To summarise, leverage trading is a strategy that allows traders to control larger positions in financial markets with small capital.

By borrowing funds from a broker, traders can amplify their exposure to market movements, potentially increasing profits and losses. This practice is prevalent in forex and stock markets, offering opportunities and risks that require careful consideration.

Understanding What Is Leverage Trading

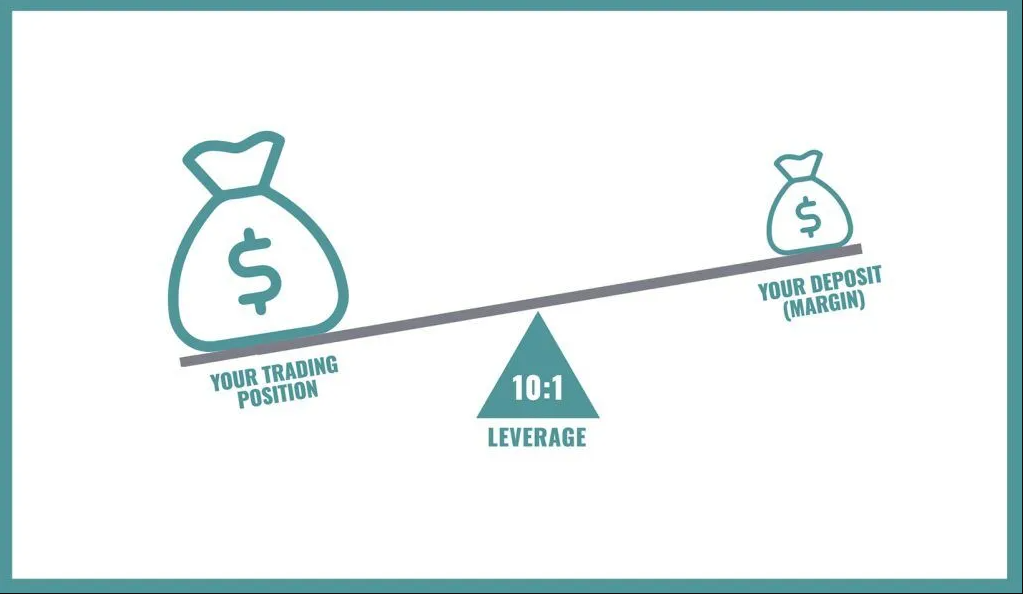

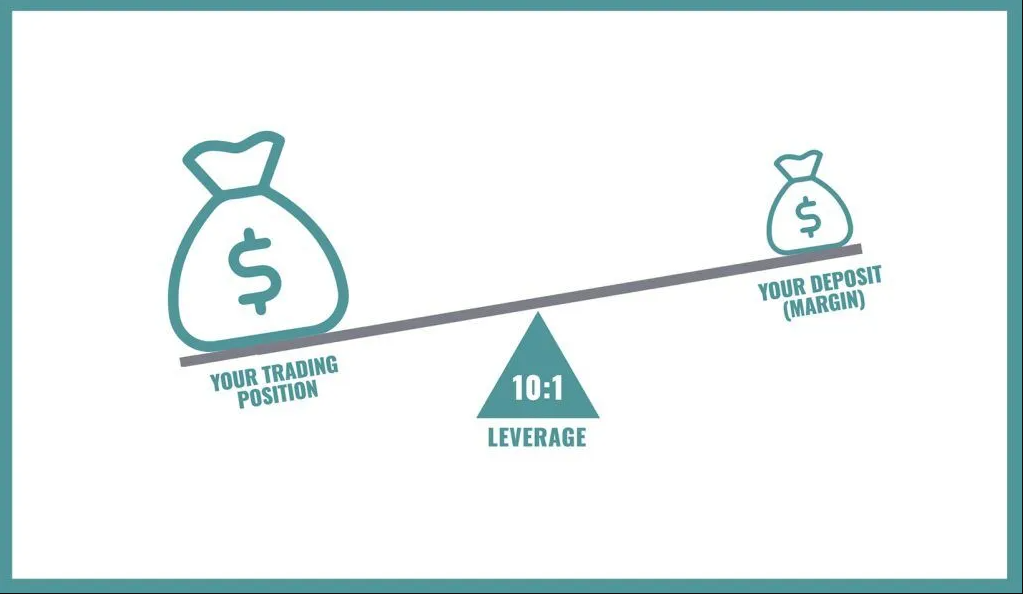

At its core, leverage trading involves using borrowed capital to increase the potential return on investment. In forex trading, leverage is commonly used due to the market's high liquidity and volatility. For example, a trader might use a 50:1 leverage ratio, meaning they can control a $50,000 position with just $1,000 of their capital.

In stock trading, leverage is typically accessed through margin accounts, where brokers lend funds to traders based on the value of their existing portfolio.

When engaging in leveraged trading, traders are required to maintain a margin account with their broker. The margin is the initial deposit needed to open a leveraged position. For instance, with a 2% margin requirement, a trader must deposit $2,000 to control a $100,000 position. If the market moves in the trader's favour, profits are calculated based on the full position size, not just the margin.

