Swiss inflation 0.0% November 2025 key numbers

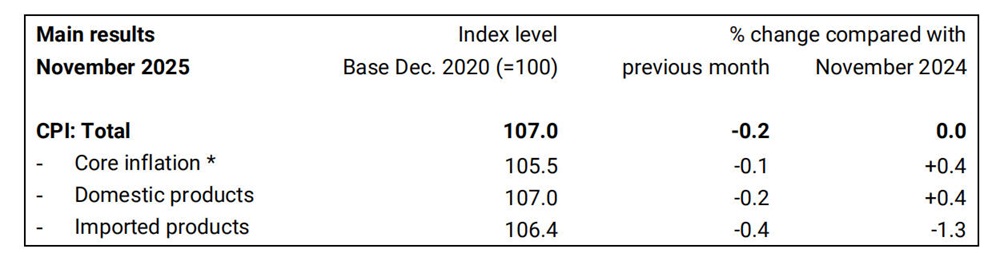

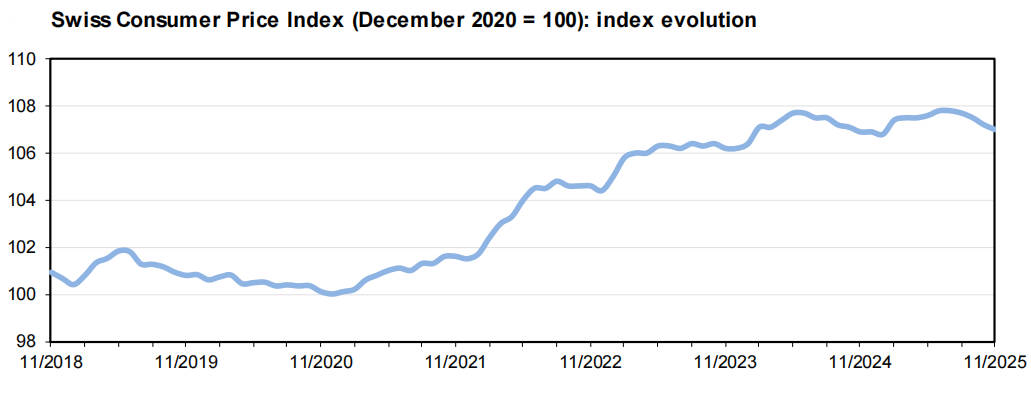

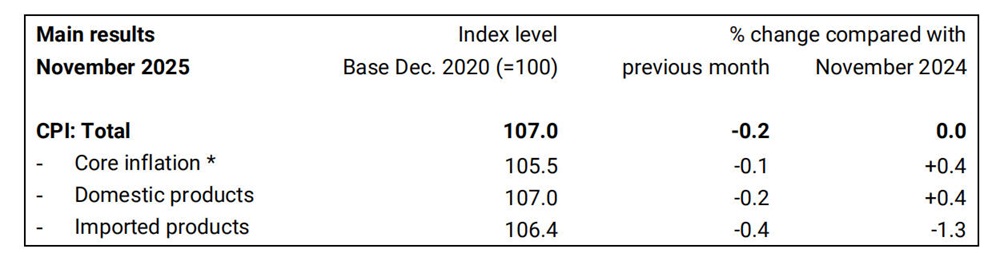

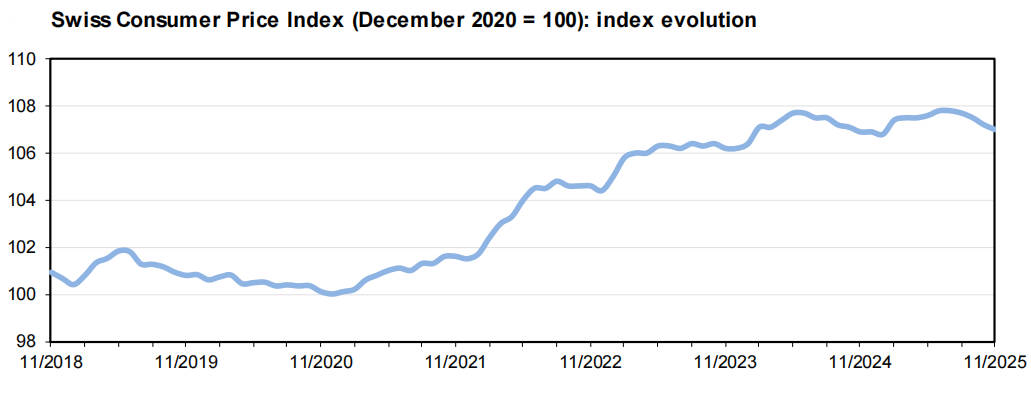

Switzerland's consumer prices fell to 0.0% year-on-year in November 2025. according to the latest data from the Swiss Federal Statistical Office (FSO). The monthly change was −0.2%, leaving the CPI index at 107.0 (December 2020 = 100).

This marks a significant cooling in inflation and represents the first time since early 2024 that headline inflation has returned to zero.

Why Swiss CPI November 2025 fell to zero

Several factors contributed to the decline in Swiss CPI to zero in November 2025. According to the FSO, prices for travel and tourism services fell, reflecting seasonal adjustments and lower demand during the late autumn period.

Transportation costs, particularly private car travel and fuel prices, also declined slightly. Imported goods, including electronics and consumer items, contributed to the moderation in overall inflation due to global price pressures easing.

Economists suggest that seasonal factors played a significant role. November is traditionally a month where post-summer travel packages drop in price, and energy costs tend to stabilise before the winter peak. These small but widespread price reductions were enough to offset modest increases in other sectors, leading to a flat headline reading.

Another contributing factor is the relative stability of the Swiss franc. While a weaker franc could push up imported prices, the currency has been largely stable, limiting imported inflation. Analysts also note that wage pressures remain subdued, so domestic cost inflation is not adding significantly to headline numbers.

Core inflation Switzerland November 2025 easing

Core inflation, which excludes volatile items such as energy and unprocessed food, also showed signs of easing in November 2025. Media reports suggest that core inflation fell to around 0.4%, marking a multi-year low.

This measure is particularly important for the Swiss National Bank (SNB) because it reflects underlying price pressures and potential trends in wage negotiations and consumption.

