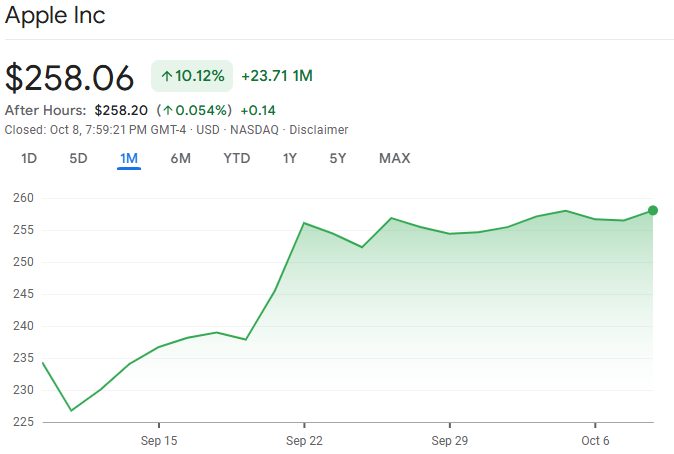

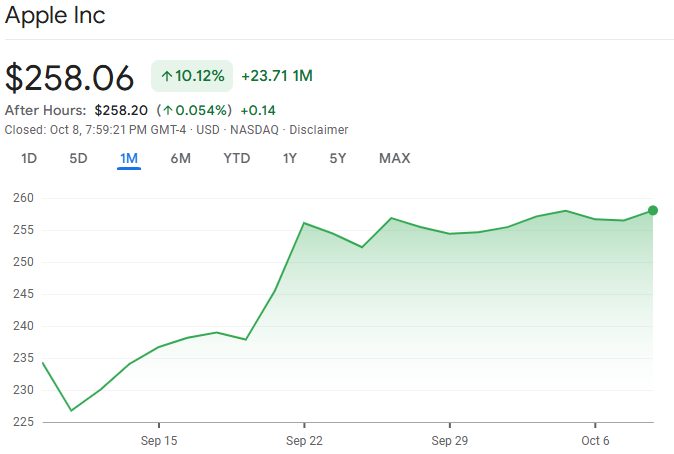

As Apple (AAPL) trades at approximately $258.06 USD, close to analyst consensus targets of $247.65, many investors are questioning: Is it wise to purchase shares ahead of Apple's Q4 2025 earnings announcement?

For context, Apple enters the quarter displaying mixed signals due to robust services growth and promising guidance, yet facing worries regarding iPhone unit demand, macroeconomic challenges, and profit margins.

In this analysis, we'll break down Apple's latest fundamentals, examine the experts' expectations, weigh the bullish against the bearish cases, outline key earnings catalysts, and suggest tactical strategies for positioning heading into the report.

Apple's Recent Financial Performance: What the Numbers Say?

| Segment |

Q3 2025 Revenue |

YoY Growth |

Q4 Outlook |

Key Drivers |

| iPhone |

$44.6B |

+13.5% |

Tariff pressure, iPhone 16 cycle |

Base model strength, upgrade timing |

| Services |

$27.4B |

+13.3% |

$28B+ target |

Subscriptions, App Store, Apple Intelligence |

| Mac |

$8.0B |

+14.8% |

Seasonal strength |

M-series chips, enterprise demand |

| iPad |

$6.6B |

-8.1% |

New models needed |

Awaiting refresh cycle |

| Wearables |

$7.4B |

-8.6% |

Vision Pro uncertainty |

Apple Watch steady, Vision Pro struggling |

1. Q3 2025 Recap

In its fiscal 2025 third quarter (ended June 28, 2025), Apple delivered $94.04 billion in revenue, up roughly 10% year over year.

Net income was $23.43 billion, or $1.57 per share, beating consensus expectations. Services revenue reached a high of approximately $27.42B, increasing by around 13%. iPhone revenue increased by ~13% to $44.58 billion, Mac revenue rose by ~15%, while iPad revenue declined by ~8%. [1]

This performance demonstrates Apple's capability to excel in essential areas while maintaining a strong balance between services and hardware.

2. Trailing Revenue and Growth Trends

Over the trailing 12 months ending June 2025, Apple's revenue was ~$408.6B, up ~5.97% YoY.

