Tesla may still appeal to long-term believers in EV growth and innovation, but slowing sales raise risks—making it a cautious, selective buy.

Few companies capture investor attention quite like Tesla. The electric vehicle (EV) pioneer has become more than just a carmaker; it is a brand synonymous with innovation, bold ambition, and controversy.

While Elon Musk pushes Tesla into artificial intelligence, robotics, and autonomous mobility, questions abound as to whether its share price reflects realistic prospects or inflated hopes. With sales faltering in several key regions and valuation metrics reaching eye-watering levels, many investors are asking the same question: is Tesla a good stock to buy right now?

The Numbers Behind the Question: Is Tesla a Good Stock to Buy?

Tesla's financial performance has grown increasingly mixed in 2025.

1)Sales Trends:

Tesla's struggles are evident worldwide: US sales fell 13% with market share down to 46%, global deliveries slid 13% to 721.000. Europe suffered seven straight months of declines with a 40% drop, and India disappointed with only 600 orders since launch.

2)Profitability:

Operating profit fell sharply from $2.8 billion to $1.3 billion in the first half of 2025. raising concerns about margin pressure.

3)Valuation:

Tesla's shares continue to trade on astronomical multiples. Forward price-to-earnings ratios hover between 132× and 178×, compared with about 24× for the S&P 500. Such valuation suggests that investors are pricing in enormous future growth.

4)Analyst Sentiment:

Piper Sandler is bullish at $400, Morningstar sees fair value at $250, and Baird cut to "Neutral." The average target is $301–$306, just under current prices.

Catalysts & Growth Drivers Behind Tesla's Growth

Despite the headwinds, Tesla is not short of bold growth initiatives.

1)AI and Robotics:

The company is investing heavily in artificial intelligence, most notably through its Optimus humanoid robot. Elon Musk has suggested that robotics could ultimately outpace car manufacturing in value creation.

2)Robotaxi Vision:

Tesla has begun testing its robotaxi service in Austin, Texas. If successful, the scheme could redefine urban mobility. However, competitors such as Waymo and Cruise are already operating commercial fleets, and Tesla's reliance on camera-only vision, without lidar sensors, is a subject of fierce debate.

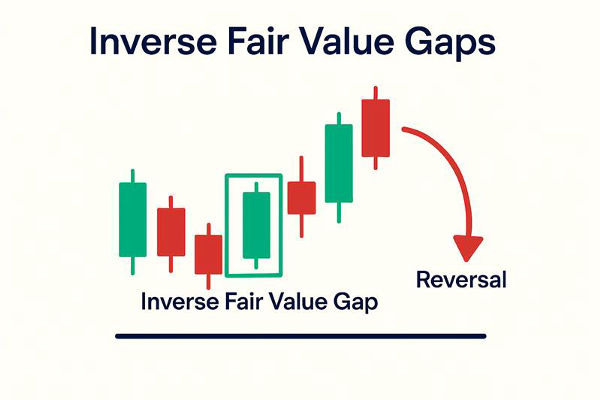

3)Technical Momentum:

For chart-watchers, Tesla's share price recently broke out of a "cup-with-handle" formation, a technical pattern that some traders interpret as the beginning of a new upward rally. Barron's has even suggested that the stock could be poised for a "rip-roaring" run if momentum holds.

The Clouds Hanging Over Tesla

No discussion of Tesla is complete without acknowledging the considerable risks.

Investor Takeaways & Strategy

Supporters argue that Tesla's future lies far beyond vehicles. If its robotics and autonomy projects succeed, Tesla could transform from an automaker into a diversified AI powerhouse. Piper Sandler's $400 price target underscores the belief in this upside.

Detractors counter that the company's slowing sales, competitive pressures, and brand controversies point to a stock that is priced too aggressively. Morningstar's $250 valuation illustrates how far Tesla could fall if expectations are not met.

Given the divergence in opinion, many investors are adopting a wait-and-see approach. With several key developments on the horizon – including the rollout of an affordable EV, further updates to its Full Self-Driving software, and pilot deployments of Optimus – the coming quarters will be decisive.

Frequently Asked Questions

1. Is Tesla undervalued or overvalued right now?

Most analysts consider Tesla overvalued at present. Consensus price targets of around $301–$306 sit below the current share price, implying limited upside and possible downside.

2. What is the outlook for Tesla's EV sales and demand?

Near-term demand looks soft. Sales are sliding in the United States and Europe, incentives are ending, and uptake in India has been far weaker than expected.

3. Can Tesla's AI and robotics initiatives justify its valuation?

Potentially, but much depends on execution. Robotaxi and humanoid robotics remain early-stage projects. While they could transform Tesla's business model, they also face strong competition and regulatory hurdles.

4. How much of Tesla's stock price is driven by its fanbase?

A significant portion. Tesla enjoys an unusually loyal retail investor base, with many shareholders holding for ideological or brand-loyalty reasons rather than fundamentals. This has historically supported the share price even during periods of weak performance.

Conclusion

Tesla remains one of the most fascinating and polarising stocks in global markets. Its extraordinary ambitions in AI and robotics offer the promise of transformative growth, yet its weakening sales, execution risks, and elevated valuation leave ample room for caution.

For some investors, Tesla represents the future; for others, it is an overhyped, overvalued gamble. At present, the evidence points to a stock where prudence may be the wisest course – and where the answer to whether Tesla is a good stock to buy depends less on today's numbers and more on belief in tomorrow's vision.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.