Imagine standing at the heart of a machine that never sleeps, where microscopic circuits hum with invisible energy and silicon dust fuels the world’s progress. Every spark of innovation begins with a semiconductor, a sliver of material behind the rapid thinking of your computer, your car’s advanced safety, and your phone’s connectivity. Navigating this complex ecosystem, the SOXX ETF stands out as a strategic investment tool: it enables investors to capture the full potential of the semiconductor universe without the risks of betting everything on a single star, offering a smarter, diversified way to invest in vital technology.

The race for smarter, faster, and smaller chips is accelerating, fueled by artificial intelligence, cloud computing, and electric vehicles consuming chips at unprecedented rates. For investors, picking the next Nvidia or AMD before they surge can be daunting and risky. The SOXX ETF offers a balanced, more prudent strategy, providing diversified exposure to the entire semiconductor supply chain in a single, liquid fund. The core question becomes whether this broader approach is the most effective and intelligent way to participate in the semiconductor industry’s growth, rather than chasing individual high-flyers.

Understanding the SOXX ETF

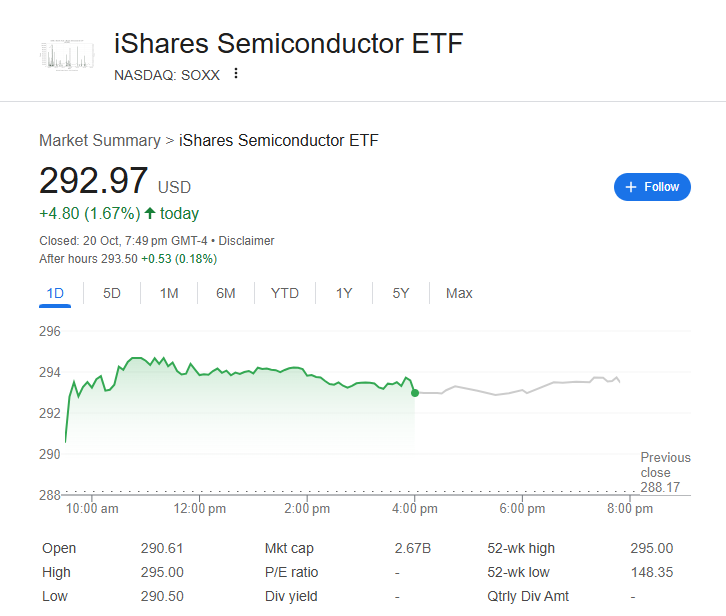

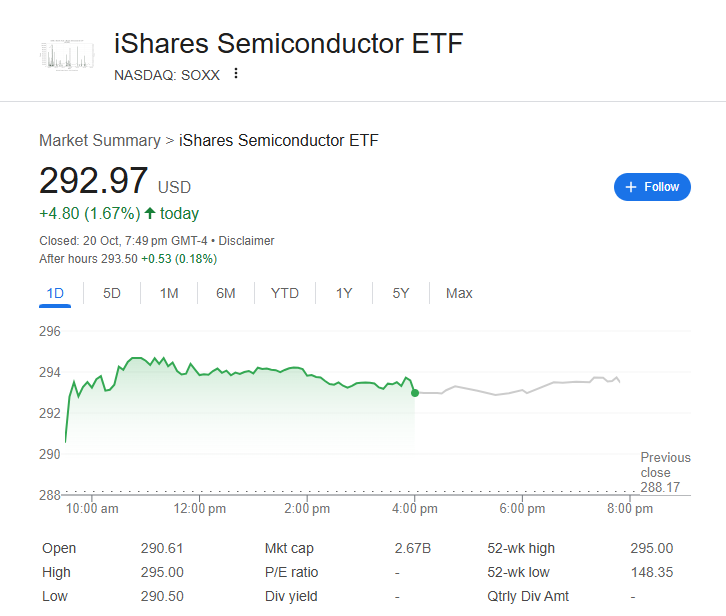

The SOXX ETF, officially known as the iShares Semiconductor ETF, was launched in July 2001 by BlackRock. Its objective is to track the performance of an index made up of major US-listed semiconductor companies. Rather than focus on one or two manufacturers, it includes designers, fabricators, equipment makers and material suppliers that make the global chip ecosystem work.