The reduction in core inflation suggests that the slowdown is not limited to seasonal effects in volatile sectors. Retail goods, services, and rental prices are also moderating, indicating that the disinflation trend could persist into the next quarter.

For monetary policy, subdued core inflation reduces the immediate pressure on the SNB to tighten rates, supporting a continued accommodative stance.

Swiss inflation 0.0% November 2025 market reaction

The November zero inflation reading triggered immediate market responses. The Swiss franc weakened against the US dollar and the euro, reflecting expectations that the SNB might maintain or even ease policy if disinflation persists.

Swiss government bond yields declined slightly, particularly at the short end of the curve, while equities showed a mixed reaction depending on sector exposure.

Analysts highlighted that sectors linked to consumer spending, such as travel and retail, could benefit from continued low inflation, whereas financials and savers may face challenges in a low-rate environment.

Investors recalibrated their portfolios, focusing on currency-sensitive exporters and cash-plus strategies rather than aggressive growth bets.

FX traders also emphasised that a prolonged period of near-zero inflation could make the Swiss franc less attractive as a carry-trade currency, potentially affecting capital flows in the coming months.

Implications of Swiss inflation 0.0% November 2025 for SNB

For the Swiss National Bank, the November CPI reading reinforces the balance between maintaining price stability and supporting economic growth. With headline inflation at zero and core inflation subdued, the SNB is likely to continue its current accommodative policy.

The options available include maintaining the current 0% policy rate, signalling readiness to cut if inflation remains low, or intervening in currency markets if necessary. Analysts suggest that the SNB will monitor wage trends, producer prices, and external inflation pressures closely before adjusting policy.

A prolonged zero inflation environment also affects forward guidance. Markets will likely expect the SNB to act cautiously, preventing disinflation from becoming entrenched while avoiding excessive franc strength that could further suppress domestic prices.

