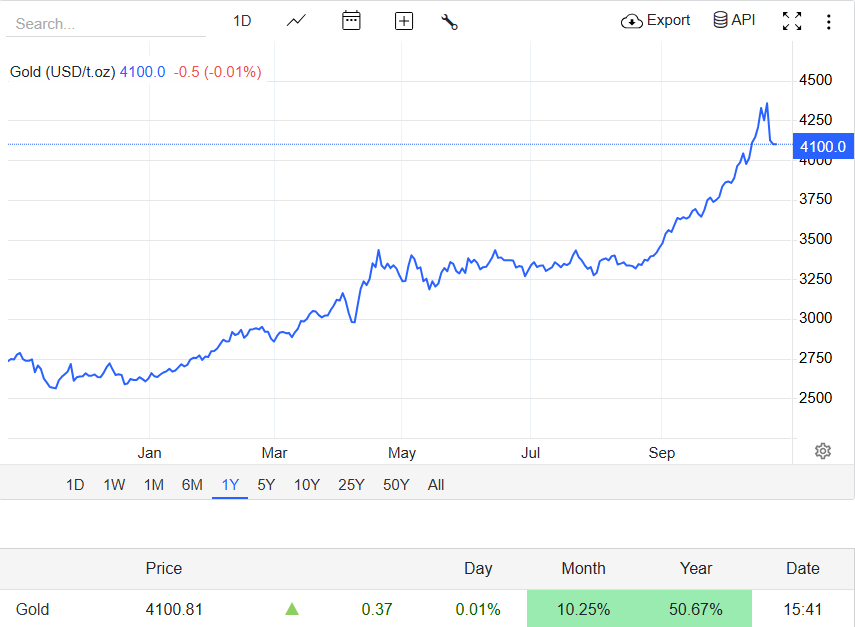

Gold continues to dominate headlines as it hovers near record highs above $4,300 per ounce in October 2025. But with markets on edge over the Fed's next move, many investors are asking: Will gold prices finally cool down, or are more highs ahead?

In the immediate days ahead, most market indicators suggest that gold will remain stable or rise further rather than decline significantly.

The interplay of increased central-bank acquisitions, heightened investor interest, and surging anticipations of U.S. rate reductions has bolstered spot gold to approximately $4,300–$4,350/oz in late October 2025.

That said, gold remains vulnerable to short-term dips if U.S. economic data surprises to the upside or the Fed errs on the hawkish side.

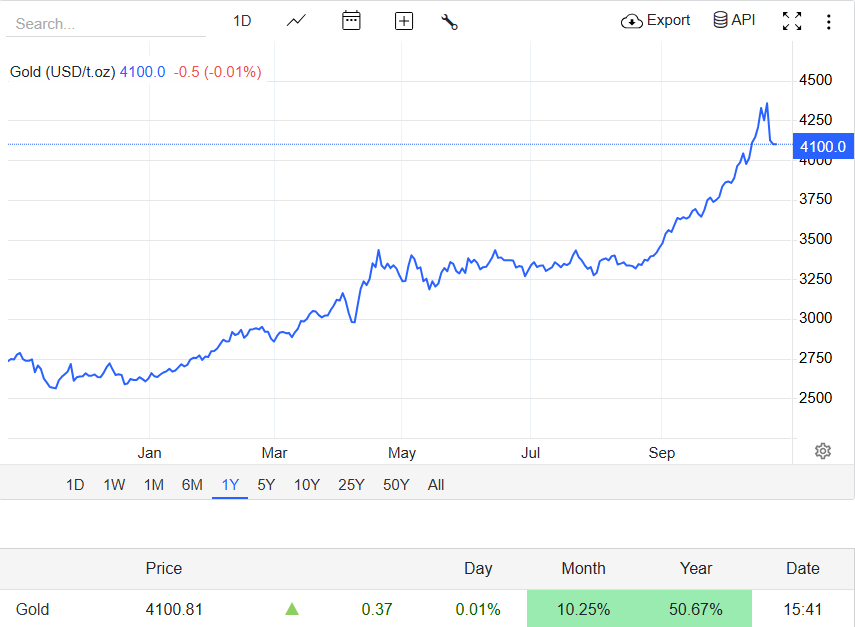

What's Happening to Gold Right Now? (October 2025 Data)

1) Spot Gold

Gold has been fluctuating in the range of $4,250 to $4,350 per ounce in mid-to-late October 2025, with recent intraday highs approaching $4,370 to $4,380. The price reached records earlier in the month as safe-haven demand surged.

2) Futures and Volumes

Volumes and open interest remain elevated, signalling active positioning ahead of key macroeconomic events. Market reports indicate persistently strong ETF inflows and central bank buy orders.