For fiscal 2024, Apple reported ~$391.04B, up ~2.02% from 2023. Apple continues to demonstrate steady growth despite macro headwinds.

3. Analyst Expectations Heading Into Q4

Analysts expect Apple's Q4 (fiscal) EPS to be in the ballpark of $1.68.

Some sources suggest revenue is expected to experience mid- to high single-digit growth for Q4, reflecting upgraded guidance. Visible Alpha consensus suggests anticipated iPhone sales of approximately $45.2B for Q4.

Thus, the market is pricing in modest growth and margin stability, but not huge upside surprises.

Apple Price Prediction: Expert Targets and Market Consensus

| Metric |

Value (Oct 2025) |

Commentary |

| Share Price |

$258.06 |

Near upper analyst range |

| Consensus EPS (Q4 2025) |

$1.68 |

Stable margins expected |

| Revenue (FY 2025E) |

$411B–$416B |

+5–7% YoY growth |

| 12-Month Price Target (Consensus) |

$247.65 |

Moderate upside |

| Bull Case (Wedbush) |

$310 |

Apple Intelligence monetization |

| Bear Case (Loop Capital) |

$226 |

Valuation compression risk |

Wall Street maintains a "Moderate Buy" rating with significant price target dispersion reflecting uncertainty. The consensus twelve-month target of $247.65 suggests limited upside, but individual targets range from $160 (bear case) to $310 (Wedbush's street-high bull case).

Recent revisions show mixed sentiment: Goldman Sachs maintains a $266 target, citing ecosystem strength, while Loop Capital reduced its $226 target due to valuation concerns. Morningstar's $210 fair value estimate reflects conservative assumptions about iPhone growth and Services scaling.

The wide target range ($160-$310) illustrates genuine disagreement about Apple's trajectory, with optimists betting on Apple Intelligence driving the next growth wave and pessimists focusing on saturation and valuation compression.

Bull Case vs Bear Case: Can Upside Outweigh Risk?

Bull Case: Why Buying Before Earnings Could Pay Off

1. Services & ecosystem strength buffer downside. Services are high-margin and recurring, reducing earnings volatility.

2. Upgraded guidance expectations give room for an upside surprise. Apple's shift to mid-to-high single-digit guidance signals possible hidden optimism.

3. AI integration & product innovation could unlock optionality beyond iPhone cycles, fueling new refresh demand or monetisation.

4. Strong balance sheet & cash reserves allow flexibility for buybacks, R&D, and cushioning in a downturn.

5. Multiple expansion potential: If Apple surprises on margins or growth, markets may re-rate the stock upward beyond consensus.

Bear Case: What Could Derail the Thesis

1. Hardware softness or demand weakening, especially in the iPhone or premium segments.

2. Margin compression from higher input costs, tariffs, or supply chain disruption.

3. Tepid guidance or a conservative tone might signal caution to investors.

4. High expectations are already priced in with limited room for error.

5. Macroeconomic headwinds: Consumer spending softness, inflation, and interest rate volatility.

6. Competitive and regulatory risk: New regulation, trade barriers, or antitrust scrutiny.

Given recent downgrades, Jefferies has downgraded Apple, citing concerns about iPhone innovation expectations, as the risk of a disappointment is not negligible. [2]

What to Watch in Apple's Q4 2025 Earnings Report

1. Hardware unit trends

iPhone units & ASPs: whether demand stays resilient in key regions, especially given macro pressure and saturation in mature markets.

Mac & iPad sales: especially with portability and AI features pushing refresh cycles.

Wearables & accessories: area of growth potential but vulnerable to consumer discretionary spend cuts.

2. Services & Recurring Revenue

Growth in App Store, Apple Music, iCloud, Apple TV+, etc. Services are now the revenue cushion and margin engine for Apple.

Subscription uptake and ARPU growth will be closely scrutinised to determine whether Apple can extract more margin from its massive installed base.

3. Margins, Guidance & Cost Pressures

Gross margin and operating margin trends: whether supply chain, component costs, or tariffs are squeezing margins.

Forward guidance: Apple reportedly upgraded its guidance for Q4 from low to mid- to high single-digit growth, signalling confidence.