As of 2025, the SOXX ETF manages approximately 15 billion US dollars in assets. It holds around 30 companies and carries an annual expense ratio of roughly 0.35%, making it cost-effective compared to actively managed technology funds. The fund’s structure is passively managed, meaning it mirrors the semiconductor index instead of relying on human stock-picking, which helps reduce management fees and bias.

Its top holdings give investors exposure to almost every part of the semiconductor value chain, from Nvidia’s data-centre dominance to ASML’s lithography machines that make modern chips possible. This makes the SOXX ETF a convenient one-stop investment for those who believe semiconductors will continue to shape the future.

Why Semiconductors Matter

The global semiconductor market is expected to reach 1.1 trillion US dollars by 2030, up from around 600 billion in 2024, reflecting a compound annual growth rate of nearly 8%. The sector’s growth has been driven by five structural shifts, including artificial intelligence, machine learning, automation, green energy and digital connectivity.

AI chips have seen explosive demand. In 2023, Nvidia’s revenue from data-centre GPUs more than doubled, reflecting how the rise of large language models and generative AI reshaped the chip landscape. The SOXX ETF benefits from this surge, as it holds several companies that supply both the hardware and software layers of the AI revolution.

In the automotive sector, semiconductors are just as critical. The average electric vehicle today uses more than 1,400 chips, almost twice that of a traditional combustion car. Tesla, BYD and Volkswagen have all reported chip shortages impacting production timelines since 2021. This surge in automotive demand has driven companies like Texas Instruments and NXP, both represented in the SOXX ETF, to expand automotive-focused production lines.

Inside the SOXX ETF: Key Holdings and Weightings

The SOXX ETF holds roughly 30 leading semiconductor firms. The top ten typically make up more than 60% of the fund’s total weight, giving investors exposure to the biggest players in the industry.

Nvidia Corporation (NVDA), around 9% weighting, leader in GPUs and AI computing, its market capitalisation crossed 2 trillion US dollars in early 2025.

Broadcom Inc. (AVGO), 8% weighting, key in networking chips and wireless connectivity, driving 5G infrastructure worldwide.

Advanced Micro Devices (AMD), 7% weighting, has gained share in both CPUs and GPUs, supplying chips for AI training servers and gaming consoles.

Intel Corporation (INTC), 6% weighting, now pivoting to become a foundry player through its IDM 2.0 strategy supported by the US CHIPS Act.

Qualcomm Inc. (QCOM), 5% weighting, dominates mobile and 5G chipsets, expanding into automotive and IoT connectivity.

Texas Instruments (TXN), 5% weighting, specialises in analog and embedded processors vital for industrial automation.

Applied Materials (AMAT), 4% weighting, provides tools that manufacture chips at the atomic level.

ASML Holding NV (ASML), 4% weighting, monopolises extreme ultraviolet lithography machines that power advanced nodes like 3nm and 2nm.

Micron Technology (MU), 4% weighting, a memory giant riding the high-bandwidth memory boom used in AI training clusters.

Lam Research (LRCX), 3.5% weighting, produces wafer fabrication tools used by foundries like TSMC and Samsung.

This mix provides exposure to all aspects of chipmaking, including design, fabrication, memory, and the tools that make it possible. When Nvidia and AMD rise on AI trends, or when ASML benefits from capacity expansion, the SOXX ETF captures all of it.

Performance Overview

Over the last decade, the SOXX ETF has delivered outstanding long-term returns. Between 2015 and 2024, its total return exceeded 400%, translating to an average annual gain of about 17%. During the same period, the S&P 500 returned roughly 12% per year.

The fund’s resilience was tested multiple times. During the 2020 pandemic, semiconductor stocks soared as remote work and cloud services surged. In 2021, semiconductor shortages drove unprecedented price hikes and record profits. The following year brought a 35% correction when inventory oversupply met rising interest rates. The SOXX ETF’s recovery in 2023 was swift, fuelled by the AI boom, with a 46% rally that outpaced both SMH and the Nasdaq 100.

