The iShares MSCI ACWI ETF (ACWI) gives investors instant access to the world's leading companies across 47 countries.

In one trade, it captures over 85% of global equity markets, offering simple, low-cost diversification for those who want to invest in the world's growth — not just one region.

This article breaks down its structure, holdings, performance, and key risks—helping you decide whether ACWI deserves a place in your long-term portfolio.

What ACWI is and who runs it

What it tracks: ACWI seeks to track the MSCI All Country World Index, a market-capitalisation weighted index that covers large- and mid-cap stocks across developed and emerging markets.

The MSCI index currently covers thousands of constituents and approximately 85% of the global investable equity universe.

Provider and structure: The ETF is managed by BlackRock under the iShares brand (ticker ACWI on US exchanges). The fund is a physical ETF that aims to replicate the index's returns.

ACWI ETF at a Glance

| Item |

Value |

| ETF |

iShares MSCI ACWI ETF (ACWI) |

| Provider |

iShares / BlackRock |

| Benchmark |

MSCI All Country World Index |

| Expense ratio (prospectus) |

0.32%. |

| NAV (example recent) |

~USD 138.5 (mid-Oct 2025). |

| Typical coverage |

Large- and mid-cap stocks from 20+ developed and 20+ emerging markets (several thousand constituents). |

| Liquidity / AUM |

Large and liquid (one of the largest all-world ETFs; see provider pages for a daily AUM snapshot). |

Note: the expense ratio and NAV above are taken from BlackRock / iShares fact sheets and are current as at the provider's latest published documents (see citations). Always check the fund pages for the precise live AUM and NAV before trading.

How the MSCI ACWI index is put together

Constituent selection.

Stocks are included or removed based on market-capitalisation, free-float, liquidity and other eligibility rules established by MSCI.

The index mix is updated on a regular schedule (quarterly reviews plus periodic rebalancings).

Weighting.

The index is market-cap weighted, which means the largest companies (by market value) receive the biggest weights.

That mechanism drives concentration: when a handful of mega-caps surge, they disproportionately influence index returns.

Implication:market-cap weighting is simple and replicable, but it concentrates exposure in the largest companies and markets—most notably, US large caps in recent years.

Portfolio composition: who's big in ACWI today

-

Top holdings.

The ETF's largest weights are typically the global mega-caps (examples in late 2025: NVIDIA, Apple, Microsoft and other US tech names).

The top 10 holdings often account for a significant single-digit to low-double-digit percentage of the fund.

Top Holdings of ACWI (%)

| NVIDA CORP |

4.57 |

| MICROSOFT CORP |

4.16 |

| APPLE INC |

3.65 |

| AMAZON COM INC |

2.48 |

| META PLATFORMS INC CLASS A |

1.19 |

| BROADCOM INC |

1.46 |

| ALPHABET INC CLASS A |

1.21 |

| TESLA INC |

1.09 |

| TAIWAN SEMICONDUCTOR MANUFACTURING |

1.06 |

| ALPHABET INC CLASS C |

1.05 |

Regional tilt.

Historically and currently, the United States represents the single biggest geographic exposure—commonly around 50–60% of the index depending on market moves—making ACWI more US-centric than a naïve "equal-country" global allocation.

-

Sector profile.

Technology tends to be the largest sector by weight, followed by Financials, Health Care and others.

Sector weights shift with markets but reflect the structure of global capitalisation.

Top Sectors of ACWI (%)

| Information Technology |

25.82% |

| Financials |

17.74% |

| Industrials |

10.91% |

| Comsumer Discretionary |

10.35% |

| Health Care |

8.84% |

| Communication |

8.57% |

| Consumer Staples |

5.80% |

| Energy |

3.54% |

| Materials |

3.48% |

| Utilities |

2.60% |

| Real Estate |

1.96% |

| Other |

0.40% |

The investment case: why investors use ACWI

Investors choose ACWI for several practical reasons:

True "one-ticket" global exposure.

ACWI lets you hold developed and emerging market equities in a single trade—useful for a core equity position.

Simplicity and rebalancing ease.

Holding one global ETF is operationally simple and makes periodic rebalancing straightforward.

Scale and liquidity.

ACWI is large and liquid, which helps keep trading costs and tracking error modest.

Cost efficiency versus many separate funds.

For many investors the combined fees of several regional funds exceed a single global ETF's fee; ACWI's 0.32% expense ratio is competitive for a broad active replication product.

When ACWI makes sense. Long-horizon investors who want balanced global equity exposure without frequent tactical tilts will find ACWI efficient.

It is especially attractive in "core and satellite" portfolios where ACWI forms the core and smaller funds provide targeted tilts (e.g. value, small cap, higher emerging market exposure).

