulatory reports show CFD users often make dozens of trades each month.

Regulation and investor protection — know the terrain

The regulatory environment shapes what you can do and how much you're protected.

1. Legal status and regional variation

In the UK, CFDs are legal for retail clients but under strict oversight by the Financial Conduct Authority (FCA). In some jurisdictions (notably the United States) retail CFD trading is banned.

For instance, EBC states its UK entity is regulated by the Financial Conduct Authority (FCA) (ref 927552) and offers access to a broad range of CFDs.

2. Retail client protections

In the UK/EU, rules include: maximum leverage limits (e.g., 30:1 for major FX), mandatory risk warnings, mandatory publishing of retail loss statistics, and negative-balance protection.

EBC Financial Group prioritises transparency, offering clear disclosures and educational support to help clients trade responsibly.

3. Why broker choice matters

Because you are often trading with the broker (as counterparty), the broker's regulatory status, transparency, client-money segregation and reputation matter greatly. A regulated, well-capitalised broker is a non-negotiable foundation.

4. Market size and trends

The UK retail leveraged trading market is moving towards fewer but more engaged traders.

For instance, active trader numbers dropped to ~167.000 in 2025. yet engagement rose.

EBC Financial Group aligns with this trend, offering advanced platforms and analytics for serious traders.

Getting started — step-by-step checklist

Here's a practical launchpad.

Educate yourself: Start by getting comfortable with the mechanics, margin, leverage, and using a demo account.

Pick your broker carefully: Verify FCA regulation (or equivalent), compare spreads, overnight financing rates, check published loss-rate disclosures.

Open a demo account: Practice trade entry/exit, stop placement, sizing, margin management.

Build a trading plan: Define chosen instruments, your allowed risk per trade (e.g., 1 % of account), maximum daily loss, trading hours.

Start small: Use low leverage initially, monitor your trades and journalling outcomes.

Review and refine: After a number of trades reflect on what worked/what didn't, adjust your plan accordingly.

Final reflections

CFDs offer a flexible way to access a variety of markets and take directional views with relatively little capital.

If you intend to trade CFDs: begin with a demo, treat it like a business (trade plan, size, stop-loss), choose a regulated broker, and start with small positions.

Remember: making money consistently with CFDs is difficult—and protecting your downside is often more important than chasing the upside.

Frequently Asked Questions

Q1: Do I own the underlying asset when I trade a CFD?

No — you don't hold the actual asset. You hold a derivative that reflects the price movement of the underlying.

Q2: Can I lose more than I deposit in a CFD trade?

Potentially yes. While many UK brokers offer negative-balance protection (so you cannot lose more than your account equity), in some jurisdictions or under some conditions you might face losses beyond your deposit.

Q3: What proportion of CFD traders lose money?

Industry surveys suggest between 62 % and 82 % of retail CFD traders lose money in a given year.

Q4: Are CFDs suitable for long-term investing?

Generally no. The overnight financing costs, the effect of leverage, and the derivative nature make them more appropriate for shorter-term trading or hedging, rather than a "buy and hold" strategy.

Q5: How should I select a CFD broker?

Look for strong regulation (FCA, ASIC, CySEC), transparent pricing and disclosures, published retail-loss statistics, clear margin/leverage rules, good client-money segregation and reliable execution.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.