As of 2025, its trailing 3-year volatility sits at 28%, with a beta of around 1.5 compared to the S&P 500. This indicates higher sensitivity to tech cycles but also stronger upside in rallies. Its 12-month yield remains around 0.5%, showing that it is designed for capital growth, not income.

Why Investors Choose the SOXX ETF

1. Exposure to High-Growth Sectors

The SOXX ETF captures the key enablers of the fourth industrial revolution. The rollout of 5G networks, exponential growth of data, and the shift toward AI and automation have driven massive semiconductor demand. By investing in the SOXX ETF, investors align themselves with multiple mega-themes rather than one company’s performance.

2. Diversification Within a Single Theme

Semiconductor companies can be volatile. Nvidia’s shares, for example, have fluctuated between 200 and 950 US dollars within 18 months. The SOXX ETF balances this volatility through diversification. If Nvidia cools off, gains from ASML or Micron might offset it.

3. Cost Efficiency

With a low expense ratio of 0.35%, the SOXX ETF offers institutional-grade exposure without high management fees. This is significantly cheaper than semiconductor-focused mutual funds, which often charge 1% or more.

4. Liquidity and Accessibility

With average daily volumes above one million shares and tight bid-ask spreads, the SOXX ETF allows both institutional and retail investors to enter and exit positions easily. It is also listed on the Nasdaq, making it accessible globally through most brokers.

Risks to Consider

1. Industry Cyclicality

Semiconductor demand tends to follow business cycles. The 2018 to 2019 slowdown, for example, saw global chip sales drop by 12% before rebounding in 2020. Investors in the SOXX ETF should be prepared for periodic downturns, as overcapacity and inventory corrections are common.

2. Valuation Risk

As of 2025, the SOXX ETF’s portfolio trades at an average forward P/E ratio of 29, high compared to the S&P 500’s 20. If AI-driven optimism cools or corporate spending slows, valuations could compress. Nvidia’s 2022 correction is a reminder that growth-driven sectors can retrace sharply when sentiment turns.

3. Geopolitical and Supply Chain Concerns

Around 70% of global chip production takes place in East Asia, led by Taiwan’s TSMC and South Korea’s Samsung. Any disruption in these regions could have a global ripple effect. During 2021’s chip shortage, automakers worldwide halted production, an example of how fragile the semiconductor chain is. The SOXX ETF is indirectly exposed to such disruptions, even through US-listed holdings.

4. Technological Disruption

The pace of innovation is relentless. Companies that fail to advance beyond current nodes or architectures risk obsolescence. Intel’s struggles with 10nm delays between 2016 and 2020 highlight how quickly market leadership can slip. The SOXX ETF mitigates this by holding a basket of leaders, but industry evolution remains a constant risk.

SOXX ETF vs. Competitors

The SOXX ETF often competes with two peers, VanEck’s SMH and SPDR’s XSD. SMH leans heavily on Nvidia and TSMC, meaning its top five holdings exceed 60% of total assets. XSD uses an equal-weight structure, giving more exposure to smaller, volatile chipmakers like Monolithic Power and ON Semiconductor. The SOXX ETF takes the middle ground, weighted by market cap but diversified enough to balance the giants and the challengers.

Over five years, the SOXX ETF returned around 140%, closely matching SMH and outperforming XSD’s 120%. During downturns, SOXX ETF’s broader base provided smaller drawdowns, making it suitable for investors seeking balance between growth and stability.

Market Outlook for Semiconductors

The World Semiconductor Trade Statistics organisation projects a 13% revenue increase in 2025, with the industry’s total value reaching 620 billion US dollars. AI data centres alone are expected to consume 8% of global electricity by 2030, requiring continuous chip innovation to maintain efficiency.

The US CHIPS and Science Act has committed over 50 billion US dollars to domestic semiconductor manufacturing, with Intel, TSMC and Samsung all building new fabs in Arizona, Ohio and Texas. These projects directly support companies like Lam Research, Applied Materials and ASML, all part of the SOXX ETF’s holdings.

