Some investments are like rivers, calm and predictable. Others resemble the open sea, full of tides, currents, and unpredictable surges that carry both danger and potential. The Invesco QQQ ETF sits in the second category. It is the ocean current of modern investing, powered by the momentum of technology, innovation, and human ambition.

In 2025, investors once again ask the same question: is QQQ a good investment now? The answer depends not only on past performance but also on how you interpret the forces shaping the future. From artificial intelligence to interest rates, every wave in the global economy touches the fund in some way. Understanding QQQ is understanding how modern markets breathe.

What Is the QQQ ETF?

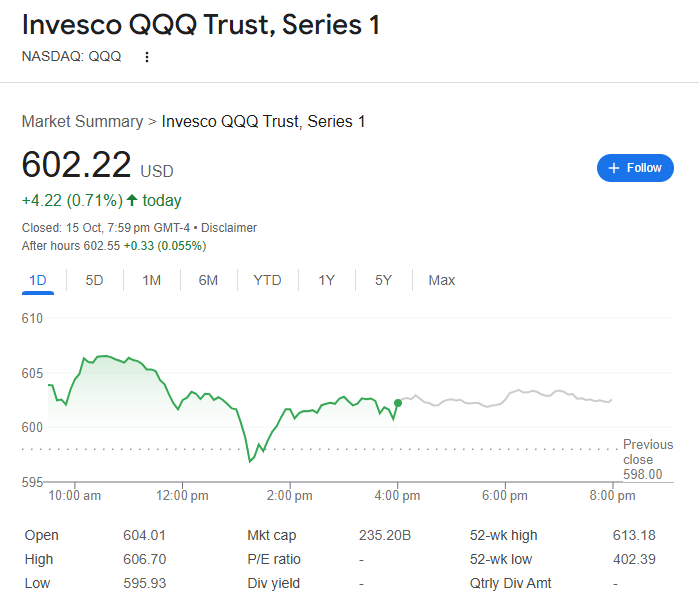

The Invesco QQQ ETF tracks the Nasdaq-100 Index, which includes 100 of the largest non-financial companies listed on Nasdaq. That means its core is dominated by firms like Apple, Microsoft, Nvidia, Amazon, and Alphabet, which together make up around 42 percent of the total weight. As of October 2025, the fund holds approximately 285 billion US dollars in assets, making it one of the largest and most traded ETFs worldwide.

When investors ask is QQQ a good investment now, they are really asking if these technology giants can continue leading global growth. Unlike diversified market funds that hold every sector, QQQ is concentrated in technology, communication services, and consumer discretionary industries. That concentration brings both power and risk.

The 2025 Market Context

Global growth in 2025 is expected to hover around 3.3 percent according to the IMF. Inflation in major economies such as the United States and the Eurozone has moderated to around 2.7 percent. The Federal Reserve’s benchmark rate remains near 4.75 percent, which means capital costs are higher than during the easy-money years of the 2010s but not as punishing as during the inflation spike of 2022.

Equity valuations reflect this middle ground. The Nasdaq-100 trades at a forward price-to-earnings ratio of roughly 27, while the S&P 500 sits closer to 19. That premium shows that investors are still willing to pay more for growth, but expectations are less euphoric than before. In this context, is QQQ a good investment now becomes a question about whether its higher valuation still matches its future earnings power.

Corporate earnings for Nasdaq constituents are projected to rise between 8 and 9 percent in 2026, supported by ongoing demand for cloud computing, semiconductor expansion, and artificial intelligence adoption. Slower than 2023’s explosive rebound but still robust enough to sustain returns.

How QQQ Has Performed Through History

The answer to is QQQ a good investment now lies partly in how it has weathered previous storms.

1999 to 2002: QQQ fell almost 80 percent during the dot-com collapse but survived and later thrived as surviving firms turned profitable.

2009 to 2019: It soared more than 400 percent during the smartphone and cloud computing boom.

2020 to 2022: The pandemic surge and subsequent inflation shock caused a rapid rise and fall, testing investor patience.

2023 to 2025: Artificial intelligence drove a new rally, with Nvidia and Microsoft leading the charge, restoring confidence in the long-term trend.

Across these cycles, QQQ has shown the same pattern: extreme volatility in the short term, but consistent growth over long horizons. It rewards those who stay invested and understand its rhythm.

Comparing QQQ with Other ETFs

QQQ vs SPY

SPY, which tracks the S&P 500, offers broader diversification across eleven sectors, including financials, energy, and healthcare. In 2025, SPY’s total return is roughly 9 percent year-to-date compared with QQQ’s 12 percent. SPY also offers a higher dividend yield of about 1.5 percent, while QQQ’s is around 0.6 percent. Investors seeking steadier returns often prefer SPY, but those chasing innovation lean toward QQQ.

