Investing in broad market indices is a time-tested way to build wealth steadily over time. Among the various indexes available to investors, the Russell 1000 Index stands out as a robust benchmark for large-cap U.S. stocks.

While the S&P 500 often takes the spotlight, the Russell 1000 is equally crucial, encompassing a broader market scope. In this guide, we'll break down the Russell 1000 Index, how it works, and how you can start investing in it even if you're new to finance and investing.

What Is the Russell 1000 Index?

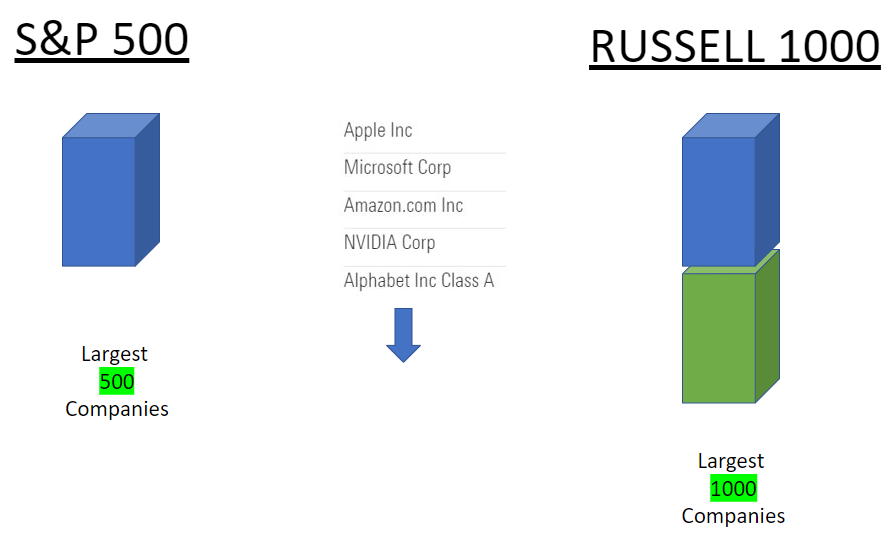

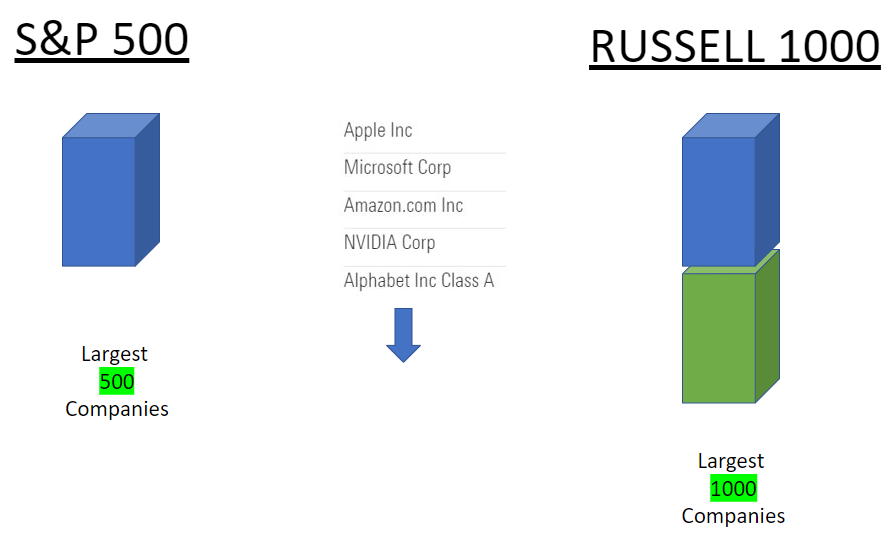

The Russell 1000 Index is a stock market index representing the performance of the 1,000 largest publicly traded companies in the United States. It is maintained by FTSE Russell, a global index provider. The index includes companies that make up about 93% of the U.S. equity market, making it one of the most comprehensive large-cap indices available.