Tariff impacts, FX movements (USD strength), and foreign exchange translation effects will matter.

4. AI, New Product & Monetisation Signals

Investors will look for signs of how Apple is monetising AI and integrating it into product ecosystems.

Any announcements or teasers of AI features, SDKs, or AI-driven upgrades.

News on Product Development Including Mixed Reality, Smart Glasses, and Next-Generation Wearable Technology.

Reports indicate that Apple is shifting focus from Vision Pro to more advanced glasses, as Vision Pro is facing difficulties with sales under 500,000 units per year, significantly lower than the anticipated 700,000-800,000 target. [3]

5. Guidance Credibility & Investor Tone

Management tone during Q&A about macro outlook, consumer spending, supply chain, and innovation investment.

Clarity around strategy, capital allocation (buybacks, dividends), and future R&D spending.

6. Shareholder Returns & Buybacks

Investors will evaluate if Apple continues to uphold substantial buybacks and dividend increases. Apple is frequently mentioned among the "Buyback Aristocrats."

7. Risks & Red Flags

Slippages in hardware guidance or cautious commentary could spook markets.

Persistent weakness in China or emerging markets.

Unanticipated hampering by tariffs, regulations, or supply constraints.

For context, the trump administration tariffs now represent Apple's most immediate financial challenge, with $800 million in Q3 costs and an estimated $1.1 billion impact in Q4 2025.

Apple has responded by diversifying production to India and Vietnam while committing $100 billion in additional U.S. manufacturing investments.

Therefore, if Apple delivers strong execution in hardware units, maintains services growth, and gives favourable guidance, upside is possible. However, missing one key component could temper gains.

Tactical Strategies: How to Position into Earnings

1) Partial Entry or Staggered Buys

Avoid all-in exposure pre-earnings. Instead, buy a partial allocation anticipating a positive surprise, and leave room to scale up post-earnings if the report is strong.

2) Use Options or Derivatives (If Available)

For more daring traders, call spreads or long calls with restricted downside can enable you to engage in upside while minimising risk. Premiums will increase before earnings, so choose wisely.

3) Hedge Exposure

If you own Apple and fear a downside surprise, consider buying a modest protective put or hedging with an inverse tech ETF to limit losses in a weak report.

4) Watch Volume & Volatility cues

Leading into earnings, monitor volume and implied volatility. An abrupt increase in implied volatility might indicate anticipations of a significant shift. Think about entering sooner if volatility remains low.

5) Be Liquidity Aware

Apple is extremely liquid, so entering or exiting isn't typically a problem. However, earnings disparities can lead to significant intraday fluctuations. Thus, use limit orders and avoid chasing in after-hours.

Is Apple a Good Stock to Buy Now? Final Verdict

Given the data and outlook, Apple remains a premium-quality stock heading into Q4 2025.

While short-term upside may be limited by valuation, Services' momentum, AI integration, and ecosystem strength underpin its long-term investment appeal.

The key catalyst is whether Apple beats on margins, iPhone units, or guidance tone; each could unlock a re-rating toward $280–$310.

Frequently Asked Questions

1. When Is Apple's Q4 2025 Earnings Date?

Apple's upcoming earnings report is scheduled for October 30, 2025.

2. What Earnings per Share (EPS) Is Apple Expected to Report?

For Q4 2025, analyst consensus targets an EPS of around $1.68.

3. Is Apple Stock Undervalued or Overvalued?

At $258, Apple trades near the consensus fair value of $245–$260, suggesting modest upside potential.

Conclusion

In conclusion, Apple remains a premium-quality stock heading into its Q4 2025 earnings. While valuation leaves limited short-term upside, its services momentum, AI integration, and resilient ecosystem underpin long-term strength.

Investors may adopt a cautious buy-and-hold approach, anticipating positive triggers in Apple Intelligence revenue generation and Q1 2026 forecasts.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.apple.com/newsroom/2025/07/apple-reports-third-quarter-results/

[2] https://www.barrons.com/articles/apple-stock-downgrade-iphone-5171922c

[3] https://www.tomsguide.com/computing/smart-glasses/apple-reportedly-scraps-vision-pro-headset-follow-up-in-favor-of-smart-glasses