Conversely, losses are also magnified, and if the account's equity falls below a certain threshold, the broker may issue a margin call, requiring additional funds to maintain the position.

Leverage Trading in the Forex Market

The forex market is known for its high-leverage offerings, often ranging from 50:1 to 500:1, depending on the broker and regulatory environment. This high leverage is possible due to the market's liquidity and the relatively small price movements in currency pairs.

However, while high leverage can magnify profits, it also increases the risk of substantial losses, making risk management crucial for forex traders.

Forex Leverage Trading Strategies

Forex markets are highly liquid and open 24 hours a day, five days a week. This environment lends itself well to leveraged trading because currency pairs often experience minor fluctuations on a percentage basis compared to equities.

With typical leverage ratios ranging from 50:1 to 500:1 depending on the region and broker, traders can manage substantial positions with relatively little capital. However, the margin for error is razor-thin, so managing that exposure is key.

1) Position Sizing Based on Risk Percentage

Instead of betting a fixed amount of currency on each trade, traders calculate the size of their position based on how much of their total account they're willing to risk — usually between 1% and 3%.

This approach ensures that even a losing streak won't wipe out their capital. With stop-loss orders, this strategy keeps the risk manageable even at high leverage.

2) Trading During High-Liquidity Periods

Traders utilise this strategy during the overlap between the London and New York sessions when market movements tend to be more predictable and spreads are tighter.

Leveraged positions are more efficient when spreads are minimal because you reduce the cost of entry and exit, which is crucial when working with amplified exposure.

3) Scalping and Intraday Trading

These short-term strategies take advantage of small price movements, entering and exiting positions within minutes or hours. Since profits per trade are typically small, leverage becomes essential to make these trades worthwhile.

However, due to the frequency of trades and the compounding risk, these strategies demand strict discipline and automation through limit and stop-loss orders.

4) Carry Trading

It is a strategy unique to forex, where a trader uses leverage to take advantage of interest rate differentials between two currencies.

For example, borrowing a currency with a low interest rate and investing in one with a higher rate can yield daily profits based on the interest difference. Leverage amplifies those yields, but you must carefully monitor the risk of sudden exchange rate reversals.

Leverage is generally more regulated and conservative in stock markets than forex. Traders can access leverage through margin accounts, where brokers lend funds based on the trader's existing equity. Regulatory bodies often set maximum leverage limits to protect investors from excessive risk.

For example, in the United States, the Federal Reserve's Regulation T allows a maximum initial margin of 50%, meaning traders can borrow up to half the purchase price of securities. Maintenance Margin Requirements also apply, ensuring the account maintains a minimum equity level to support leveraged positions.

Stock Leverage Trading Strategies

1) Using Leverage for Blue-Chip or Dividend-Paying Stocks

These equities are typically less volatile, making them safer candidates for leverage. Investors might use margin to double their exposure in a stable, income-generating stock, enhancing dividend returns and capital appreciation.

The risk is lower than using leverage on small-cap or speculative stocks, though the gains are proportionally modest.

2) Swing Trading

Here, traders hold positions for several days to weeks to capture medium-term price movements. When paired with leverage, swing trades can yield strong returns with relatively controlled exposure. Traders using this strategy usually rely on technical analysis tools like moving averages, RSI, and MACD to identify trends and entry points.

With leverage, they must monitor margin requirements and have predefined exit points if the trend reverses.

3) Event-Driven Trading

Traders use leverage to bet on price movements related to earnings announcements, product launches, or mergers and acquisitions. These events can cause sharp, short-term price movements that leveraged positions can exploit.

However, these are high-risk and often involve increased volatility and slippage, so tight risk management and immediate execution are crucial.

4) Hedging

Traders may hold a long-term stock position and use leveraged instruments like options or inverse ETFs to hedge against potential downturns. It allows the investor to keep their position intact while managing short-term risk.

While not a direct form of leverage, this use of derivative instruments often involves margin and exposure beyond the capital invested.

Risks and Regulatory Considerations

Regardless, risk control is the cornerstone of any leverage trading strategy. Traders should always define risk before entering a trade and never rely on hope when positions go against them. Stop-loss orders, trailing stops, and proper account sizing are non-negotiable. Keeping leverage ratios low until confidence and experience build is another common-sense approach.

It's also critical to understand the broker's margin call policy. In volatile markets, positions can move quickly, and if equity falls below required maintenance levels, brokers will liquidate positions automatically. It can lock in large losses. Therefore, traders need to keep additional capital in their accounts as a buffer, especially when markets are volatile.

Lastly, regulatory bodies have implemented measures to control leverage in trading. For instance, in the United States, the Commodity Futures Trading Commission (CFTC) limits leverage for retail forex traders to 50:1 on major currency pairs and 20:1 on others.

In the European Union, the European Securities and Markets Authority (ESMA) has set leverage limits ranging from 30:1 for major currency pairs to 2:1 for cryptocurrencies. These regulations aim to protect investors from excessive risk and promote market stability.

Conclusion

In conclusion, leverage trading offers the potential for enhanced returns in forex and stock markets but comes with significant risks that require careful management.

Only by understanding how leverage works, adhering to regulatory requirements, and employing sound risk management strategies can traders begin considering this strategy.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.