Introduction

The bid-ask spread is a key concept in trading and investing that represents the difference between buying and selling prices in the market. It matters because it reflects both market liquidity and the cost of executing a trade.

Understanding the bid-ask spread helps traders identify market liquidity, control transaction costs, and make more efficient buy and sell decisions.

Definition

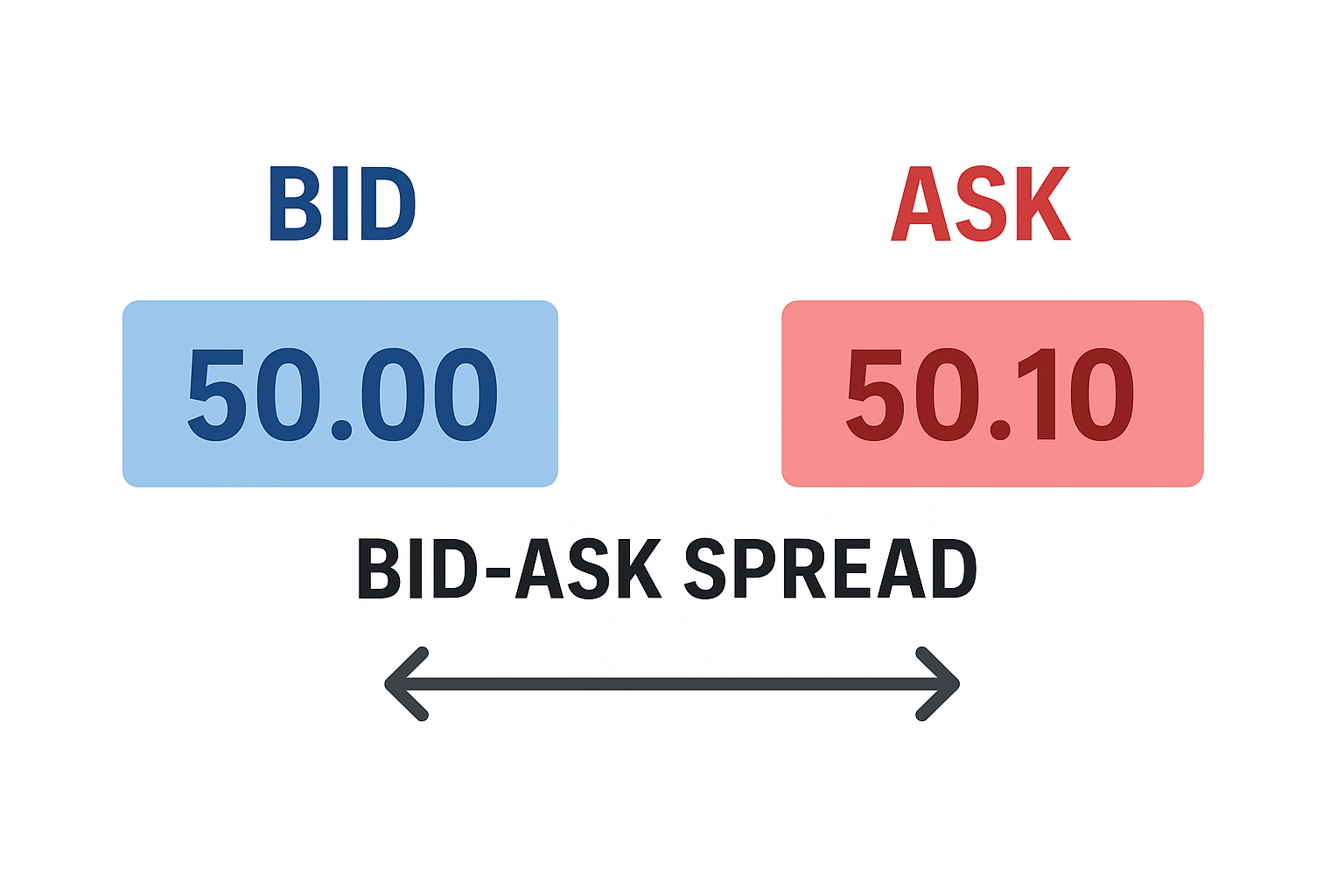

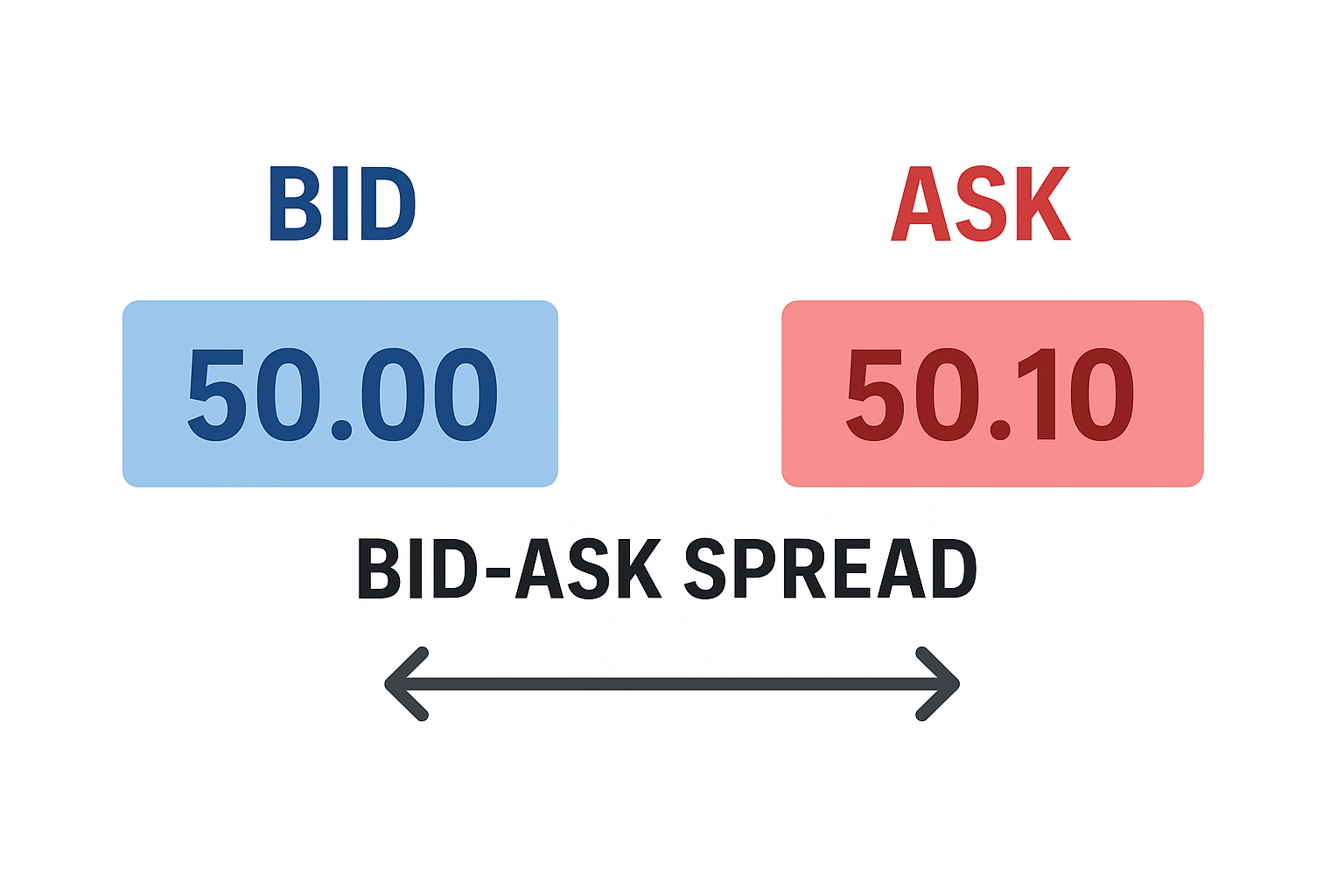

The bid-ask spread is the numerical gap between the bid and ask prices of a financial instrument. It measures the transaction cost between buyers and sellers.

A narrow spread signals high liquidity, while a wide spread suggests lower trading activity or higher market uncertainty.

How Bid-Ask Spread Works

Every market has two sides: buyers posting bids and sellers quoting asks. The difference between these two prices forms the bid-ask spread, which acts as a transaction cost for market participants.

Think of an open market where buyers and sellers are haggling over a price. The seller wants the highest possible price, so they set an “ask,” while the buyer offers a lower “bid.” This negotiation continues until both agree on a price, completing the trade.

In financial markets, this principle works the same way, just faster and electronically. The bid-ask spread reflects how efficiently a market operates, where narrow spreads suggest strong liquidity and high trading activity, while wider spreads signal lower liquidity or greater volatility.

For example, in options trading, a contract might be quoted at $0.50 / $0.60.

The spread here is $0.10, and the midpoint of $0.55 often serves as a fair estimate of the option’s real market value and the balance point between buyers and sellers.

Example

Consider Apple Inc. (AAPL) trading on the NASDAQ. At a given moment, its market quote might show $180.00 / $180.05 (bid / ask).