Key risks and limitations of Investing in ACWI ETF

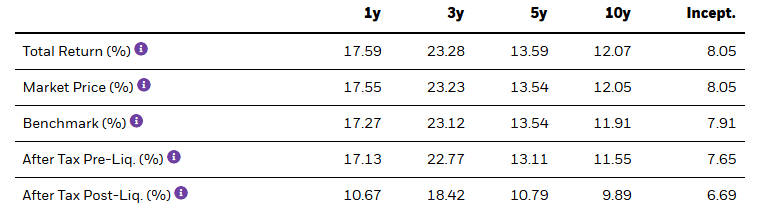

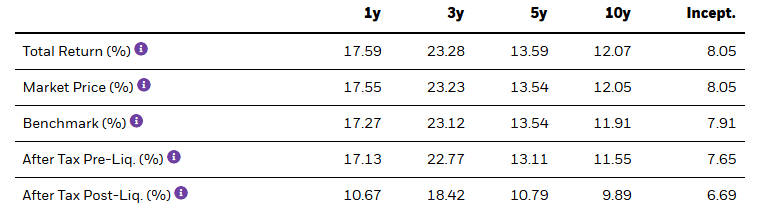

Performance review and valuation snapshot

Comparison with peers:

ACWI and Vanguard's VT are close peers; their performance, fees and holdings differ only slightly.

For many investors the practical difference is small, but VT and ACWI have distinct index backbones and slight differences in fee and domicile.

How to use ACWI in a real portfolio

Core equity allocation.

Use ACWI to represent the equity portion of a long-term, diversified portfolio (for example, as the equity sleeve within a 60/40 allocation).

Complement with tilts if desired.

If you want extra exposure to value, small caps, or emerging markets, pair ACWI with a satellite position (a dedicated emerging-market ETF, small-cap ETF or factor ETF).

Rebalancing rules.

Rebalance periodically (quarterly or annually) back to target allocations to control drift—ACWI makes rebalancing operationally simple because it covers the globe.

Tax and domicile considerations.

Non-US investors should check whether to use the US-domiciled ACWI or a UCITS/locally domiciled share class (differs by tax treatment and currency).

Position sizing and concentration check.

If you already hold a large domestic equity stake, size ACWI so it does not unintentionally increase that domestic exposure due to the fund's US tilt.

Operational and technical points to check before buying

Ticker and share class:

ACWI (US-listed) is the common ticker; there are UCITS / Ireland-domiciled share classes (e.g., SSAC) for European investors—be sure to pick the right listing for your tax domicile.

Expense ratio:

0.32% as per the prospectus—confirm the latest prospectus for any fee updates.

Bid-ask spreads & liquidity:

ACWI is broadly liquid with narrow spreads on US exchanges, but spreads can widen in market stress.

Tracking error: Historically modest for a large, physically replicated ETF, but check the provider's tracking-error disclosure for details.

Market context and near-term outlook

Macro drivers.

Global interest rates, central bank guidance, growth differentials between the US, Europe and Asia, and the US dollar's direction are the principal drivers for ACWI returns in the short term.

Regional rotation risk.

Analysts have flagged the potential for rotation away from US tech and into undervalued regions (Europe, Japan) if valuations and macro data support such moves.

Citigroup and others have published medium-term outlooks suggesting modest further upside but caution around 2025–26.

Geopolitical shocks.

Trade policy, sanctions and geopolitical tensions can disproportionately affect specific countries within ACWI (emerging markets, resource exporters, supply-chain sensitive sectors).

Conclusion

Who should consider ACWI?

Long-term investors who want a simple, single-fund solution for global equity exposure.

Investors who value operational simplicity and broad diversification, and who accept a market-cap weighted exposure (i.e., the US will often be the largest slice).

Final checklist before you invest:

Confirm the live expense ratio and AUM on the iShares product page.

Check the current top holdings and regional weights to see whether the fund's tilt matches your view.

Decide whether you need the US listing or a UCITS/share-class that better suits your tax domicile.

If you already own significant domestic equities, calculate the overlap to avoid unwanted concentration.

Set a rebalancing rule and stick to it.

Frequently Asked Questions

Q1: What does ACWI track?

ACWI tracks the MSCI All Country World Index—a market-cap weighted index covering large- and mid-cap stocks across developed and emerging markets.

Q2: How much does it cost to own ACWI?

The prospectus expense ratio is 0.32% for the US iShares ACWI share class—confirm the latest prospectus on iShares.

Q3: Is ACWI heavily tilted to the US?

Yes. The United States commonly accounts for roughly 50–60% of the index weight, so ACWI’s returns are closely linked to US large-cap performance.

Q4: How is ACWI different from VT (Vanguard Total World)?

Both are "all-world" ETFs. Differences are modest: they track different indices, have slightly different fee and domicile options, and small variations in country/sector weights—so the choice is often one of preference and tax domicile.

Q5: Can ACWI be a core holding for retirement or long-term investors?

Absolutely. ACWI is widely used as a core global equity holding for long-term investors—provided you accept its market-cap weighting and US tilt, and address any desired tactical tilts with satellites.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.