3) Analyst Forecasts

Major banks have raised medium-term forecasts. For example, Bank of America has increased its 2026 gold price forecast to $5,000 per ounce, while HSBC expects average prices around $3,455 per ounce in 2025, fueled by robust demand and lasting expectations for Federal Reserve easing. [1]

4) Central Banks

China and several emerging market central banks have been making substantial gold purchases for 10 consecutive months this year to diversify away from dollar assets.

According to the World Gold Council's Q3 2025 data, global central banks purchased over 1,000 tonnes YTD, led by China, India, and Turkey, the strongest accumulation pace since 2022. This institutional demand continues to underpin prices.

Gold's Sudden Pullback on October 22: A Temporary Dip or Trend Shift?

In late October (Oct 21-22), gold dropped sharply, having scaled intraday records near $4,370–$4,380/oz. It then sank into the low $4,000s amid profit-taking, dollar strength and investor repositioning. [2]

Market commentary emphasised that the move appeared technical rather than the start of a major downtrend.

Scenario Analysis: Three Plausible Near-Term Cases for Gold

Bull case (40% probability):

Fed signals easy money policy, real yields decline, PBOC maintains buying; gold breaks above $4,500 and tests $4,700–$4,900 by early 2026. Upgrades by multiple banks support this scenario.

Base case (45% probability):

Fed signals patience, data remains mixed; gold consolidates in the roughly $4,000–$4,300 range, with central bank buying and solid ETF demand preventing sharp declines.

Bear case (15% probability):

Strong U.S. economic data or Fed hawkish surprise pushes real yields and the dollar higher, forcing gold down toward $3,800–$3,900; a short correction unless fundamentals change.

Will Gold Rate Decrease in Coming Days 2025? Expert Consensus

1) Goldman Sachs and Bank of America have raised price targets amid structural central bank demand and risk-off positioning.

2) Independent brokers describe the recent correction/volatility as a buying opportunity, emphasising medium-term bullish momentum. Support near $4,000 and resistance near $4,300 set the stage for current trading ranges.

Short-term volatility of 2–5% in intraday pullbacks is normal in trending markets and does not indicate a trend reversal unless macroeconomic conditions shift dramatically.

The Big Drivers: Why Gold Won't Collapse Soon

1. Fed Outlook and Interest Rates

Investors anticipate that the Federal Reserve will finish its tightening phase shortly, with possible rate reductions beginning in late 2025 or early 2026. Lower real rates would support higher gold prices.

2. Dollar Strength / Weakness

The U.S. dollar index (DXY) has been in the high-90s (~98-99) in October. A weaker dollar would benefit gold, though sharp USD upticks pose short-term risks. [3]

3. Central-Bank Buying

Central banks, particularly in China, India, and other emerging markets, are actively diversifying their reserves into gold, creating a solid and reliable price floor.

4. Physical and ETF flows

While physical demand from retail Indian and Middle Eastern markets slightly slowed due to high prices, global ETF inflows remain positive, indicating persistent financial investor demand for gold exposure.

5. Geopolitics and Trade Policy Shocks

Continuing geopolitical risks and tariff tensions keep a safe-haven bid under gold, fostering price resilience.

Practical Guidance for Different Investors

Traders (Short-Term)

Utilise strategically placed stops below recent support levels (around $4,000) to manage risk and trade in response to key U.S. data and Federal Reserve communications.

Expect intraday swings of 2-5% in trending environments.

Investors (Medium to Long-Term)

Portfolio & Financial Planners

Revisit gold allocation strategies, and factor in both upside and correction scenarios.

Utilise a combination of physical assets, ETFs, and futures positions that correspond with the risk profile and investment timeframe.

Frequently Asked Questions

Q1. Is Gold Expected to Decrease in Price in the Short Term?

Minor corrections are possible if inflation eases or if the Fed remains hawkish. Geopolitical issues and macroeconomic uncertainties indicate that prices are likely to remain high overall.

Q2. Is Gold a Buy Now?

For long-term strategic investors seeking a hedge, accumulation on dips is reasonable given central bank demand and rate-cut expectations. Traders should use disciplined risk management.

Q3. How Can Investors Protect Themselves if Gold Prices Drop?

You can hedge with ETFs, diversify into other commodities, or buy in small quantities during price dips to average costs over time.

Conclusion

In conclusion, updated data through late October 2025 support a gold price environment that is poised to hold or modestly rise toward year-end, rather than collapse. The metal's surge is supported by significant central bank demand, solid ETF and flow dynamics, and the anticipation of future Fed rate reductions.

While short-term dips can occur amid stronger U.S. data or dollar rallies, active risk management and market awareness will remain key for participants navigating this volatile but bullish environment.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.reuters.com/business/finance/bofa-hikes-gold-price-forecast-5000oz-2026-2025-10-13/

[2] https://www.reuters.com/world/india/golds-record-run-pauses-investors-book-profits-2025-10-21/

[3] https://www.reuters.com/world/india/gold-inches-down-dollar-firms-focus-us-inflation-data-2025-10-23/