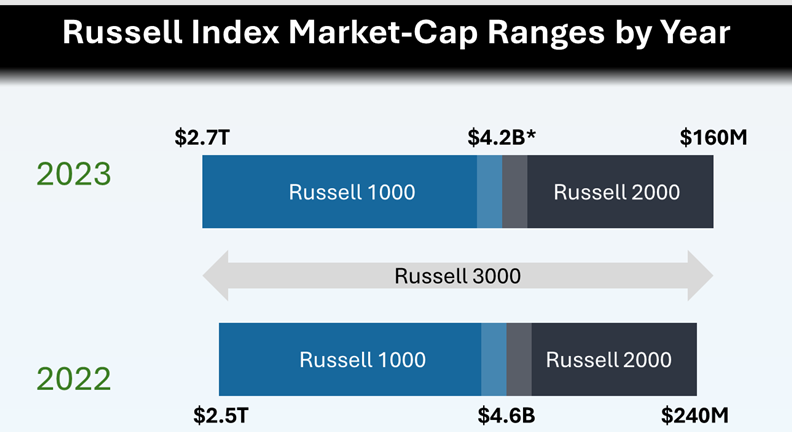

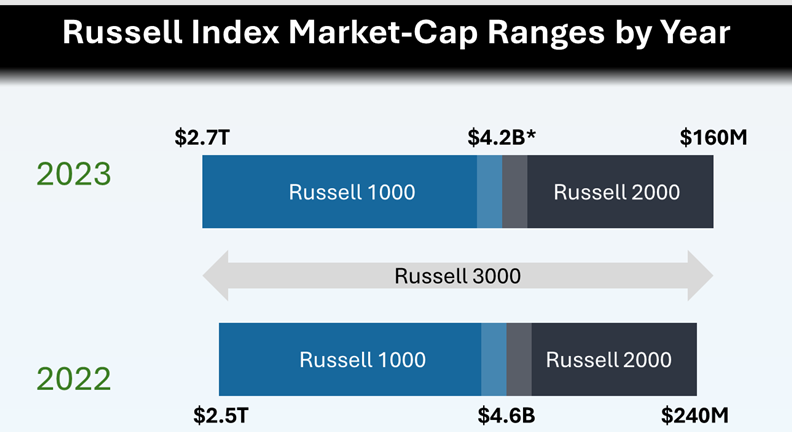

The Russell 1000 is also a subset of the broader Russell 3000 Index, which includes 3,000 U.S. stocks and covers about 98% of the U.S. equity market. The Russell 1000 focuses on large-cap stocks, which are generally considered more stable and less volatile than mid- and small-cap companies.

For example, companies like Apple, Microsoft, and Amazon typically form a significant portion of the index.

Performance History

Historically, the Russell 1000 Index has delivered strong returns, reflecting the long-term growth of the U.S. economy. Over the last 10 years, it has averaged annualised returns of approximately 11–13%, though performance varies yearly.

The index performs well during economic expansions and bull markets, but may struggle during recessions or high-inflation environments. Still, its diversified structure and large-cap focus help cushion extreme losses compared to more volatile indices like the Nasdaq 100 or Russell 2000.

Why Invest in the Russell 1000 Index?

Investing in the Russell 1000 Index offers several benefits for beginner and experienced investors. First, it provides diversification across a broad spectrum of industries and sectors. Since the index includes 1,000 of the largest companies in the U.S., you're not betting on a single stock or sector.

Second, large-cap companies tend to be more financially stable, have established business models, and pay dividends more consistently. It makes the Russell 1000 attractive for long-term investors who value growth and stability.

Lastly, index investing generally comes with lower fees. Most Russell 1000 index funds or ETFs have lower expense ratios than actively managed funds. Lower expenses mean more money stays invested and can compound over time.

