The Vanguard Total World Stock ETF (VT) offers a simple, low-cost way to invest in thousands of companies across global markets.

Meet VT: One Fund for the Whole World

For investors who want simplicity without missing out on opportunities, the Vanguard Total World Stock ETF (VT) is often the go-to choice.

Launched in 2008. VT aims to mirror the FTSE Global All Cap Index, which covers thousands of companies of all sizes, across both developed and emerging markets. It's a passive fund, meaning it doesn't try to beat the market—it simply tracks it.

The appeal is obvious. With an expense ratio of just 0.06%, VT allows you to invest globally at minimal cost. For long-term investors, that level of efficiency can make a big difference over time.

What Makes VT ETF Stand Out?

Several features give VT its unique edge:

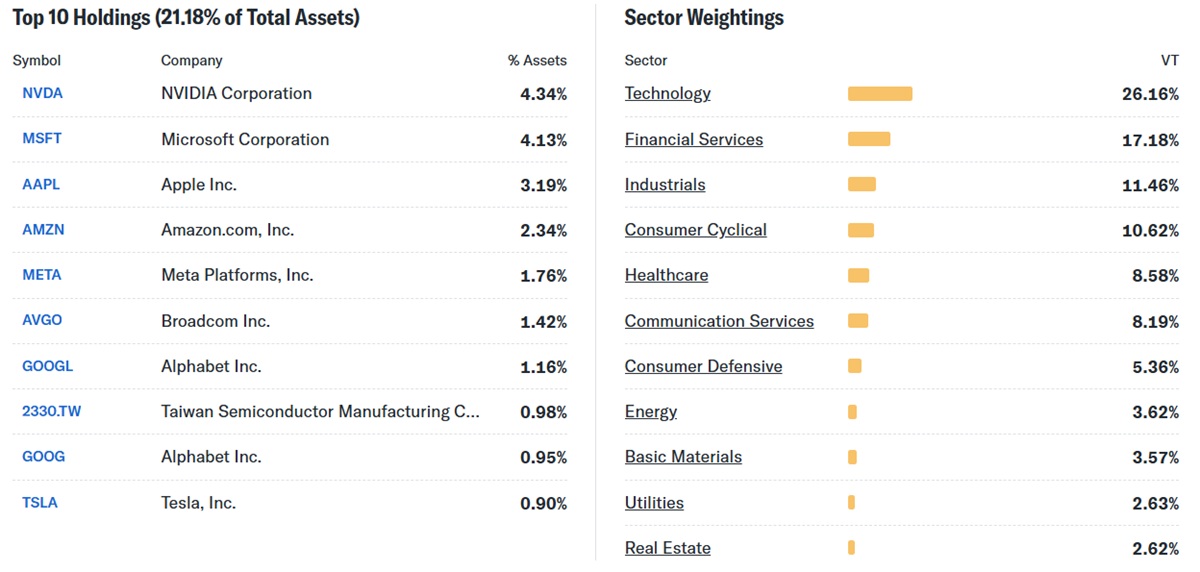

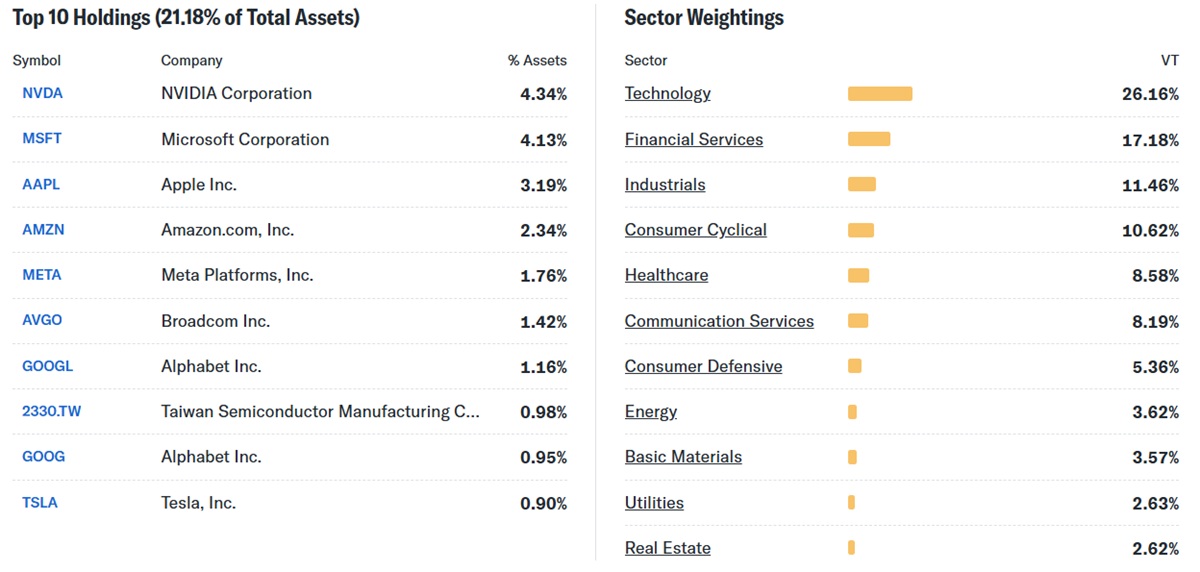

Enormous diversification – VT holds over 10.000 stocks, reducing reliance on any single company or country.

Ultra-low cost – At 0.06% a year, it's far cheaper than actively managed global funds.

Scale and liquidity – With more than $50 billion in assets, buying and selling VT is straightforward.

Worldwide reach – Around 60% of the fund is U.S. equities, with exposure to Europe, Japan, the UK, and fast-growing emerging markets.

In short, VT offers investors a single, tidy package with exposure to nearly every corner of the global stock market.

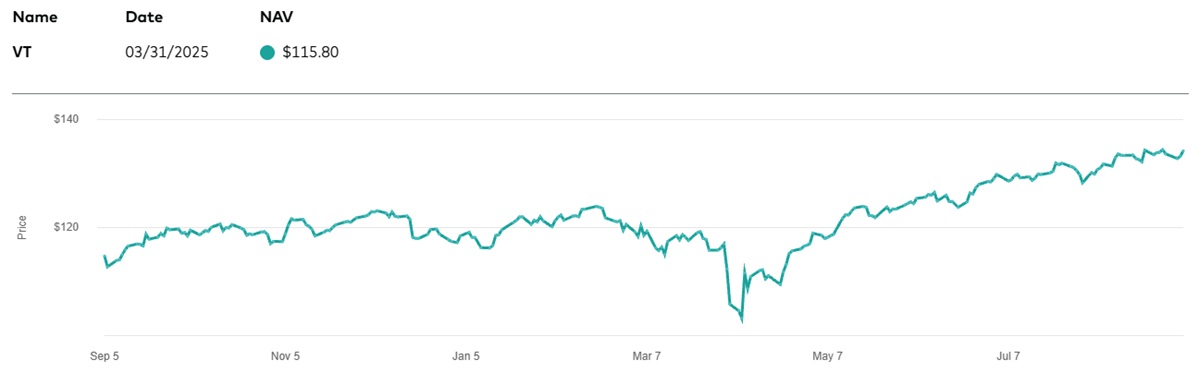

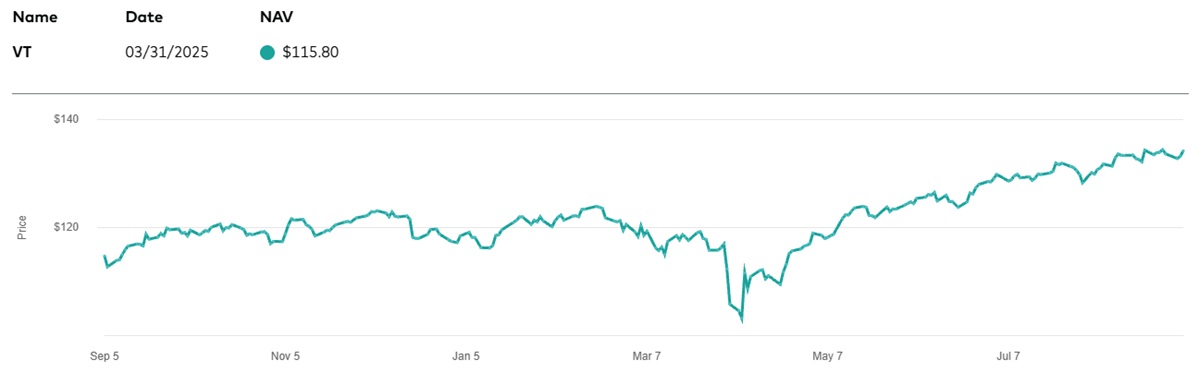

How Has VT Been Performing?

