Key Takeaways

The decline of the U.S. dollar has been a major driver behind the significant gains in global stock markets this year.

Emerging markets, Europe, and Japan are leading global stock performance this year.

Currency translation and global liquidity shifts amplify returns for U.S.-based investors.

A rebound in the dollar or a slowdown in commodity prices could quickly erode these favourable tailwinds.

When the U.S. dollar softens, the value of non-U.S. assets rises in dollar terms. That basic calculation, along with significant macro influences this year (expectations of a Fed pivot, China's recovery, and robust commodity performance), has contributed to a powerful rally in international stocks in 2025.

From Asia to Europe and emerging markets, many global equities have rallied, propelled in part by the sliding value of the dollar.

In simpler terms, a weaker greenback makes foreign equities more attractive and magnifies their returns for dollar-based investors. Current market fluctuations demonstrate this trend instantaneously.

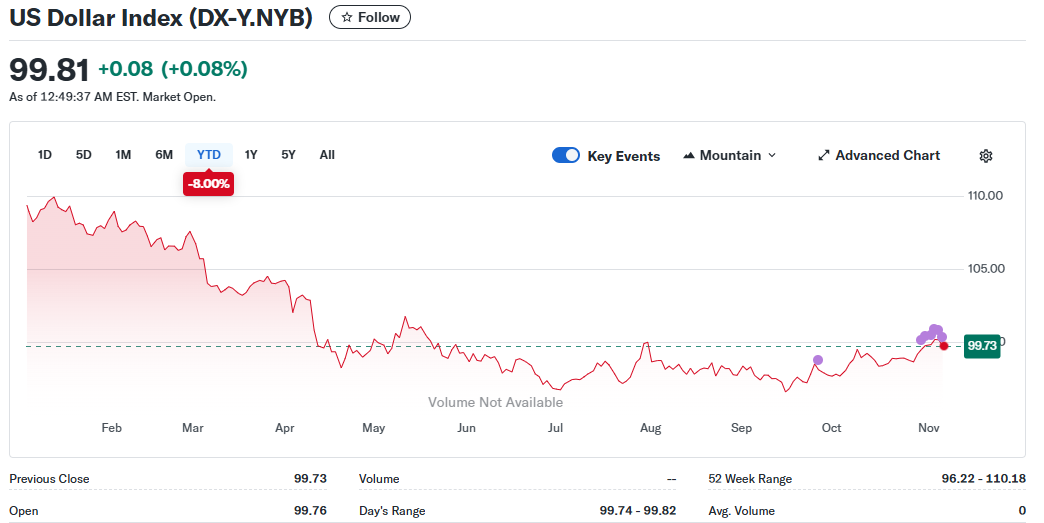

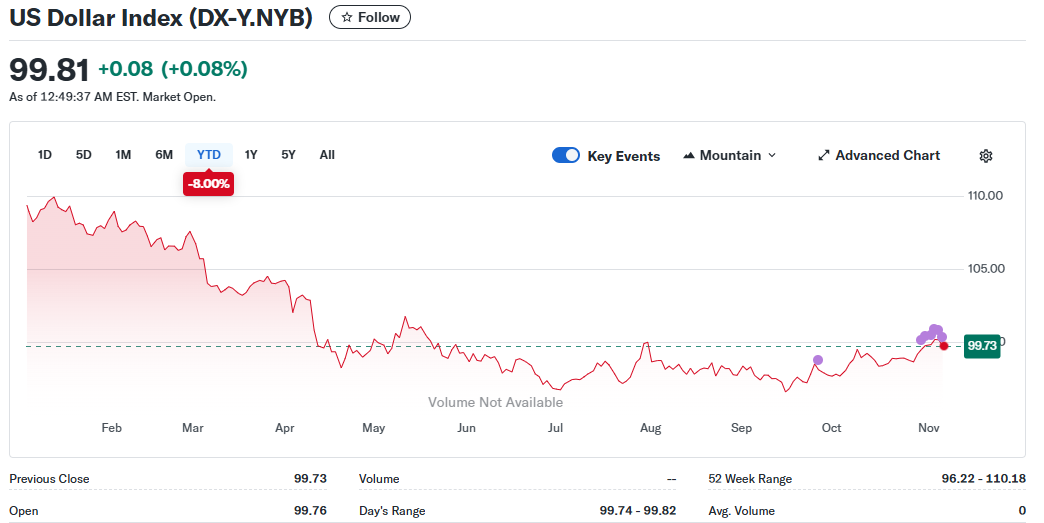

Current State of the U.S. Dollar in November 2025

The U.S. Dollar Index (DXY) has been trading around the high-90s to roughly 100 in early November 2025 (near ~99), providing a modest currency advantage to foreign assets when converted into dollars.

The dollar's current weakness is attributed to:

Federal Reserve pivot expectations

U.S. growth softness and political uncertainty [1]

Global growth dispersion & China stabilisation

Commodity strength

Investor Takeaway: Dollar softness has been the single biggest tailwind for foreign equity returns in 2025.

Which International Stocks Are Outperforming and by How Much

| Year |

DXY Average |

MSCI ex-US Return |

USD vs EM Basket |

| 2023 |

103.5 |

+11% |

+2% |

| 2024 |

101.2 |

+14% |

+6% |

| 2025 (YTD) |

~99 |

~+25–26% |

MSCI Emerging Markets (USD) YTD: ~+24–28% |

1) Developed Ex-US Outperformance

MSCI ACWI ex-US (or MSCI ex-US indexes) has outperformed the S&P 500 by its widest margin since 2009, underlining the scale of the international rally this year.