Step 1: The bid price of $180.00 is the highest price buyers are currently willing to pay for Apple shares.

Step 2: The ask price of $180.05 is the lowest price sellers are willing to accept.

Step 3: The difference between these two prices, $0.05, is the bid-ask spread.

If a trader buys 200 shares of Apple instantly at the market price, they will pay $180.05 × 200 = $36,010.

If they sold those shares immediately at the bid price, they would receive $180.00 × 200 = $36,000.

This means the trader effectively loses $10, which represents the implicit trading cost of crossing the spread ($0.05 × 200 = $10).

Interpretation

That $10 is the cost of liquidity is the price for executing a trade instantly. In highly liquid stocks like Apple, spreads are very tight, often just a few cents. But for smaller or less frequently traded companies, spreads can widen, increasing the cost of buying or selling quickly.

Related Terms

Bid Price: The highest price a buyer is willing to pay for an asset.

Ask Price: The lowest price a seller will accept for an asset.

Market Liquidity: The ease with which assets can be bought or sold without major price changes.

Frequently Asked Questions (FAQ)

1. What causes the bid-ask spread to widen?

Spreads widen when market volatility rises, liquidity falls, or fewer traders participate, as sellers demand more compensation for risk.

2. Why is a narrow spread better for traders?

A narrow spread means lower transaction costs and faster trade execution, making it easier to enter and exit positions efficiently.

3. Can the bid-ask spread change during the day?

Yes. It fluctuates continuously as trading volume, market sentiment, and economic news affect supply and demand.

Summary

The bid-ask spread is simply the gap between what buyers are willing to pay and what sellers want to receive for an asset. It shows how active and liquid a market is where the smaller the gap, the smoother and more efficient trading tends to be.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.