Different Ways to Invest

If you're ready to invest in the Russell 1000 Index, you won't buy individual stocks within the index one by one. Instead, you'll invest through index funds or ETFs (Exchange-Traded Funds) designed to replicate the performance of the Russell 1000.

Some of the most popular Russell 1000 ETFs include:

iShares Russell 1000 ETF (IWB): One of the most widely held ETFs tracking the index.

Vanguard Russell 1000 ETF (VONE): Known for its low fees and strong reputation.

SPDR Russell 1000 ETF (ONEK): Another alternative that offers Russell 1000 exposure.

These funds can be purchased through any brokerage account, including platforms like Fidelity, Charles Schwab, Robinhood, E*TRADE, or Vanguard.

Russell 1000 vs S&P 500: What's the Difference?

The Russell 1000 and S&P 500 aim to capture large-cap U.S. equities, but with some distinction. The S&P 500 includes 500 of the largest companies, handpicked by a committee based on specific criteria like profitability, market capitalisation, and liquidity. In contrast, the Russell 1000 uses a rules-based methodology, ranking companies strictly by market cap without subjective filtering.

This difference means the Russell 1000 provides a broader objective view of large-cap companies. It also includes companies that might not yet meet the S&P 500's profitability or other requirements, offering more comprehensive exposure.

Who Should Invest and How Much Should You Invest?

The Russell 1000 Index is ideal for a range of investors, especially:

Long-term investors who are seeking steady growth.

Beginner investors who want a simple way to gain diversified exposure.

Retirement savers who are building a balanced portfolio.

Passive investors who are seeking low-fee, hands-off strategies.

It's also suitable for people who want to focus on the U.S. large-cap market without analysing individual stocks.

The amount you invest depends on your financial goals, risk tolerance, and time horizon. The Russell 1000 Index suits long-term investors who want consistent growth. If you're saving for retirement, a Russell 1000 ETF can form the core of your equity allocation.

While you can start with a small amount—some ETFs allow investments of under $100—it's crucial to invest regularly and stay disciplined. Dollar-cost averaging (investing the same amount regularly) can reduce the impact of market volatility.

Steps to Start Investing

1. Open a Brokerage Account

The first step is to open a brokerage account if you don't already have one. Choose a brokerage that offers low fees, user-friendly tools, and access to index funds or ETFs. Popular options include Fidelity, Schwab, Vanguard, and TD Ameritrade.

2. Fund Your Account

Once you set up an account, deposit funds using a bank transfer or wire. Most platforms allow you to set up automatic deposits, a great way to invest consistently.

3. Research and Choose Your ETF or Fund

Decide which Russell 1000 ETF or mutual fund suits your needs. Consider expense ratio, liquidity, minimum investment, and tracking error.

4. Place Your Order

Once you've selected a fund, place a buy order through your brokerage. ETFs can be bought in real-time like stocks, while mutual funds are priced at the end of the trading day.

5. Monitor and Rebalance Periodically

After investing, monitor your investment periodically. Depending on your financial goals, you may need to rebalance your portfolio occasionally to maintain your desired asset allocation.

Alternative Indexes to Consider

While the Russell 1000 is an excellent choice, there are other indexes that might complement or serve as alternatives:

S&P 500: Slightly narrower but more widely followed.

Russell 2000: Focuses on small-cap stocks for higher growth potential.

Total Stock Market Index (like VTI): Offers exposure to large-, mid-, and small-cap U.S. companies.

MSCI World or ACWI: Provides global diversification if you want exposure beyond U.S. borders.

These indexes can be used alongside the Russell 1000 to build a well-rounded portfolio.

Conclusion

In conclusion, investing in the Russell 1000 Index is smart for anyone looking to tap into the long-term growth of America's largest companies. It offers broad diversification, low cost, and relatively stable performance—perfect for beginners and seasoned investors.

By understanding how the index works, choosing the right ETFs or funds, and sticking to a disciplined investment plan, you can make the Russell 1000 a foundational piece of your financial future.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.