QQQ vs QQQM

Both track the same index. The main difference is cost and liquidity. QQQM’s fee is 0.15 percent compared with QQQ’s 0.20 percent, while QQQ trades over 10 billion dollars in daily volume. Active traders prefer QQQ’s liquidity.

QQQ vs XLK

XLK holds only technology stocks, while QQQ also includes consumer and communication companies that behave like technology platforms. In 2025, XLK gained 14 percent compared with QQQ’s 12 percent, showing that QQQ’s broader mix smooths returns when software or chips slow down.

The Core Drivers of 2025

1. Earnings Momentum

The top ten holdings of QQQ generate more than 2.8 trillion dollars in combined revenue and about 520 billion dollars in profit annually. Microsoft and Nvidia dominate through artificial intelligence services and data-centre expansion, while Amazon’s AWS and Alphabet’s ad network continue to grow steadily.

Apple, once seen as a maturing story, now earns more than 90 billion dollars in quarterly revenue, with wearables and services expanding faster than iPhone sales. Together, these trends keep investors revisiting whether is QQQ a good investment now remains true.

2. Research Spending

The collective research and development budget of QQQ’s top holdings exceeds 300 billion dollars each year, surpassing the GDP of some developed nations. That investment in innovation acts as both a moat and a growth engine. It ensures that QQQ’s leading companies do not just react to change but actively create it.

3. Valuation Metrics

The ETF’s price-to-book ratio is around 8.7, high by historical standards but underpinned by the value of software, patents, and brand equity. Its dividend yield of 0.63 percent signals that profits are being reinvested rather than distributed, reinforcing a growth-first philosophy.

The Main Risks to Consider

Even if the answer to is QQQ a good investment now leans positive, the risks cannot be ignored.

Valuation Compression: If inflation re-accelerates, higher yields could cut tech valuations.

Concentration Risk: Nearly half the fund lies in five names. One major earnings miss could drag the entire index.

AI Overpricing: Markets may have overestimated near-term AI profits, setting up potential disappointments.

Geopolitical Dependence: The fund is sensitive to semiconductor supply chains linked to Taiwan and China.

Interest Rate Sensitivity: Every 50-basis-point change in yields historically moves QQQ by 3 to 5 percent.

QQQ’s volatility is intrinsic. Its one-year beta of 1.2 means it moves 20 percent more than the overall market. For traders, this volatility creates opportunity. For conservative investors, it introduces anxiety.

Case Studies from Real Markets

Case Study 1: Nvidia’s Dominance

From 2023 to 2025, Nvidia’s share price rose more than 230 percent as demand for graphics processors exploded. Its contribution alone added nearly 9 percent to QQQ’s total performance. However, this dependency also means any slowdown in Nvidia’s revenue could weigh heavily on the fund.

Case Study 2: Amazon’s Dual Engine

Amazon’s retail business struggled with thin margins in 2024, but AWS’s 92 billion dollars in quarterly revenue offset that weakness. This balance within a single company demonstrates QQQ’s resilience through internal diversification.

Case Study 3: The Rate Pause Effect

In 2018, when the Federal Reserve paused its rate hikes, QQQ rose 39 percent over the following year. With the Fed again on pause in late 2025, a similar pattern could emerge if inflation remains stable.

Structural Themes Supporting QQQ

Artificial Intelligence Expansion: Global AI spending is expected to exceed 420 billion dollars by 2026, directly benefitting Microsoft, Nvidia, and Alphabet.

Cloud Computing: Global cloud revenue is projected to surpass 1 trillion dollars by 2030, with QQQ’s holdings controlling over 60 percent of that market.

Digital Advertising Recovery: Online ad spending grew 9 percent in 2025 after the 2022 downturn, lifting results for Meta and Alphabet.

Semiconductor Re-shoring: The movement to localise chip production in the US and Europe supports long-term growth for equipment and design firms inside QQQ.

These forces suggest that QQQ remains at the centre of the global innovation cycle, reinforcing its case as a structural growth vehicle.

How to Use QQQ in a Portfolio

Retail investors often treat QQQ as a growth allocation within a balanced portfolio. A typical structure might include 20 percent in QQQ, 60 percent in global equities, and 20 percent in bonds or defensive assets. This approach provides exposure to innovation while smoothing volatility.

Institutional investors employ QQQ tactically. Pension funds may use QQQ futures to hedge technology exposure, while hedge funds use options to capture short-term volatility. Dollar-cost averaging remains one of the most effective retail strategies. An investor who invested 500 dollars per month since 2015 would have contributed 66,000 dollars and accumulated about 142,000 dollars by 2025, a compound annual return near 11.4 percent despite two market corrections.

Analyst Views in October 2025

Morningstar rates QQQ as a “Gold” fund for long-term growth exposure.

Bloomberg Intelligence projects a 14 to 16 percent total return over the next 12 months under a stable rate scenario.

Goldman Sachs forecasts 9 percent technology earnings growth in 2026, supporting the current premium valuation.

