Recognizing how the bid price works is essential for making better entry and exit decisions.

Introduction

The bid price is a core concept in trading and investing that shows what buyers are willing to pay for an asset at any given moment. It helps traders understand demand levels and gauge how eager buyers are to enter the market.

Recognizing how the bid price works is essential for making better entry and exit decisions.

Definition

The bid price is the highest price a buyer is currently willing to pay for a security, currency, or commodity. It represents the buying side of the market and is always lower than the ask price.

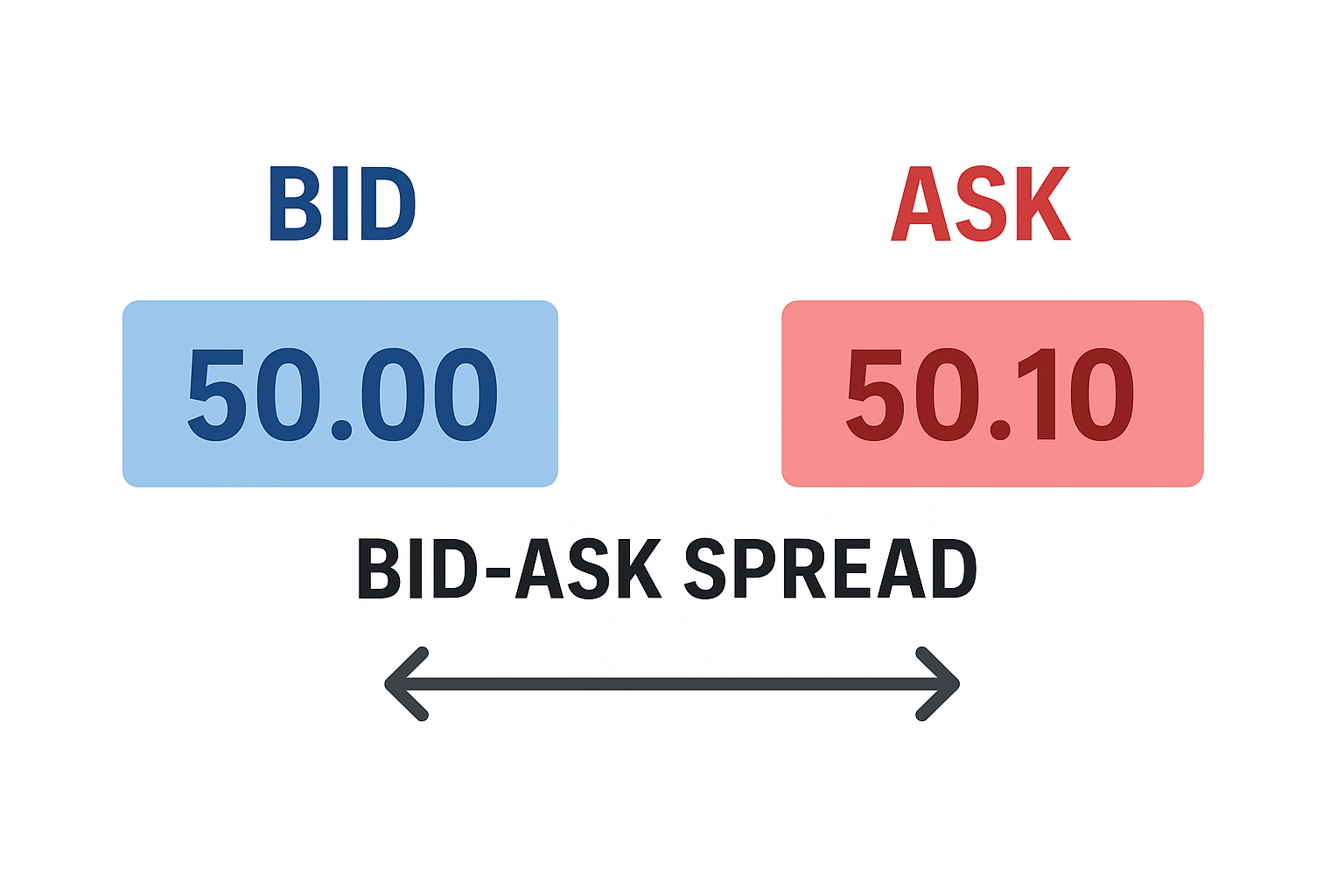

Together, the bid and ask form the bid-ask spread, a key measure of market liquidity.

How Bid Price Works

The bid price functions as the foundation of market demand. It constantly updates as traders and investors place new buy orders or adjust existing ones based on market trends, economic data, and sentiment.

Buyers, brokers, or market makers enter buy orders into the order book, specifying how much they’re willing to pay and how many units they want. The highest of these offers becomes the current bid price.

Think of a bustling marketplace. Buyers shout out how much they’re willing to pay for an item , that’s the bid. Sellers call out their asking prices.

When a buyer agrees to a seller’s offer, a deal is made. The highest bid in the crowd sets the tone for what something is worth at that moment.

The bid price rises when buying pressure is strong, as buyers compete for limited supply. It falls when demand weakens or market sentiment turns cautious. Events such as earnings reports, interest rate decisions, or geopolitical news can all cause rapid changes in the bid price.

Example

Apple Inc. (AAPL) is quoted at $188.45 / $188.50 (bid / ask).

The first number, $188.45, is the bid price which is the highest amount buyers are currently offering per share.

If an investor sells Apple shares immediately using a market order, the trade will execute at $188.45, since that’s what buyers are willing to pay at that moment.

The bid price, therefore, represents the actual amount a seller will receive for an instant sale.

The small difference between bid ($188.45) and ask ($188.50) is known as the bid-ask spread, showing the transaction cost of immediate execution.

Related Terms

Ask Price: The lowest price sellers are willing to accept for an asset.

Bid-Ask Spread: The difference between the bid and ask prices, reflecting liquidity and transaction cost.

Market Order: An instruction to buy or sell immediately at the best available price.

Frequently Asked Questions (FAQ)

1. Who determines the bid price?

Buyers and market makers determine it by posting limit orders showing how much they’re willing to pay for an asset.

2. Why does the bid price keep changing?

It moves continuously as buy orders are placed, modified, or filled, reflecting shifts in supply and demand.

Does a higher bid price benefit sellers?

Yes. A higher bid price means buyers are competing more aggressively, allowing sellers to receive better value when they sell.

Summary

The bid price is the highest price buyers are willing to pay for a security at a given moment. It represents what a seller will actually receive if they sell instantly using a market order.

A higher bid price often signals stronger buying interest and greater market demand for the asset.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.