Sector impact of Swiss CPI November 2025 at zero

Different sectors are affected differently by the zero inflation reading. Consumers benefit from slower price rises, particularly in travel, retail, and transport services. Exporters may gain from a weaker franc enhancing competitiveness, though demand in Europe remains a key constraint.

Different sectors are affected differently by the zero inflation reading. Consumers benefit from slower price rises, particularly in travel, retail, and transport services. Exporters may gain from a weaker franc enhancing competitiveness, though demand in Europe remains a key constraint.

Savers and lenders face challenges as low interest rates persist, eroding returns on deposits. Conversely, borrowers can benefit from a low-rate environment. Property markets may see moderate adjustments as rent increases are dampened, while wage negotiations may reflect lower expectations for cost-of-living adjustments.

The zero inflation environment creates a unique context for both businesses and households, shaping decisions around spending, investment, and saving strategies.

Swiss inflation 0.0% November 2025 versus other countries

Switzerland's zero inflation contrasts with other European economies. For example, Germany's CPI in November remained positive, and the Eurozone average inflation continues to exceed 2%. The divergence highlights Switzerland's unique economic position, with a strong currency, low domestic wage pressures, and limited imported inflation.

This international comparison matters for policy and market expectations. A relatively low Swiss inflation rate can strengthen the franc against other currencies, affecting trade competitiveness, while external inflation trends influence domestic policy decisions indirectly.

Long-term impact of Swiss CPI November 2025 at zero

If zero inflation persists, it could influence long-term inflation expectations, wage negotiations, and fiscal planning. Anchored expectations at or near zero may reduce nominal wage growth, easing cost pressures for businesses but limiting consumer purchasing power.

Governments may experience slower revenue growth in nominal terms, while monetary policy will face constraints in returning to positive real rates.

Monitoring leading indicators such as producer prices, rental indices, and wage agreements will be critical for assessing whether disinflation trends will persist and how the SNB may respond in the coming months.

FSO Swiss CPI November 2025 full data

| Month (2025) |

YoY CPI (%) |

MoM Change (%) |

CPI Index (Dec 2020=100) |

| June |

0.2 |

−0.1 |

106.8 |

| July |

0.1 |

0.0 |

106.9 |

| August |

0.3 |

0.2 |

107.1 |

| September |

0.2 |

−0.1 |

107.0 |

| October |

0.1 |

−0.3 |

107.2 |

| November |

0.0 |

−0.2 |

107.0 |

Frequently Asked Questions (FAQ)

Q1: What caused Swiss inflation to reach 0.0% in November 2025?

Swiss inflation fell to 0.0% due to declines in travel and transport costs, cheaper imported goods, and seasonal price adjustments. Core inflation also eased, indicating broader moderation in domestic price pressures.

Q2: How does Swiss CPI November 2025 affect the Swiss National Bank?

With headline inflation at 0.0% and core inflation low, the SNB is likely to maintain accommodative policy. The central bank will monitor wage trends, producer prices, and international inflation before any potential rate adjustments.

Q3: How did markets react to Swiss inflation 0.0% November 2025?

The Swiss franc weakened briefly, bond yields dropped slightly, and investors adjusted portfolios. Currency-sensitive exporters and cash-plus strategies gained focus, while savers faced challenges in a low-rate environment.

Q4: What are the long-term implications of zero inflation in Switzerland?

Persistently low inflation may anchor expectations near zero, limiting nominal wage growth and affecting fiscal revenue. It could also constrain SNB policy and influence sectors like property, wages, and consumer spending.

Q5: Which sectors benefit from Swiss CPI November 2025 at zero?

Consumers benefit from stable prices in travel, retail, and transport. Exporters gain from a relatively stable or weaker franc, while borrowers benefit from low interest rates, and savers face reduced returns on deposits.

Conclusion

Investors should consider both currency and interest rate exposure. A weaker franc can benefit exporters, while cash-plus strategies remain preferable in a low-inflation, low-rate environment. Consumers may see opportunities to postpone non-urgent purchases if seasonal price declines continue.

Key watchpoints include core CPI trends, SNB policy statements, and wage developments. Staying alert to these indicators will help investors and consumers anticipate market shifts and make informed decisions in a disinflationary context.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.