UBS Wealth Management calls QQQ “a core innovation holding” but highlights concentration risk.

Consensus across institutions is mildly bullish. The overall verdict leans toward yes when investors ask is QQQ a good investment now, provided they can withstand volatility.

Scenarios for 2026

Base Case (60 percent): Inflation stable, single rate cut mid-year, earnings up 8 percent, total return 12 to 15 percent.

Bull Case (25 percent): Faster monetary easing, AI revenue exceeds forecasts, valuation expands to 30×, return up to 25 percent.

Bear Case (15 percent): Inflation rebound above 3.5 percent, valuations compress to 22×, return minus 15 percent.

These outcomes highlight that even in conservative cases, QQQ’s downside appears manageable relative to its historical risk profile.

Examples of Real Investor Outcomes

Example 1: A UK investor who began accumulating QQQ in 2020 via monthly contributions has achieved an average annual return near 16 percent.

Example 2: A Singapore-based wealth fund using QQQ futures as a tactical overlay improved portfolio efficiency by 0.18 on its Sharpe ratio.

Example 3: US endowments continue holding 5 to 10 percent of assets through QQQ, citing its innovation exposure as irreplaceable.

These examples demonstrate how QQQ operates not just as an ETF but as a strategic instrument across different investor types.

EBC Financial Group as a Platform for QQQ ETF CFDs

For traders who want to capture the Nasdaq-100’s movement without directly buying the ETF, EBC Financial Group provides access through Contracts for Difference (CFDs). This allows investors to speculate on QQQ’s price direction, using leverage to amplify exposure while keeping control over position size and risk.

EBC’s CFD offering combines advanced execution technology with institutional-grade liquidity sourced from more than 25 global providers. This ensures orders are filled within an average of 20 milliseconds, even during periods of volatility. Traders can open long or short positions, apply stop-loss and take-profit levels, and manage portfolios through MetaTrader 4 or MetaTrader 5 platforms.

By trading QQQ ETF CFDs with EBC, participants can react to earnings seasons, interest rate decisions, or AI-driven rallies in real time. There is no need to hold the underlying asset, and trades are settled in fiat currency, avoiding complexities such as fund custody or foreign exchange conversions.

For professional and retail traders alike, this approach merges the depth of US equity exposure with the flexibility of derivatives. It gives investors a way to participate in the performance of QQQ while managing capital efficiently within a regulated global environment.

FAQs About Is QQQ a Good Investment Now

Q1. What index does QQQ track?

It tracks the Nasdaq-100 Index of 100 large non-financial companies listed on Nasdaq.

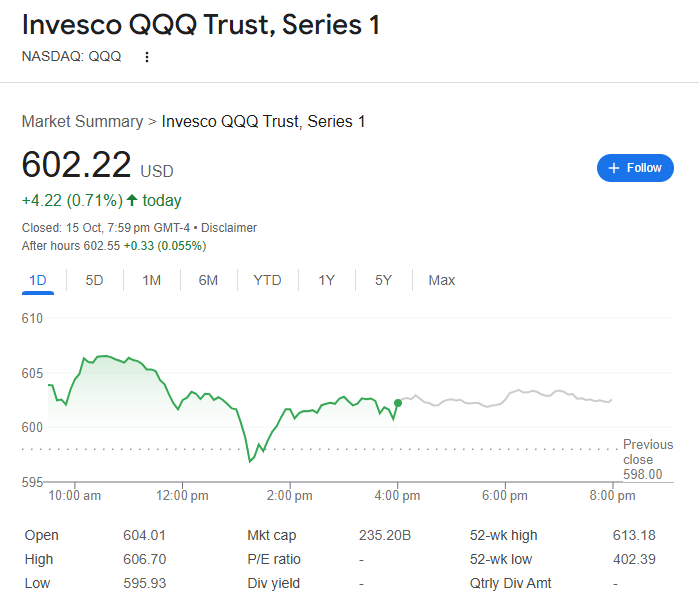

Q2. How has it performed in 2025?

It is up about 12 percent year-to-date as of October 2025.

Q3. Is QQQ a good investment now for beginners?

Yes, if treated as a long-term growth position rather than a short-term trade.

Final Thoughts

So, is QQQ a good investment now? For long-term investors who believe innovation will continue driving economic growth, the answer remains yes. It provides efficient access to the world’s most dynamic companies, strong liquidity, and decades of proven performance.

Yet timing matters. Valuations are not cheap, and short-term pullbacks will happen. The key is perspective. Over any 10-year window since its inception, QQQ has historically outperformed broad market averages. Investors who stay disciplined and diversified have been rewarded.

Ultimately, the ETF is not just a collection of stocks. It represents a bet on progress, on human creativity, and on the continuing power of technology to reshape the world. For those willing to hold through the noise, QQQ remains one of the most compelling vehicles of modern investing.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.