Meanwhile, global chip demand in healthcare and industrial robotics is growing at double-digit rates. Medical imaging equipment, wearable devices, and automation sensors all depend on advanced semiconductors. This broad-based demand provides the SOXX ETF with multiple pillars of growth beyond consumer electronics.

Global Diversification Within the Fund

Although the SOXX ETF tracks US-listed equities, many of its holdings have deep international footprints. ASML and NXP operate from Europe, while Micron, Qualcomm and Nvidia generate over half their sales from Asia. Broadcom’s customer base spans telecom operators in North America, Asia and Europe.

In effect, the SOXX ETF gives investors global exposure through US markets. Approximately 55% of the revenues from its holdings come from Asia, 25% from the Americas and 20% from Europe. This geographic balance reduces dependence on any single economic cycle.

Investment Strategies Using the SOXX ETF

1. Long-Term Growth Holding

Investors seeking exposure to future technology megatrends can hold the SOXX ETF as part of their equity portfolio. Its performance historically compounds well over five-year horizons, making it suitable for patient investors who can ride out volatility.

2. Tactical Trading

Traders use the SOXX ETF to capture momentum during earnings seasons or industry rallies. For instance, during Nvidia’s 2023 surge, SOXX gained nearly 12% in a single month, reflecting sector-wide optimism.

3. Inflation Hedge Through Innovation

As productivity-driven industries, semiconductors indirectly hedge inflation. Advanced chips improve energy efficiency and automation, reducing production costs in other sectors. As these innovations spread, the SOXX ETF benefits from being exposed to companies leading that charge.

How SOXX ETF Fits in a Portfolio

For most investors, the SOXX ETF serves best as a satellite growth holding. A diversified allocation might look like this:

This allows investors to gain exposure to long-term semiconductor growth while managing risk through diversification. The ETF’s volatility profile means it should not exceed 10 to 15% of a balanced portfolio.

Historical Returns Snapshot

1 Year (2024): +36%

3 Years: +65%

5 Years: +140%

10 Years: +420%

The SOXX ETF’s track record shows the compounding power of semiconductors. From Nvidia’s rise to ASML’s equipment dominance, investors benefit from owning the entire ecosystem rather than betting on one name.

FAQs About the SOXX ETF

1. Is the SOXX ETF suitable for beginners?

Yes. The SOXX ETF can be suitable for beginners who want exposure to the semiconductor industry without picking individual stocks. It is passively managed, diversified across about 30 leading chip companies, and trades like any normal stock on the Nasdaq. However, new investors should note that it remains a growth-oriented, cyclical sector, meaning short-term volatility is normal. Holding it for at least five years helps to smooth out these fluctuations and capture long-term growth trends in AI, 5G and automation.

2. How does the SOXX ETF compare to investing directly in Nvidia or AMD?

Buying a single stock like Nvidia or AMD offers potentially higher returns but also higher risk. Their performance can swing sharply based on product launches or earnings reports. The SOXX ETF spreads that risk by owning both of those companies plus around 28 others, including ASML, Intel and Broadcom. This diversification means that while gains may be steadier, they are less extreme than what a single outperforming stock might deliver. For investors seeking exposure to semiconductors with less stress over timing, the SOXX ETF provides a balanced option.

3. How can investors buy and hold the SOXX ETF?

Investors can purchase the SOXX ETF through most major brokerage platforms under its ticker symbol “SOXX.” It trades during regular market hours, with prices fluctuating like any other equity. Because it is US-listed, international investors should check for any withholding taxes or foreign-exchange considerations before buying. The fund suits a variety of strategies, including long-term growth portfolios, sector rotation plays and thematic exposure to global technology trends.

Final Thoughts: Is SOXX ETF the Smarter Bet?

The SOXX ETF offers investors a gateway into the most critical technology of the modern era. Its diversified exposure to chip designers, foundries, and equipment makers ensures that it captures every link in the semiconductor value chain. Supported by global trends like AI, electric mobility, and 5G, its growth potential remains immense.

But as with every innovation cycle, patience is vital. Semiconductor markets will continue to face volatility and cyclical swings. For long-term investors who can stay the course, the SOXX ETF stands out as one of the smartest ways to participate in the next generation of technological growth.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.