If you want to start CFD trading, the first step is to understand what CFDs are and how they work. Begin by learning the basics of leverage, margin, and market movements. Then, choose a regulated broker, open and fund an account, and start with a demo account to practice risk-free.

Once you're comfortable, apply a tested trading strategy, utilise strict risk management tools like stop-loss orders, and trade in markets you understand, whether that's forex, commodities, indices, or stocks.

In this guide, we'll walk you through each step, explain proven strategies, and highlight the risks so you can start CFD trading with confidence.

Step-by-Step Guide on How to Start CFD Trading

1) Understanding What CFD Trading Is

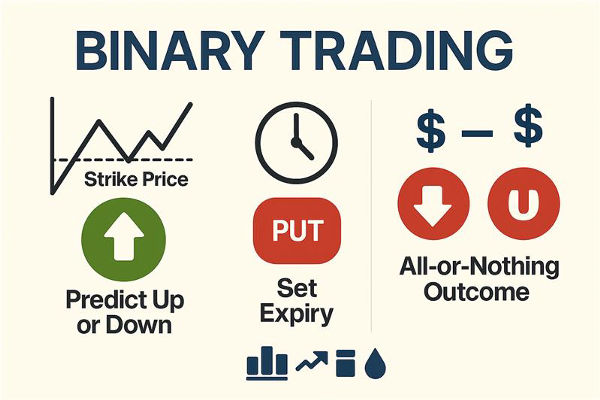

A Contract for Difference (CFD) is a financial derivative that allows traders to speculate on the price movement of an asset without actually owning it.

When you open a CFD position, you agree to exchange the difference in the asset's price between the time the contract is opened and when it is closed.

If the price moves in your favour, you make a profit.

If the price moves against you, you incur a loss.

CFDs cover a wide range of markets, including:

Forex currency pairs

Precious metals like gold and silver

Indices such as the S&P 500 or FTSE 100

Commodities like oil and natural gas

Cryptocurrencies such as Bitcoin

Stocks from global exchanges

2) Learning How CFD Trading Works

CFD trading involves speculating on the direction of the market. You can either:

CFDs use leverage, meaning you only need to deposit a fraction of the trade's value, known as the margin. While leverage amplifies potential profits, it also increases the risk of larger losses.

Example:

If you buy 1,000 CFDs of a stock priced at ₹200 with a 10% margin, you only need ₹20,000 to open the position. If the price rises to ₹210, you gain ₹10 per share, making a ₹10,000 profit. If the price falls, losses are equally magnified.

3) Choosing a Regulated Broker with Multiple CFD Markets

After learning the basics, select a CFD broker that is licensed by recognised financial authorities, offers a reliable platform, fast trade execution, and transparent fee structures, such as EBC Financial Group.

For context, EBC is known for its fast execution speeds, tight spreads, and a wide range of tradable CFDs, including forex, commodities, indices, and more.

With advanced trading platforms, strong regulatory compliance, and competitive leverage, EBC is an ideal choice for traders looking for reliability and transparency in the cfd market.

After that, complete the KYC process and deposit funds into your trading account. However, if you want to practice first, you can practice trading with virtual funds in a demo account to test strategies without risking real capital.

4) Practising Popular CFD Trading Strategies

Trend Following Strategy

Identify and follow the prevailing market trend using indicators like Moving Averages or MACD.

Breakout Trading

Enter trades when the price breaks through key support or resistance levels, signalling potential strong momentum.

Scalping

Execute multiple small trades throughout the day to profit from minor price movements.

Swing Trading

Hold positions for several days to capture medium-term price moves.

Hedging with CFDs

Use CFDs to offset potential losses in other investments, such as shares or physical commodities.

5) Applying Risk Management in CFD Trading

Lastly, risk management is crucial to long-term success. Traders should:

Use stop-loss orders to limit potential losses.

Avoid overleveraging their account.

Only risk a small percentage of capital per trade.

Diversify across different assets instead of focusing on a single market.

Additional Tips for Successful CFD Trading

Keep Emotions in Check: Stick to your trading plan and avoid impulsive decisions.

Stay Updated on Market News: Economic data releases, central bank meetings, and geopolitical events can impact prices.

Test Your Strategy: Backtest and paper trade before using real funds.

Control Leverage: Use the lowest leverage needed to meet your goals.

Review Trades Regularly: Learn from past trades to improve your approach.

Frequently Asked Questions

Q1. Is CFD Trading Good for Beginners?

A: CFD trading can be suitable for beginners if they take the time to learn, start with a demo account, and use strict risk management. However, CFDs are leveraged products, meaning losses can be significant if not managed carefully.

Q2. How Much Money Do I Need to Start CFD Trading?

A: Many brokers allow you to start with as little as $100–$500, but it's best to start with an amount you can afford to lose. The actual requirement depends on the broker, the provided leverage, and the market in which you trade.

Q3. Do I Need Special Software to Trade CFDs?

A: Yes, you'll need a trading platform, often provided by your broker. Popular platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and proprietary web-based platforms designed for CFD trading.

Conclusion

In conclusion, CFD trading can be a powerful way to access global markets and diversify your portfolio, but it's not without risks. By starting small, using a well-thought-out strategy, and managing risks effectively, traders can increase their chances of success.

Whether you're looking to profit from short-term market moves or hedge existing investments, CFDs offer flexibility that traditional investing cannot match.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.