Europe and Japan are major beneficiaries thanks to attractive valuations and cyclical momentum.

2) Emerging Markets Rally:

The MSCI Emerging Markets index has enjoyed a long winning streak in 2025, with some EM regions posting monthly gains and cumulative returns well above U.S. peers. [2]

Bank and commodity names have led many of these moves, and currency appreciation in local markets amplified dollar returns for foreign investors.

3) Regional Standouts:

Africa and parts of Latin America have been standouts, with some national indices up 30–40% year-to-date in dollar terms, driven by commodity exports and domestic reforms. [3]

Although these are focused actions (lower market cap and increased volatility), they emphasise how a weak dollar can amplify returns in commodity and emerging markets.

How Does a Weak Dollar Boost International Stocks?

1. Currency Translation Effect (The Direct Math):

Currency translation alone can add several percentage points to dollar returns on foreign equities (often mid-single digits and sometimes higher), depending on the scale of the currency move and index composition.

2. Valuation and Multiple Expansion:

A weaker dollar often coincides with easier global financial conditions (lower real U.S. yields, expectations of Fed easing).

Lower discount rates lift valuations globally, not just for U.S. stocks, which boosts price-to-earnings multiples in markets that already have reasonable earnings momentum.

3. Fund Flows and Risk Appetite:

Currency weakness signals cheaper dollar funding and higher expected returns abroad. Asset managers and momentum-driven funds tend to shift allocations toward more attractive non-U.S. equities when the dollar weakens, boosting demand and reducing liquidity in foreign markets.

This creates a self-reinforcing cycle where capital flows elevate prices, which in turn attract further investment.

International Winners and Losers: Sector & Country Impact

A soft dollar does not help everything equally. Listed below is a short list of who tends to win and who can lose when the greenback falls:

Winners

1. Export-Oriented Emerging Markets:

Commodities exporters (countries in Africa and Latin America) perceive strong local currencies and increased export revenues in local currencies, bolstering corporate profits and stock prices.

2. Multinational Stocks Listed Outside the U.S

Global luxury, industrial and semiconductor firms that earn a significant portion of revenues in dollars benefit when those earnings translate into stronger local-currency reported results.

3. Local-Currency Bond and Equity Funds:

Investors using dollars to purchase local assets benefit from dual gains, through price increases and currency fluctuations.

Losers

1. U.S. Dollar–Denominated Exporters in the U.S.:

U.S. multinationals that depend on a strong dollar for cheaper imported inputs can see margins compressed when the dollar weakens (though many hedge).

2. Countries That Import Energy and Commodities:

Nations that rely heavily on dollar-priced imports can face inflationary pressure if their currency lags; that can hurt domestic demand and local equities over time.

Risks and Cautionary Points

A weaker dollar is helpful to international stocks only under certain conditions. Beware of these risk scenarios:

1) Dollar Snapbacks:

The dollar may recover swiftly due to unforeseen robust U.S. data or if geopolitical events render the U.S. a safe haven once more. Snapbacks can erase currency gains and amplify losses for unhedged investors.

2) Local Political or Macro Shocks:

Gains in currency can be undone by errors in local policy, unexpected capital controls, or sovereign debt problems in emerging market economies. High returns in frontier markets often come with elevated tail risks.

3) Commodity Collapses:

Regions that benefit from higher commodity prices are vulnerable if commodity cycles reverse, which would hurt local currencies and equities.

4) Valuation Re-Rating Risk:

If international markets rapidly re-rate, the next leg of returns may be limited; chasing performance after big moves increases drawdown risk.

How Can You Invest During a Weak Dollar?

1) Use Currency-Aware Allocations:

If you buy non-U.S. equities, be explicit about whether you want currency exposure (unhedged) or prefer to hedge FX risk (hedged ETFs or currency forwards).

2) Favour Diversified International ETFs:

If you want exposure without single-stock risk, check the MSCI ex-US and EM ETF family flows and top holdings.

3) For Active Managers, Consider Selective Country/Sector Plays:

Commodity exporters and Asian tech names often outperform when the dollar weakens and global growth broadens.

4) Keep Position Sizes Manageable and Plan for Volatility:

FX reversals can be sudden, so implement staggered entries (DCA) and size correctly.

Frequently Asked Questions

Q1: How Much Does a Weak Dollar Contribute to International Stock Gains?

While difficult to isolate, currency effects can add 5-15% gains to reported earnings in foreign markets.

Q2: Is Investing in International Stocks Risky With a Fluctuating Dollar?

Currency fluctuations add risk but also diversification benefits. Risk can be managed with hedging.

Q3: Will the Dollar Continue to Weaken?

Experts forecast moderate dollar weakness into 2026, contingent on U.S. monetary policy and global growth.

Conclusion

In conclusion, the dollar's drop in 2025 has served as a significant advantage for global stocks, enhancing profits, capital inflows, and commodity prices.

For dollar-based investors, the math is straightforward: foreign equities plus stronger local currencies = higher USD returns.

Treat this environment as an opportunity to diversify and rebalance intelligently, not as a guarantee of effortless gains.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.reuters.com/business/dollar-dips-peaks-sterling-squeezed-ahead-boe-2025-11-06/

[2] https://www.bloomberg.com/news/articles/2025-11-05/as-us-rally-pauses-global-stocks-enjoy-historic-outperformance

[3] https://www.ft.com/content/c62752d9-5961-4afa-b97e-9577b5643dac