Performance has been strong. Since its launch in 2008. VT has delivered an average annual return of about 8%.

More recently, by mid-2025. The ETF had gained nearly 19% over the past year, hitting new highs and trading more than 24% above its 52-week low. Global rallies in Europe, Japan and emerging markets have boosted its momentum.

There is a trade-off, though. In years when the U.S. dominates global performance, VT can lag behind U.S.-only funds like VTI. Still, its broad reach provides balance and reduces dependence on one market.

VT in the Spotlight: Comparisons That Matter

When deciding on VT, many investors compare it to alternatives:

1)VT vs. VTI

VTI invests only in U.S. stocks, while VT spreads across the globe. VTI has recently outperformed thanks to U.S. market strength, but VT offers greater diversification.

2)VT vs. ACWI

The iShares ACWI fund is another global option, but VT holds more companies, including smaller firms. VT is also typically cheaper.

This is why VT is often called a "one-stop shop ETF"—it provides worldwide equity exposure in a single holding.

The Future of VT: Can One ETF Really Do It All?

Despite its popularity, some investors question whether global diversification is truly necessary. After all, the United States still dominates in innovation, technology, and capital markets.

For those who believe U.S. leadership will continue indefinitely, a U.S.-only ETF like VTI may seem more attractive.

But history tells a different story. In the 1980s, Japan was the world's rising economic star. In the 2000s, emerging markets such as China and Brazil took the lead. No single country has remained the growth champion forever.

By owning VT, investors are automatically positioned to benefit whenever leadership rotates.

Looking ahead, the rise of emerging economies is one of VT's most compelling features. As countries like India, Indonesia, and Vietnam expand, VT adjusts its portfolio accordingly.

This means investors don't have to guess the next big growth story—the fund naturally evolves with global markets.

Hidden Strengths of VT Most Investors Miss

Beyond the obvious diversification, VT also carries strengths that often go unnoticed:

1)Automatic rebalancing

VT constantly refreshes its holdings to stay aligned with the global index. Investors don't need to worry about shifting weights between regions; the ETF does it for them.

2)Access to small caps

Many global ETFs ignore smaller firms. VT includes them, offering exposure to companies that may one day grow into industry leaders.

3)Institutional-level coverage

With more than 10,000 stocks, VT mirrors the kind of broad allocation usually available only to pension funds and sovereign wealth funds.

These hidden qualities make VT more than just "another global ETF." It is, in effect, a complete equity portfolio in a single wrapper.

Who Should Consider VT?

VT is best suited for:

Long-term, buy-and-hold investors who want global exposure without frequent tinkering.

Minimalists who prefer one fund that covers almost everything.

Core portfolio builders are looking for a solid foundation, which can then be paired with bonds or other assets.

That said, investors seeking targeted plays, such as technology, small caps, or a single region, may wish to combine VT with more specialised ETFs.

FAQ: Straightforward Answers

What exactly does VT invest in?

VT tracks the FTSE Global All Cap Index, giving exposure to over 10.000 companies across developed and emerging markets.

How much does VT cost to hold?

The expense ratio is only 0.06%, making it one of the cheapest global equity ETFs available.

How has VT performed recently?

In the past year, VT has returned nearly 19% and reached a new 52-week high. Long-term, it averages around 8% annually since inception.

Should I go with VT or VTI?

Choose VT if you want global diversification. Opt for VTI if you prefer to focus exclusively on U.S. equities. Both are strong options depending on your goals.

Final Thoughts

The Vanguard Total World Stock ETF (VT) is more than just a convenience—it's a gateway to the global economy. With automatic diversification, hidden strengths, and the ability to evolve with market shifts, VT makes a compelling case as a core holding for almost any investor.

VT ETF at a Glance

| Feature |

Details |

| Fund Name |

Vanguard Total World Stock ETF (VT) |

| Ticker Symbol |

VT |

| Launch Year |

2008 |

| Fund Objective |

Track the FTSE Global All Cap Index for worldwide equity exposure |

| Number of Holdings |

10,000+ stocks across developed and emerging markets |

| Top Regions |

U.S. (~60%), Europe, Japan, UK, Emerging Markets |

| Expense Ratio |

0.06% per year |

| Assets Under Mgmt |

$50+ billion (as of 2025) |

| Dividend Yield |

~2% (varies with market conditions) |

| Average Return |

~8% annually since inception |

| Liquidity |

Highly liquid with tight spreads |

| Best For |

Long-term investors seeking low-cost, global diversification |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.